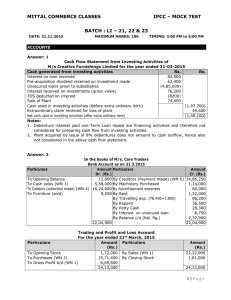

finance_problems

advertisement

8- 1 Ahl Enterprise lists the following data for 2011 and 2010: 2011 2010 Net income $ 52,500 $ 40,000 Net sales 1,050,000 1,000,000 Average total assets 230,000 200,000 Average common equity 170,000 160,000 Required Calculate the net profit margin, return on assets, total asset turnover, and return on common equity for both years. Comment on the results. (For return on assets and total asset turnover, use end-of-year total assets; for return on common equity, use end-of-year common equity.) 8-4 Revenue and expense data for Vent Molded Plastics and for the plastics industry as a whole follow: Vent Molded Plastics Plastics Industry Sales $462,000 100.3% Sales returns 4,500 0.3 Cost of goods sold 330,000 67.1 Selling expenses 43,000 10.1 General expenses 32,000 7.9 Other income 1,800 0.4 Other expense 7,000 1.3 Income tax 22,000 5.5 Required Convert the dollar figures for Vent Molded Plastics into percentages based on net sales. Compare these with the industry average, and comment on your findings P 9-1 McDonald Company shows the following condensed income statement information for the current year: Revenue from sales Cost of products sold Gross profit Operating expenses: Selling expenses General expenses Operating income Other income $ 3,500,000 (1,700,000) 1,800,000 $ 425,000 350,000 (775,000) 1,025,000 20,000 Interest Operating income before income taxes Taxes related to operations Income from operations Extraordinary loss (less applicable income taxes of $40,000) Income before noncontrolling interest Noncontrolling interest (loss) Net income (70,000) 975,000 (335,000) 640,000 (80,000) 560,000 (50,000) $ 510,000 Required Calculate the degree of financial leverage. P 9-9 Assume the following facts for the current year: Net income $200,000 Common dividends $ 20,000 Preferred dividends (The preferred stock is not convertible.) $ 10,000 Common shares outstanding on January 1 20,000 shares Common stock issued on July 1 5,000 shares 2-for-1 stock split on December 31 Required a. Compute the earnings per share for the current year. b. Earnings per share in the prior year was $8.00. Use the earnings per share computed in (a) and present a two-year earnings per share comparison for the current year and the prior year.