Sales Arrangements That Include Specified-Price Trade-in

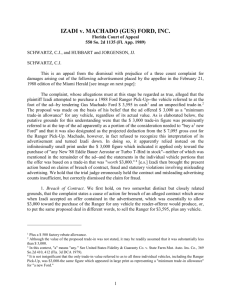

advertisement

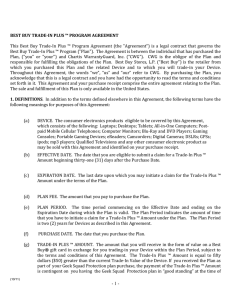

EITF ABSTRACTS Issue No. 00-24 Title: Revenue Recognition: Sales Arrangements That Include Specified-Price Trade-in Rights Date Discussed: References: September 20–21, 2000 FASB Statement No. 5, Accounting for Contingencies FASB Statement No. 48, Revenue Recognition When Right of Return Exists FASB Statement No. 121, Accounting for the Impairment of Long-Lived Assets and Long-Lived Assets to Be Disposed Of FASB Statement No. 125, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities FASB Statement No. 133, Accounting for Derivative Instruments and Hedging Activities FASB Interpretation No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others FASB Concepts Statement No. 5, Recognition and Measurement in Financial Statements of Business Enterprises FASB Concepts Statement No. 6, Elements of Financial Statements AICPA Statement of Position 97-2, Software Revenue Recognition AICPA Statement of Position 98-9, Modification of SOP 97-2, Software Revenue Recognition, With Respect to Certain Transactions AICPA Technical Practice Aids, Section 5100.01, "Equipment Sales Net of Trade-Ins" SEC Staff Accounting Bulletin No. 101, Revenue Recognition in Financial Statements ISSUE 1. Certain vendors offer specified-price trade-in arrangements on equipment for sale that give customers the right to trade in that equipment toward the purchase of new equipment at some point in the future. These programs are common in the aircraft and heavy equipment markets. The trade-in right may be exercisable by the customer at a specified point in time or during a specified period of time. Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 1 2. The trade-in rights may be offered at a specified price or the price may be indexed to an industry standard. The scope of this Issue includes only trade-in rights with a price that is specified at the time of delivery as a fixed amount at a specified point in time or as a specified percentage of the original equipment sales price during a specified period of time. Trade-in rights that provide the customer with the right to trade in equipment in the future at the equipment's then-current fair value are not the focus of this Issue. Currently, views are diverse about how to account for specified-price trade-in rights. 3. The issue is how a vendor should account for a specified-price trade-in right in connection with the sale of the underlying equipment, including its effect on revenue recognition, from the date the equipment is sold to the date the trade-in right is exercised or expires. EITF DISCUSSION 4. The Task Force discussed the types of transactions described in paragraph 1 of this Issue and the various methods of accounting for them. A majority of the Task Force members agreed with the view that if (a) the amount of credit that will be received upon exercise of a specified-price trade-in right is equal to or less than the estimated fair value of the equipment at the trade-in date (determined on the date of the sale of the equipment subject to the specified-price trade-in right) and (b) the buyer is required to pay a significant incremental amount in addition to the trade-in credit for the new equipment at the trade-in date, then no revenue from the sale of the equipment should be allocated to the trade-in right and no liability should be recognized for the trade-in right at the time of the sale. [Note: The majority view has been nullified by Interpretation 45. See STATUS section.] However, if the seller subsequently determines that it is probable that a loss will be incurred upon the buyer's exercise of the specified-price trade-in right, the seller should record a liability pursuant to Statement 5. The Task Force requested that Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 2 the FASB staff, together with the Working Group established to address Issue No. 00-21, "Accounting for Multiple-Element Revenue Arrangements," further explore the nature of and accounting for those transactions. [Note: See STATUS section.] Also, the Task Force stated that the final accounting model must be reconciled with the requirements of Statement 48. The Task Force was not asked to reach a consensus. STATUS 5. At the November 21, 2002 meeting, the Task Force agreed to discontinue further discussion of this Issue, which relates to revenue recognition. This Issue was placed on the EITF agenda prior to the Board agreeing to add to its agenda a major project on the recognition of revenues and liabilities in financial statements. That project is intended to result in a comprehensive revenue recognition standard with the objectives of (a) eliminating the inconsistencies in the existing authoritative literature and accepted practices, (b) filling the voids that have emerged in revenue recognition guidance, and (c) providing guidance for addressing issues that arise in the future. 6. Interpretation 45, which was issued in November 2002, requires a guarantor to recognize, at inception of the guarantee, a liability for the obligation undertaken in issuing the guarantee. The Interpretation also elaborates on the disclosures to be made by a guarantor. 7. The scope of the Interpretation includes “contracts that contingently require the guarantor to make payments (either in cash or in other assets, services, shares of its stock, or financial instruments) to the guaranteed party based on changes in an underlying that is related to an asset or liability of the guaranteed party.” If the buyer exercised its tradein right (functionally an option written by the vendor), the vendor would make a payment of nonfinancial assets in exchange for the original asset. The customer would typically Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 3 only exercise that trade-in right if the fair market value of the asset decreased below the price specified in the trade-in right. Thus, the vendor can be seen as a guarantor that will have to contingently issue credits based on changes in the underlying, which is the fair market value of the original asset. 8. Since the specified-price trade-in right qualifies as a guarantee under the Interpretation, it should be initially recognized and initially measured at fair value. The majority view would not require recognition of a liability if the two conditions listed above are met and is, therefore, inconsistent with the fair value measurement objective of the Interpretation. As a result, the majority view is nullified by Interpretation 45. 9. If the vendor does not recognize revenue in the arrangement because of the existence of the trade-in right (that is, the guarantee), then the guarantee would qualify for the scope exception in paragraph 6(f) of Interpretation 45. 10. No further EITF discussion is planned. Copyright © 2000, Financial Accounting Standards Board Not for redistribution Page 4