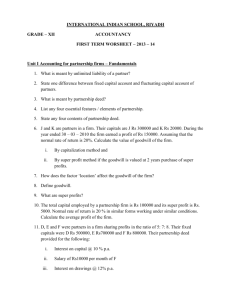

Multi Disciplinary Questions

advertisement

Multi Disciplinary Questions ACCOUNTANCY CLASS 12 QUESTION NO-1 • A and B are partners sharing profits in the ratio of 3:2 with capitals of Rs. 3,20,000 and Rs. 2,60,000.On 1st April,2013,they admit C into the partnership. A surrenders 1/5th of his share and B surrenders 2/5th of his share in favor of C.C brings in Rs. 1,40,000 for goodwill and the proportionate amount of Capital in cash. Partner’s are entitled to interest on capital @5% p.a. Profits for the year ending 31st March,2014 before allowing interest on capitals amounted to Rs. 3,00,000. Pass journal entries for the above mentioned transactions. Date Particulars L.F. Dr.(R.s) Cr.(Rs.) 2013 Apr-01Bank A/c Dr. 4,20,000 To C's Capital A/c 2,80,000 To premium for goodwill A/c 1,40,000 (the amount of capital and goodwill/premium brought in cash) Apr-01Premium for Goodwill A/c Dr. 1,40,000 To A's Capital A/c 60,000 To B's Capital A/c 80,000 (Goodwill credited to old partners in sacrificing ratio i.e., 3 : 4) 2014 Mar-31Profit & loss A/c Dr. 3,00,000 To Profit and Loss appropriation A/c 3,00,000 (Transfer of profit & loss to appropriation A/c) Mar-31Interest on Capital A/c Dr. 50,000 To A's Capital A/c 19,000 To B's Capital A/c 17,000 To C's Capital A/c 14,000 (Interest on partner's Capitals) Mar-31Profit and Loss Appropriation A/c Dr. 50,000 To interest on Capital A/c 50,000 (Transfer of interest on capital to appropriation A/c) Mar-31Profit and Loss Appropriation A/c Dr. 2,50,000 To A's Capital A/c 1,20,000 To B's Capital A/c 60,000 To C's Capital A/c 70,000 Transfer of balance of appropriation A/c to capital accounts in the profit sharing ratio i.e., 12 : 6: 7) Working notes 1. share surrendered by A: 1/5th of 3/5 =3/25 Share surrendered by B : 2/5th of 2/5 = 4/25 Sacrificing ratio 3/25 : 4/25 = 3 : 4 A’s new share = 3/5 – 3/25 = 15-3/25 =12/25 B’s new share = 2/5 – 4/25 = 10-4/ 25 = 6/25 C’s share = 3/25 +4/25 = 7/25 hence., new ratios of A, B and C = 12 : 6 : 7 2. adjusted capital of A = Rs. 3,20,000 + share of goodwill Rs. 60,000 = Rs. 3,80,000 adjusted capital of B = Rs. 2,60,000 + share of goodwill Rs. 80,000 = Rs. 3,40,000 Total adjusted capital of A and B for 18/25th share = Rs. 3,80,000 + Rs. 3,40,000 = Rs. 7,20,000 total capital of new firm : Rs. 7,20,000 × 25/18 = Rs. 10,00,000 Proportionate capital of C = Rs. 10,00,000 × 7/25 = Rs. 2,80,000 3. interest on capitals : A 5% on Rs. 3,80,000 = Rs. 19,000 B 5% on Rs. 3,40,000 = Rs. 17,000 C 5% on Rs. 2,80,000 = Rs. 14,000 Rs. 50,000 4. net profit after interest on capital = Rs. 3,00,000 –Rs. 50,000 = Rs. 2,50,000 QUESTION NO-2 • The partners of a firm distributed the profits for the year ended 31st March,2013,Rs. 7,50,000 equally without providing for the following adjustments: (1) A and B were entitled to a salary of Rs. 10,000 each per month. (2) B was entitled to a commission of Rs. 60,000. (3) Profits were to be shared in the ratio of 3:2:1. Partners decided to pass an adjusting entry on 1ST April,2013 rectifying the same. On the same date, they admitted D as a new partner for 1/7th share in the profits. The new profit sharing ratio will be 2:2:2:1respectively. D brought Rs. 3,00,000 for his capital and Rs. 45,000 for his 1/7th share of goodwill. Showing your workings clearly, pass the necessary journal entries in the books of the firm for the above mentioned transactions. DATE PARTICULAR L.F. Dr.(RS) 2013 C’s Capital A/c Dr. APRIL 1 To A’s Capital A/c To B’s Capital A/c (Adjustment for wrong appropriation of profit) 1,75,000 APRIL 1 Bank A/c Dr. To D’s Capital A/c To Premium for Goodwill A/c (The amount of capital and goodwill/premium brought in cash) 3,45,000 April 1 45,000 37,500 Premium for Goodwill A/c Dr. C’s Capital A/c To A’s Capital A/c To B’s Capital A/c (Premium for goodwill brought in D credited to A and B along with 5/45 of the goodwill to be contributed by C due to gain in his profit sharing ratio) Cr.(RS) 95,000 80,000 3,00,000 45,000 67,500 15,000 Working Notes : TABLE SHOWING ADJUSTMENTS PARTICULAR Salary (Cr.) Commission (Cr.) Remaining profit i.e., 7,50,000-2,40,000-60,000=4,50,000 will be divided in 3 : 2 : 1 (Cr.) Less : Profit already distributed equally A (RS) B (RS) 1,20,000 1,20,000 60,000 2,25,000 3,45,000 2,50,000 (Cr.) 95,000 1,50,000 3,30,000 2,50,000 (Cr.) 80,000 C (RS) TOTAL (RS) 2,40,000 60,000 75,000 75,000 2,50,000 (Dr.) 1,75,000 4,50,000 7,50,000 7,50,000 --- On D’s admission C has also gained to the extent 5 of 42 . Hence, he must also compensate A and B to the extent of of the firm’s goodwill. 1 For share, goodwill brought in by D = Rs.45,000. 7 Total goodwill of the firm based on D’s share = 7 45,000 x = 3,15,000 1 5 42 5 42 C to compensate = 3,15,000 x = 37,500. Total Goodwill contributed by D and C (45,000 + 37,500) = 82,500 will be distributed between A and B in their sacrificing ratio. 9 A’s share = 82,500 x = 67,500. B’s share = 82,500 x 11 2 11 = 15,000. QUESTION NO-3 • A,B and C were partners in a firm sharing profits in the ratio of 1:2:2. On 1st July,2014 A retired and the new profit sharing ratio of B and C was 3:2. Goodwill of the firm was valued at Rs. 4,00,000. D is admitted as a partner . B and C surrenders ½ of their respective share in favor of D. D is to bring his share of premium for the goodwill in cash. Pass necessary entries for the record of goodwill in the above case. Also calculate the sacrificing ratios and new ratios. JOURNAL DATE PARTICULAR 2014 July 1 B’s Capital A/c Dr. 1 To A’s Capital A/c (5 th of 4,00,000) (B’s Capital account debited as he alone has gained on A’s retirement )(see Note 1) 80,000 July 1 Bank A/c Dr. To Premium for Goodwill A/c (Premium for Goodwill brought in cash by D) 2,00,000 Premium for Goodwill A/c Dr. To B’s Capital A/c To C’s Capital A/c (Premium brought in by D credited to B and C in the sacrificing ratio of 3 : 2) 2,00,000 July 1 L.F. Dr. (Rs) Cr. (Rs) 80,000 2,00,000 1,20,000 80,000 Working Notes : (1)Calculation of Gaining Ratio : 3 Gaining Ratio of B = − Gaining Ratio of C = 2 5 5 − (2) B’s existing share Share surrendered by B C’s existing share Share surrender by C 2 = 5 1 = 2 2 5 2 5 = = 0 3 = 5 1 = 2 of 1 5 2 5 3 5 of = = 2 10 3 10 3 2 Therefore, Sacrificing Ratio = A ∶ B = 3 10 10 3 3 6−3 3 New Ratio : B’s new share = − = = 5 10 10 10 2 2 4−2 2 C’s new share = − = = 5 10 10 10 D’s new share = 3 2 + 10 10 = :2 5 10 Hence, new ratio of B,C and D = 3 10 ∶ 2 10 (3) D’s share of Goodwill = 4,00,000 x ∶ 5 10 5 10 = 3 : 2: 5 = 2,00,000. Q.4. A,B and C were in partnership sharing profits and losses in the proportions of 3 : 2 : 1. On 1st April,2011,B retires from the firm. On that date , their Balance Sheet was as follows : Liabilities (Rs) Trade Creditors 69,000 Expenses owing 45,000 Reserve Fund 1,05,000 Workmen’s Compensation Reserve 48,000 Capitals : A: 1,95,000 B: 1,57,000 C: 81,000 4,33,000 7,00,000 Assets Cash in hand Debtors Less : Provision Stock Factory Premises Investments Loose Tools (Rs) 85,000 1,60,000 10,000 1,50,000 1,20,000 2,25,000 80,000 40,000 7,00,000 The terms were : (1) Goodwill of the firm to be valued at 2 times of Average Super Profits of last three years . Taking into consideration the risk of the business, normal profits of the firm are estimated at 5,00,000 every year. But actual profits three years ending 31st march were as 2009 : 6,00,000 , 2010 : 5,50,000 , 2011 : 5,75,000. (2) Expenses owing to be brought down to 37,500. (3) Investments are valued at 72,000.A took over investments at this value. (4) Factory premises is to be revalued at 2,43,000;and Loose tools at 36,000. (5) Provision for doubtful Debt to be increased by 19,500. (6) Claim on account of workmen’s compensation is 18,000. (7) B be paid 50,000 in cash and balance due to him treated as a loan carrying interest @ 6% per annum. As per partnership deed, partners are allowed 6% p.a. interest on their capitals. Profits for the year ending 31st march 2012 before allowing interest on the loan and capitals amounted to 22,000. Show Journal entry for goodwill adjustments, prepare Revaluation Account and Capital Accounts as on 1st April 2011 and the distribution of profit for the year ended 31st March,2012. Calculation of Goodwill : Average profits of the past three years 𝟔,𝟎𝟎,𝟎𝟎𝟎+𝟓,𝟓𝟎,𝟎𝟎𝟎+𝟓,𝟕𝟓,𝟎𝟎𝟎 = 𝟑 = 5,75,000. Super profits = Actual profit – Normal profits =5,75,000-5,00,000=75,000. Goodwill at 2 years purchase of super profits = 75,000x2=1,50,000. JOURNAL ENTRY FOR GOODWILL DATE 2011 April 1 PARTICULAR A’s Capital A/c Dr. C’s Capital A/c Dr. To B’s Capital A/c (B’s share of goodwill adjusted to the accounts of continuing partners in their gaining ratio 3 : 1) L.F. Dr. (Rs) Cr. (Rs.) 37,500 12,500 50,000 REVALUATION ACCOUNT PARTICULAR To Investments To Loose Tools To Provision for doubtful debts (Rs.) 8,000 4,000 19,500 31,500 PARTICULAR By Expenses owing A/c By Factory Premises By Loss transferred to : A 3,000 B 2,000 C 1,000 (Rs.) 7,500 18,000 6,000 31,500 TICULAR pril 2011 evaluation A/c ’s capital A/c vestments A/c ash A/c ’s loan A/c alance c/d CAPITAL ACCOUNTS A (Rs.) 3,000 37,500 72,000 0 0 1,50,000 2,62,000 B (Rs.) C (Rs.) 2,000 1,000 0 12,500 0 0 50,000 0 2,00,000 0 0 90,000 2,52,000 1,03,500 PARTICULAR 1st April 2011 By Balance b/d By Reserve Fund A/c By Workmen’s Compensation Reserve A/c By A’s Capital A/c By C’s Capital A/c A (Rs.) B (Rs.) 1,95,000 1,57,000 81 52,500 35,000 17 15,000 0 0 2,62,000 10,000 37,500 12,500 2,52,000 1, PROFIT & LOSS ACCOUNT for the year ended 31st march, 2012 PARTICULAR To Interest on B’s Loan ( 6% on 2,00,000) To Profit transferred to P & L Appropriation A/c (Rs.) PARTICULAR By Profit (before interest) (Rs.) 22,000 12,000 10,000 22,000 22,000 Since partnership deed is silent in treating on capital as a charge or appropriation it will be treated as appropriation of profits. PROFIT AND LOSS APPROPRIATION A/C PARTICULAR To Interest on Capital A 10,000 x B 10,000 x (Rs.) 5 8 3 8 PARTICULAR (Rs.) By Profit & Loss A/c 10,000 6,250 3,750 10,000 10,000 Interest on A’s Capital 6% on 1,50,000 Interest on A’s Capital 6% on 90,000 9,000 5,400 14,400 The available profit is 10,000 whereas the interest due on capitals is 14,400. Since the profit is less than interest, the available profit will be distributed in the ratio of interest, i.e., 9,000 : 5,400 or 5 : 3.