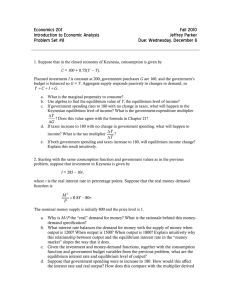

proj_2

advertisement

Due Date : December 10, 5 pm. [ No late homework will be accepted.] Each question counts 1 point. No hand-written homework will be accepted. [Please use word processor]. Don’t consult with other students, and if you have any question ask the instructor. Show all of your work including your final answer. Don’t send it through e-mail. • Use the following information to answer next 5 questions. UH company makes memory chips, which it ships to computer manufacturers in Japan [Market 1] and the U.S[Market 2]. Demand for the chips in the two markets is given by the following functions: Japan P1 = 12 – Q1 U.S.A P2 = 8 – Q2 C = 5+ 2• (Q1 + Q2) Total cost function for these memory chips is Suppose that price discrimination is allowed.[i.e., the firm can charge two different prices to two markets] Question 1) What is the firm’s maximized total profit ? Question 2) What is total deadweight loss ? Question 3) Determine the respective elasticities in the Japanese and U.S. markets at the optimal solution ? Now, suppose that price discrimination is NOT allowed. Question 4) What is the firm’s maximized total profit ? Question 5) What is total deadweight loss ? • Before you solve next 7 questions, please carefully read Chapter 12.2, Chapter 12.3 and The Advantage of Moving First (Page 493) in the text book. [ We didn’t cover this in the class, but I am sure you can do it !!!] Suppose our duopolists faces the following market demand curve: P = 20 – Q Where Q = Q1 + Q2 Also suppose that both firms have zero marginal cost. Question 6). At the Cournot Equilibrium, what are the output level and profit for each firm? Question 7). At the Competitive Equilibrium, what are the output level and profit for each firm? Question 8). At the Collusive Equilibrium, what are the output level and profit for each firm? Question 9). Construct a payoff diagram similar to the Table 13.10. [Please note that the output levels of 7.5, 10, 15 in the Table 13.10 are also shown in the Figure 12.5] By using the table obtained from Question 9, please answer the following 4 questions. [Please make sure that the Table obtained in Question 9 is correct since next 3 questions depend on it.]. Question 10). Is there any dominant strategy for Firm 1 or Firm 2 ? Question 11). Is there any nash equilibrium? If yes, how many and what are they ? Question 12). If there is any nash equilibrium, is this equilibrium pareto efficient and explain why?