RD-Update-2009

advertisement

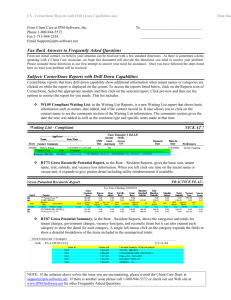

USDA Rural Development Multifamily Housing Programs 2 • Agency of US Dept of Agriculture (USDA) • 15,000 section 515 rural multi-family projects • 1,000 section 514 projects Section 515 Program • M/F housing in rural areas • 30 year term with 50 year amortization • Rate established by agency based on market 3 Section 514 Program • Affordable housing for farmworkers • Terms comparable to 515 4 Types of Projects • • • • • Family Elderly Congregate homes Group homes Coops 5 Section 521 Overview 6 • Rental assistance • Used with both 515 and 514 programs • Tenant pays no more than 30% of income General Program Requirements • • • • • Civil Rights Nondiscrimination Limited English proficiency Environmental Requirements Construction standards 7 Management Plan • • • • Management plan Policy and procedure manual Initially submitted at application Certify every 3 years 8 Management Certification • Form RD 3560-13 • Operate project according to management plan • No inducement payments • Management agreement complies • Disclose IOIs 9 Management Agent • • • • Borrower/Manager IOI Independent Fee Management Agent Must have 2 years experience to be approved • Follow management plan • Must also certify to compliance • Form RD 3560-30 10 Management Fee • Occupied unit fee – Based on established state rates • Add-on fees – Flat PUPM – Cannot cover conditions already covered in base fee 11 Items Paid from Fee 12 • Managing compliance • Establishing policies and procedures • Implementing policies and supervision of on-site staff Paid from Income • Project-related items – – – – Salaries & benefits Office expenses Maintenance Processing tenants • Must be reasonable 13 Financial Reporting Requirements 7 CFR Part 3560 Subpart G 3560.308 and HB-2-3560 Section 4.32 and Attachment 4-B 14 Project Accounting – System Requirements 15 • Must establish appropriate accounting system • Must be approved by RD (notify if major changes) • May use cash, accrual or modified accrual (must be consistent with guidance) • Retain financial records for at least 3 years and available to 3rd party • Bank accounts must be in US accounts and insured Project Accounting – System Requirements, con’t 16 • Funds must be held in trust by borrower • May not be used as collateral • Systems must maintain identity of each project • Establish minimum # of bank accounts – Operating, tax & insurance, reserve, security deposit General Operating Account • All revenues and expenses • Initial operating capital (2% of total development costs) – May be released between the 2nd and 7th year • Will be deemed to have a surplus when balance > 20% of operating and maintenance expenses • Surplus must be used for capital, reserves, reduce debt or reduce rents 17 Tax and Insurance Account • Deposited from mortgage payments monthly • May be kept in operating acct • Must be tracked separately 18 Reserve Account • Payments in monthly amounts and are paid with mortgage • Major repairs or other improvements • Must be in supervised account and require agency counter signature 19 Security Deposits • • • • 20 Uses outlined in management plan Used to fix repairs on damaged units Unused funds returned to tenant May be transferred to operating account is unclaimed • Interest in handled in accordance with state law Initial Operating Capital • Borrower must provide initial operating capital = 2% of loan amount • Uses have to be approved by RD • Not treated as excess funds if in operating account 21 Other Borrower Advances 22 • Require written approval • If not short-term, project budget must be reviewed • May not use for reserve funds, or initial operating capital or rent increase Repayment of Initial Operating Capital 23 • Requires RD approval • May be removed in installments or lumpsum between 2nd and 7th year • Must have been operating for at least 2 years • Must be repaid before end of 7th year Borrower Submission of Request • Submit request with transmission of annual financial report • In writing • Document that criteria is met – – – – Stable financial condition 90% occupancy over last 12 months Reserves adequate No outstanding compliance violations • Describe method of repayment 24 Return on Investment 25 • Owner may take ROI before withdrawing IOG • Positive net cash flow • Reserves up-to-date • Excess cash is determined from Form RD 3560-7 that exceeds 20% of operating and maintenance expense • May consider A/P and reserve withdrawals to cover operating expenses Replacement Reserves • Used for major capital expenditures • Interest –bearing account • Begins with 1st loan payment; adjusted throughout project’s life 26 Replacement Reserves, con’t • Deposits continue until amount reaches the specified limit in loan agreement • Payments resume after withdrawals • May change based on revised capital needs assessment 27 Reserve Account Principles • May be held in checking, savings or similar federally-insured account • Must be readily marketable • Securities must be backed by Feds including triple-A rated GNMA bonds • Actual costs of securities must be disclosed in report 28 Uses of Reserves • Withdrawals requested on RD Form 3560-12 before they are needed • Should be included in budgets at least annually • Unexpected uses must be approved by RD • See list for approval process 29 Reserve Withdrawal Process • • • • • • Form RD 3560-12 Statement of purpose Current balance in account Estimated costs (bids, if obtained) RD completes process Excess reserves may be transferred to operating account 30 Requirements for Budgets • • • • • • Required for projects > 8 units Submitted through MINC Reasonable and realistic Only necessary expenses Not include organizational expenses NFP or Coops may request asset management fee 31 Annual Capital Budget • Identify needs during budgeting cycle • Must be submitted 60 days before year end • RD approves 30 days before year end • Rent increases must be submitted 90 days before • Tenants have 30-day comment period • See additional procedures 32 Additional Budget Items • Must include narrative • Describe project, including indicators of status • Statement of compliance • Description of financial status • Projected capital expenditures 33 Reasonableness Review • RD will review – – – – Operating expenses within 10% Income sources within 10% Vacancy allowance < 15% if 15 units Utility allowance documented • If any of above = no, then review additional items • Borrower may have to submit revision 34 Annual Reporting • • • • 35 Applies to all projects Requirement vary by project size Hardship exceptions are available Engagement or Limited Scope Engagement Report - due within 90 days of the end of the • Requirements of Handbook were revised by PN 413 for all year ends after 12/31/2007 for projects > 24 units The Engagement Report 36 • Based on the RHS/OIG Audit Program • 16 units or more = Engagement • Use Agency-approved engagement letter (Handbook Letter 209) • Report the results of the AUP’s • Must use a CPA • All engagements must be prepared for use by the Agency • Borrowers certification that project meets the “Performance Standards” The Limited Scope Engagement Report • • • • 37 Based on the RHS/OIG Audit Program 8 - 15 units = Limited Scope Engagement May use a CPA Borrowers must self-certify that the project meets the “performance standards” as shown in Exhibit 4-6 of the HB-2-3560 Audit vs Agreed-Upon Procedures 38 • Difference Between an Audit of Financial Statements and Agreed-Upon Procedures • An audit is a comprehensive process that includes planning, testing, verification, confirming, documenting, and adjusting the financial statements in order to be able to issue a report on whether the financial statements as a whole are materially in accordance with GAAP • AS WELL AS to issue a report on the entity’s internal control and compliance with major programs. Audit vs Agreed-Upon Procedures 39 • Agreed-upon procedures are simply procedures prescribed by the client for the CPA to perform and conclude upon. • The report – Description of the procedures – CPA’s conclusion on those procedures. • AUP’s do not include: – – – – Financial data (i.e. Balance Sheet) Report on the financial statements Internal controls Compliance with major programs. Audit vs Agreed-Upon Procedures 40 • The agreed-upon procedures report to RD must accompany forms 3560-7 and 3560-10; (formerly 1930-7 and 1930-8), due to RD within 90-days of the project’s year-end. SSAE 10 41 • Agreed-upon procedure engagement: – CPA is engaged by a client to issue a report of findings based on specific procedures. – The specified parties and the CPA agree upon the procedures to be performed – Report clearly indicates its uses is restricted to specified parties Analysis of Financial Reports 42 • Loan Servicers must review financial statements : – Confirm that the engagement was conducted by a qualified person; – Confirm that the performance standards were certified; – Confirm that nonprofit and public bodies have submitted the OMB-required annual financial statements; and – Note any problems identified in the examination, and determine appropriate corrective actions. Analysis of Financial Reports 43 – Analysis of Income and Expenses: – Did the expenses in any of the main categories (maintenance & operating, utilities, admin., and taxes and insurance) differ by more than 10 percent from their proposed levels? – Did the actual sources of income (rental, subsidy, and non-rental) differ by more than 10 percent from their proposed levels? – Was the vacancy allowance in the permissible range? – Were debt payments and reserve payments correct? – Was non-operational cash use reasonable (as compared to last year)? – Was the cash flow positive? Analysis of Financial Reports 44 • Account maintenance, tracking, and disclosure – Record in MFIS the account balances from the report and confirm that the financial report states that: – Required accounts are maintained and tracked separately; and – Payments from operating accounts are disclosed and accurately represented. Analysis of Financial Reports – Reserve account status. • Confirm that the financial report states that the reserve account is current and that there are no encumbrances on the reserve account funds. – Tenant security deposit account status. • Confirm that the report shows that the tenant security deposit balance meets liabilities and • The funds are maintained in a separate account and in accordance with state law. 45 Analysis of Financial Reports 46 – Payment of return to owner. • Confirm that the payment of the owner's return was consistent with the terms of the loan agreement or resolution. • Record in MFIS the actual return paid and its effect on cash flow, using the actual project budget. Analysis of Financial Reports 47 – Insurance status. • Confirm that all relevant insurance requirements were met. – Taxes and other assessments. • Confirm that taxes and other assessments are current. • List any taxes or assessments that are not current. Analysis of Financial Reports 48 – Issues of financial compliance and conditions. • Confirm that any funds used for unauthorized purposes have been repaid. – Payment of management fees. • Confirm that the management fee was paid in accordance with the management certification, and • The management agent is not charging the project for agent expenses. AUP Step #1 49 • Examine selected receipts, invoices and cancelled checks for admin, operating & maintenance to determine if they are project expenses • Follow testing criteria • See sample size tables • Obtain supporting documentation • See reporting requirements AUP Step #2 • Confirm balance in reserve account – Not encumbered – Federally insured – Withdrawals agree to approvals • Follow testing procedures 50 AUP Step #3 • • • • • Obtain IOI listing Sample invoices Any undisclosed IOIs Follow sample selection criteria Following reporting guidelines 51 Small Projects 52 • Projects between 8 to 15 Units • Limited Scope Engagement • Borrower’s certify compliance with “Performance Standards” • No AUP required • May use CPA to prepare forms. • 3560-10 must be submitted through MINC Performance Standards 53 • These 9 standards must each be addressed by a CPA in the Engagement (certified to in a Limited Scope engagement). • Questions stress compliance with RD regulations regarding reserve, return to owner, security deposit accounts and insurance maintenance. Performance Standards 54 • Required accounts are properly maintained and tracked separately; • Payments from operating accounts are disclosed and accurately represented; • Reserve amount is current (i.e., contributions are on schedule and balance accounts for contributions less authorized withdrawals), and there are no encumbrances; • Tenant security deposit accounts are fully funded and are maintained in separate accounts; Performance Standards 55 • Payment of owner return was consistent with the terms of the applicable loan agreement or loan resolution; • Borrower/grantee has maintained proper insurance in accordance with the requirements of 7 CFR 3560.105; and • All financial records are adequate and suitable for examination. • There have been no changes in ownership • The real estate taxes are paid in accordance with state and/or local requirements. Financial Summary 56 • See chart is a summary of the financial reporting requirements under Regulation 3560, effective December 31, 2007. Other Financial Reports 57 • In addition to the Engagement or Limited Scope engagement, nonprofits must comply with A-133 requirements. • Agency retains authority to require an audit on any Borrower. • Any audits independently obtained by the Borrower must be provided to the Agency if paid with project funds. Other Audits 58 • May be required -– To satisfy the requirements for nonprofit and public bodies under OMB Circular A-133. – To satisfy the requirements of limited partnership agreements. – Possibly to satisfy the requirements of a HUD Section 8 Contract. – To satisfy the requirements of any other regulatory agency or agreements that require the issuance of audited financial statements. Other Audits • If required by a 3rd party… – the property can pay for it; – does not replace the engagement; • If independently obtained by the borrower… – the audit must be provided to the Agency if paid with project funds. – the audit does NOT replace the required engagement. 59 Monitoring Physical Condition • Quality must be maintained • Requires systems – – – – – – Preventative maintenance Response to calls Workorder system Inspections Energy Conservation Tenant Damages 60 Correcting Deficiencies • • • • Systemic review Tenant complaints Comply with standards May require reserve funds 61 Project Occupancy • Eligible household • Meet income requirements • Meet screening requirements 62 Income Requirements • • • • 63 Established by RD Very low income – 50% of median income Low-income – 80% of median income Moderate – add $5,500 to low-income limit Eligible Household • • • • • • Elderly – at least 62 Disabled Resident assistant Foster children Remaining family members Students 64 Calculating Income • Owner must verify income expenses, assets, deductions, family and other factors • Sign consent forms • SSNs • 3rd party verifications • Recertifications • Comply with Privacy Act 65 Tenant Income • • • • • 66 Determine eligibility and ability to pay rent Determine rental assistance Annual income – all household members Adjusted income – see 6.8C in 3560 Zero income – generally not eligible Adjusted Income • Deductions – – – – – Dependents Child Care Elderly Disability Medical 67 Applicant’s Assets • • • • Reporting Assets Calculating Market and Cash value Retirement assets Income from assets 68 Verification Procedures • • • • • • • • 3rd party verifications Signed consent forms Valid for 90 days Temporarily accept paystubs or other documentation Award or benefit letter Verify disability, household, Income Release and consent form SSNs 69 Occupancy Policies • • • • • Unit density – how many people Occupancy rules Must allow pets unless rules violated Consult with tenants on policy changes Must reasonable and written 70 Fair Housing • • • • • Maintain FMHP Approved at application Affects marketing efforts Educate staff Systemic 71 Tenant Application • • • • • • • • • Name & address Household information Handicaps Certifications SSN Income & adjustments Signature Race Disclosure Notice 72 Wait List 73 • All applicants placed on wait list • Documents final disposition of all applications • Should include date and time of complete application • Race and ethnicity collected for information purposes only • Electronic waiting lists – Data backups – Printed record at least monthly – Family statuses recorded as occurred Wait List (con’t) 74 • Applicant must submit a complete application and an authorization to verify employment • Selection from the wait list will be made according to date and time in the following order: – Very low income – Low income – Moderate income Tenant Recertification 75 • 75 – 90 days prior to certification expiration tenant must receive notice in writing that they must recertify to remain eligible • Second letter 30 days prior to recertification date • Must recertify at least annually or whenever a change in household income of $100 per month occurs Tenant Recertification (con’t) 76 • The tenant must: – Provide income and other household information – Authorize borrower to verify income eligibility – Report all changes in household status that may affect eligibility – Failure to do so will result in ineligibility Tenant Recertification (con’t) 77 • The borrower must: – Verify household income and other relevant data – Review all reported household changes that affect eligibility – Must submit updated certification forms to RD – Failure to perform these procedures may result in overages charged – Must maintain documentation for at least 3 years or until the next agency visit, whichever is longer Rents and Shelter Costs 78 • Major Rent Levels – Note rent (rent established to cover approved expenses and loan costs at interest charged on promissory note) – Basic rent (rent established to cover expenses and loan costs reduced by interest credit agreement) – HUD rent (rent established for Sec 8 subsidies) – LIHTC rent (rent established by LIHTC requirements) Rent by Project Type 79 Utility Allowances 80 • Borrowers must establish a utility allowance that is deducted from total shelter cost • May be issued on a joint check payable to tenant and utility company • Based on expected costs • Must be reviewed annually during budget process • Approved by field office staff • Review tenant during supervisory visits Determining Tenant Rent Payment 81 • Follow Form 3560-8 Tenant Certificate to determine individual rents • Must be adjusted for changes in household status sufficient to generate a new certification • Tenant rent must not exceed the highest of: – 30% of monthly adjusted income adjusted for utility allowances – 10% of gross monthly income adjusted for utility or – If household is receiving public assistance the portion of such payment designated to meet shelter costs – The basic rent unless Rural Housing Service assistance is provided • See example Unit Rents 82 • Note Rents – tenant pays note rent regardless of income unless they are ineligible (Plan II projects experiencing vacancies may be approved for special rents) • Basic Rents – tenant will pay the net tenant contribution, but no less than basic rent and no more than note rent • Rental Assistance Rents – tenant pays net tenant contribution • HUD Section 8 – tenant pays total tenant payment (TTP) which is the greater of 30% of monthly adjusted income or 10% of gross income, welfare rent or $25. HUD rent should never be less that basic rent. Security Deposits 83 • Must be specified in management plan and approved by RD • May charge customary for the area, but may not exceed the higher of tenant contribution for 1 months rent or the basic rent • HUD projects must comply with HUD • COOPs pay one month’s rent • Increases may only be charged to new tenants • May be paid on a payment plan • Held in separate federally insured account • Interest follows state law but may never accrue to the borrower • Unclaimed amounts go to operating account Rent Collection 84 • Collect rent monthly on first day of month • Borrower must have a collection system that: – Uses serially numbered receipts – Tenant ledger – If collections are onsite they must be secure • Description of procedures must be in management plan Late Fees 85 • Borrowers may charge late fees according to schedule approved by RD • Must provide for 10-day grace period • Not exceed the higher $10 or 5% of gross tenant contribution • Tenants receiving housing benefits form other agencies may be subject to additional late fee requirements Reporting of Rents • Borrowers must report to RD on Form 3560-29 for all collection activities • Form also includes occupancy status of each unit • Overage is the amount that total rental payments exceed total basic rent • Overage is returned to the agency • Tenant contributions are first applied to rental charges 86