Easy Way To Fix Issues When You are Reconciling in QuickBooks

advertisement

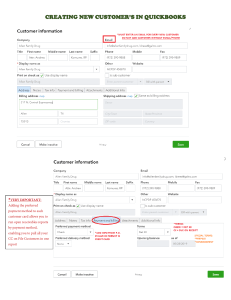

F ix Issues When Y ou are R econciling in Q uickB ooks QuickBooks is a popular application in the accounting field, with a wide range of features and tools that help it become more respected. Even when transactions are integrated smoothly through forms, bank feeds, or third-party data-fetching applications, consumers could experience problems while reconciling their data. This blog will guide you to fix issues when you’re reconciling in QuickBooks. Ensuring accounting accuracy requires regular reconciliation, which emphasizes how important it is to swiftly resolve QuickBooks bank reconciliation issues. This calls for a thorough comprehension of typical banking errors and practical debugging techniques. Are you having trouble resolving QuickBooks reconciliation errors? Do not be alarmed! To receive the appropriate assistance from our QuickBooks expert team, simply call our TollFree Number +1.833.802.0002. What Leads to Reconciliation Error in QuickBooks Desktop? Understanding the sources of the reconciliation error in QuickBooks desktop. Disparities between QuickBooks and your bank records may result from an incorrect starting balance entered at the start of the reconciliation procedure. Inaccuracies in the reconciliation process can be introduced by modifying earlier reconciliations using journal entries. The reconciliation process might be hampered by adding or removing previously reconciled transactions, which can lead to disparities between the bank statement and QuickBooks data. Measures to Fix Errors While Reconciliation in QuickBooks To fix errors while reconciliation in QuickBooks, try out these four steps in detail. Step 1: Review Starting Balance • First, ensure that your initial and starting balances are accurate before proceeding to identify reconciliation discrepancies in QuickBooks Desktop. • Step 2: Identify alterations, deletions, or additions in transactions • Check for any modifications, deletions, or insertions in your transactions using various reports available in QuickBooks: • Run a report on reconciliation discrepancies: • • • • Go to the "Reports" tab first, and then select "Banking." Select "Reconciliation Discrepancy" now. After selecting the account name, click "OK." Review the report for discrepancies and communicate with the person responsible for any changes. Make necessary edits to transactions. Generate a Missing Checks report: • From the ‘Reports’ menu, select ‘Banking,’ then ‘Missing Checks.’ • Choose the account and click ‘OK’ to view the report. • Identify any missing checks that could affect your reconciliation's ending balance. Utilize a Transaction Detail report: • Access the ‘Reports’ menu, then ‘Custom Reports,’ and select ‘Transaction Detail.’ • On the ‘Display’ tab, set the date range from the earliest date in QuickBooks to the date of your last reconciliation. • Apply filters for the specific account and date range. • Run the report and review for any discrepancies or transactions not matching your bank statement. • Discuss any changes with the relevant party and make adjustments as necessary. Step 3: Check for reconciliation adjustments Ensure there are no reconciliation adjustments made without proper guidance. Reconciliation adjustments should only be made under the direction of your accountant as they don't resolve errors and can cause issues in the future if errors are corrected later. Here's how to review the account for any inaccurate adjustments: • • • • In the ‘Lists’ menu, select ‘Chart of Accounts.’ Open the ‘Reconciliation Discrepancies’ account. Set dates for your recent reconciliations. If you find any adjustments causing inaccuracies in the account balance, contact the individual who made the adjustment. Ensure your corrections align with the adjustment to avoid conflicts. Step 4: End Reconciliation You can proceed to finish the reconciliation procedure once all inconsistencies have been resolved. Consider reversing the prior reconciliation until the initial balance is accurate if you're still having trouble reconciling because of outstanding difficulties. • Whether navigating through this process independently or seeking expert assistance, mastering how to fix issues when you're reconciling in QuickBooks is paramount for maintaining financial integrity. Our tech experts offer the right help to fix issues when you are reconciling in QuickBooks. Connect with us at our Toll-Free Number +1.833.802.0002 for expert guidance and let us streamline your reconciliation process effortlessly.