Tactical Guidelines, TG-17-7216

J. Grigg

Research Note

17 September 2002

Financial Engineering: The Outsourcing Challenge

Outsourcing firms are reeling as a result of renegotiating

financially engineered service contracts. Enterprises should

understand how financial engineering works so they can

separate deal funding from service delivery.

Core Topic

Business Management of IT: Financial

Management

Key Issue

What strategies will enterprises use to

track, manage and optimize IT

investments?

Tactical Guidelines

Enterprises should only use financial

engineering in relationships with external

service providers in cases of extreme shortterm financial pressure, and where the

nature and magnitude of the engineering is

well-understood. Make the loans inherent in

financial engineering explicit, and ensure

that they are kept separate from the price of

service delivery at all times.

Note 1

Definition of Financial Engineering

The process of manipulating the pricing

algorithm for a service relationship so that

the payment structure is tailored to meet

cash flow needs and is no longer connected

to the actual cost of delivering the services.

This typically involves the use of explicit or

implicit financial loans by the service

provider, which are not easily separable

from service delivery cost in the new

payment structure. Where financial

engineering is used by an ESP, these loans

are often securitized and sold to third

parties in the form of structured credit

derivative products.

A persistent driver toward the consideration of external service

provider (ESP) models such as outsourcing is cost reduction. For

most utility task loads, such as data center or help desk services,

this can be a supportable long-term premise, due to the ESP's

ability to leverage its overheads and other indirect costs across

multiple service relationships. Yet, for many reasonably efficient

IS organizations, there is not likely to be any significant cost

saving from best-in-class processes once the ESP’s contingency

and margin is factored in. In addition, even where there are longterm savings to be obtained, transition and establishment

requirements invariably raise the costs at the beginning of a new

service relationship. Since most outsourcing deals are chosen

with cost savings in mind, the service provider faces the

quandary of how to win the deal when its delivery costs will rise

immediately after contract execution.

To assuage these concerns and present the service recipient's

CFO with apparent short-term savings, ESPs often engage in the

process of financial engineering (see Note 1). This is a

circumstance in which the service provider overlays an implicit

loan structure upon the underlying costs of transition, delivering

services and improving delivery efficiency in such a way that

prices are artificially cheap in the first few years and rise rapidly

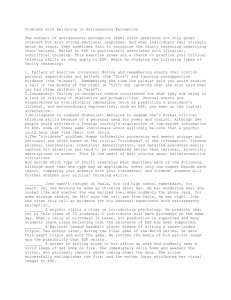

at the back end of the contract term (see Figure 1).

Gartner

Entire contents © 2002 Gartner, Inc. All rights reserved. Reproduction of this publication in any form without prior written permission is

forbidden. The information contained herein has been obtained from sources believed to be reliable. Gartner disclaims all warranties as to the

accuracy, completeness or adequacy of such information. Gartner shall have no liability for errors, omissions or inadequacies in the information

contained herein or for interpretations thereof. The reader assumes sole responsibility for the selection of these materials to achieve its intended

results. The opinions expressed herein are subject to change without notice.

Figure 1

The Difference Between Cost and Price in Financial Engineering

$

Loss

Financially

Engineered

Price

Profit

Cost of

Functional

Delivery

Transformed

Cost of

Delivery

Reorganization

Crisis

Time

Break-Even

Breakeven

Point

Source: Gartner Research

The straight line in Figure 1 marked "Cost of Functional Delivery"

depicts the gently rising cost of service delivery over time for a

given scope of work and using a given technology platform,

typically driven by rising labor costs. The curved function marked

"Transformed Cost of Delivery" depicts the actual costs borne by

the service provider in making the transition to the operating

state necessary to deliver the service in question, as well as the

long-term recurrent savings from doing so due to its continuous

improvement activities. The function marked "Financially

Engineered Price" reflects the new price structure, in which the

service recipient pays less cost at the front of the deal, and

steadily more as time progresses. The viability of such a model is

predicated on two conditions:

1. Uninterrupted payment for services until the break-even

point, at which the net present value (NPV) of the funds

received equals the NPV of the upfront investment.

2. An extremely high profit for each service delivered after the

break-even point is reached. It is this high marginal profit that

provides such a strong incentive for the ESP to use financial

engineering.

In operation, these assumptions rarely hold true for the length of

the contract, due to the increasingly rapid evolution of service

requirements over time and the extreme unpalatability to the

service recipient of paying prices that are above market during

the cost-recovery part of the curve. For these reasons, service

recipients often drive for renegotiation of the financial terms of

the relationship well before the break-even point is reached, a

trend that is particularly evident in times of economic downturn. If

the new service requirements are substantially less than those

Copyright 2002

TG-17-7216

17 September 2002

2

initially contracted for, the service provider can be financially

exposed by such a renegotiation. Additionally, financial troubles

within the service recipient may render adhering to the agreed-to

payment structure difficult or impossible, leading to a similar

exposure. The well-publicized crisis in the EDS-WorldCom

outsourcing relationship provides a vivid example of this

phenomenon, and clearly demonstrates the financial impact of

terminating a deal well before the break-even point.

ESPs deal with this problem by insisting on conditions such as

minimum payments or resource utilization in the contract, which

provide legal recourse to protect the ESP from the ramifications

of a breach. When the service recipient attempts to renegotiate

as an alternative to breaching the contract, the ESP is faced with

a difficult choice: Should it try to recover historical investments in

the deal through legal action despite the hostility and disruption

to the relationship with its client, or should it accept a lesser deal

that at least keeps cash flowing to service the upfront investment

in the engineered price structure?

The use of financial engineering presents a number of problems

for all parties that are affected by changes in their incentive

structures:

1. Service recipients face dramatically rising service prices at

the back end of these deals, which may not always be

apparent.

2. Service providers' margin models are at risk from early

renegotiation or client bankruptcy.

3. Internal IS organizations can't be price-competitive with ESPs

because of artificially low short-term pricing, skewing the

outsourcing decision against them.

4. Financial analysts who cover ESPs wonder why these

service firms are signing more business but not increasing

their profitability proportionately.

To address these problems, we advise enterprises to eschew

financially engineered ESP deals by:

1. Ensuring that service pricing is based on cost of delivery, and

will be periodically adjusted to take advantage of continuous

improvement opportunities.

2. Separating funding from service delivery costs in the pricing

structure of ESP relationships. In this way, any renegotiation

of service contracts can be based on a clear understanding

of service requirements, and the cash-flow management

Copyright 2002

TG-17-7216

17 September 2002

3

issue may be dealt with explicitly. Taking this approach also

assists in ensuring that the service provider's resistance to

renegotiating service levels during the term of the contract is

minimized, and, thus, supports the notion of a true

partnership between the parties.

Bottom Line: Enterprises should be wary of entering into

outsourcing relationships that employ financial engineering,

because their long-term service cost can be prohibitive and their

ability to adjust the scope of services delivered can be severely

compromised.

Copyright 2002

TG-17-7216

17 September 2002

4