9th of March – Dr Roberto Fontana – University of Pavia Title

advertisement

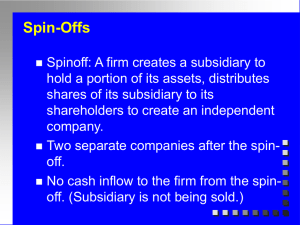

9th of March – Dr Roberto Fontana – University of Pavia Title: LANlords! Heritage and market dominance in the Local Area Networking industry Abstract: One of the most important determinants of economic growth and competitiveness is the speed at which firms react to innovative opportunities. In this respect, the existing research has highlighted the slow response of incumbents firms to radical innovative challenges (King and Tucci, 2002; Christensen and Rosenbloom, 1995; Henderson, 1993) and the role of new start-ups as important engines of growth and development at both the industry and country level. Several factors can explain why new entrants outperform incumbents when faced with new innovative challenges. Our research will focus upon one aspect that has becoming increasing important lately: the ‘pre-entry experience’ of new entrants. In several industries, Hard Disk Drive (Agarwal et al., 2004), lasers (Klepper and Sleeper, 2005), semiconductors (Garnsey et al., 2008; Klepper, 2009), medical devices (Chatterji, 2009), TV-sets (Klepper and Simons, 2000), and automobile (Klepper, 2002), entrepreneurs with previous experience in the same or in related industries have successfully seized new opportunities and entered new markets by creating spin-offs. Underlying this evidence lays the idea that spin-offs are relatively more successful than other entrants because they take advantage of industry- specific knowledge which is embodied in their founder(s) and which has been inherited from the parent firm. This paper focuses on entry and innovation in the Local Area Networking industry a high tech industry which has experienced phenomenal growth during the 1990s paving the way for the rise of the so called ‘new economy’. In this context there are the following aspects that we seek to disentangle. The first aspect concerns the identification of the factors that create the preconditions for successfully start and enhance the transfer of knowledge from the parent company to the spin-off. The second aspect concerns the identification of the factors that contribute to the expansion and growth of the new entrants. Data and method Our research relies upon two sources of information. The first one is a comprehensive dataset of firms that have been active in the Local Area Networking (LAN) industry between 1985 and 1999 the period of inception, take off and consolidation of the industry. This dataset virtually includes all the main actors who contributed to the birth, and rapid expansion of the industry, those who tried and fail and those who begun as start-ups and rapidly raised to market dominance (i.e. Cisco Systems). For each firm in the dataset we have collected information on their founders, information about their entry date in the industry, age, size in terms of employees, sales and R&D expenditures when available. The second source is a dataset of 1818 products marketed over the period in three LAN submarkets: hubs (536 products), routers (747 Products), and switches (535 products). For each product in our dataset we have information on: year of market introduction, technical characteristics, market price, and name of the manufacturer. In addition to these data we also collected information on the patenting activity of the firms included in our sample to be able to link patents to innovative activity in a specific submarket. On the basis of these data we carry out the following analyses. First, we employ information on company founders to trace the genealogy of each new firm and link it to some specific parents active in the industry. Second, we employ data on product characteristics and prices. In particular, we proceed in two steps. For each product, hedonic price regressions are estimated and predicted prices are calculated. Predicted prices are then used to calculate two types of indicators. The first indicator is an indicator of product relatedness. It will be used to assess the distance in the market place of the new firms with respect to the parent. The second indicator is an indicator of firm location with respect to the technological frontier it will be used to assess the performance of both parent and new firms. Third, we estimate duration models to study the determinants of the probability to survive for the firms in our sample. Our covariates include the indicators of performance and heritage, as well a series of firm level controls such as R&D intensity, firm size, age, and possession of intangible capital in terms of patent stock. Preliminary results Our preliminary results highlight the following. Concerning the role of heritage as a mean of knowledge transfer in the LAN industry: i) More knowledgeable parents have generated more spin-offs; ii) More innovative parents have generated more innovative spin-offs; iii) The richer the know-how of the parent, the greater the number of expected spin-offs; iv) Parents were usually late to seize innovative opportunities to avoid cannibalization; v) Parents (at least initially) did not perceived spin-offs as a possible threat to their position. Concerning the performance of the new firms and their rise to market dominance: i) Path breaking innovations and/or innovations that opened up new submarkets were the most likely to lead to spin-off formation; ii) Spin-offs generally used the same technology of the parents and produce identical products or a close variant; iii) The Spin-offs’ founders are likely to have been frustrated with their previous employers’ failure to pursue their ideas; References Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. B. (2004) “Knowledge transfer through inheritance: Spin-out generation, development and survival” Academy of Management Journal, 47, 501–522. Chatterji, A.K. (2008) “Spawned with a silver spoon? Entrepreneurial performance and innovation in the medical device industry” Strategic Management Journal, 30, 185-206 Christensen, C.M. and R.S. Rosenbloom (1995) “Explaining the attacker’s advantage: technological paradigms, organizational dynamics and the value network” Research Policy, 24(2), 233-257 Garnsey, E., Lorenzoni G. and S. Ferriani (2008) “Speciation through entrepreneurial spinoff: the Acorn_ARM story” Research Policy, 37, 210-224 Henderson, R. (1993) “Underinvestment and incompetence as responses to radical innovation: evidence from the photolithographic equipment industry” RAND Journal of Economics, 24(2), 248-270 King, A.A. and C.L. Tucci (2002) “Incumbent entry into new market niches: the role of experience and managerial choice in the creation of dynamic capabilities” Management Science, 48(2), 171-186 Klepper, S. (2009) “Silicon Valley – a chip off the old Detroit bloc”, in Zoltan, A. and D.B. Audretsch and R. Strom (eds.) Entrepreneurship, Growth and Public Policy. Cambridge University Press, Cambridge, UK, 79-115 Klepper, S. and S. Sleeper (2005) “Entry by Spinoffs” Management Science, 51(8), 1291– 1306. Klepper, S. (2002) “Firm survival and the evolution of oligopoly” RAND Journal of Economics, 33, 37–61. Klepper, S. (2001) “Employee Start-ups in High-Tech Industries” Industrial and Corporate Change, 10(3), 639-674. Klepper, S. and Simons K. (2000) “Dominance by birthright: entry of prior radio producers and competitive ramifications in the US television receiver industry” Strategic Management Journal, 21(10-11), 997-1016. Bio: Roberto Fontana is Associate Professor of Applied Economics at the University of Pavia, Italy and Research Fellow at KITeS Research Centre at Bocconi University, Italy. Roberto received his PhD in Science and Technology Policy Studies at SPRU University of Sussex, UK in 2002 and his Master of Science in Science and Technology Policy Studies from SPRU University of Sussex in 1998. His main interests are in the field of innovation diffusion and standardisation, product innovation, variety and its implications for the dynamics and structural evolution of industries with particular reference to high technology sectors such as semiconductors, computers, and communication equipment.