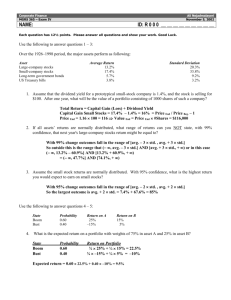

Question 11 uses data from 9/3/08 to 9/3/09 for firms listed below

advertisement

Question 11 uses data from 9/3/08 to 9/3/09 for firms listed below EXXON-MOBILE Date Open High Low Close Volume Adj Close RETURN 9/1/2009 68.93 69.5 67.83 68.26 23667200 68.26 -0.01287 8/3/2009 70.96 71.89 66.09 69.15 21999600 69.15 -0.01158 7/1/2009 70.67 72.79 64.46 70.39 26744900 69.96 0.006764 6/1/2009 70.46 74.83 68.08 69.91 28378500 69.49 0.008124 5/1/2009 67.13 71.39 65.6 69.35 28182500 68.93 0.046455 4/1/2009 67.04 71.15 64.5 66.67 31807000 65.87 -0.0211 3/2/2009 67 71.49 61.86 68.1 44298300 67.29 0.002981 2/2/2009 76.06 80.5 67.9 67.9 44023900 67.09 -0.10773 1/2/2009 80.06 82.73 74.01 76.48 44802100 75.19 -0.04192 12/1/2008 77.89 83.64 72.68 79.83 46656300 78.48 -0.00393 11/3/2008 73.45 81.03 67.54 80.15 54003200 78.79 0.087509 10/1/2008 77.19 81.75 56.51 74.12 62482300 72.45 -0.04558 9/3/2008 77.01 82 71.51 77.66 39056100 75.91 annual std dev std dev 0.04807 0.16652 AMAZON Date Open High Low Close Volume Adj Close RETURN 9/1/2009 80.74 82.42 77.51 78.46 7012900 78.46 -0.03362 8/3/2009 86.56 88.2 80.25 81.19 5613600 81.19 -0.05329 7/1/2009 84.42 94.4 75.41 85.76 8243100 85.76 0.025102 6/1/2009 78.21 88.56 76.25 83.66 7275900 83.66 0.072702 5/1/2009 80.38 83.6 73.1 77.99 7133700 77.99 -0.03142 4/1/2009 73.02 86.68 71.71 80.52 9217600 80.52 0.096405 3/2/2009 63.94 75.61 59.82 73.44 10754100 73.44 0.133508 2/2/2009 58.57 67.36 58.13 64.79 10435100 64.79 0.101496 1/2/2009 51.35 59.74 47.63 58.82 12192700 58.82 0.147036 12/1/2008 42 54.85 38.82 51.28 9726600 51.28 0.200937 11/3/2008 56.35 58.73 34.68 42.7 12185900 42.7 -0.25402 10/1/2008 71.78 71.99 43.31 57.24 14809100 57.24 -0.2133 9/3/2008 81.4 86.77 61.32 72.76 9975400 72.76 std dev 0.140536 annual std dev 0.486832 #12 a. A long-term United States government bond is always absolutely safe in terms of the dollars received. However, the price of the bond fluctuates as interest rates change and the rate at which coupon payments received can be invested also changes as interest rates change. And, of course, the payments are all in nominal dollars, so inflation risk must also be considered. b. It is true that stocks offer higher long-run rates of return than do bonds, but it is also true that stocks have a higher standard deviation of return. So, which investment is preferable depends on the amount of risk one is willing to tolerate. This is a complicated issue and depends on numerous factors, one of which is the investment time horizon. If the investor has a short time horizon, then stocks are generally not preferred. a. Unfortunately, 10 years is not generally considered a sufficient amount of time for estimating average rates of return. Thus, using a 10-year average is likely to be misleading. a. In general, we expect a stock’s price to change by an amount equal to (beta change in the market). Beta equal to –0.25 implies that, if the market rises by an extra 5 percent, the expected change in the stock’s rate of return is –1.25 percent. If the market declines an extra 5 percent, then the expected change is +1.25 percent. b. “Safest” implies lowest risk. Assuming the well-diversified portfolio is invested in typical securities, the portfolio beta is approximately one. The largest reduction in beta is achieved by investing the $20,000 in a stock with a negative beta. Answer (iii) is correct. #22