Cash flow - Business Case Studies

advertisement

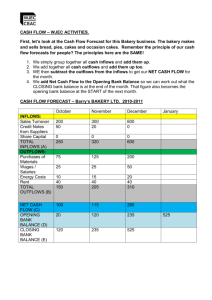

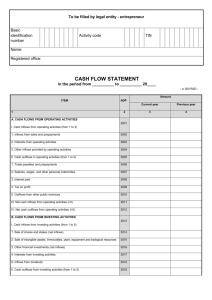

Cash flow THE TIMES 100 What is cash? Cash is notes, coins and bank deposits that provide firms with the spending power to pay their bills and expenses THE TIMES 100 Cash flow Cash flow refers to the flows of cash both into and out of a business Cash inflows are payments into a firm from customers or other sources Cash outflows refer to payments made by a business Net cash flow=cash inflow–cash outflow THE TIMES 100 Cash flow forecasting Cash inflows result from: Cash sales from customers Payments from debtors Cash from other sources such as bank loans Cash outflows result from: Paying overheads such as rent & wages Paying for raw materials & other variable costs THE TIMES 100 Cash flow forecasting A cash flow forecast will include: Cash inflows (receipts) Cash outflows (payments) Net cash flow (inflows minus outflows) Opening balance (this is the same as the closing balance of the previous period) Closing balance (opening balance combined with net cash flow) THE TIMES 100 Cash flow forecasting Jan Feb March April May June Cash inflows £17,000 £18,500 £19,000 £19,800 £21,000 £18,900 Cash outflows £14,300 £15,100 £24,900 £16,300 £17,800 £24,800 Net cash flow £2,700 £3,400 (£5,900) £3,500 £3,200 (£5,900) Opening balance £2,200 £4,900 £8,300 £2,400 £5,900 £9,100 Closing balance £4,900 £8,300 £2,400 £5,900 £9,100 £3,200 THE TIMES 100 Importance of cash flow forecasting To identify periods of cash shortfall so action can be taken to deal with this To identify periods of cash surplus so expenditure can be planned To secure additional funding, for example, from a bank THE TIMES 100 Consequences of cash flow problems If a firm does not have the cash to pay its debts: Relationships with suppliers may deteriorate Workers may leave It may have to cease trading In the short-term CASH is considered to be more important than PROFIT THE TIMES 100 Causes of cash flow problems Poor planning External factors e.g. the credit crunch Inadequate credit control Holding excessive stock Investing too heavily in fixed assets Overtrading – expanding quicker than available funds allow THE TIMES 100 Improving cash flow In simple terms, cash flow can be improved by: Increasing, or speeding up, cash inflows Decreasing, or slowing down, cash outflows THE TIMES 100 Methods of improving cash flow Increase & speed up cash inflows Decrease & slow down cash outflows Overdraft or bank loan Delay paying creditors Debt factoring Delay unnecessary capital spending Sale of assets or ‘sale & leaseback’ Lease rather than buy Shorten credit terms for customers & chase up debts Reduce spending on expenses e.g. negotiate lower rent THE TIMES 100 Cash v profit Do not confuse cash and profit The receipt of cash may not coincide with an associated sale, for example: An item may be bought on credit and paid for at a later date A bank loan may be taken out causing a positive cash flow, but no sales have been made THE TIMES 100 Cash flow in context THE TIMES 100 Fill the gaps Cash inflow Cash outflow Net cash flow Opening balance Closing balance January February March £10,000 £11,000 ? £9,000 £11,500 £10,800 £1,000 ? £400 ? £1,600 £1,100 £1,600 £1,100 £1,500 What are the missing figures? Use the CIMA case study to help you THE TIMES 100 Controlling cash Management accountants deal with a range of issues related to controlling cash in organisations. Give examples of these activities. Use the CIMA case study to help you THE TIMES 100 Managing cash shortfalls Trained management accountants will forecast when there may be possible cash shortfalls and have strategies in place to deal with these. What might a business do if a possible shortfall has been forecast, to ensure it can pay its creditors? Use the case study to help you. THE TIMES 100 Effective forecasting Organisations operate within dynamic business environments so management accountants must take a range of external factors into account when forecasting cash flow. Give examples of changes that may affect cash flow forecasts. Use the CIMA case study to help. THE TIMES 100 Useful resources Cash flow lesson suggestions and activities (The Times 100) CIMA case study (The Times 100) CIMA website THE TIMES 100