Froeb_22 - Vanderbilt Business School

advertisement

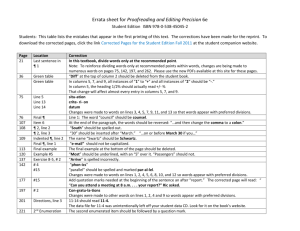

Chapter 22: Getting Divisions to Work in the Firm’s Best Interest Managerial Economics: A Problem Solving Appraoch (2nd Edition) Luke M. Froeb, luke.froeb@owen.vanderbilt.edu Brian T. McCann, brian.mccann@owen.vanderbilt.edu Website, managerialecon.com COPYRIGHT © 2008 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Summary of main points • Companies are “principals” who try to align the incentives of divisions (“agents”) with the goals of the parent company. • Transfer pricing is a big source of conflict between divisions because they transfer profit from one division to another; they can also result in too few goods being transferred. Transfer prices should be set equal to the opportunity cost of the transferred asset. • A profit center on top of another profit center can result in too few goods being sold; one common way of addressing this problem is to change one of the profit centers into a cost center. This eliminates the incentive conflict (about price) between the divisions. Summary of main points (cont.) • Companies with functional divisions share functional expertise within a division and can more easily evaluate and reward division employees. However, change is costly, and senior management must coordinate the activities of the various divisions to ensure they work towards a common goal. • Process teams are built around a multi-function task and are evaluated based on the success of the task. • When divisions are rewarded for reaching a budget threshold, they have an incentive to lie to make the threshold as low as possible, to make the threshold easier to reach. In addition, they will pull sales into the present, and push costs into the future, to make sure they reach the threshold. A simple linear compensation scheme eliminate this incentive conflict. Introductory anecdote: Acme • The by-product of producing Acme paper is “black liquor soap” that is converted into “crude tall oil” used in resin manufacturing. • The Paper division at Acme sold it’s soap to the Resin company at a transfer price set by senior management. • But both divisions fought over the transfer price. • The Resin division wanted a low transfer price • The Paper division wanted a high price • The corporate parent company “gave” the Resin department a very low transfer prices. As a result, the Paper division began burning the soap as a fuel instead of selling it to Resin. • The soap’s value as a fuel was below its value as an input into resin manufacturing. Incentive Conflicts between Divisions • In a multi-divisional company, transactions between divisions can create incentive conflicts. • In these transactions the company is the principal and divisions are the agents. • To understand the source of conflicts that arise between divisions, personify the divisions and consider each to be a rational actor. Then ask the same three questions, 1. Which division is making the bad decision? 2. Does the division have enough info. to make a good decision? 3. Does it have the incentive to do so? • Without proper control, these conflicts can deter profitable transactions from occurring. Incentive conflicts (cont.) • Again the answers suggest three possible solutions • Change the division that does the decision making, • Change the flow of information, or • Change a division’s evaluation and compensation schemes • Often, parent companies organize so that each division is an autonomous, and separate profit center. • Definition: A profit center is a division that is evaluated based on the profit it earns. • The benefit of a profit center is that they are easy to evaluate (and manage); the cost is that they are concerned only with their own division profit. Analyzing Black Liquor Soap Problem • Who is making the bad decision? The Paper Division made the bad decision to burn the soap for fuel instead of transferring it to the Resins Division. • Did they have enough information to make a good decision? The Paper Division had enough information to know that the soap’s value as a fuel was below its value as an input to resin manufacturing. • And the incentive to do so? The Paper Division was rewarded for increasing its own profit, not that of the Resin Division. Transfer Pricing • One common belief is that transfer pricing just shifts profits between divisions & doesn’t affect firm profits. • THIS IS A MYTH. • Sometimes they move assets to lower valued uses, i.e. the “black liquor soap” incident. • Transfer pricing is always a problem between two profit centers because they “fight” over the transfer price. • You can get rid of the conflict by turning one division into a cost center. • A cost center is rewarded for reducing the cost of producing a specified output. (but remember, cost centers can come with problems of their own.) • Discussion: Are your transfer prices set equal to the opportunity cost of the product? If not, why not? Paper Company Anecdote • A company can transfer paper from its upstream Paper division to its downstream Cardboard Box division. • The company set a transfer price to guarantee a contribution margin of 25% to the Paper division. • So, if the Paper MC is $100, the transfer price would be $125 • The Box Division considers the transfer price to be its MC, and then marks up the cost again. • The Box division makes all sales where MR > MC, but now the MC is overstated (because of the included contribution margin of the Paper division). • Discussion: Solution? Paper company anecdote (cont.) • The analysis makes clear that the conflict arises because two profit centers are each trying to extract profit from a single product. • This creates a “double markup” problem. • One way to solve the problem is to make the Paper division a cost center. • Cost centers are not evaluated based on the profit they earn, and so don’t care about the transfer price. • Once the Paper division began transferring at MC the Box division began winning more jobs from its rivals. Organizational options: U-form • Functional (U-form): A functionally organized firm is one in which various divisions perform separate tasks, such as production and sales. • Example of functional organization are Henry Ford’s automobile assembly line, or Adam Smith’s pin factory. • Advantages: • Workers develop high functional expertise. • Information can be shared easily within a division. • It’s easier to tie pay to performance because performance is easily measured. • Disadvantages: • Each division must coordinate with each other, a burden that falls on management; and change is costly. Banking Coordination Problem • Banks have many different divisions, all of which must work together for the bank to create profits. • The Loan Origination Division (think of them as “mortgage brokers”) identifies potential borrowers, lends money to them, and then hands them over to • The Loan Servicing Division, which collects interest on the loan and makes sure that borrowers repay the loans when they come due. • For the bank in question, there was an unusually high number of defaulted loans. • What caused this to occur, and how can it be fixed? Banking problem (cont.) • Three questions: • Who is making the bad decision? The Loan Origination Division was making risky loans. • Did the Division have enough information to make a good decision? The Division could have easily verified the credit status of the borrowers. • And the incentive to do so? Like many sales organizations, the Loan Origination Division (“mortgage brokers”) were evaluated based on the amount of money they were able to lend, regardless of the credit worthiness of borrowers. Organizational options: M-form • M-Form: An M-form firm is one whose divisions perform all the tasks necessary to serve customers of a particular product or in a particular region. • Advantages: • Divisions can respond more easily to change. • Easier to establish customer relationships because one person can serve each customer’s needs • Disadvantages: • Individual workers develop less functional expertise. • Example: re-organize a bank into “home” and “business” loans, where both divisions originate and service loans. This reduces incentive to make bad loans. Corporate Budgeting: Paying People to Lie • A toy company’s Marketing Division creates sale projections for each season. The Manufacturing Division uses the forecast to plan production. • Problem: There was excess inventory at the individual business units within the toy company. • HINT: each business unit is rewarded with a big bonus if it meets budget. • This system created incentives for business units to set low budgets. • The CEO knew this and “stretched” each budget goal, even though he lacked specific information about business unit. • When the goals were set too high, the inventory was not sold and accumulated; if too low, stock-outs occurred. Corporate Budgeting: Paying People to Lie (cont.) • Once budget goals were reached, there was no incentive to exceed them. (“shirking”) • Also, there are incentives to “game” the system • Accelerate sales or delay costs if just short of target • Delay sales or accelerate costs if target already met to make next year’s goals easier to reach • Accelerating or delaying sales can be costly, e.g., discounts offered to customers to delay or accelerate demand. • Discussion: How should it be fixed? Corporate Budgeting: Typical Problem • This threshold compensation scheme creates incentives to lie Corporate Budgeting: solution • Adopting a linear compensation scheme solves problem Alternate Intro Anecdote • Company X, one of the world’s largest suppliers of supplies for printers, copiers, and fax machines, included two separate divisions. • Toner Division produced toner, which it sold to the Cartridge Division and to the external market. • The Cartridge Division integrated the toner into cartridges sold to original equipment manufacturers and consumers. • Company management allowed the two divisions to negotiate the transfer price of toner and evaluated each division on its profitability. Alternate Intro Anecdote (cont.) • After negotiations were unsuccessful, both divisions elected not to transact. • Toner Division continued to sell to the external market at its customary price • Cartridge Division elected to buy toner from an external supplier. • The Cartridge Division ended up buying its toner from the exact same supplier to whom the Toner Division was selling. • Rather than paying one markup to the Toner Division, the Cartridge Division ended up paying that markup plus an additional margin to the external supplier • Price was 38 percent higher cost than originally proposed in negotiations • External supplier’s shipment arrived at Company X’s docks with the products still emblazoned with Company X’s logo. CEO noticed this. 21 1. Introduction: What this book is about Managerial Economics 2. The one lesson of business 3.Benefits, costs and decisions Table of contents 4. Extent (how much) decisions 5. Investment decisions: Look ahead and reason back 6. Simple pricing 7.Economies of scale and scope 8. Understanding markets and industry changes 9. Relationships between industries: The forces moving us towards long-run equilibrium 10. Strategy, the quest to slow profit erosion 11. Using supply and demand: Trade, bubbles, market making 12. More realistic and complex pricing 13. Direct price discrimination 14. Indirect price discrimination 15. Strategic games 16. Bargaining 17. Making decisions with uncertainty 18. Auctions 19.The problem of adverse selection 20.The problem of moral hazard 21. Getting employees to work in the best interests of the firm 22. Getting divisions to work in the best interests of the firm 23. Managing vertical relationships 24. You be the consultant EPILOG: Can those who teach, do?