Summative Project

advertisement

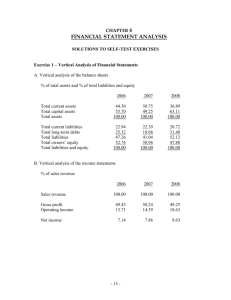

Grade 12 Accounting ISP Financial Analysis of a Company Description Choose a company that is of interest to you and analyze their financial position and their investment worthiness. The company must be a publicly traded Canadian company. Write the report as if you have been hired by a client to determine whether or not they should invest in the company. This is a formal report so avoid the use of ‘I’. Final Report Contents 1) Title Page 2) Table of Contents 3) Executive Summary: This contains a brief summary of your analysis as well as your recommendations. Use headings. One page maximum. 4) Company Information 5) Ratio and Trend Analysis 6) Conclusion and Recommendation 7) Works Cited (to be handed in with each section) 8) Financial Statements (must be submitted with the Ratio and Trend Analysis) Part One: Company Information Use headings to separate the sections of your report. You may use tables where appropriate to summarize financial information. Otherwise, complete sentences and proper spelling and grammar are required. Company Background Name of the company. A brief description of the company that includes: o the products or services it sells (some companies will have several very different products and/or services, be sure to make that clear), o location(s), o number of employees, o a short history including recent business acquisitions or sales of other companies. o The fiscal year end of the company Company Activities and Current Events Describe three recent activities of the company. Focus on new products/services, new store openings, new company-wide initiatives, mergers, acquisitions, restructuring, layoffs, lawsuits etc. If the most recent annual report is more than 9 months old, include a brief summary (revenue, income) of the company’s performance from the most recent quarterly report. For this section you will need to consult outside sources. Annual Report Commentary Briefly summarize the CEO’s letter to shareholders. Note the areas of concern that the CEO mentions, challenges and opportunities in the future Briefly summarize any plans provided for improvement. Risk Management and Analysis Read through the risk management portion of the annual report. Summarize the three most important risks facing the company. Make sure you are not summarizing the credit risks. Auditors The name of the accounting firm that audited the books. Describe the duties of the auditor. IFRS Implementation Briefly summarize the impacts of IFRS implementation of the company’s accounting practices Financial Statement Components Look at the level of detail provided in the balance sheet and income statement. Are there many items listed on the statements or are they grouped together in few, large categories? Comment on the level of detail and overall ease of interpretation of the statements. Using the data provided in the financial statements, list the following: o major sources of revenues (many corporations have multiple sources of revenue), o the top two operating expenses o net income o total current assets (which is the largest, what does this tell you about the company) o total fixed assets (which is the largest, what does this tell you about the company) o total current liabilities (which is the largest, what does this tell you about the company) o total long-term liabilities (which is the largest, what does this tell you about the company) A description of the shares. Types, number outstanding, current market price and dividends issued. Also include the 5 year trend in share prices – best shown as a graph. From the notes to the financial statements describe the method(s) of: o Depreciation/amortization o Goodwill o Inventory costing and valuation o Any changes in accounting methods practices o Bad debt expense Part Two: Ratio and Trend Analysis For a minimum of three years, compute and analyze the company’s performance in four areas: o Liquidity and Efficiency o Solvency o Activity o Profitability Provide a commentary on each ratio. The commentary should describe the overall favourability of the ratio as well as a comment on the trend of the ratio (increasing, decreasing, good or bad for the company) The use of graphs and charts is required. Part Three: Conclusion Determine whether or not your company is a good investment for your client based on company information and ratio and trend analysis. You do not lose marks if your company is a poor investment and you advise your client not to invest. Appendices You must include a copy of the relevant portions of your company’s financial statements and any other supporting documentation and/or graphs. You must include a works cited list with each section of the report. You can consolidate it into one list for the final report. You must hand in a bound hard copy with a table of contents, title page and works cited list. Due Dates Company Information Tuesday, December 6th Ratio and Trend Analysis TBA Final Report with Conclusion and all required sections TBA Company Suggestions Afexa Air Canada Andrew Peller Bombardier Boston Pizza (Income Fund) Barrick Gold Bell Canadian Tire Cineplex Galaxy Income Fund (Income Trust) CN Railways Corus Entertainment Empire Company EnCana Corporation Imperial Oil Indigo Books and Music Le Chateau Loblaw Magna International Maple Leaf Foods Metro Reitmans Research in Motion Rogers Rona Second Cup (Income Trust) Shaw Communications Shoppers Drug Mart Suncor Energy Tim Hortons TorStar Corp West Jet You can choose to do a bank or an insurance company but they are more difficult due to the composition of their assets and liabilities. For a bank, because they don’t have receivables or inventory in the traditional sense, it is necessary to look at additional ratios such as the Tier one capital ratio. A Note on Sourcing If at any point you are copying a phrase directly from the annual report, you must footnote or endnote it or use an in text citation. For instance, for the method of accounting for goodwill, you may find it difficult to put the statement in your own words. If you copy it directly, you must source it properly by putting a footnote1 and including the annual statement information at the bottom of the page or by putting an in text citation. (Company name, year). This also applies to any ratio descriptions used from the web. 1 WestJet Airlines. (2008). Annual report to shareholders. Calgary, AB: Author. Retrieved from http://www.sedar.com Ratio Guide Formula Guide Current Assets - Current Liabilities Positive, Healthy Current Assets Current Liabilities 2:1 Current Assets above Inventory Current Liabilities 1:1 Inventory Current Assets – Current Liabilities Lower better Liquidity Ratios: Working Capital ($) Current Ratio Quick Ratio Inventory to Net Working Capital Activity Ratios: Inventory Turnover Cost of Good Sold Average Inventory Higher Better Inventory Turnover Period (days) 365 Inventory Turnover Lower better Net Sales on Credit (or closest approximate) Average A/R Higher Better Accounts Receivable Turnover Period (days) 365 A/R Turnover Lower Better Operating Cycle (days) Inv. Turnover Period + A/R Turnover Period Lower Better Accounts Receivable Turnover Borrowing Capacity/Solvency Ratios: Times Interest Earned Equity Ratio (%) Operating Income Interest Expense Total Equity Total Assets Higher Better x 100% > 50% Debt Ratio (%) Total Liabilities x 100% Total Assets < 50% Debt to Equity Total Liabilities Total Equity <1 Gross Profit Margin (%) (Sales – COGS) Sales Higher Better Return on Net Sales (%) Net Income Net Sales Higher Better Return on Equity (%) Net Income Average Equity Higher Better Return on Assets (%) Operating Income Average Assets Higher Better (Profits After Taxes – Preferred Shares Dividends)/Number of common shares outstanding Higher Better Profitability Ratios: Earnings per Share (normally you can find this on your financial statements – you won’t have to calculate it.)