ECON 191 (Spring 2011) Suggested Answer Keys to HW#1 1

advertisement

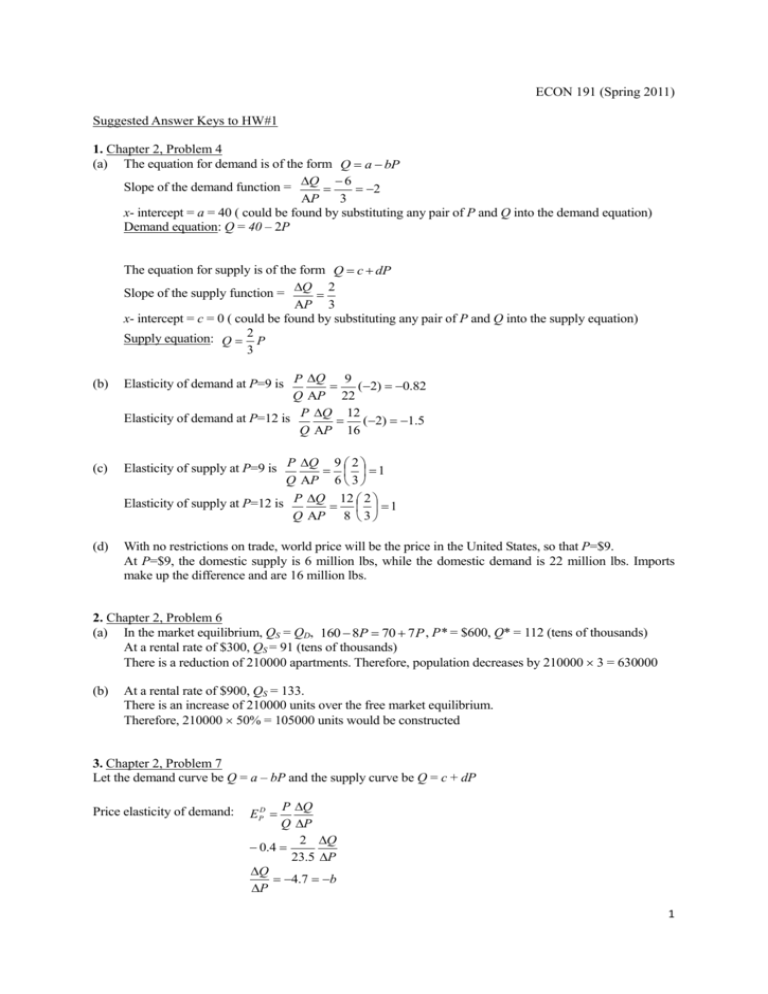

ECON 191 (Spring 2011) Suggested Answer Keys to HW#1 1. Chapter 2, Problem 4 (a) The equation for demand is of the form Q a bP Slope of the demand function = Q 6 2 P 3 x- intercept = a = 40 ( could be found by substituting any pair of P and Q into the demand equation) Demand equation: Q = 40 – 2P The equation for supply is of the form Q c dP Slope of the supply function = Q 2 P 3 x- intercept = c = 0 ( could be found by substituting any pair of P and Q into the supply equation) Supply equation: Q 2 P 3 (b) (c) (d) Elasticity of demand at P=9 is P Q 9 (2) 0.82 Q P 22 Elasticity of demand at P=12 is P Q 12 (2) 1.5 Q P 16 Elasticity of supply at P=9 is P Q 9 2 1 Q P 6 3 Elasticity of supply at P=12 is P Q 12 2 1 Q P 8 3 With no restrictions on trade, world price will be the price in the United States, so that P=$9. At P=$9, the domestic supply is 6 million lbs, while the domestic demand is 22 million lbs. Imports make up the difference and are 16 million lbs. 2. Chapter 2, Problem 6 (a) In the market equilibrium, QS = QD, 160 8P 70 7 P , P* = $600, Q* = 112 (tens of thousands) At a rental rate of $300, QS = 91 (tens of thousands) There is a reduction of 210000 apartments. Therefore, population decreases by 210000 3 = 630000 (b) At a rental rate of $900, QS = 133. There is an increase of 210000 units over the free market equilibrium. Therefore, 210000 50% = 105000 units would be constructed 3. Chapter 2, Problem 7 Let the demand curve be Q = a – bP and the supply curve be Q = c + dP Price elasticity of demand: P Q Q P 2 Q 0.4 23.5 P Q 4.7 b P EPD 1 Substitute for Q, P, and b into the above formula so that 23.5 = a – 4.7(2) and a = 32.9. The equation for demand is therefore Q =32.9 – 4.7P Price elasticity of supply: P Q Q P 2 Q 0.5 23.5 P Q 5.875 d P E PS Substitute for Q, P, and b into the above formula so that 23.5 = c + 5.875(2) and c = 11.75. The equation for supply is therefore Q = 11.75 + 5.875P 4. Chapter 3, Problem 10 (a) New Books 5 Used Books 8 (b) 8.38 IAntonio is not worse off since he can still afford to buy 5 new books with the new income of $440. He may in fact be better off if he decides to switch to used books. 5. Chapter 3, Problem 15 Foreign (Days) U(1200) U(1000) U(800) (a) Domestic (Days) The indifference curve with a utility of 800 has the equation 10DF=800, or DF=80 The indifference curve with a utility of 1200 has the equation 10DF=1200, or DF=120 2 (b) If Jane spends all of her budget on domestic travel she can afford 40 days. If she spends all of budget on foreign travel she can afford 10 days. her (c) Yes she can afford some of the bundles that give her a utility of 800 as part of this indifference curve lies below the budget line. She cannot afford any of the bundles that give her a utility of 1200 as this whole indifference curve lies above the budget line. (d) The optimal condition for utility maximization: MRS PD PF MU D 10 F F and PD 1 , thus 4F D --- (1) MRS PF 4 MU F 10 D D Budget Constraint: 100D 400F 4000 --- (2) Solving (1) and (2) gives D = 20 and F = 5. Utility is 1000 6. Chapter 4, Problem 5 (a) X2 Week 3 Week 1 (8, 31) (7, 19) (10.20) Week 2 X1 Bill’s utility decreases between week 1 and 2 since he consumes less of both x1 and x2. In week 2, the price of good 1 increases and his income remained constant. The budget line will pivot inwards and he will have to move to a lower indifference curve. Bill’s utility increases between week 1 and 3. The price of x1 increases by $1, he would need an extra $10 to afford the same bundle of goods that he chose in week 1. However, his income went up by $15, so his budget line shifted out beyond his week 1 bundle. Therefore, his original bundle lies within his new budget set, and his new week 3 bundle is on a higher indifference curve. (b) X2 Week 1 (10.20) (6, 14) (20, 10) Week 2 Week 3 X1 3 Mary’s utility increases between week 1 and 3. To afford the week 1 bundle at the new prices, she would need an extra $20, which is exactly what happened to her income. However, since she could have chosen the original bundle at the new prices and income but chose not to, she must have found a bundle that left her slightly better off. In the diagram, the week 1 bundle is at the intersection of the week 1 and week 3 budget lines. The week 3 bundle is somewhere on the line segment that lies above the week 1 indifference curve. This bundle will be on a higher indifference curve. A good is normal if more is chosen when income increases. Good 2 is not normal because when her income went up from week 2 to week 3, she consumed less of the good (holding prices the same). (c) X2 (16.32) (12, 24) Week 1 Week 3 Week 2 X1 In week 2, the price of good 1 goes down and Jane consumes more of both goods. Her budget line pivots outwards. In week 3 the prices remain at the new level, but Jane’s income is reduced. This will shift her budget line inwards, and cause her to consume less of both goods. Notice that Jane always consumes the two goods in a fixed 1:2 ratio. This means that Jane views the two goods as perfect complements, and her indifference curves are L-shaped. Intuitively if the two goods are complements, there is no reason to substitute one for the other during a price change because they have to be consumed in a fixed ratio. Thus the substitution effect will be zero. When the price ratio changes and utility is kept at the same level, Jane will choose the same point (12,24). 7. Chapter 4, Problem 7 (a) Price 100 50 35 Ds 60 Dgp 200 325 500 Quantity The general public demands 325 tickets and the students demand 60tickets. (b) The elasticity for the general public is E gp P Q 5 35 0.54 Q P 325 The elasticity for the students is Es P Q 4 35 2.33 Q P 60 4 (c) No, he is not maximizing revenue since the demands are not unitary elastic (elasticity = –1). The demand by the general public is inelastic at the current price, the director could increase the price to increase the revenue. The demand by the students is elastic at the current price, the director could decrease the price to increase revenue. (d) We can set the price elasticity of demand equal to –1, and solve for the price and quantity. For the general public: E gp P P Q 5 1 Q P Q 5P Qgp 500 5P P = 50 and Q = 250 For the students: ES P P Q 4 1 Q P Q 5P Qgp 200 4P P = 25 and Q = 100 8. Chapter 4, Problem 12 (a) We could find the elasticity of demand at P = $45 and P = $30 as well as the average price of P = $37.5 to see the effect on quantity demanded for a 10% increase in price. Elasticity of demand when P = $45 and Q = 1200: E P Q 40 45 1.5 Q P 1200 Elasticity of demand when P = $37.5 and Q = 1500: E P Q 40 37.5 1 Q P 1500 Elasticity of demand when P = $30 and Q = 1800: E P Q 40 30 0.67 Q P 1800 If P = $45, then a 10% increase in price will cause quantity demanded to fall by 15%. If P = $37.5, then a 10% increase in price will cause quantity demanded to fall by 10%. If P = $30, then a 10% increase in price will cause quantity demanded to fall by 6.7%. (b) If E is close to –1.5, then a 10% increase in price will cause an reduction in revenue If E = –1, then a 10% increase in price will cause a reduction in revenue If E is close to –0.67, then a 10% increase in price will cause an increase in revenue 5 9. Given, I = $100, Pi = $2 and Initial equilibrium: 10 hours of internet access and $80 worth of other goods Spending on other goods ($) Spending on other goods ($) 100 100 B 90 80 A 80 BL2 BL2 ICB ICA Slope = -2 Slope = -2 BL1 10 50 BL1 Internet access (hrs) 5 50 Internet access (hrs) (a) In the initial equilibrium, indifference curve is ICA and budget line is BL1 with a slope of -2 (b) With a monthly fee of $200 for unlimited internet access, the budget line becomes BL2. John is better off as he can choose any point on the new budget line in which he can still consume $80 worth of other goods and unlimited hours of internet access. (c) Suppose initially, John is consuming $90 worth of other goods and 5 hours of internet access (ICB). John is not worse off as he can choose any bundle on BL2 which gives him a higher utility level. (Note: John could be better off or worse off, depending on his preference and the consumption bundle chosen after the introduction of the new pricing policy) 10. P SS 5 ES 2.25 2 DD Q 7000000 20000000 12000000 (a) In the market equilibrium, QS = QD 20000000 – 4000000P = 7000000 + 2500000P P* = 2, Q* = 12000000 Consumer surplus = 0.5 (5 – 2) 12000000 = 18000000 (b) Suppose there is a price floor of $2.25. At PF = 2.25, QS = 12625000 and QD = 11000000. The government will buy the excess supply of 1625000. Consumer surplus = 0.5 (5 – 2.25) 11000000 = 15125000 6