theorem finite

advertisement

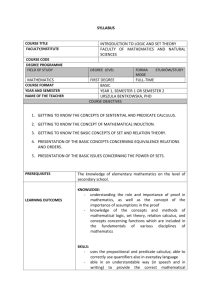

The International College of Economics and Finance The course syllabus Optimisation theory The eighth semester I. An explanatory note The Lecturer and Class teacher: Kantorovich G.G. Requirements to students: If taken as part of a BSc degree, courses, which must be passed before this half course, may be attempted: MT2116 Abstract mathematics. Students are also strongly encouraged to take MT3041 Advanced mathematical analysis. The student should have knowledge and skills of calculus for functions of one and several variables, and of linear algebra, including the general theory of systems of linear algebraic equations and matrixes operations. The summary: The course is a half course for students of specialization "Mathematics and Economics". This half course is designed to: enable students to obtain a rigorous mathematical background to optimisation techniques used in areas such as economics and finance; enable students to understand the connections between the several aspects of continuous optimisation, and about the suitability and limitations of optimisation methods for different purposes. The aim of the course is not only acquisition of new skills in a solution of mathematical problems with an economic problematics, but study of methods of proofs and strict reviewing of some sections of mathematics. At the end of this half course and having completed the essential reading and activities students: have knowledge and understanding of important definitions, concepts and results in the subject, and of how to apply these in different situations; have knowledge of basic techniques and methodologies in the topics covered; have basic understanding of the theoretical aspects of the concepts and methodologies covered; be able to understand new situations and definitions, including combinations with elements from different areas covered in the course, investigate their properties, and relate them to existing knowledge; be able to think critically and with sufficient mathematical rigour; be able to express arguments clearly and precisely. The structure of the course includes strict abstract construction of linear spaces, calculus of functions of several variables, a general problem of optimization of function of several variables without restrictions and with restrictions both equalities and inequalities, finite and infinite horizon continuous dynamic optimization. The course material should teach students to understand and prove the basic formulas of linear algebra and calculus, and to investigate the economic problems of comparative statics and optimization within the framework of developed tools of mathematical models. The course program provides lecturing and teaching classes, and regular self-study of students. Self-study includes deepening of theoretical material offered at lectures, and solutions of the offered home assignments. At the end of the course, the final examination is set. Educational task of the course: Because of study of material, a student should master and be able to prove the basic facts of strict abstract construction of optimization theory. A student should know the basic concepts of multivariable calculus, including calculation of partial derivatives of explicit and implicit functions, solutions of problems of unconstrained and constrained optimization, finite and infinite horizon continuous dynamic optimization. The student should be able to investigate economic problems of comparative statics with the methods of a calculus, to discover points of maximum and minimum of functions of several variables, the method of Lagrange multipliers. He should master the basic facts of nonlinear and convex programming, be able to investigate economic problems of optimization, to solve problems of dynamic programming. The student should have skills of application of the indicated mathematical tools and methods to solution of problems in Micro- and Macroeconomics. Forms of control: A current control of students' knowledge consists of weekly assessments of home assignments, appraisal students' activity during classes, marks for mid-session exam. The final mark of the course is given by the final exam’s mark (60% of the course mark), by the home assignments' mark (20% of the course mark), by the mid-term exam’s mark (20% of the course mark). The UoL exam’s mark in “Theory of optimisation” will be used for UoL Diploma only. II. Thematic calculation of hours № Topics 1 2 3 4 5 6 7 8 9 10 Lectures Classes Total Mathematical preliminaries. Euclidean spaces. Basic concepts of set theory. Metrics and norms. Topology. Open and closed sets. Compactness. Functions. Weierstrass’ Theorem. Unconstrained optimization. Optimisation under equality constraints. The Lagrange theorem. Lagrange multipliers. The constraint qualification. Optimisation under inequality constraints. 4 4 2 2 Kuhn-Tacker Theorem. Elements of convex analysis. Quasiconvex and quasiconcave functions. Pseudoconvex functions. Finite horizon Dynamic Programming. Infinite horizon Dynamic Programming. Total Control works Selfstudy Total hours 8 8 16 2 2 4 4 4 4 8 8 4 4 8 8 16 2 2 4 4 8 4 4 8 8 16 2 2 4 4 8 4 4 8 8 16 4 4 8 8 16 4 4 8 8 16 32 32 64 64 128 III. Course outline 1. Linear (affine) n-dimensional space. An inner product. Euclidean spaces. Distance in Euclidean spaces. A Cauchy-Bunyakovsky-Schwarz inequality. (1, 1.1.2, p. 4 - 7; 1, C1 – C3, p. 330 - 336; 2, 27.1 - 27.2, p. 750 – 756; 2, 10.1 - 10.7, p. 199 236). The basic concepts of the set theory. Properties of number sets: a supremum and an infimum. A limit of sequence. A limit and a continuity of real-valued functions of one variable. Neighbourhoods and open sets in 𝑅𝑛 . Sequences in 𝑅𝑛 and their limits. Closed sets in 𝑅𝑛 . Compact sets. (1 1.1.1, p. 2; 1. 1.2, p. 7-24; 1. B, p. 323 – 330; 2, 2.1 - 2.2, p. 10 - 20; 10.1 - 10.4, p. 199 - 221; 12.1 - 12.6, p. 253 - 274). Functions of several variables. Functions from 𝑅𝑛 to 𝑅1 . Functions from 𝑅𝑛 to 𝑅𝑘 (vector functions of several variables). Continuity of function of several variables. Differentiability of functions of several variables. 𝐶 1 -functions. Directional derivatives and the gradient. (1, 1.4, p. 41 -50; 2, 14.1 - 14.6, p. 300 - 322). 2. Bolzano-Weierstrass theorem for 𝑅1 and 𝑅𝑛 . Weierstrass’ theorem. (1, 3, p. 90 -100; 2, 29.2, p. 807 - 809). 3. Unconstrained optimization of several variables’ function. Stationary points and the first order conditions. The second order conditions for a maximum and a minimum. (1, 4, p. 100 – 111; 2, 16.1 - 16.2, p. 375 - 385; 17.1 - 17.4, p. 396 - 410). 4. Optimisation under equality constraints. Lagrangean function and Lagrange multipliers. First order conditions. Constraint qualification. Second order conditions for optimisation under equality constraints. The bordered Hessian. (1, 5.1 – 5.3, p. 112 – 122; 2, 16.3 - 16.4, p. 386 - 395; 18.1 - 18.2, p. 411 - 423; 19.3, p. 457 - 465; 2, 12.1 12.3, p. 369 - 386). Economic meaning of Lagrange multipliers. Smooth dependence on parameters. (1, 5.4 – 5.8, p. 121 – 144; 2, 8.7 - 19.2, p. 442 - 456; 2, 19.4, p. 469 - 471). 5. Optimisation under inequality constraints. Complementary slackness conditions. The mixed restrictions. (2, 18.3 - 18.6, p. 424 - 442; 2, 18.3, p. 430 - 434). Economic meaning of Lagrange multipliers. The Envelope theorems. Smooth dependence on parameters. (2, 18.4 - 18.7, p. 442 - 447; 19.1 - 19.2, 19.4, p. 448 – 457). 7. Kuhn-Tacker Formulation. Kuhn-Tacker Theorem. (1, 6, p. 145 – 171). 8. Convex and concave functions. Properties of convex functions. Quasiconvex and quasiconcave functions. Pseudoconvex functions. Convex programming. (1, 7 – 9, p. 172 – 232; 2, 21.1 - 21.6, p. 505 - 543). 9. Finite horizon Dynamic Programming. Statement of the problem. Value functions. The method of the backward induction. The Bellman equations. (1, 11, p. 252 – 267). 10. Infinite horizon Dynamic Programming. Statement of the problem. Existence of an optimal strategy. (1, 12, p. 281 – 314). IV. The reading 1. Sundaram, R.K. A First Course in Optimization Theory. (Cambridge University Press, 1996), [ISBN 9780521497701]. 2. Carl P. Simon and Lowrence Blume. Mathematics for Economists, W. W. Norton and Compony, 1994. [ISBN 0-3393-95733-0] 3. Ostaszewski A., Advanced Mathematical Methods, 3-rd edition, McGrowHill, 1984. 4. Rudin W., Principles of Mathematical Analysis (International Series in Pure & Applied Mathematics), (New York, London: McGrow-Hill Publishing Co., 1976). [ISBN 9780070856134]. 5. Binmore K., Calculus: Concepts and methods. 6. Anthony M., Linear Algebra: Concepts and methods, Cambridge University Press, Cambridge, UK, 1996. 7. Anthony M., Reader in Mathematics, LSE, University of London; Mathematics for Economists, Study Guide, University of London. 8. M. Baltovich. Optimistion theory. LSE, Study Guide, University of London, 2007 9. Leon, S. j., Linear Algebra with Applications (5-th edition). Prentice Hall, New Jersey, 1998 10. Bartle, R.G. and D.R. Sherbert. Introduction to Real Analysis. (New York: Wiley, 1999). [ISBN 9780471321484]. 11. Hewitt, E. and K. Stromberg. Real and Abstract Analysis. (New York: Springer-Verlag, 1965). [ISBN 9780387901381]. 12. Royden, H.L. Real Analysis. (New York: Macmillan, 1988) [ISBN 9780024041517]. 13. Bryant, V. Yet Another Introduction to Analysis. (Cambridge: Cambridge University Press, 1990). [ISBN 9780521388351].