The Stock Market Game

advertisement

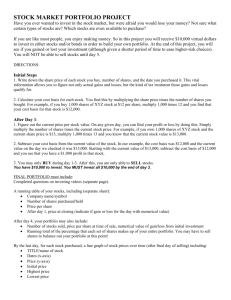

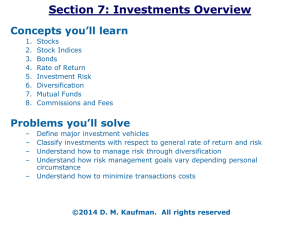

The Stock Market Game Economics and the Stock Market Micro vs. Macro Economics Going from a good idea to a corporation Microeconomics Microeconomics studies the behavior of the consumer, household, or firm. Scarcity and choice Utility and profit maximization How do we allocate our budget, time? How do firms allocate resources to produce goods and services? Efficiency Micro and the Stock Market Look at one company: How does this company make its product? Who buys the product? Does the company have good managers? Who supplies the company? Look at one industry: How much competition in the industry? Is the industry young or old? Macroeconomics Macroeconomics studies the economy as a whole or as aggregates and attempts to predict or forecast changes in national output, unemployment, and inflation. Macro and the Stock Market Look at the whole economy: Inflation: Producer and Consumer Price Indices (PPI & CPI) Employment: Unemployment Rate Interest Rates: Actions of the FED (discount rate) Productivity Use information to estimate good times to buy and times to sell. Going Public From a Good Idea to a Corporation Product idea: the “widget” Need funds to start business – find investors “venture capitalists.” Each investor owns a stake or “share” of the corporation and has limited liability. Going from a good idea to a corporation Suppose the company is doing well. You need more money – Go public, “initial public offering” Going public: investment bank creates a prospectus and buys all shares of stock and resells them at a set price to the public A “tombstone” is the public notice of an IPO Investment Basics Different Types of Investments: Insured Savings Accts Savings Bonds Certificates of Deposit Treasury Bonds Corporate Bonds Mutual Funds Stocks Collectibles Commodities The Difference Between Stocks, Bonds, and Mutual Funds Stocks Bonds You own a piece of the company You make money if the company does well You loan money to a corporation or government You earn the interest Mutual Funds: You own one portion of a collection of stocks, bonds, or other securities The Three Main Markets NYSE New York Stock Exchange NYSE MKT LLC (formerly AMEX) American Stock Exchange Oldest, largest, best-known stocks Mid-sized growth companies NASDAQ Large, mid-sized, and small growth companies The Difference Between Large and Small Companies Large: Often have high prices Low risk of failure Usually pay regular dividends Small Potential for growth is greater than for larger companies General prices are lower Long Term Investing The Best Route Stock Splits More shares are created at a lower price per share, the investor has the same equity Indicated with an (s) in the paper Example: You own 100 shares of Dell at $30 per share. A 2-for-1 split of Dell stock means you have 200 shares at $15 per share What Stocks Should I Buy? Normal vs. Inferior Goods Normal goods Inferior goods Goods that you buy more during good economic times (gourmet foods, fresh veggies, individual entrees) Goods that you buy less of when economy is good (cheap soda, potatoes, pasta, canned beans) Stock traders watch this… If we’re experiencing poor economic times, invest in inferior goods. If we are in good economic times, invest in normal goods. How to Play the STOCK MARKET GAME SMG Basics Real-time stock market simulation Played on the internet from any computer Each team begins with $100,000 10-week trading period (10/08/12-12/14/12) Invest in most stocks and mutual funds traded in the three major US exchanges Teams of 2 students SMG Basics The team with the highest portfolio equity at the end of the game wins Portfolio equity in the tenth week is used for final rankings SMG Rules Rules to note… Transactions are made at the SMG WorldWide site at: www.smgww.org Trades are made based on prices at time of order. If trades are made after 4:00 PM, then they are made at the next day’s opening price (at 9:30 AM). Game week runs Monday thru Friday. Stock and cash dividends are automatically computer into team portfolios Portfolios are updated and available on a daily basis. 5% interest is earned on cash balance. Rankings are updated every weekend. Buying Stocks Ticker symbols available online Must be a minimum of 100 shares Must have a closing price of at least $5.00 per share Must not exceed total number of shares actually traded on the market that day May set a maximum purchase price limit, the maximum you are willing to pay Selling Stocks Must already own the stock Must be a minimum of 100 shares (unless selling the only remaining shares) Ex: If you bought 120 shares, then sold 100, you may then sell the remaining 20. Must not exceed total number of shares actually traded on the market that day May set a minimum selling price limit. The sale will not go through until the stock price reaches or exceeds the limit price. Buying on Margin You may borrow part of the required funds using the stock in your portfolio as collateral for the loan. If the Total Equity in your portfolio falls below 30% of the value of your ‘long’ and ‘short’ positions, your team will receive a margin call. This figure is only relevant for teams that have borrowed money. Interest charged at 7% Initial Margin Requirement = 50% Margin call must be satisfied by 3rd week Maintenance requirements are calculated as % of total value of long and short positions Where to get more info… Internet Yahoo! Finance: http://finance.yahoo.com The Street: www.thestreet.com NYSE: www.nyse.com CNNfn: www.cnnfn.com EDGAR Database of Corporate Information: www.sec.gov/edgarhp.htm GOOD LUCK!