International Trade and Finance - Multiple Choice Questions

advertisement

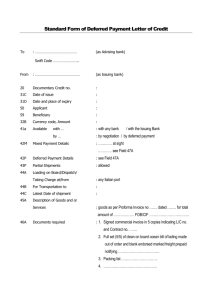

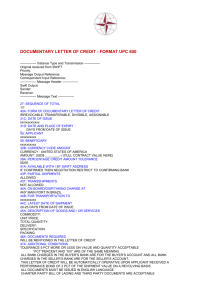

INSTITUTE OF BANKERS OF SRI LANKA Diploma in Applied Banking and Finance (DABF) International Trade and Finance - Guidance Multiple Choice Questions a) The questions below are provided to guide students and teachers in their studies on the subject as per the syllabus. b) The first question in the Examination Paper will carry a number of multiple questions up to 10 carrying two marks each. 1. Which of the following is NOT acceptable way of indicating the maturity date of a term bill? Assume the bill was drawn on 25June 2007 a. At 30 days from sight pay…. b. On 23rd July 2007 pay…. c. 30 days after arrival of goods, pay …. d. 30 days after B/L date 23rd June 2007 pay ….. 2. West Bank send a collection on behalf of one of their exporters to their correspondent, North Bank. North Bank pass it on to the importer’s bank, East Bank. East Bank contacts the importer and requests payment. How many Collecting Banks are there? a. one b. two c. Three d. None 1 3. In which of the following circumstances might an exporter chooses to use a collection? a. The buyer’s country is politically unstable. b. The buyer is creditworthy, but has a record of slow payment. c. There is some buyer risk, but there is a market for the goods in the buyer’s country. d. Above B and C 4. A company wishes to import food items for distribution to wholesale traders. With its excellent contacts, it expects to be able to sell the goods within 2-3 weeks. Which payment method would suit it best? a. Cash in advance b. Collection (sight bills) c. Collection (60 day term bill) d. A letter of credit (payable at sight) 5. In a collection, who is the principal? a. The exporter b. The importer c. The exporter’s bank d. The importers bank 6. West Bank has received a collection from South Bank, one of its overseas correspondent banks, for presentation to one of its customers. For whom is West Bank acting in this transaction? a. For its own customer. b. For South Bank c. For the exporter of the goods d. Above B and C 2 7. If a bank in the buyer’s country issued a performance guarantee based on a counter indemnity issued by another bank in seller’s country, how many contracts are there in respect of the bond? a. one b. two c. three b. none 8. When deciding whether to issue a bond, what following factors the issuing bank will consider. (i) Supplier performance risk (ii) The applicant’s credit standing (iii) The beneficiary’s credit standing. (iv) Risk of unfair calling of the bond. a. Above one, two and three b. Above two, three and four c. Above one, three and four d. Above one, two and four 9. Colombo Ports Authority is inviting various contractors for constructing their new terminal. The project will be awarded to only one of the contractors. What type of a bond is called from the contractors? a. Performance Bond b. Bid Bond c. Advance Payment Bond d. Retention Bond 10. The Key Group has asked their bankers ABC Bank to issue a performance bond in favour of their customer Dubai Ports Authority. Who is the Principal of this transaction? a. Key Group 3 b. Dubai Ports Authority c. ABC Bank b. None 11. The presentation period of a letter of credit is : a. The time interval between issue of a letter of credit and the latest date when documents can be presented. b. The time interval between the latest date of shipment and the latest date when the documents can be presented. c. The time interval between the actual date of shipment and the latest date when the documents can be presented. d. The time allowed after presentation for a bank to examine documents and report its findings. 12. A Bill of Lading has been consigned to order and blank endorsed. To claim the goods, which of the following would the importer require? a. All the signed original Bills of Ladings b. Any one of the signed originals c. A signed original plus a copy d. All the signed originals and all the copies 13. A letter of Credit has an expiry date of 28th May and a latest shipment of 7th May. No presentation period is specified. The goods are shipped on 3rd May. What is the latest date for presentation of documents? a. 17th May b. 18th May c. 24th May d. 28th May 14. Which of the following clauses or notations appearing on the face of the Transport Document would preclude it from being accepted? a. Oil drums are leaking. 4 b. Highly inflammable material. c. Potentially explosive material d. Refrigerated seafood may spoil during voyage. 15. Which of the following will be a requirement under all the different INCOTERMS? a. Seller clear regulatory clearances in their country b. Seller provide the goods in travel worthy packaging c. Seller identify the carrier d. Seller decide the date of delivery 16. Exporter is in Hong Kong and Importer is in UK which of these Incoterms could apply: (i) CFR Hong Kong (ii) FOB London (iii) CIF London a. Only (i) b. (i) and (iii) c. Only (iii) d. Any of them 17. Customer has a contract to which requires him to ship goods on FOB basis from Hong Kong latest by 10th of March 2012. If the goods have to be purchased from India so that he can on deliver without any processing by him which of the following terms is likely to help meet the requirement. a. FOB Mumbai delivery 10th March 2012 b. CIF Hong Kong delivery 5th March 2012 c. DAT Mumbai delivery 5th March 2012 d. FCA Mumbai delivery 28th April 2012 18. The method of payment be agreed on a. At the time of shipment 5 b. When export documents are submitted c. When payment is being claimed d. In the sale contract 19. In this type of payment transaction, all shipping documents, including title documents, are handled directly by the trading parties. The role of banks is limited to clearing funds as required. This statement is true for : a. Clean Payments b. Bills for Collection c. Documentary Credit d. None of these 20. If payment is to be made at the time that documents are presented, this is referred to as a __________ Letter of Credit a. Usance b. Confirmed c. Irrevocable d. Sight 21. Which one of the following International Chamber of Commerce (ICC) Publication’s governs dealing in documentary collections? a. URC522 b. UCP600 c. URR725 d. ISP98 22. Avalised Collections are: a. Discrepant documents under DCs which are held pending realization b. Collection bills which have been already accepted by the Buyer c. Deferred Payable Bills under DCs d. Collection bills where the importers bank has provided a guarantee 6 23. If there is a tenor draft a. The term for delivery must be DA – any instructions to the contrary will be ignored b. The term for delivery must be DP c. DP or DA – depends on whether the documents include shipping documents. d. If instructions are silent DP will be presumed. 24. The case in need must be identified by a. Remitting Bank b. Principal c. Collecting Bank d. Drawee 25. If a DC requires you to add confirmation what are you required to do if you do not wish to add it: a. Revert to the issuing bank refusing to advise the DC b. Revert to the issuing bank after advising the DC stating that you have not adding your confirmation c. Advise the DC 26. If a bank issue a Shipping Guarantee on the 1st of January and the Bill of lading never turns up. How long do you think the bank is open to an unlimited claim. a. 3 months b. 01 year c. 06 years d. for ever 7 27. A DC calls for presentation of an Insurance Certificate. Which of the following Insurance documents would be acceptable for CIF shipment where the invoice value is USD 75,000? (i) Insurance Certificate for USD 82,500 (ii) Insurance Policy for USD 85,000 (iii) Insurance declaration under open cover for USD 75,000 (iv) Insurance certificate for USD 75,000 a. 1 and 2 only b. 1 and 4 only c. 2 and 3 only d. 3 and 4 only 28. Which party has the MOST responsibility to examine the terms and conditions of a Documentary Credit against the sales agreement? a. Applicant b. Beneficiary c. Issuing Bank d. Confirming Bank 29. What Was The First Form Of Letters Of Credit Called a. Traveller's Cheques b. Documentary Credit c. Traveller's Letter Of Credit d. None of The Above. 30. What Are The Main Requirements Of The Beneficiary Has To Meet To Obtain Payment Under Documentary Credits. 8 a. Provided All Documents Stipulated Under The Contract Have Been Presented And All Terms And Conditions Of The Credit Are Complied With. b. Provided All Documents Stipulated Under The Credit Have Been Presented And All Terms And Conditions Of The Credit Are Complied With. c. Provided All Documents Presented Within The Time Limits Of The Credit. d. Provided Credit Terms And Conditions Are Fully Complied. 31. Which Of The Following Will Be A Part Of An Effective Sales Agreement? a. The Terms Of Delivery Of The Goods. b. Commercial Documents Needed And Content Of Those Documents. c. Party Who Will Be Arrange The Insurance And Up to What Point. d. All of The Above. 32. Which Of The Following Statement Is Correct? a. Banks Only Deal With Documents And Goods. b. An Irrevocable Confirmed Credit Only Constitutes A Definite Undertaking Of The Issuing Bank Provided Stipulated Documents Are Presented And The Terms And Conditions Of The Credit Are Complied. c. An Irrevocable Unconfirmed Credit Constitutes A Definite Undertaking Of The Issuing Bank Provided Stipulated Documents Are Presented And The Terms And Conditions Of The Credit Are Complied. d. Bank's Are Only Concerned If Contract Number Is Mentioned In The Credit. 33. Irrevocable Confirm Credit Cannot Be Cancelled Or Amended Without The Agreement Of a. Beneficiary, Confirming Bank, Issuing Bank b. Applicant, Beneficiary, Issuing Bank c. Beneficiary, Confirming Bank, Applicant d. Advising Bank, Beneficiary, Issuing Bank 9 34. Bank 'A' Will Receive A Documentary Credit Opened By Bank 'B'. Confirmation Instructions: Confirm Bank 'A' Is Not Prepared To Add Their Confirmation To The Documentary Credit. Which of The Following Should Be Bank A's Action. a. Advise The Credit To Beneficiary Without Adding The Confirmation. b. Return The Credit To Bank B. c. Advise The Credit To Beneficiary Without Adding The Confirmation And Inform Bank B Without Delay. d. Inform Bank B and Wait For Their Instructions. 35. Bank C Gets A Credit From Bank X For USD 100,000/- On 01st Feb 2001. On 05th Feb 2001 Bank C Gets An Amendment Increasing The Value Upto USD 150,000/-. Beneficiary Does Not Communicate His Acceptance Or Rejection. On 20th February He will Present A Set Of Documents For USD 150,000/-.(All Documents Required Under The Credit Presented And All Terms And Conditions Are Complied) a. Bank C Will Reject Documents Since Beneficiary Has Not Accepted The 01st Amendment. b. Documents Are Accepted. c. Documents Will Be Rejected As Credit Overdrawn. d. Refer To Issuing Bank For Their Approval. 10