Types of Securities - Oklahoma State University

Investing for the Next

Decade

“The Age of “Macro” Investing”*

*The Wall Street Journal, Sept. 10-11, 2011 pg B7.

Objectives for the Course

Understand the characteristics and the reasons for investing in various securities.

Understand the relationship between risk and return when investing.

Understand the role of diversification in successful investing.

Be familiar with financial considerations important to those nearing retirement or currently retired.

2

Today’s Class

Become familiar with characteristics of popular financial securities commonly used by individual and institutional investors and how these instruments are traded on organized security exchanges.

3

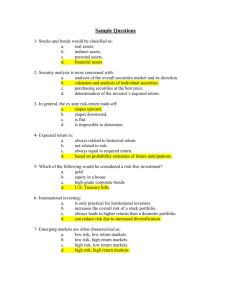

Classifying Securities

Basic Types

Interest-bearing

Equities

Derivatives

Major Subtypes

Money market instruments

Fixed-income securities

Common stock

Preferred stock

Futures

Options

4

Interest-Bearing Assets

Money market instruments are short-term debt obligations of large corporations and governments.

These securities promise to make one future payment.

When they are issued, their lives are less than one year.

Fixed-income securities (a bond) are longer-term debt obligations of corporations or governments.

The typical bond promise to make fixed payments according to a pre-set schedule. At maturity you received the principal (par value) back.

A “zero coupon” bond pays no annual interest. It is bought at a discount price that reflects the current interest rate. At maturity pays the par value (typically stated as 100).

When they are issued, their maturity exceeds one year.

5

Money Market Instruments

Examples : U.S. Treasury bills (T-bills), bank certificates of deposit (CDs), corporate and municipal money market instruments.

Potential gains/losses : A known future payment/except when the borrower defaults (i.e., does not pay).

Price quotations : Usually, the instruments are sold on a discount basis , and only the interest rates are quoted, not the prices.

6

Why Buy Money Market Securities

?

A safe place to store cash balances and earn interest on the proceeds.

Provides liquidity for your portfolio.

Most money market instruments have a very low probability of default.

Price risk is low because of short time to maturity.

However, the interest earned will be the lowest of all fixed income assets.

7

Fixed-Income Securities (Bonds)

Examples : U.S. Treasury notes, corporate bonds, municipal bonds.

Bond Quality is rated by three private companies:

Standard & Poor’s (AAA), Moody’s (Aaa) and Fitch’s.

Rating ranges from “AAA” (best) to “D” (in default)

Investment grades are AAA, AA, A and BBB-.

Like grades, “+” and “-” may be used, eg. AA-

8

Quote Example: Fixed-Income Securities

Price quotations from www.wsj.com

—the online version of

The Wall Street Journal (some columns are self-explanatory) :

You will receive 6.875% of the bond’s face value each year in 2 semi-annual payments.

The price (per $100 face) of the bond when it last traded.

The Yield to Maturity (YTM) of the bond.

9

Pros and Cons of Bonds in a Portfolio

Pros - Include Bonds in a portfolio to:

1.

2.

3.

Reduce risk. Bonds are more stable in value than stocks or many other assets.

Provide income. They provide consistent payments every six months(the interest).

Provide some liquidity. U.S. Treasury Bonds are highly liquid, however, many others are not.

Cons - Risk of Bonds include:

1. Prices vary with interest rates. Up and down.

2. Can be highly volatile. Like the last three years.

3. Many bonds are highly illiquid. Eg. Municipals and some corporates.

10

Common Stock

Represents ownership in a company. You are an equity owner and typically have voting rights in the company.

May be publicly traded, (eg. Williams Companies) or privately held, (Koch Industries).

Typically you get two things of value when you buy a stock: (1) The price rises over time and (2) dividends.

Stocks that pay no dividends but have a good business are typically called “growth stocks”.

Stocks that pay a relatively large dividend (eg. 3+%) are typically called “value stocks”.

11

Common Stock Price Quotes Online at http://finance.yahoo.com

*

*From Monday, Sep 12, 2011

12

Common Stock Price Quotes

13

The Pros of having stocks in a portfolio

Stocks provide the growth factor in a portfolio

Stock prices tend to rise over time as the economy grows.

Dividends tend to rise over time reflecting inflation and growth in the economy.

See the S&P Dividends Aristocrats list of 42 stocks that have raised their dividends every year for the past 25 years. Most are household names : Johnson & Johnson; Emerson Electric; Pepsico; Proctor and

Gamble, etc.

Exxon Mobil has increased dividends an average of 5.7% a year for 27 years.

Most portfolios should have some common stock exposure

14

The Cons of owning stocks

Stocks are more “risky” than the other assets we have discussed.

That is, they tend to vary more in price.

They go to zero if the company goes bankrupt.

There is a wide variety of stocks that you can own, ranging from very safe to very risky.

Thus, more time is needed to research individual stocks.

15

A risk-return comparison of various investments.

16

Indexes and Averages to Measure Stock

Market Performance

17

Popular Stock Market Indexes

Dow Jones Industrials – 30 large blue chip companies

(DJIA).

Standard and Poor’s –

S&P 500 Index

S&P 400 Midcap Index

S&P 600 Small cap index

Russell 2000 – small cap firms

NASDAQ Composite – stocks listed on the National

Assoc. of Securities Dealers Automated Quote

System.

18

Yields on Dow Jones Industrial Average Component

Stocks

19

Top 10 Stocks in S&P 500 by Market Cap

20

Stock Market Indexes, I.

Indexes can be distinguished in four ways:

The market covered,

The types of stocks included,

How many stocks are included, and

How the index is calculated

price-weighted , e.g. DJIA, versus value-weighted , e.g. S&P 500.

21

Stock Market Indexes, II.

For a value-weighted index (i.e., the S&P 500), companies with larger market values have higher weights.

For a price-weighted index (i.e., the DJIA), higher priced stocks receive higher weights.

This means stock splits cause issues.

But, stock splits can be addressed by adjusting the index divisor.

Note: As of March 8, 2008, the DJIA divisor was a nice “round”

0.122834016!

22

A Variety of Market Indexes

23

Why do we have so many indexes?

Many are based on something called market capitalization or market cap for short.

Market cap is the $ value of the equity of the firm that is in the hands of the shareholders:

Market cap = shares outstanding x $ price per share

It varies daily because the price of the stock changes

Shares outstanding change gradually, usually at most at each quarter.

Others are based on the geographical region or company characteristics.

24

Common Categories of Stock Indexes

By Market Cap

All Cap – Russell 3000; Wilshire 5000

Large Cap – S&P 500; Russell 1000

Mid Cap/Small Cap – S&P 400/600;

Russell 2000 and 2500

By Firm Objective

Growth

Value

25

By Geographical Area;

EAFE (Europe, Australia, Far East)

BRIC (Brazil, Russian, India, China)

MSCI ACWI (Morgan Stanley Capital International

World Index)

By type of market

Emerging Markets

Frontier Markets

26

Useful Internet Sites

www.nasdbondinfo.com

(current corporate bond prices) www.investinginbonds.com

(bond basics) www.finra.com

(learn more about TRACE) www.fool.com

(Are you a “Foolish investor”?) finance.yahoo.com

(prices for option chains) www.wsj.com

(online version of The Wall Street Journal ) www.morningstar.com

(Morningstar’s information on stocks and mutual funds)

How Common Stock Gets to the Public Market Place

28

The “Capital” life cycle of a business

An idea leads to starting a small business, financed by the owner’s own money – equity.

A bank may provide initial financing – debt.

A Private equity or Venture Capitalist investor may provide additional capital to finance growth – equity financing.

Ultimately, the successful firm decides to “go public” and sell its common stock on the open market. This is called an Initial Public Offering (IPO).

29

Private Equity and Venture Capital

Private Equity is the used for the rapidly growing area of equity financing for nonpublic companies.

Because banks generally are not interested in making loans to start-up companies, especially small ones.

Firms often seek equity financing from a venture capital (VC) firm , an important part of the private equity markets.

30

Venture Capital, I

Venture Capital refers to financing new, often high-risk, start-ups .

Individual venture capitalists invest their own money.

Venture capital firms pool funds from various sources, like

Individuals

Pension funds

Insurance companies

Large corporations

University endowments

Venture capitalists know that many new companies will fail, but the companies that succeed can provide enormous profits.

31

The Venture Capital Process

To limit their risk:

Venture capitalists generally provide financing in stages.

Venture capitalists actively help run the company.

At each stage, enough money is invested to reach the next stage.

Ground-floor financing

Mezzanine Level financing

At each stage of financing, the value of the founder’s stake grows and the probability of success rises.

If goals are not met, the venture capitalists withhold further financing.

If a start-up succeeds:

The big payoff frequently comes when the company is sold to another company or goes public.

27

Selling Securities to the Public

The primary market is the market where investors purchase newly issued securities.

Initial public offering (IPO): An IPO occurs when a company offers stock for sale to the public for the first time.

Seasoned equity offering (SEO): If a company already has public shares, an SEO occurs when a company raises more equity.

The secondary market is the market where investors trade previously issued securities. An investor can trade:

Directly with other investors.

Indirectly through a broker who arranges transactions for others.

Directly with a dealer who buys and sells securities from inventory.

The NYSE is an example of a secondary market for securities.

33

Bringing an IPO to the Market

The issuing firm hires an investment banking firm that performs the following functions:

Development of the prospectus:

Red Herring; Official

Origination

Underwriting arrangement – “best efforts”, “all or none”, “firm purchase”, etc.

Syndication – the group of investment banks that will help sell the issue

Distribution – Through the syndicate

Market Stabilization

34

IPO Tombstone

35

The Secondary Market for Common Stock

Most common stock trading is directed through an organized stock exchange or trading network.

Whether a stock exchange or trading network, the goal is to match investors wishing to buy stocks with investors wishing to sell stocks.

The market maker function is key to providing a liquid and fair market for any financial asset. They are ready to take the other side of your order.

36

The New York Stock Exchange

The New York Stock Exchange (NYSE), popularly known as the Big Board , celebrated its bicentennial in 1992.

The NYSE has occupied its current building on Wall Street since the early

1900’s.

For 200 years, the NYSE was a not-for-profit New York State corporation.

The NYSE went public in 2006

(NYSE Group, Inc., ticker: NYX)

Naturally, NYX stock is listed on the NYSE

In 2007, NYSE Group merged with Euronext to form NYSE Euronext, the world’s largest exchange.

37

NYSE Seats and Trading Licenses

Historically, the NYSE had 1,366 exchange members. These members:

Were said to own “seats” on the exchange.

Collectively owned the exchange, although professionals managed the exchange.

Regularly bought and sold seats (Record seat price: $3 million in 2005)

Seat holders could buy and sell securities on the exchange floor without paying commissions.

In 2006, all of this changed when the NYSE went public.

Instead of purchasing seats, exchange members purchase trading licenses:

number limited to 1,500

In 2007, a license would set you back a cool $55,000—per year.

Having a license entitles the holder to buy and sell securities on the floor of the exchange.

38

Types of NYSE Members

The largest number of NYSE members are registered as commission brokers .

Commission brokers execute customer orders to buy and sell stocks.

Second in number of NYSE members are specialists , or market makers .

Market makers are obligated to maintain a “fair and orderly market” for the securities assigned to them.

39

NYSE-Listed Stocks

In 2006, the total number of companies listed on the NYSE represented a total global market value of about $25 trillion.

Initial and annual listing fees are charged based on the number of shares.

To apply for listing, companies have to meet certain minimum requirements with respect to

The number of shareholders

Trading activity

The number and value of shares held in public hands

Annual earnings

40

Operation of the New York Stock

Exchange

The fundamental business of the NYSE is to attract and process order flow .

In 2007, the average trading volume on the NYSE was over

2 billion shares a day.

Volume breakdown:

About one-third from individual investors.

Almost half from institutional investors.

The remainder represents NYSE-member trading, mostly from specialists acting as market makers.

41

Stock Market Order Types

42