HW CH. 5

E5-3.

Information Item

Report

A,F (1) Summarized financial data for 5- or 10-year period.

C (2) Initial announcement of quarterly earnings.

B (3) Announcement of a change in auditors.

D (4) Complete quarterly income statement, balance sheet and cash flow statement.

A,F (5) The four basic financial statements for the year.

E (6) Summarized income statement information for the quarter.

F

(7) Detailed discussion of the company’s competition.

A,F (8) Notes to financial statements.

A,F (9) A description of those responsible for the financial statements.

C (10) Initial announcement of hiring of new vice president for sales.

A. Annual Report

B. Form 8-K

C. Press Release

D. Form 10-Q

E. Quarterly Report

F. Form 10-K

G. None of the above

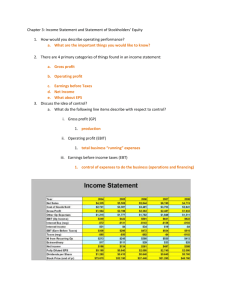

E5-9.

Terms

E (1) Cost of goods sold

Definitions

A. Sales revenue minus cost of goods sold.

G (2) Interest expense

B (3) Extraordinary item

C (4) Service revenue

F (5) Income tax expense

B. Item that is both unusual and infrequent.

C. Sales of services for cash or on credit.

D. Revenues + Gains - Expenses - Losses including effects of discontinued operations, on operations

I (6) Income before extraordinary items

D (7) Net income

A (8) Gross margin on sales

H (9) EPS

J (10) Operating expenses extraordinary items, and cumulative effects of accounting changes (if any).

E. Amount of resources used to purchase or produce the goods that were sold during the reporting period.

F. Income tax on revenues minus operating expenses.

G. Cost of money (borrowing) over time. operations outstanding.

I. Income before unusual and infrequent items and the related income tax.

J. Total expenses directly related to operations.

K. Income before all income tax and before discontinued operations, extraordinary items, and cumulative effects of accounting changes

(if any).

L. None of the above.

E5-11.

VILLAGE CORPORATION

Income Statement

For the Year Ended December 31, 2007

Computations in Order

Sales revenue ................................. Given

Cost of goods sold .......................... (a) $70,000 - $24,500

Gross profit ..................................... Given

Operating expenses:

Selling expense............................. Given

Administrative expense ................. (c) $12,500 – $8,000

Total operating expenses ................ (b) $24,500

– $12,000

Pretax income ................................. Given

Income tax expense .................... (d) $12,000 x 30%*

Net income ...................................... (e) $12,000

– $3,600

Earnings per share ($8,400

3,000 shares*) $2.80

$8,000

4,500

*Given

P5-6.

(a) THOMAS SALES COMPANY

Income Statement

For the Year Ended March 31, 2008

Sales revenue ...................................................................

Cost of goods sold ......................................................

Gross profit .......................................................................

Operating expenses:

Operating expenses ...................................................

Depreciation expense .................................................

Total operating expenses .......................................

Income from operations ....................................................

Interest expense .........................................................

Income before income taxes ............................................

Income tax expense ($34,000 x 30%) ........................

Net income ........................................................................

Earnings per share ($23,800

30,000 shares) .................

3,600

18,000

5,500

$70,000

45,500

24,500

12,500

12,000

$ 8,400

$ .79

$90,000

30,000

60,000

23,500

36,500

2,500

34,000

10,200

$23,800

P5-6. (continued)

(b) THOMAS SALES COMPANY

Balance Sheet

March 31, 2008

Assets

Current Assets:

Cash ...........................................................................

Accounts receivable ...................................................

Office supplies inventory ............................................

Total current assets ................................................

Noncurrent Assets:

Automobiles ................................................. $30,000

Less accumulated depreciation ................ 10,000

Office equipment ......................................... 3,000

Less accumulated depreciation ................ 1,000

Total noncurrent assets ..........................................

Total assets ............................................................

Liabilities

Current Liabilities:

Accounts payable .......................................................

Income taxes payable .................................................

Salaries and commissions payable ............................

Total current liabilities ............................................

Long-Term Liabilities:

Note payable ..............................................................

Total liabilities .........................................................

Stockholders' Equity

Contributed capital:

Capital stock (30,000 shares, par $1) .........................

Paid-in capital .............................................................

Total contributed capital .........................................

Retained earnings (beginning balance, $7,350 + net income,

$23,800 - dividends declared and paid, $8,000) .............

Total stockholders' equity ...........................................

Total liabilities and stockholders' equity .................

$53,000

44,800

300

20,000

2,000

$20,250

10,200

1,500

30,000

5,000

35,000

23,150

$98,100

22,000

$120,100

$31,950

30,000

61,950

58,150

$120,100