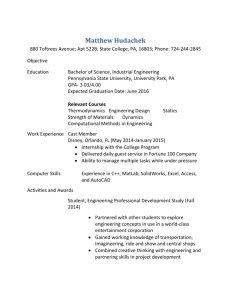

here - Daniel P Marland

advertisement

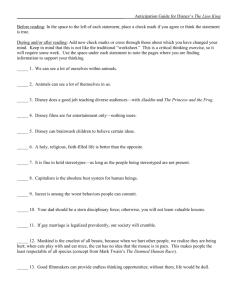

Memo September 1, 2011 To: Robert A. Iger CEO From: Daniel Marland, Junior Analyst Re: Walt Disney Corporation is Stronger Financially than News Corp. The purpose of this memo is to compare Walt Disney Corporation with News Corp. According to Hoover’s, Disney’s biggest competitor is News Corp. (NWS) with revenues of $33 billion in 2011(Yahoo! Finance). NWS’ position as the second largest firm in the Entertainment Industry makes it a perfect company for a comparative analysis with Disney. Disney has seen a higher growth rate over the past three years in both sales and net income than that of NWS. Over the past year NWS’ stock price has fallen and Disney’s has risen, indicating high perceived value. Disney’s P/E ratio is lower than News Corp, indicating lower risk to investors. NWS’ EPS is lower than Disney’s, showing that NWS is less profitable. Walt Disney Corporation is stronger financially than the leading competitor News Corp. Growth in Sales and Net Income Display Overall Strength The growth in both sales and net income for Disney indicates industry dominance. Disney’s growth rate in the sales and net income sectors over the last three years were 2.88% and 7.22% respectively (Standard and Poor’s 2012). NWS had a sales growth of 1.12% and no meaningful growth in net income (Standard and Poor’s 2012). The fact that Disney had growth of 7.22% in net income, and NWS saw no growth is a major sign of Disney’s strength in the industry. Disney’s growth rates are important; however it is also important to look at how its stock performs. 8.00% Walt Disney Corp. and News Corp. Three Year Net Income and Sales Growth Trends 7.00% 6.00% 5.00% Growth Rate 4.00% 3.00% 2.00% 1.00% 0.00% Three Year Growth Rate: Sales Three Year Growth Rate: Net Income Walt Disney 2.88% 7.20% News Corp. 1.12% 0 Figure 1: Displays the 3yr net income and sales growth trends for Disney and NWS (Standard and Poor’s 2012). Walt Disney Corp. Rising Stock Prices Reflects High Perceived Value Over the last year, Disney’s stock prices have outperformed News Corps substantially, showing the market views Disney as more valuable. Walt Disney’s 6-month average stock price was at $36.84 and our year avg. was $38.05 versus NWS at $16.06 and $16.97 respectively (Yahoo! Finance). Disney’s growth from 6 month average, to one year average illustrates investor’s high intrinsic value for the stock. Although stock price is a very important indicator of how a firm is doing, it is also important to examine other indices, such as the P/E ratio. Disney’s Lower P/E Ratio equals Lower Risk Walt Disney Corp. low price per earnings ratio, compared to NWS, indicates Disney as a low risk investment. Disney’s price per earnings ratio in 2011 was 13.61 and NWS was 15.21 (Yahoo! Finance). For every 13.61 dollars that gets invested we have one dollar of earnings, from an investor’s standpoint the lower the better. While P/E ratio is good indicator of strength it cannot tell the whole story. Disney’s Higher EPS Indicates High Profits Walt Disney Corp. high EPS, compared to NWS, demonstrates Disney’s high profitability. Disney’s earnings per share was 2.52 and NWS was 1.12 (Standard and Poor’s). This means that Disney has profits of $2.52 for every share outstanding, which is better than NWS’ $1.12 profit for every outstanding share. Works Cited Disney (Walt) Co. (2012). Standard and Poor's IQ. Retrieved from Standard and Poors NetAdvantage database. News Corp. (NWS) (2012). Profile, business summary. Yahoo!Finance. Retrieved from http://finance.yahoo.com/q?s=nws&ql=1 Walt Disney Corp. (DIS) (2012). Profile, business summary. Yahoo!Finance. Retrieved from http://finance.yahoo.com/q?s=DIS