Notes for Chapter 4

advertisement

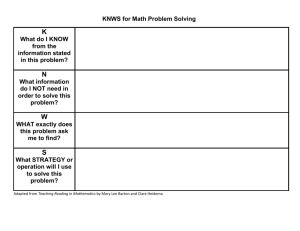

Time Value of Money Chapter 4 TVM on YouTube Barton College 2 Don’t forget to look at the Notes Pages (See Below how to do this..) Barton College 3 Chapter Topics • TVM Introduction • Single Period Investments • Multiple Period Investments • Compound Interest • Future Value (FV) and Compounding • Present Value (PV) & Discounting • Determining the Discount Rate given the PV or FV • Determining the Number of Periods given the PV or FV • A few Problems for practice….. Barton College 4 Introduction to the Time Value of Money (TVM) • Someone wins the PowerBall Lottery and the payout is $110M. Does the recipient really receive this amount or something less? • One person invests $1M in savings bonds and another person invest $1M in a franchise restaurant chain. Are these investments similar, different, or contain different amounts of risk…..? – Understanding how to interpret the TVM will help the investor/manager choose a decision that best fits the particular purpose. – It also helps the investor understand why a dollar today is more than a dollar tomorrow (if held in one’s pocket and not invested) Barton College 5 Basic Definitions • Future Value – later money on a time line • Present Value – earlier money on a time line • Interest rate – “exchange rate” between earlier money and later money – Discount rate – Cost of capital (wacc) – Opportunity cost of capital – Required return – Historical return – Expected return Barton College 6 Future Value Future Value is the amount an investment is worth after one or more periods. Board Example • Single Period and Simple Interest – Suppose you invest $1000 for one year at 5% per year. What is the future value in one year? • • • Interest = 1000(.05) = $50 Value in one year = principal + interest = 1000 + 50 = $1050 Future Value (FV) = 1000(1 + .05) = $1050 • Multiple Periods: Suppose you leave the money in for another year. How much will you have two years from now? – FV = 1000(1.05)(1.05) = 1000(1.05)2 = $1102.50 Barton College 7 Compounding Effects Simple Interest vs. Compound Interest • Consider the earlier example – FV with simple interest = 1000 + 50 + 50 = $1100 – FV with compound interest = 1102.50 • FV = 1000(1.05)(1.05) = 1000(1.05)2 = $1102.50 – The extra $2.50 comes from the interest of .05(50) = 2.50 earned on the first interest payment Barton College 8 Future Values: General Formula • FV = PV(1 + r)t – FV = future value – PV = present value – r = period interest rate, expressed as a decimal – t = number of periods • Future value interest factor = (1 + r)t Barton College Future and Present Value Interest Factors can be found at the back of your book. 9 A few basic Definitions • Compounding – The process of accumulation interest on an investment over time to earn more interest. • Interest on Interest – Interest earned on the reinvestment of previous interest. • Compound Interest – Interest earned on both the initial principal and the interest reinvested from prior periods. • Simple interest – just the interest earned on the original principle. Barton College 10 Future Values – Example 2 • Suppose you invest the $1000 from the previous example for 5 years. How much would you have? – i = 5%, t = 5, PV = $1000 – FV = PV(1+r)t – FV = 1000(1+.05) 5 – FV = 1000(1.05)5 = 1276.28 • The effect of compounding is small for a small number of periods, but increases as the number of periods increases. (Simple interest would have a future value of $1250, for a difference of $26.28.) Example of (100 @ 10% rate) = $10.00 • Simple interest provides $10 x 5 = $150 • Compound Interest provides $161.05 – – – – – Period 1: Period 2: Period 3: Period 4: Period 5: Barton College 100(1.10) = $110 110(1.10) = $121 121(1.10) = $133.10 133.10(1.10) = $146.41 146.41(1.10) = $161.05 FV = 100(1.10)5 = $161.05 161.05 – 150 = $11.05 11 Future Values – Example 3 • Suppose you had a deposit $10 at 5.5% interest 200 years ago. How much would the investment be worth today? – FV = PV(1+r)n = 10(1.055)200 = 447,189.84 • What is the effect of compounding? – Simple interest = 10 + 200(10)(5.5%) = 210.55 Compounding added $446,979.29 to the value of the investment Calculator: N = 200; I/Y = 5.5; PV = 10; CPT FV = -447,198.84 Barton College 12 FV Calculator Keys • Texas Instruments BA-II Plus – FV = future value – PV = present value – I/Y = period interest rate • • • Use Appendix D to help set up your calculator P/Y must equal 1 for the I/Y to be the period rate Interest is entered as a percent, not a decimal – N = number of periods – Remember to clear the registers (CLR TVM) after each problem – Other calculators are similar in format Calculator Page Barton College 13 Finding the Present Value or (Discounting a Future Value back to the Present) Barton College 14 Present Values • How much do I have to invest today to have some amount in the future? – FV = PV(1 + r)t – Rearrange to solve for PV = FV / (1 + r)t • When we talk about discounting, we mean finding the present value of some future amount. • When we talk about the “value” of something, we are talking about the present value unless we specifically indicate that we want the future value. Barton College 15 Present Value – One Period Example • Suppose you need $10,000 in one year for the down payment on a new car. If you can earn 7% annually, how much do you need to invest today? – PV = FV / (1+r)n = 10,000 / (1+.07) 1 – PV = 10,000 / (1.07)1 = 9345.79 – Calculator • 1= N • 7 = I/Y • 10,000 = FV • CPT PV = -9345.79 Calculator Example of Present Value (PV) • http://movies.atomiclearning.com/movie/k12/21142/play Barton College 16 Present Values – Example 2 • You want to begin saving for you daughter’s college education and you estimate that she will need $150,000 in 17 years. If you feel confident that you can earn 8% per year, how much do you need to invest today? • PV = FV / (1+r)n • PV = 150,000 / (1.08)17 = $40,540.34 Key strokes: 1.08 yx 17 = 3.70002 and $150,000/3.70002 = $40, 540.34 Calculator: N = 17; I/Y = 8; FV = 150,000; CPT PV = -40,540.34 Barton College 17 Present Values – Example 3 • Your parents set up a trust fund for you 10 years ago that is now worth $19,671.51. If the fund earned 7% per year, how much did your parents invest? • PV = FV / (1+r)n – PV = 19,671.51 / (1.07)10 = 10,000 Calculator: N = 10; I/Y = 7; FV = 19,671.51; CPT PV = -10,000 Barton College 18 Present Value – Important Relationship I • For a given interest rate – the longer the time period, the lower the present value – What is the present value of $500 to be received in 5 years? 10 years? The discount rate is 10% – 5 years: PV = 500 / (1.1)5 = 310.46 – 10 years: PV = 500 / (1.1)10 = 192.77 A dollar decreases in value more and more over time….. Or… the discount factor increases over time…. Barton College 19 The Basic PV Equation Refresher • PV = FV / (1 + r)t • There are four parts to this equation – PV, FV, r and t (I will sometimes mix n and t for the same thing…) – If we know any three, we can solve for the fourth • If you are using a financial calculator, be sure and remember the sign convention or you will receive an error when solving for r or t Barton College 20 Discount Rate • Often we will want to know what the implied interest rate is in an investment • Rearrange the basic PV equation and solve for “r” – – – – FV = PV(1 + r)t FV/PV = (1+r)t (FV/PV)1/t = ((1+r)t)1/t (FV/PV)1/t = 1+r – r = (FV / PV)1/t – 1 • If you are using formulas, you will want to make use of both the yx and the 1/x keys Barton College 21 Discount Rate – Example 1 • You are looking at an investment that will pay $1200 in 5 years if you invest $1000 today. What is the implied rate of interest? – FV = 1200 – N=5 – PV = 1000 r = ______ r = (FV / PV)1/t – 1 – r = (1200 / 1000)1/5 – 1 = .03714 = 3.714% – Calculator – the sign convention matters!!! • N= 5 • PV = -1000 (you pay 1000 today) • FV = 1200 (you receive 1200 in 5 years) • CPT I/Y = 3.714% Barton College 22 Discount Rate – Example 2 • Suppose you are offered an investment that will allow you to double your money in 6 years. You have $10,000 to invest. What is the implied rate of interest? – r = (FV / PV)1/t – 1 – r = (20,000 / 10,000)1/6 – 1 = .122462 = 12.25% Calculator: N = 6; FV = 20,000; PV = 10,000; CPT I/Y = 12.25% Barton College 23 Discount Rate – Example 3 • Suppose you have a 1-year old son and you want to provide $75,000 in 17 years towards his college education. You currently have $5000 to invest. What interest rate must you earn to have the $75,000 when you need it? – r = (FV / PV)1/t – 1 – r = (75,000 / 5,000)1/17 – 1 = .172688 = 17.27% Calculator: N = 17; FV = 75,000; PV = 5,000; CPT I/Y = 17.27% Barton College 24 Solving for the Number of Periods – Example 1 • You want to purchase a new car and you are willing to pay $20,000. If you can invest at 10% per year and you currently have $15,000, how long will it be before you have enough money to pay cash for the car? Given: FV = PV (1+r)t Solve for t – FV/PV = (1+r)t – Using the ln and “The Power Rule for natural logs” – ln (FV/PV) = t ln(1+r) – t = ln(FV/PV) / ln(1+r) – t = ln(20,000 / 15,000) / ln(1.1) = 3.02 years – ln xt = t ln x Barton College (The Power Rule) 25 Number of Periods – Example 2 Continued • To buy a house you have $15,000 but you need $21,750 that includes all your closing costs. Rates are currently 7.5%. How long will it take to reach the desired amount? – Down payment = .1(150,000) = 15,000 – Closing costs = .05(150,000 – 15,000) = 6,750 – Total needed = 15,000 + 6,750 = 21,750 • Compute the number of periods – PV = -15,000 – FV = 21,750 – I/Y = 7.5 – CPT N = 5.14 years To buy a House??? t = ln (FV/PV) / ln (1+r) • Using the formula – t = ln(21,750 / 15,000) / ln(1.075) = 5.14 years Barton College 26 Spreadsheet Example • Use the following formulas for TVM calculations – – – – FV(rate,nper,pmt,pv) PV(rate,nper,pmt,fv) RATE(nper,pmt,pv,fv) NPER(rate,pmt,pv,fv) • The formula icon is very useful when you can’t remember the exact formula • Click on the Excel icon to open a spreadsheet containing four different examples. Barton College 27 Practice Problems • Complete the following problems in your book. Questions and Problems in your Book: – 1-5, 12, 13, 14 & 15 – Try the problems several different ways, e.g., using the basic formulas, your calculator and Excel. – If you need help with using your calculator, please see the FNC 330 website. I have several user guide links to the HP 10-B and TI BA-II. Barton College 28 Future Value and Present Value Formulas Barton College 29