CMG article - Ducas Capital Management

advertisement

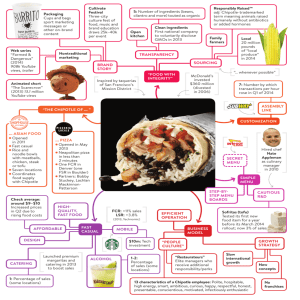

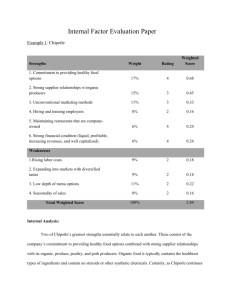

Samba 1 Changing the Way We Think Of Fast Food Chipotle Mexican Grill (NYSE:CMG) Chipotle Mexican Grill (NYSE: CMG) is an energetic and fast growing company within the restaurant sector. Since opening its first store in 1993, founder Steve Wells has revolutionized the way we think of fast food. Since its IPO in 2006 CMG’s stock has risen 1,461%. More recently, shares of the restaurant have surged 19.5% over the last year and more than 25% in the last six months. Not only is Chipotle a great place to eat, it is also a great place for investors to put their money. Samba 2 Leaving Its Sector in the Dust Chipotle’s main competition is fast food companies. More specifically MCD, YUM, PNRA and SBUX. CMG has outperformed its industry in just about every aspect. Its Price to Earnings Ratio is 51.3 while the industry average is 22.18.Its Q3 earnings per share increased 56% to $4.15. CMG leads the industry with a price to sales ratio of 5.32. Trailing is SBUX with a ratio of 3.83, MCD has a P/S ratio of 3.42, Yum Brands has a 2.56 ratio, and PNRA finishes last with a ratio of 1.78. Lastly Chipotle’s price to cash flow ratio is a stellar 44.81, twice as much as the industry average and well above its competition. Revenue increased 31% to $1.08 billion as demand for its product has increased. Same store sales growth increased 19.8% this last quarter. CMG also increased their earnings per share by an outstanding 56% in Q3. Lastly the bottom line also surged more than 50%, mainly because of a higher top line and efficient management of costs. Growth Chipotle’s P/E Ratio is like that of an innovative tech company. Matter of fact, its PE is almost 3 times larger than Apple. The average newly opened Chipotle store (Opened for 12months) makes an outstanding $2.4 million a year and Chipotle plans to open 195-205 new stores in 2015. CMG’s forward PE is 38.1 compared to its current PE of 51.3. A lowered forward PE means analyst expect earnings to grow over time. Chipotle has shown spectacular growth and Samba 3 will continue to show rapid growth in the next decade. Hurdles One reason investors may be slightly dubious in investing in Chipotle is the talk of rising wages in America. This year labor accounted for 21.2% of Chipotle’s sales. Chipotle pays their entry level employees $8.51 while the average minimum wage in America is $7.25. I don’t imagine minimum wage will exceed $8.50 anytime in the near future. Food inflation was a major problem in the restaurant sector this fiscal quarter. According to Papa Johns in Q3 the price of cheese has risen from $1.74 per pound to $2.14 per pound. Food inflation affects three main foods for Chipotle; avocado, dairy, and meats. Currently food costs 34% of Chipotle’s sales. To offset an 8% increase in food inflation, Chipotle increased its menu by 6.2%.This did not affect Chipotle’s sales at all, the price increase was met by a less than 1% in price resistance. Going Forward During the quarter CMG repurchased about $13 million of their stock or over 20,000 shares and the average annual share -- average share price was about $654. At the end of the third quarter Chipotle had about $127 million left on their share buyback program, so Chipotle will increase the amount of cash they spend on retrieving shares. CMG has also gone past Mexican style cuisine. Chipotle’s two new developments are Shophouse and Pizzeria Locale. ShopHouse serves Southeast Asian style rice bowls and Pizzeria Locale serves gourmet pizza. Both offer counter service that enables diners to customize meals made from fresh, local, organic ingredients, and naturally raised meats. These new developments follow similar business models as Chipotle and allow Chipotle loyalist to have variety within their diet. Experts say Chipotle’s decision to develop new chains will help it maximize its supplier relationships, extend its brand equity and spread its “food with integrity” Samba 4 philosophy. Lastly Chipotle plans to open 195-205 new developments by 2015. These restaurateurs will increase revenue handsomely. Conclusion In conclusion, Chipotle has proven to be a great company. Chipotle’s business model appeals to Millennials across the nation and these Millennials will drive Chipotle for years to come. I expect to see Chipotle’s share price hit $712 by the end of Q4. Investors who are interested in long term growth will see CMG as a prudent investment. Work Cited: "Chipotle Mexican Grill's (CMG) CEO Steve Ells on Q3 2014 Results - Earnings Call Transcript." Seeking Alpha. Seeking Alpha, 20 Oct. 2014. Web. 27 Nov. 2014. <http://seekingalpha.com/article/2576875-chipotle-mexican-grills-cmg-ceo-steve-ells-on-q32014-results-earnings-call-transcript?part=single>. "Valuation by Company within Restaurants Industry." Restaurants Industry Valuation, Price to Earnings PE, Price to Earnings PE, Price to Book Ratios. N.p., n.d. Web. 27 Nov. 2014. <http://csimarket.com/Industry/Industry_Valuation.php?ind=914> Samba 5 "Chipotle Mexican Grill, Inc. (CMG) Earnings Forecast." NASDAQ.com. Nasqaq, n.d. Web. 27 Nov. 2014. <http://www.nasdaq.com/symbol/cmg/earnings-forecast> Guenette, Ryan. "Is Chipotle Mexican Grill Still Worth Its Premium Valuation?" Is Chipotle Mexican Grill Still Worth Its Premium Valuation? Fool Investing LLC, 16 July 2014. Web. 27 Nov. <2014. http://www.fool.com/investing/general/2014/07/16/is-chipotle-mexican-grill-stillworth-its-premiu-2.aspx>.