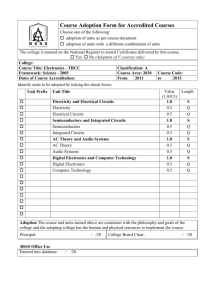

Goal Setting and Energy Efficiency

advertisement