IntelliConnect

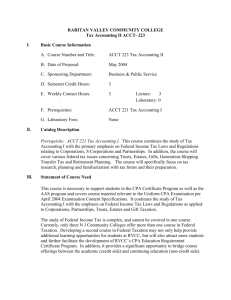

®

Faster Answers, Better Results™

CCH® Expert Treatise Library: Federal

Taxation of Partnerships & Partners

Get Up-to-Date, Comprehensive Expert Treatise Guidance

for Complex Tax Issues Affecting Partners and Partnerships

CCH® Celebrates 100 Years in Tax & Accounting

The CCH® Expert Treatise Library: Federal Taxation of Partnerships & Partners provides complete, in-depth analysis of all aspects

of partnership taxation. Written by prominent experts in the field, the treatise offers numerous examples and expert insights,

and also allows users to easily access cited cases, regulations, IRS rulings, the Internal Revenue Code and other authoritative

sources via links to the primary source documents. With Federal Taxation of Partnerships & Partners, you can quickly find expert

answers to your partnership tax accounting and planning questions.

Expert Perspectives from Active Practitioners

Our authors are practicing tax, academic and legal experts who can

translate complex regulatory language into easy-to-understand

examples and opinions. From their experience and insight, you can

better develop effective tax plans for your clients.

Patricia Hughes-Mills, Professor at the University of Southern

California — Ms. Mills is a Professor of Clinical Accounting at the

University of Southern California’s Marshall School of Business,

Leventhal School of Accounting, where she teaches Partnership

Taxation in their Masters of Business Taxation program. She

practiced tax law in several Los Angeles law firms prior to

joining Arthur Andersen, where she managed a firm-wide real

estate tax group. Ms. Mills is a former member of the State Bar

of California Taxation Section Executive Committee and has

taught in the Masters of Tax program at Golden Gate University.

She has authored numerous articles on a variety of tax topics

and is a frequent speaker at several professional and academic

organizations, including New York University’s Federal Tax

Institute and the University of Southern California’s Institute

on Federal Taxation.

Thomas A. Humphreys, Partner at Morrison & Foerster, LLP —

Mr. Humphreys is head of the Federal Tax Practice Group and the

co-chair of the Tax Department at Morrison & Foerster, LLP. He

has extensive experience with the tax aspects of capital markets

transactions, financial instruments, real estate investment trusts,

mortgage and asset-backed securities, mutual funds, mergers and

acquisitions, bankruptcy and reorganization, and international

transactions. Mr. Humphreys is the author of Limited Liability

Companies and Limited Liability Partnerships, published by Law

Journal Seminars-Press. He is a frequent speaker on financial

instruments topics at professional organizations such as the

AICPA and the Structured Products Association, and he is also

an adjunct professor of law at New York University Law School,

where he teaches Taxation of Financial Instruments in the

L.L.M. program.

Formerly, Mr. Humphreys was Chairman of the American Bar

Association’s Section of Taxation Committee on Regulated

Investment Companies and was co-chair of the New York Bar

Association’s Committees on Financial Intermediaries, Financial

Instruments, Financial Institutions and Passthrough Entities.

Mr. Humphreys is also a former member of the New York Bar

Association’s Tax Section Executive Committee.

James M. Kehl, CPA, M.S. Taxation — Mr. Kehl is currently with

the accounting firm of Weil, Akman, Baylin & Coleman, P.A.

He has more than 38 years of accounting experience, focused

primarily on taxation. Mr. Kehl is the author of The Practical

Guide to Code Sec. 199 and the Code Sec. 199 Tax Planning &

Compliance Manual. He has also written numerous articles on

partnership income tax topics that have appeared in The Journal

of Passthrough Entities, TAXES — The Tax Magazine®, Tax Strategies

and BNA’s Daily Tax Report. Mr. Kehl speaks at various seminars in

professional organizations and with CCH.

Stuart L. Rosow, Partner at Proskauer and adjunct

Professor at Columbia Law School — Mr. Rosow is a Partner

in the Tax Department at Proskauer and is the leader of their

transactional tax team. He concentrates on the taxation of

complex business and investment transactions, and his practice

includes representation of publicly traded and privately held

corporations, financial institutions, investment partnerships,

health care providers, charities and other tax-exempt entities

and individuals. A frequent lecturer at CLE programs, Mr. Rosow

is also an adjunct faculty member at Columbia Law School where

he currently teaches Partnership Taxation.

CCH® Expert Treatise Library: Federal Taxation of Partnerships & Partners

Simplify Your Tax Research

Other CCH Expert Treatise Library Titles Available

CCH Expert Treatise Library: Federal Taxation of Partnerships

& Partners will allow you to:

Corporations Filing Consolidated Returns

Understand complex partnership tax issues.

Estate Planning by John Price and Samuel Donaldson

Federal Research and Development Tax Incentives

Assess the impact on your clients’ businesses, allowing them

to make informed decisions.

Federal Taxation of Corporations & Shareholders

Federal Taxation of Partnerships & Partners

Provide practical advice to your clients.

Quickly find accurate answers to your partnership

taxation questions via easy-to-understand explanations

and numerous examples.

Federal Taxation of Subchapter S Corporations

International Taxation: Corporation & Individual

Limited Liability Companies: Federal and State Taxation

Access answers seamlessly through integrated tax links.

State Sales & Use Taxation

Access to Primary Source Documents

State Taxation of Income & Other Business Taxes

Tax Accounting in Mergers and Acquisitions:

IRS Rulings

Transactional Analysis

Internal Revenue Code

Tax Planning for Troubled Corporations:

Federal Tax Regulations

Bankruptcy and Nonbankruptcy Restructurings

Federal Court Decisions

Tax Practice & Procedure

Committee Reports

Taxation of Compensation & Benefits

Topics Include

Training and Consulting Options to Fit Your Needs

Choice of Entity

CCH also offers valuable training, consulting and CPE to keep

you ahead of the curve. From live training and consulting, to

on-demand online learning, CCH provides the tools that everyone,

from new hires to seasoned pros, needs to strengthen their abilities.

Visit CCHGroup.com/Learning to learn more.

Classification as a Partnership for Tax Purposes

Acquiring Partnership Interests

Accounting and Partnership Operations

Partnership Income Allocations

Partnership Distributions

Transfers of Partnership Interests

Transactions Between Partners and Partnerships

Special Partners and Partnerships — Tax Planning Considerations

Termination of a Partnership

Partnership Mergers and Divisions

Treatment of Distressed Partnerships

Death or Retirement of a Partner

Basis Adjustments to Partnership Assets (Inside Basis)

CCH Expert Treatise Library: Federal Taxation of Partnerships and Partners provides

complete and authorative analysis of partnership taxation, along with practical

examples to help effectively understand the law and regulations that apply.

For More Information

CCHGroup.com

800-CCH-REPS (888-224-7377)

All trademarks and copyrights are property of their respective owners.

3/13 2013-0203-46

Join us on

at CCHGroup.com/Social

©2013 CCH and/or its affiliates. All rights reserved.