Assistant Director, Accounting Services

advertisement

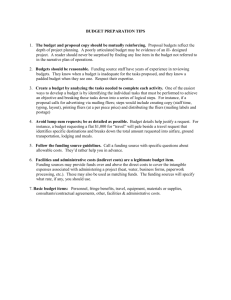

ADMINISTRATIVE FACULTY JOB DESCRIPTION APPROVED POSITION INFORMATION (to be completed by HR) Effective: March 1, 2015 Title Assistant Director, Accounting Services Essential Function: Sedentary Work Range JCC PCN 4 67452 11900 Description: Exerting up to 10 pounds of force occasionally and/or a negligible amount of force frequently to lift, carry, push, pull, or otherwise move objects, including the human body. Sedentary work involves sitting most of the time, but may involve walking or standing for brief periods of time. 1. Summary Statement: State the major function(s) of the position, the role in the university, and the supervisor’s title.* (This section is used for advertisement of the position.) The Assistant Director, Accounting Services is responsible for the preparation and accuracy of all Facilities Services’ budgets, purchase utility cost forecasting, utility and maintenance reimbursement, construction project accounting and fiscal reporting to management and other entities. Primary responsibilities of the position are oversight of accounting functions; preparing and monitoring budgets by reviewing accounting reports; analyzing and balancing budgets; reviewing and making recommendations on budgets and analyzing the impact on existing and future budgets. The position provides fiscal guidance to the Managers, Senior Directors and Associate Vice President (AVP) of Facilities Services. The incumbent reviews budget requests to ensure compliance with budgetary directives, policies and regulations and limitations for authorized spending. * Attach an organizational chart with positions, ranges, and names for the division. 2. List the major responsibilities, including percentage of time devoted to each. Provide enough detail to enable a person outside the department to understand the job (percentage first with heading and then bulleted information). If line of progression, define for each range as above. 45% - Budget Preparation and Monitoring Coordinate the preparation and compilation of operational projects and annual budgets with the Facilities Services Department (FSD) senior management within the established policies for FSD and manage the approved budgets Analyze campus Purchase Utility trends, estimates, and projections and report significant changes to the senior management team Resolve campus and departmental staff questions regarding Purchase Utilities Recharge and maintained space and/or acreage operations and maintenance (O&M) funding Assist with developing, evaluating, and implementing internal audit processes and procedures to ensure daily compliance with existing policies and new processes established in response to periodic audits or to improve facilities systems and procedures 1 Assistant Director, Accounting Services Conduct planning meetings with Facilities Services Directors to develop departmental budgets Analyze, organize, review, recommend and balance all budgets Review all financial and budget documents before submitting for signatures Assist departmental staff with questions regarding budgets and proper preparation of paperwork Collect and analyze data to ensure orderly year-end spend down of State appropriations Review accounting reports to look for trends and changes to current budget projections and analyze the impact on current and future budgets Provide fiscal oversight to Managers, Senior Directors and Associate Vice President (AVP) of Facilities Services Analyze prior year operating accounts to recommend the next year’s opening budget for state appropriated accounts Resolve position control issues and ensure personnel processes and records are in compliance with University and Facilities Services policies Complete budget revisions during the year to ensure accounts maintain a positive balance Oversee the processing of the bimonthly purchasing card statements for purchasing cards assigned to individuals or departments in Facilities Services Monitors, evaluates and recommends improvements for internal policies and procedures 35% - Accounting, Compliance and Reporting Devise and implement strong systems for internal controls Review and evaluate the “shadow system” of accounting currently used by facilities and make recommendations for improvement Establish and enforce policies and procedures that produce accurate cost accounting records and reports for all accounts, including projects funded through the State Public Works Board Responsible for monitoring and reporting budgets that adequately reflect the financial position; reports provided internally, and externally (e.g., Board of Regents, State Public Works, surveys, etc.) Establish and maintain an inventory control system to ensure supply levels, reduce costs, and control/detect shrink Ensure appropriate procedures are in place to detect errors Provide direction on utility analysis Perform analyses to determine trends, estimates, and complete projections for significant changes Write narrative reports for use in decision making and communication 20% - Supervision Manage accounting operations including billing, collections, and processing of payments Manage staff who handle the University’s recharge accounts and resolve campus and departmental staff questions regarding Purchase Utilities Recharge and maintained space Collaborate with Planning, Budget and Analysis on campus Purchase Utilities biennium rate calculations Supervise staff Develop staff by providing training and identifying skills development opportunities Review the work product of staff 2 Assistant Director, Accounting Services Provide training to FSRV staff regarding accounting policies, procedures, and efficiencies 3. Describe the types of decisions the position(s) makes independently as part of the core responsibilities. Provide examples. If a line of progression, describe the decisions made at the highest level. The Assistant Director is responsible for the implementation of financial strategies for Facilities Services. Decisions are made in line with defined goals and objectives, policies, procedures and accounting practices, but will occasionally extend beyond established precedent in consideration of alternative solutions. Decisions and judgments impact how effectively resources are utilized which directly impacts service levels, goals and objectives as well as the financial condition of Facilities Services. Proper decisions regarding the expenditure, recording, and reporting of funds directly affect future funding. The Directors and others on the leadership team are consulted for input as needed. 4. Describe the types of problems, issues, action, communications this position typically takes to the supervisor for resolution and/or consultation. Provide examples. If a line of progression, describe the supervisory consultation at the highest level. The individual works in consultation with the Senior Director of Planning and Construction on all major fiscal decisions. The incumbent is expect to report findings of non-compliance and significant changes in financial status. 5. Select the applicable competencies required to successfully perform the job. The selected competencies will be evaluated within the Administrative Faculty evaluation as Competencies for Success. Competency Required Adaptability ☒ Analytical Thinking ☒ Communication ☒ Diversity and Inclusion ☐ Financial Responsibilities ☒ Human Resource Responsibilities ☒ Leadership ☒ Program/Project/Functional Knowledge ☒ Resource Responsibilities ☒ Serving Constituents ☒ Teamwork ☒ 3 Assistant Director, Accounting Services ☐ Other (specify) 6. Minimum requirements of the position. Example provided. If Line of Progression, minimum requirements must be defined for each range. Education Experience Bachelor’s Degree Five years of related professional experience Master’s Degree Three years of related professional experience Relevant Experience: in accounting or business administration with progressively responsible accounting or business management responsibilities Certification and Licensure: Certified Public Accountant Nevada Class “C” or higher operator’s license within 30 days of appointment Schedule or Travel Requirements: None Optional Addendum: Describe the knowledge, skills, and abilities required to successful performance of this job (in bullet format). Knowledge of: Generally Accepted Accounting Principles (GAAP) Accounting, forecasting, budgeting and fiscal development to include cost accounting principles and processes, financial statement preparation and evaluation, revenue and expenditure tracking (reconciliation), strong internal control evaluation and design, accounting systems evaluation and design, higher education organizational structures, operations, policies, and procedures Interpretation of purchasing and grant procedures, laws and regulations Payroll processing and reporting Accounts payables and accounts receivables practices Skills: Proficiency in use of a personal computer and current software applications including but not limited to Microsoft Office Suite (Word, Access, Excel, PowerPoint, and Outlook), CAIS and Advantage Conflict management and resolution, leadership Staff supervision and management Ability to: Establish internal control procedures Evaluate, design and implement adequate accounting and computer systems Interact effectively with administrative faculty and staff and other employees at all levels of responsibility Understand and interpret formalized policies, guidelines, rules, and regulations Manage a budget Prepare accurate and complex reports Write reports, business correspondence and procedure manuals Provide projections and recommendations as to proper budget and cost control 4 Assistant Director, Accounting Services Prepare analytical studies and economic evaluations Provide variance or cost analysis details 5