state funding - Strongsville City Schools

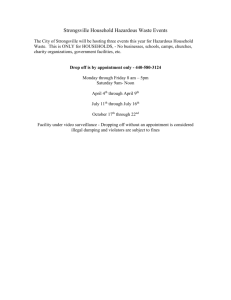

advertisement

Mission: The mission of the Strongsville City Schools, an “Excellent” school district with a tradition of nationally recognized students and staff, is to ensure all students reach their fullest potential, through challenging curriculum and activities, provided by a highly qualified, motivated staff, in a safe, supportive environment, with up-to-date facilities and technology - in partnership with the community. District Goals: Our all encompassing goal is to maintain our excellence in the face of continuing financial uncertainty. 1) Student Achievement Preserving Academic Excellence 2) Fiscal Stability & Responsibility 3) Update Strategic Plan Student Achievement 1) Ohio Improvement Process 2) Response To Intervention 3) State Report Card 9 years of excellence Fiscal Stability & Responsibility Mr. William Parkinson Treasurer Strongsville City Schools HOUSE BILL 920 & PROPERTY TAXES STATE FUNDING PROACTIVE FISCAL DECISIONS UNCONTROLLABLE FACTORS CURRENT FINANCES HOUSE BILL 920 & PROPERTY TAXES Property tax rates are defined as mills where 1 mill = 1/10th of $0.01 or $1.00 of taxation for every $1,000 in property value. Property taxes have historically accounted for 71% of the total General Fund Revenue budget. This line item, by law, never changes regardless of property values, unless an additional levy is passed. HOUSE BILL 920 & PROPERTY TAXES §12.02 of the Ohio Constitution “With respect to each voted tax authorized to be levied by each taxing district, the amount of taxes imposed by such tax against all land and improvements thereon . . . shall be reduced in order that the amount charged for collection against all land and improvements . . . in the current year . . . equals the amount charged for collection against such land and improvements in the preceding year.” HOUSE BILL 920 & PROPERTY TAXES No matter if property values rise or decline, the amount of dollars generated from any particular levy remains exactly the same. Since 1976, the year HB 920 was enacted, property values have grown by 751%. HOUSE BILL 920 & PROPERTY TAXES In 1976, property values were about $169,452,000 and generated about $5,300,000 from 31.8 mills Today, property values are estimated to be $1,442,739,000 and generate $5,300,000 from 31.8 mills. 1,442,739,000 169,452,000 5,300,000 5,300,000 HOUSE BILL 920 & PROPERTY TAXES 34 levy attempts since 1985 (including debt & permanent improvement requests). 12 have passed (35%) 22 have failed (65%) 30% of Cuyahoga County School Districts are on the May ballot; 70% project a deficit by 2014. HOUSE BILL 920 & PROPERTY TAXES No other public organization’s primary revenue source is governed by these set of rules. Not cities, not townships, not villages, not counties, not even the State. These organizations may receive some funding from property taxes, but none are dependent on it as schools are as a primary revenue source. STATE FUNDING Is governed primarily by two factors, enrollment and property values. As enrollment rises and falls, state funding rises and falls. As property values rises and falls, state funding falls and rises (contradicts HB 920; referred to as “phantom revenue”). STATE FUNDING As property values rise, the State assumes the District has become more property “wealthy” and is/should be less reliant on State Funding Since 1976, property values have grown by 751%. The result? Our school district is “less reliant” on State funding. STATE FUNDING FY10, the State transitioned from SF-3 funding model to Ohio Evidence Based Model funding model. Under this new funding model, the State took into consideration “proven” educational criteria and funded those areas. As a result, funding to schools was declared “adequate”. The new funding model still makes a distinction between “wealthy” Districts and “poor” Districts (i.e. those declared wealthy must rely more on local funding and less on state funding). STATE FUNDING What does this mean for Strongsville? Strongsville is considered to be property “wealthy”, and therefore, under the funding model, the Strongsville resident must provide the majority of funding. As a result of the funding model, the State’s share of funding responsibility in Strongsville is far less than that of the local property owner. STATE FUNDING Since the last levy was passed, funding from the State has declined by 10%. Part of the District’s planning process is being prepared as best as possible for further funding cuts that may be proposed and adopted as part of the next State biennium budget. STATE FUNDING (GOVERNOR'S PROPOSAL) Foundation Funding Formula FY13 0% 0% appears to continue as constituted under HB1 Tangible Reimbursements FY12 (-)37% (-)34% proposing to accelerate phase-out of payments Transportation (-)5% (+)1% PROACTIVE FISCAL DECISIONS (COMPENSATION) District bid out its insurance plan 133 Employees RIF’d / retired and not replaced includes the closing of Allen Elementary OAPSE negotiations in FY10 SEA negotiations in FY11 savings effective beginning July 1 PROACTIVE FISCAL DECISIONS (COMPENSATION) 3 year salary freeze for all employee groups applies to fiscal years ‘08 / ‘09 / ‘10 SEA / Admin through 2012 / OAPSE through 2011 Reduction of W/C premiums through better risk management Eliminate Camp Y-Noah / D.C. trips / Outdoor Education TOTAL SAVINGS $5,094,900 PROACTIVE FISCAL DECISIONS (PURCHASED SERVICES) Closing of Allen Elementary (fixed costs) Reduction of liability insurance premiums through better risk management Reduction of non-transportation costs / non-special ed. costs / employee travel costs TOTAL SAVINGS $987,900 PROACTIVE FISCAL DECISIONS Reduction of instructional & library supplies Reduction of repair & maintenance / facilities / vehicle / equipment supplies Reduction / delay of textbook adoptions TOTAL SAVINGS $586,300 PROACTIVE FISCAL DECISIONS Eliminate / delay school bus purchases Eliminate / delay technology hardware / software upgrades Eliminate / delay facility upgrades & maintenance TOTAL SAVINGS $874,200 PROACTIVE FISCAL DECISIONS Eliminate SCS-TV Closing of Allen Elementary (costs not associated with purchase services or supplies) TOTAL SAVINGS $262,600 PROACTIVE FISCAL DECISIONS TOTAL REDUCTIONS FROM ALL CATEGORIES $7,805,900 UNCONTROLLABLE FACTORS Declining collection rate ($0.96 / $1.00) Rising delinquencies Ohio Constitution keeps school funding flat regardless of valuation changes Tangible Tax eliminated under HB66 UNCONTROLLABLE FACTORS Declining enrollment Declining State funding specific impact from recent budget proposal unknown Declining interest earnings (5.18% to 0.11%) Bottom line => the District does not have any ability to change its revenue and is completely subject to outside influences UNCONTROLLABLE FACTORS Increasing utility costs Increasing diesel fuel costs Increasing costs due to State mandates Increasing fees paid to County CURRENT FINANCES – FY11 BUDGET REVENUE EXPENDITURES PROPERTY 46,958 SALARIES 40,659 TANGIBLE 213 BENEFITS 21,233 STATE 9,852 PURCHASED 4,966 REIMBURSE 6,445 SUPPLIES 1,537 ROLLBACK 5,831 CAPITAL OTHER 4,978 OTHER 5,824 TOTAL 74,277 TOTAL 74,439 220 CURRENT FINANCES – FY11 BUDGET ENDING CASH BALANCE PROJECTED BALANCES REVENUE 74,277 FY11 (+) 60 EXPENDITURES 74,439 FY12 (-) 7,348 FY13 (-) 19,767 FY14 (-) 38,509 FY15 (-) 60,613 NET REVENUE (-) 162 CASH BALANCE (7.020) (+) 60 8.0 7.0 6.8 Estimated Mills 6.0 How Was the Levy Determined? 5.0 4.0 3.0 2.1 2.0 1.0 1.0 0.0 Projected Deficit / County Auditor Advances Estimated State Funding Estimated Increases in Fixed Reductions Costs What Will the Levy Pay For? $0.85 $0.08 Operational Costs $0.02 $0.01 Utilities, Property Bus Fuel, Debt Service Insurance, Instructional Transportation & Supplies, Repair Special Ed. & Maintenance Costs $0.01 $0.03 Capital Expenditures County Fees, Liability Insurance, Auditing, Banking Fees THANK YOU Strongsville City School District State of the Schools Address March 2011 Important District Financial Information: www.strongnet.org Strategic Plan • Initiated in 2006 Key to Decision Making Process Oriented Builds Partnerships with Stakeholders • Comprehensive Overview Curriculum Teaching/Learning Facilities Operations Technology Student Activities Communications Strategic Plan • Status Review Reviewed Initial Plan (2006) Conducting Internal Audits by Dept. • Moving Forward Re-evaluating District Priorities Working Document Proactive vs Reactive Collaboration with Stakeholders / Community Involvement Facilities Aside from our employees, our facilities are our most important asset. 832,149 sq. ft. Educational Space, Plus BOE, Transportation, P.S. Most built in ‘50s & ‘60s, with 22 additions. Facilities 1) Preventive Maintenance 2) Unplanned Maintenance 3) Planned Repair 4) Capital Replacement The more $ spent on preventive maintenance, the less spent on other costs, as well as lower utilities. Facilities As the financial situation has become more challenging, we have made some tough decisions. General fund custodial & maintenance budgets decreased. Permanent Improvement fund used for capital expenditures. Five Year Plan PI fund provides $1,000,000 for capital expenditures each year. PI funds used for facilities, buses, technology needs. To balance district’s needs, we must use common sense, ‘biggest bang for the buck’. Strongsville High School Major Projects List Project: Rational: Replace windows in 4 classrooms FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Beyond Water intrusion Hall doors for ASAP Education need $ 1,591 Clean univent coils 700s/800s $ 21,410 No heat Replace roof sections Door replacement $ 750,000 In need Failing doors $ 7,502 $ 5,000 $ 5,000 $ 5,000 Catan Stadium heating RR & vending $ 20,000 Parking lot repaving Cracks & holes $ 125,000 Overdue $ 25,000 Duct cleaning Replace clocks Not working Fire suppression fix Fire inspection $ 2,125 Back flow preventer upgrade Out of order $ 2,450 Totals $ 19,151 $ 69,229 $ 755,000 $0 $ 5,000 $ 5,000 $ 170,000 Major Projects List Summary Project: FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Beyond $0 $ 5,000 $ 5,000 $ 170,000 $0 $ 915,000 $ 9,500 $ 75,000 $ 90,000 $0 $ 265,000 Strongsville High School $ 69,229 Albion Middle School $ 67,706 $0 Center Middle School $ 13,030 $0 Chapman Elementary School $ 71,225 $0 $0 $ 23,500 $0 $ 485,000 Drake Elementary School $ 69,800 $0 $0 $0 $0 $ 750,000 Kinsner Elementary School $ 402 $0 $0 $0 $0 $ 160,000 Muraski Elementary School $0 $0 $0 $0 $0 $ 135,000 Surrarrer Elementary School $ 832 $0 $0 $0 $0 $ 20,000 Whitney Elementary School $ 25,000 $0 $0 $0 $0 $ 298,000 Zellers Elementary School $ 3,800 $0 $0 $0 Early Learning Preschool $ 6,215 $0 $0 $0 Support Services Complex $ 364,120 $0 $ 24,500 $ 50,000 $ 38,500 $0 $ 15,000 $0 Board of Education District Wide $ 755,000 $ 663,000 $ 224,000 $ 245,000 $ 49,000 $ 410,000 $ 465,000 $0 $ 160,000 $ 315,000 $ 1,715,000 $0 $ 165,000 $ 260,000 $0 $ 160,000 $ 953,859 $ 1,000,000 $ 751,500 $ 1,248,500 $ 999,500 $ 4,858,000 Five Year Plan Next five years = OK, 2015 to 2025? Reconvene Facilities Committee, Present a Strategic Plan for Facilities. Additional Priorities 1) Partnership with the City - Quality of life 2) Communicating with Stakeholders 3) Use of Technology to Enhance Student Achievement 4) Professional Development for our Staff 5) Collaborative Approach to Decision Making Management of Change Vision Organizational & Personal Capacity Bldg. Skills Bldg. Culture Bldg. Incentives Resources Action Plan CHANGE Capacity Bldg. Skills Bldg. Culture Bldg. Incentives Resources Action Plan CONFUSION Incentives Resources Action Plan ANXIETY Resources Action Plan RESISTANCE Action Plan FRUSTRATION Vision Organizational & Personal Vision Organizational & Personal Capacity Bldg. Skills Bldg. Culture Bldg. Vision Organizational & Personal Capacity Bldg. Skills Bldg. Culture Bldg. Incentives Vision Organizational & Personal Capacity Bldg. Skills Bldg. Culture Bldg. Incentives Resources FALSE STARTS Killer Phrase n. 1. a knee-jerk response that squelches new ideas; 2. a threat to innovation • “It won’t work” • “Let’s form a committee” • “If it ain’t broke, don’t fix it” • “The boss will never go for it” • “Put it in writing” • “We don’t have time” • “They won’t accept it” • “It’s too old” • “You don’t understand our problem” • “We’re too small for that” • “It sounds good, but …” • “Here we go again” • “Don’t move too fast” • “I don’t see the connection” • “It’ll just mean more work” • “I have a problem with that” • “We don’t have the training” • “You gotta be kidding” Keeping things in perspective. Questions? 440-572-7010 lampert@strongnet.org