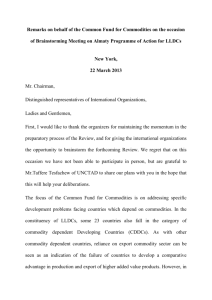

Cfc Projects* impact analysis

advertisement

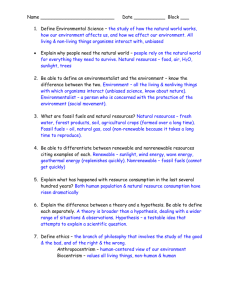

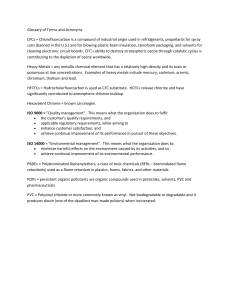

The Common Fund for Commodities Partner in Commodity Development Common Fund for Commodities Intergovernmental financial institution Established within the framework of the United Nations in 1989 Headquarters: Amsterdam, The Netherlands 102 member countries Institutional Members: EU, African Union, Common Market for eastern and Southern Asia(COMESA), South African Development Community (SADC), Economic Community of West African States (ECOWAS), West African Economic and Monetary Union (UEMOA), Caribbean Community (CARICOM), East African Community (EAC), Eurasian Economic Community (EAEC), Andean Community 2 Common Fund for Commodities The Common Fund for Commodities (“CFC”) is an intergovernmental financial institution established within the framework of the United Nations in 1989 and headquartered in Amsterdam • Financing projects aimed at mitigating the vulnerability of commodity producers by financing the development of innovative business models in the commodity business • The CFC supports interventions cover all aspects of the value chain from production to consumption Mandate Core values • • • Address vulnerability of poor participants of agricultural commodity value chains Practical measures include diversification, value addition, market expansion, risk management Projects are structured around commodity value chains 3 CFC Mandate Enhance the socio-economic development of commodity producers, processors and traders • • CFC interventions aim at enhancing the competitiveness and income opportunities of commodity producers, processors and traders in developing Countries by: • • • • • Supporting a value chain approach (vertical integration, diversification and reducing dependency on a single commodity) Improving the competitiveness and cost effectiveness of commodity production: through the introduction of modern technologies, sustainable inputs, higher quality seeds and planting materials, waste reduction, IPM strategies, etc. Technology transfer - Stimulating the dissemination of technology & know-how Enhancing Food Security Synergies among producers, industry, Government for commodity-based economic development Promoting and supporting Sustainable Development 4 CFC Technical competence in commodity sector • • • • • 26 years of experience in financing projects in the commodity sector Number of total Project financed: 390 Total cost almost USD 800 million, of which USD 400 million is CFC funding 5 Projects financed in the tea industry, for a total of USD 8.5 million of grants Currently a USD 4.2 mln investment is under appraisal for a CFC loan up to USD 1.5 millions to finance an investment aimed at the modernization of tea infrastructure in Sri Lanka • Some projects are supported by: Dutch Trust Fund EC 5 The CFC Network Agricultural Development Research Institutions (CGIAR) / NARS National Governments International Commodity Bodies (ICBs) Charity Foundations /Non-profit organisations Consultants / Technical experts Producer organisations / NGO’s Impact Investing Funds UN System CFC Private Sector 6 Evaluation methodology Beneficiaries Direct Beneficiaries Indirect Beneficiaries Economic Production impact on Others (Net) Project Benefits Hectares under production Food Security Value Added Modernization/ access to markets Sustainability Farmers’ Income increase Yield increase Modernization and environmental impact Quality improvements benefit Women inclusion Firms/Cooperatives assisted Minority inclusion Production Costs Jobs Created Additional Revenues 7 CFC – Activities until the end 2012 • Up until the end of 2012 CFC interventions was mainly in the form of grants to finance projects of general interest for all the commodity stakeholders (Research Institutes, International Commodity Bodies, producers organizations, NGOs, national governments, and the private sector) 8 CFC – Activities until the end 2012 Breakdown by geography Starting from 2013 the % of grants is decreasing in favor of other financing instruments 9 CFC – Activities until the end 2012 Intervention in the value chain Financing structure 10 CFC - New Financing Policy • Starting from 2013 CFC’s mandate has been extended to finance projects promoted by Small and Medium Sized Enterprises operating in the private sector. Grant financing are limited to small scale interventions up to USD 120,000. • This change represents a great opportunity for private sector players in the commodity business to propose innovative projects for CFC financing. • Private sector stakeholders may benefit from pilot projects and previously financed researches. 11 CFC - New Financing Policy • Flexible Financing Instruments depending on project characteristics and final beneficiary profile and financial need. • Main Instruments of financial support to commodity stakeholders: Loans on concessional terms Financial intermediaries Participation in investment funds Direct equity investments Grants Associations and NGO’s Corporates ICBs, Research Institutes, Development agencies Corporates Associations and NGO’s • • • Micro, Small and Medium sized projects Amount of CFC financing ranging from USD 100,000 to USD 1.5 million CFC financing is up to 50% of the project costs 12 CFC - New Financing Policy Projects : • Shall be Innovative • Shall promote inclusive growth and engagements with indigenous people • Shall be financially sustainable • Shall be environmentally sustainable • Shall have a reliable management and implementation strategy • Shall have final beneficiary focus • Shall be scalable and replicable • Should have and economic and social development impact on vulnerable stakeholders (direct/indirect beneficiaries) The CFC does not finance start-ups 13 CFC - New Financing Policy - Grants • The Fast Track Projects limited to small scale interventions. • Between USD 50,000 and USD 120,000 • Some example: • Bamboo as housing material in Nepal – via INBAR • Sisal value chain enhancement in Haiti – via Concern World Wide • Coffee and Cocoa production by a minority group in Peru – via Rainforrest Foundation UK 14 CFC - New Financing Policy - Loans Term loans • Loan Amount: Between USD 300,000 and USD 1,500,000; • Eligibility criteria: innovative projects, commercially viable with an economic development or social impact. The CFC finances up to 50% of project costs • Tenor: up to 7 years; • Interest rate: depending on CFC risk assessment • Repayment: amortized with the possibility of obtaining a grace period on repayments Commodity Orientation Interventions Development Relevance/Impact Environment Effects/Impact Addressing Receptive Market Financial Viability Quality of Loan Proposal Own Contribution USD 300,000 – USD 1.5 mln 15 CFC provides expertise as Partner in Impact Investment Funds The CFC provides technical assistance to AATIF and the companies in its portfolio. TA includes: • Training for credit officer on agribusiness lending • Project structuring • Contract farming outgrow schemes • Value chain analysis The CFC is currently expanding this business line CFC invests in Impact Investment Funds Starting from 2012, the CFC started participating in impact investment funds related to agricultural commodities, recognizing the impact of these funds carry on communities and value chains. AAF SME Fund Sustainable Investment Fund Tanzania Application and Appraisal Process CFC seeks applications for financing from all interested parties through open call for proposals targeting specific commodity issues. The call for proposals are published on international press (The Economist) • • Project Proposals obtained through 2 Open Calls per year (April and October) Lead Time – from selection to Financing about 8 months (April to December) Open Call for Proposals and development of the Project Profile ICB review (Optional) CFC Secretariat assessment and screening CFC Consultative Committee – Technical review CFC Executive Board – Final approval 18 Application Process - Information & Documentation needed • Completed application form and a business plan • On the CFC web site is possible to download the application form • Application needs to clearly state expected impact such as: • Beneficiaries and Incomes • Impact on the environment • Additional development impact indicators, as applicable for the proposed activity such as: • Impact on value chain • Impact on the market system 19 Financed Projects in the Tea industry Development production and trade of organic tea – China and India – FIGT 04 – in cooperation with FAO, IFOAM and Indian Tea Board Developed, on a pilot basis, the technology and techniques for organic tea production Set up of modern farms in China and India Model farms established in: Zhejiang province; Fujian Province, Guangdon province in China Assam, Darjeeling, Anamalai in India Developed appropriate export strategies and market development Total project costs: USD 7 mln of which USD 3.5 mln financed by the CFC in the form of a grant 20 Financed projects in the Tea industry Capacity building and rejuvenation of tea smallholders farmers in Indonesia and Bangladesh –– FIGT 05 – in cooperation with FAO and Indonesia Tea Board and Bangladesh Tea Board Total project costs: Objective: The project aimed at: • strengthening the knowledge base of tea small holder farmers • rejuvenate smallholder farmers production technique in Indonesia and Bangladesh for enhanced productivity and quality improvement USD 2 mln of which USD 1.8 mln financed by the CFC in the form of a grant (including USD 0.9 mln from the OPEC Fund for International Development - OFID) Tea Board of Indonesia acted as Project Executing Agency and manager for the project activities in both countries. The Bangladesh Tea Board acted as Project Implementing Agency in Bangladesh The project is completed in both countries 21 Financed projects in the Tea industry Capacity building and rejuvenation of tea smallholders farmers in Indonesia and Bangladesh –– FIGT 05 – in cooperation with FAO and Indonesia and Bangladesh Tea Board Indonesia Jan 2011 to June 2015 Budget USD 1.1 mln Results: • Increased performance of existing tea smallholdings • Training of smallholder tea farmers on production and harvesting techniques • creation of cooperatives for strengthening relation with processors • Self help group system implemented The project benefitted around 1,000 households for a total area of 790 ha 3 locations in the outlined areas: Bandung, Cianjur and Majalengka 22 Financed projects in the Tea industry Capacity building and rejuvenation of tea smallholders farmers in Indonesia and Bangladesh –– FIGT 05 – in cooperation with FAO and Indonesia and Bangladesh Tea Board Panchagarh Bangladesh Limited progress during the project life (3 years including a one year extension) Two tea nurseries have been established in Panchagarh and one in Bandarban Training has not been completed Bandarban 23 Projects in the Tea industry under appraisal Tea Supply chain in Sri Lanka – investment in a state of the art warehouse in Colombo Objective: The project aims at: • Building a state of the art warehouse in Colombo Open Call for Potential borrower: One of the largest tea broker in Sri Lanka Total project costs: USD 4.2 mln of which Proposals USD 1.5 financed by the CFC and Development impact: • reducing delivery time at the Colombo Auction from 1.5 days to 1.5 hours • reducing the tea to cash cycle to 3 weeks. • Enhancement of hygienic and safety of warehousing services • additional jobs created development of36the Project Profile • additional 30,000 tea growers will benefit from racking storage which is far superior to storing on the floor. • assuming ownership of two acres per grower, 3% income increase. 24 Upcoming Call for Proposals • The next Call for proposals will be opened on March 2016 • Deadline for submission of applications: the deadline will be around April 2016 • Screening of proposals: May 2016 Contacts Website: Phone Number: E-mail General Questions: E-mail Open Call for Proposals: Visiting Address: www.common-fund.org +31 (0)20 575 4949 managing.director@common-fund.org clt@common-fund.org Stadhouderskade 55 1072 AB Amsterdam The Netherlands Thank You