Annexure-III RBI MUMBAI PPP - Regional Training Institute,Shillong

advertisement

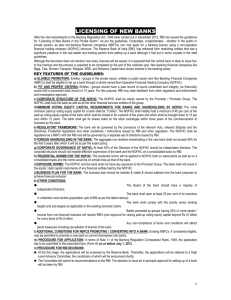

Seminar on Reduction / Elimination of Cash in Government Transactions Reserve Bank of India Dept. of Payment & Settlement Systems Central Office, Mumbai Presentation Structure • Overview of Payment & Settlement Systems • Introduction to Electronic Payment Systems • Present status in the country and the North Eastern states • Roadmap for implementation in North Eastern states for Government transactions February 9, 2011 DPSS, RBI 2 Overview of Payment & Settlement Systems February 9, 2011 DPSS, RBI 3 Payment System “A set of instruments, procedures and rules for the transfer of funds between or among participants, as well as the entity operating the arrangement typically based on an agreement between or among participants and the Financial Market Infrastructure transfer of funds is effected using an agreedupon technical infrastructure” February 9, 2011 DPSS, RBI 4 Legal Basis Payment and Settlement Systems Act, 2007 BPSS the apex body No payment system to operate without authorisation RBI as the regulator and supervisor Legal basis for Netting Dishonor of electronic debit instruction on par with Cheque Directives Issued Settlement and Default Handling Procedures Dispute Resolution framework February 9, 2011 DPSS, RBI 5 Mission “To ensure that all the payment and settlement systems operating in the country are Safe, Secure, Sound, Efficient, Accessible and Authorised". February 9, 2011 DPSS, RBI 6 Payment Systems – Major Milestones HV Close / Directives on Settlement, Defaults and Disputes 2008 RTGS IT ACT CTS / NECS / Mobile / NPCI / Act Notification 2005 DPSS / NEFT / NFS 2002 EFT / IDRBT CCIL MICR 1994 INFINET 1986 February 9, 2011 ECS DPSS, RBI 7 Payment Systems February 9, 2011 DPSS, RBI 8 Payment Systems – By volume February 9, 2011 DPSS, RBI 9 Payment System – By value February 9, 2011 DPSS, RBI 10 Introduction to Electronic Payment Systems February 9, 2011 DPSS, RBI 11 Electronic Payment Systems (EPS) • • • • • • Simpler Safer Faster Cost Effective Enhanced Reach Eco-friendly February 9, 2011 DPSS, RBI 12 Why EPS Cash / Paper Electronic Physical Movement of cash / paper instruments Electronic Message movement Fraud prone as paper moves outside the banking system Message moves inside the banking system hence less prone to frauds Geographical restrictions No such restrictions. Payment anywhere in India possible Time required to move paper makes the system slow Electronic movement of messages makes the system real time Operational cost of running the system very high Operational cost is very low As volume increases, logistics to be increased No such requirement February 9, 2011 DPSS, RBI 13 EPS – Benefits • Individuals Beneficiaries – – Funds in on the due date – Bills / EMIs paid automatically – No frequent writing of cheques / standing in the queue • Govt. Departments / Corporates – Instruction based – Direct payment / receipt on due date / time – Easy Reconciliation – Cost effective – No interaction between payer and payee February 9, 2011 DPSS, RBI 14 EPS - Variants • Electronic Clearing Service (ECS) – ECS – Credit and Debit – National ECS – Regional ECS – Credit and Debit • National Electronic Funds Transfer (NEFT) • Real Time Gross Settlement (RTGS) • Alternate Payment Channels – – – – Internet Banking ATMs Mobile Banking Pre-paid Payment Instruments February 9, 2011 DPSS, RBI 15 Electronic Clearing Service (ECS) • Used for bulk transfers – repetitive payments or receipts • Disbursement of funds – from one source to many beneficiaries – called Credit • Collection of funds – to one beneficiary from many customer s – called Debit • Operates on a T+1 basis • Available at 90 major locations • Geographical restriction – confined to cover local Clearing House only February 9, 2011 DPSS, RBI 16 ECS – Users • All prominent listed companies on exchanges • Used for – – – – – Salaries Vendor Payments Dividends IPO / FPO refunds Bill Collections (Telephone, Electricity, Water), EMIs, School / Exam fee collection etc. • Handled 16.7 mn transactions for value Rs 253.51 bn during October 2010 February 9, 2011 DPSS, RBI 17 National ECS • Credit Clearing introduced in September 2008 • Centralised processing at Mumbai • Covers about 52,000 branches • File acceptance timings extended till 6.30 pm • Processes around 75% of total ECS Credit volumes • Handled 2.6 mn. transactions in a single day February 9, 2011 DPSS, RBI 18 Regional ECS (RECS) • Credit and Debit Variants at Ahmedabad, Bangalore, Bhubaneshwar, Chennai, Kolkata – Since launched • Guwahati, Hyderabad and Jaipur – Ready for implementation • Bhopal, Kanpur, New Delhi, Nagpur and Patna – Being planned February 9, 2011 DPSS, RBI 19 National Electronic Funds Transfer (NEFT) • NEFT facilitates one-to-one funds transfers between banks, irrespective of location • Eleven Hourly Settlements from 9 am to 7 pm • Covers 101 banks and about 75,000 branches • Operates on a Batch+2 basis • Same day availability of funds • Returns within two hours of the settlement • Highly Secured – smart card based access – PKI security • Positive confirmation of credits to the originator • Highly popular – Number of transactions went up from 3.17 mn. during December 2008 to 13.46 mn. during December 2010 • Processed 13.46 mn. transactions worth Rs. 936.64 bn. during December 2010 • Processed a record 1.07 mn. transactions on a single day – January 31, 2010 February 9, 2011 DPSS, RBI 20 February 9, 2011 DPSS, RBI 21 NEFT – By amount February 9, 2011 DPSS, RBI 22 Real Time Gross Settlement (RTGS) • • • • • For remitting large value payments Credit on real time basis Minimum amount limit – Rs. 2 lakh Centralised processing at Mumbai Covers 74,000 branches February 9, 2011 DPSS, RBI 23 Alternate Payment Channels ATMs 68,000+ ATMs Avg. daily turnover – 11 mn transactions of ` 30 bn National Infrastructure – NFS operated by NPCI – Largest network, covers 98% of ATMs Customer Service Issues – Withdrawal from any bank ATM made free up to 5 times a month Timely resolution of complaints / penalty Standardised template for complaints February 9, 2011 DPSS, RBI 24 Alternate Payment Channels… Points of Sale Growth in POS Terminals 0.55 mn terminals Avg. Daily Volume : 1.5 mn. 550 Value : Rs. 3.20 bn. up to Rs. 1,000 using Debit cards Number in '000s Cash withdrawal permitted 500 450 400 350 300 250 200 150 100 50 0 Sep, 08 Sep, 09 Sep, 10 Forward Looking Possibility of IndiaCard by NPCI DPSS, RBI February 9, 2011 25 Alternate Payment Channels Mobile Banking Enables money transfer and mcommerce transactions through Mobile phones Implemented the bank-led model in October 2008 subject to certain limits Fund transfer for maximum Rs. 50,000 Beneficiary can receive funds up to Rs. 5,000 even without having a bank account with max. of Rs. 25,000 in a month Approval granted to 40 banks Monthly Volume : 0.50 mn Monthly Value : Rs. 0.44 bn February 9, 2011 DPSS, RBI 26 Alternate Payment Channels… Pay before (Pre-paid Cards) Guidelines issued in April 2009 Broadly classified into – (i) Open (cash withdrawal permitted); (ii) Semi-closed (no cash withdrawal) Non-banks – Only semi-closed; funds need to be placed in Escrow Account; Maximum cap – Rs. 50,000 28 banks and 16 non-banks given approval DPSS,Trail RBI Gives better Audit February 9, 2011 27 Electronic retail payment systems – By value February 9, 2011 DPSS, RBI 28 RBI Initiatives • • • • • • • Introduction of various Electronic Payment Products Enhancing the reach of these products Constantly improving these products Creating awareness among the public about these products Setting benchmarks for participants Authorisation of Prepaid cards for toll and other payments Approval for issue of cards by government departments / financial institutions to users • Rationalization of RTGS / NEFT charges levied by the banks • Waving of processing charges February 9, 2011 DPSS, RBI 29 RBI Initiatives • Processing inward transactions based solely on account number • Furnishing details in pass books / account statement of customers to help them in clearly identifying the source of funds / debits • Uniform penal interest rate prescribed for delay in crediting customers account or in returning the transactions – RBI LAF Repo rate + two percent. • Guidelines issued for bringing RRBs under NEFT umbrella • Set up Customer Facilitation Centres (CFCs) and placing details on banks’ websites February 9, 2011 DPSS, RBI 30 Present status in the country and the North Eastern states February 9, 2011 DPSS, RBI 31 Satellite Connectivity Scheme • To provide satellite connectivity in the North Eastern Region and encourage banks to bring more branches under CBS – Implemented effective from April 2009 • RBI provides to branches and off-site ATMs of banks, State Co-operative and RRBs 100% subsidy subject to maximum of Rs. 12,000 per month, per branch for providing connectivity to their branches provided they offer electronic fund transfer service free of cost • Banks eligible for subsidy for three years February 9, 2011 DPSS, RBI 32 Branch coverage NEFT NECS RTGS ATMs All India NE (6 States) Assam February 9, 2011 74687 50595 73876 67591 525 308 609 387 1114 579 1093 1007 DPSS, RBI 33 Share of NE States in NECS • Inward transactions for NE (6) states and Assam for the month of January 2011 are 1302 and 5897 respectively out of total 2.69 mn. transactions February 9, 2011 DPSS, RBI 34 Roadmap for implementation in North Eastern states for Government transactions February 9, 2011 DPSS, RBI 35 Possible Channels • • • • RECS NEFT Mobile Banking Prepaid Payment Instruments February 9, 2011 DPSS, RBI 36 RECS – Process Flow Sponsor Banks SBI Imphal SBI Agartala UBI Itanagar SBI RECS Service Centre UBI Dispur UBI RECS Service Centre Secure Web Server (SWS) DAD Guwahati Processing NCC, GUW SWS IDBI RECSSC BOB RECSSC CITI RECSSC UBI RECSSC YES RECSSC Destination Banks February 9, 2011 DPSS, RBI 37 Participation Essentials • • • • • Account with RBI / Commercial Banks Details of beneficiaries Process re-engineering Checks and balances Training February 9, 2011 DPSS, RBI 38 Discussion Points February 9, 2011 DPSS, RBI 39