The Structural Analysis of Industries

advertisement

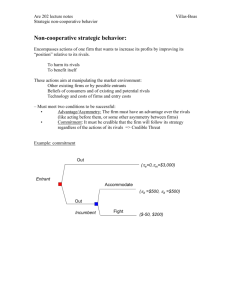

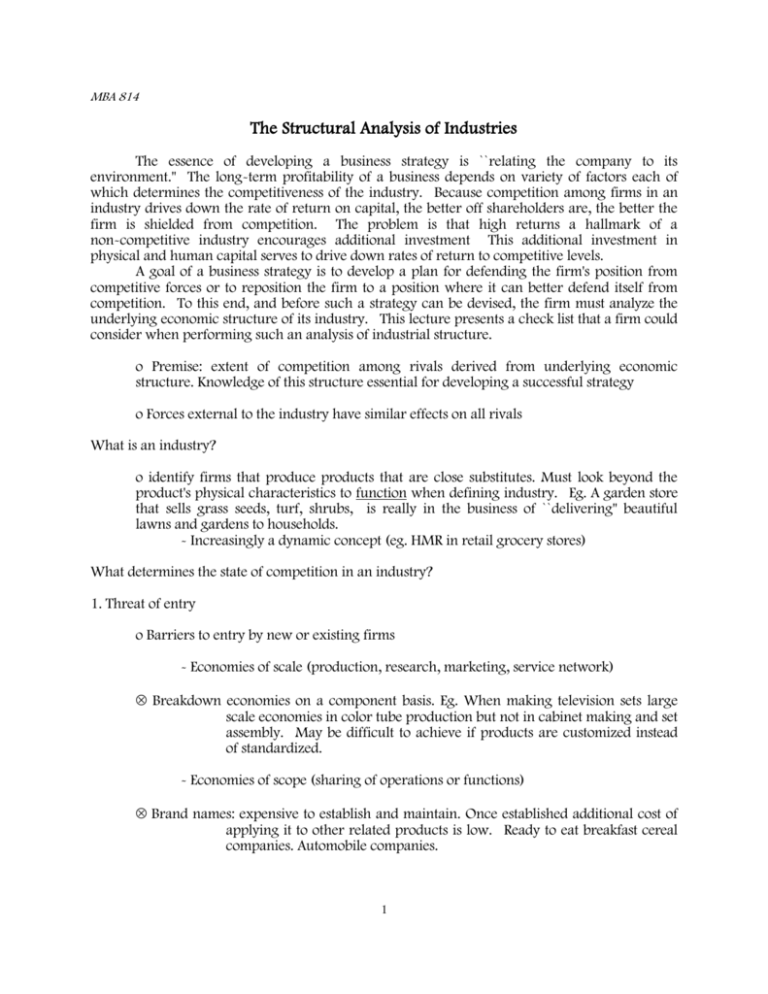

MBA 814 The Structural Analysis of Industries The essence of developing a business strategy is ``relating the company to its environment.'' The long-term profitability of a business depends on variety of factors each of which determines the competitiveness of the industry. Because competition among firms in an industry drives down the rate of return on capital, the better off shareholders are, the better the firm is shielded from competition. The problem is that high returns a hallmark of a non-competitive industry encourages additional investment This additional investment in physical and human capital serves to drive down rates of return to competitive levels. A goal of a business strategy is to develop a plan for defending the firm's position from competitive forces or to reposition the firm to a position where it can better defend itself from competition. To this end, and before such a strategy can be devised, the firm must analyze the underlying economic structure of its industry. This lecture presents a check list that a firm could consider when performing such an analysis of industrial structure. o Premise: extent of competition among rivals derived from underlying economic structure. Knowledge of this structure essential for developing a successful strategy o Forces external to the industry have similar effects on all rivals What is an industry? o identify firms that produce products that are close substitutes. Must look beyond the product's physical characteristics to function when defining industry. Eg. A garden store that sells grass seeds, turf, shrubs, is really in the business of ``delivering'' beautiful lawns and gardens to households. - Increasingly a dynamic concept (eg. HMR in retail grocery stores) What determines the state of competition in an industry? 1. Threat of entry o Barriers to entry by new or existing firms - Economies of scale (production, research, marketing, service network) Breakdown economies on a component basis. Eg. When making television sets large scale economies in color tube production but not in cabinet making and set assembly. May be difficult to achieve if products are customized instead of standardized. - Economies of scope (sharing of operations or functions) Brand names: expensive to establish and maintain. Once established additional cost of applying it to other related products is low. Ready to eat breakfast cereal companies. Automobile companies. 1 MBA 814 2 Air travel and air cargo services: Technological considerations make it impossible to fill plane up with people. Space for cargo. Incremental cost of expanding into cargo business is very low. - Capital requirements Often sunk capital required. Eg. Mineral extraction companies. - Product Differentiation ``Customer loyalties.'' Investment made through advertising, customer services, and product design differences. Entrant faces large start up costs to overcome this advantage. These costs are sunk and have no ``salvage value'' if they fail. Eg. baby care products, baby food, over the counter drugs. - Switching costs for buyers Does buyer have to incur costs when buying entrant's products? Eg. kits used for medical diagnoses, heavy machinery, computer operating systems. - Access to Distribution Channels Cost associated with forming new relationships with wholesalers and retailers. Does entrant have create its own distribution channel? Eg. food processing firms, mail order catalogue companies. - Incumbent cost advantages Proprietary knowledge or technology. Patents, secret formulas (Coca Cola, American Home Products). Location is a scarce resource! Experience or position on the ``learning curve.'' A type of technological change that occurs only as a result of producing and selling. Eg. Firms with skilled labor, universities, investment banks, accounting firms etc.; also complex assembly requirements. This barrier is not the same as economies of scale! - Government policy Licensing requirements; pollution controls and standards for product testing increase fixed cost of entry. Some regulations may delay entry providing incumbents with time to adjust strategies. MBA 814 3 Expiration of Patents. Eg. Established drug faces competition from ``generic'' drugs; Kodak enters to compete with Polaroid's instant camera. o Expected retaliation - Do firms in the industry have a history of engaging in price cutting when encountering new rivals? Do they have the resources to engage in a prolonged period of price discounting? Eg. major airlines with new carrier begins service on one of their routes. o Entry Deterring Price - Do firms price at a point where short run marginal revenue is less than short run marginal cost. This means output is larger and price lower as a way of deterring entrants. If economies of scale a factor as output expands this would be a further deterrent. 2. Intensity of Rivalry Among Incumbents o Competition occurs because a rival sees an opportunity of improve its position (ie. profitability). However, rivals ``moves'' have effects on the firm as well as other competitors. The pattern of reaction among competitors may or may not leave the producer better off. - Price competition especially dynamic. Price reductions easily met by rivals. Competition occurs not only with price, but with product quality, service, warranties, advertising etc. Industry may derive more benefits from some forms of non-price competition. o Factors contributing to intensity of rivalry. - High exit barriers: Specialized assets with low salvage values often associated with substantial economies of scale (see next tick) ; interrelationships between business unit and other units in the firm; especially common outside the United States, government restrictions. Eg. In India, legal environment makes closing a plant with 50 + employee difficult. - High fixed costs production methods: When ``excess capacity'' is present (ie. very low marginal costs) price cutting occurs. Eg. In paper products industry, production process often most efficient when let to run 24 hours a day 7 days a week. Storage or inventory costs associated with bulky items becomes important consideration in pricing. Fishing industry faces similar challenges. - Inability to differentiate product: Successful product differentiation makes producers’ product a poorer substitute for other products in the industry. This differentiation makes the demand for the producer's product less sensitive to price changes. Low consumer ``switching'' cost intensifies competition in a similar manner. MBA 814 4 - Many equally balanced competitors (including foreign competitors): Industry with many firms and little concentration likely will experience more intense competition than one with a similar number of firms, but greater concentration of output among a few firms. (Corresponds to View #2 in lecture on Industries With Few Sellers.) - Slow industry growth: Competition over the size of producer's market share appears to be more important part of its strategy. 3. Competition From Substitute Products o Industries selling substitute products limit profit potential because their product prices create a ``ceiling'' on the producer's prices. Identify such products by finding those that while different perform the same function. ( Eg. ``Low end'' chain restaurants and HMR programs in grocery stores; Sugar producers compete with corn syrup industry; fiberglass insulation and rock wool and styrofoam; security guards and electronic alarm and surveillance systems.) 4. Bargaining Power of Buyers o Buyers affect industry profitability by their ability to hold out for lower price, higher quality, better service. An important determinant is the number of buyers (consumers) in the industry. Eg. ready to wear clothing producers and retail department stores. In the extreme case, there may be only one or a few buyers of a service. Eg. tank gunners may find employment only with the military or as a mercenary. An even better example is the NCAA. The buyers do not take price (wage) as given and instead realize that their decisions about the employment of factors affect price. When there also are few sellers, prices determined as a result of bargaining (although more advanced economic analyses suggests the range of ``rational'' price and output outcomes is limited. o Other factors affecting buyer power. - Product is a significant fraction of buyer's (consumer's) total cost - Products purchased from an industry producing standardized (as opposed to customized) products - Buyer (Consumer) encounters low switching costs. - Buyers could integrate backwards and produce the product themselves: Historically true in the U.S. automobile industry. - Buyer (consumer) is well informed 5. Bargaining Power of Suppliers o Similar analysis as with buyers, but here very important to analyze the state of labor relations. Implications of unionization differs substantially among countries. MBA 814 5 6. Government Policy o Producer faces an ``alphabet soup'' of regulations at the national, state, and local level. If the firm does business internationally, the regulatory environment is even more complex. Important to understand the unique impact that the public sector has on competition (rivalry) in the industry.