IMPORTANCE OF LIQUIDITY AND CAPITAL ADEQUACY TO

advertisement

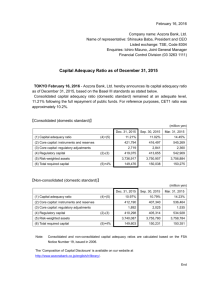

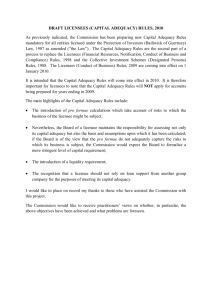

Introduction Reasons for banks requiring liquidity Capital Adequacy Financial Institutions that Failed in Recent Times Conclusion The need to be able to cover withdrawal of funds by customers. To meet inter-bank indebtedness, which may arise on day-to-day basis following the payment clearing process; To be able to meet unforeseen borrowing requests from customers. To be able to cope with interruptions to their normal cash flow. The capital of a commercial bank may be defined as the value of its net assets. (That is total assets less total liabilities). The capital base normally comprises the bank’s share capital, various forms of accumulated capital reserves and certain types of sub-ordinated loan stock. The capital base of a bank is vital for the protection of its creditors (its depositors) and hence for the maintenance of general confidence in its operations and the underpinning of its long-term stability and growth. Bank for Housing and Construction Ghana Cooperative Bank Lehman Brothers, a 158-year old investment bank collapsed because it had assumed risks several multiple times over its capital base, and had run out of liquidity. Lehman was the biggest corporate bankruptcy in history in terms of assets (it held $639 billion of assets). Lehman’s high degree of leverage made it precariously vulnerable to market conditions. For example, in 2007 the ratio of its total assets to shareholders equity was 31. Another US investment bank Merrill Lynch, had to be bailed out by Bank of America in a $50 billion rescue bid. American Insurance Group (AIG) had to be rescued with an $85 billion loan because it had destroyed its capital. The Bank of Ghana measures the capital adequacy of a bank, as a percentage of the adjusted capital base to its adjusted asset base, and this should be 10% as already indicated. The importance of capital to a bank is again given a global impetus by the Basel II Agreement on capital standards and relevant EU Directives. For example, in order to maintain authorisation to operate in the UK, and other EU countries, a bank must hold capital equal in value to at least 8% of its risk-weighted assets. As already indicated, due to the high importance that regulatory authorities attach to capital adequacy of a bank, control is more stringent and banks are statutorily required to submit prudential returns on a monthly basis, and when they fall short of the required level, have 90 days to make up for the deficit or face sanctions in the form of penalty payments.