GTSF Investments Committee - Georgia Tech Student Foundation

advertisement

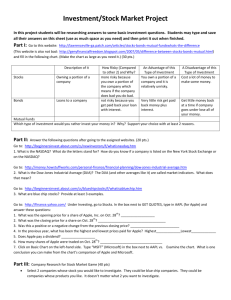

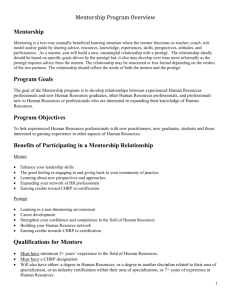

GTSF Investments Committee Mentorship, Fall 2013 Daniel Bruce danielbruce@gatech.edu Itinerary Week 1 Intro/About the IC / Intro to Capital Markets Critical Ratios / Financial Statements / Fundamental Analysis Week 2 Macro/Micro Analysis / Growth Drivers / Basic Technical Analysis How to do a pitch/presentation / Exit Strategies Week 3 Sector Work / Rotationals Sector Work / Rotationals Notes Bring a laptop to every meeting Expected to learn outside the sessions www.bloomberg.com www.yahoofinance.com www.investopedia.com www.wsj.com TD Ameritrade Be thinking about what sectors interest you Will get into more detail later GT Student Foundation “Moving forward by giving back” Development Committee PR and Marketing Arm Fund Raising Allocations Committee Makes Grants to Student Organizations ~$30,000 per year Investments Committee Invests and Grows Endowment Welcome to the IC Largest student managed endowment in the country. $853,002 What’s New This Year Mentorship Assessment At the end of Mentorship, an Analyst Test will be administered Top Performers will be granted Analyst roles Others are welcome to attend meetings and other IC events but will not be allowed to pitch or present. Professional Dress While Presenting No pitches/presentations will be heard otherwise Exit Strategy Every presentation must come with an exit recommendation. No Exceptions. Asset Classes Asset Classes Equities Company Stock Alternative Investments International Companies Commodities Hedges REIT’s Special class of company Not necessarily limited to real estate Fixed Income Sovereign Debt US Bonds Cash Equities Financials Banks, insurance, etc Energy Oil, Nat Gas, Alternative Energy Technology High Tech, hardware, semiconductors, software Services Anyone that doesn’t sell a physical product Staples Consumer non-discretionary items, shampoo, etc… Cyclicals Discretionary items, retail, etc… Health Care Pharmaceuticals, Health Care Services, etc… Industrials Machinery, engines, etc… What is the Stock Market? A loose network of economic transactions for the trading of company shares and derivatives at an agreed price. Not in any one physical location, although there are trading floors/desks/etc… NYSE Largest equities-based exchange in the world NASDAQ World’s first electronic stock market Stock – individual units of ownership of a company Usually issued by a company to raise capital or reward employees (hence, capital markets) You and I can buy pieces of company ownership for publically traded companies on one of the above exchanges. We will get into these next time. Important Benchmarks Dow Jones Industrial Average The “Dow 30” or just “The Dow” 30 Large Cap Stocks S&P 500 500 Largest Public Companies NASDAQ Tech Weighted Index with >3000 Stocks ETF’s Exchange Traded Funds Basket of stocks or other financial instruments meant to achieve the performance of a certain idea. Ex: Grains, Financials, S&P, Euro Trades Like a Stock, Acts Like a Mutual Fund Highly Liquid Have Been Blamed for Increasing Systematic Risk ETF’s make whole sectors move in tandem, reducing the benefic of diversification Important Terminology Bulls Group of traders who are generally positive about the movement of a stock or the market as a whole. “bullish” Bears Group of traders who are generally negative about the movement of a stock or the market as a whole. “bearish” Why the IC? Questions Daniel Bruce – Director of the Mentorship danielbruce@gatech.edu Alex Han – Senior Managing Director ahan1991@gmail.com Nick Keith – Senior Financial Director nkeith88@gmail.com