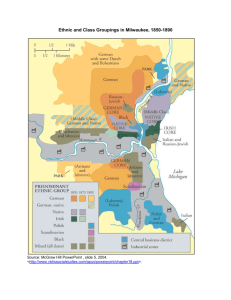

Cleveland from Startup to the Present

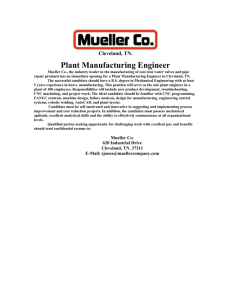

advertisement