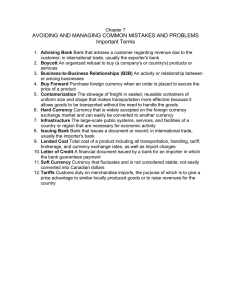

Management of Transaction Exposure Three Types of Exposure • It is conventional to classify foreign currency exposures into three types: 1. Transaction exposure is the potential change in the value of financial positions due to changes in the exchange rate between the inception of a contract and the settlement of the contract 2. Economic exposure is the possibility that cash flows and the value of the firm may be affected by unanticipated changes in the exchange rates 3. Translation exposure is the effect of an unanticipated change in the exchange rates on the consolidated financial reports of an MNC 8-2 Transaction exposure • The firm is subject to transaction exposure when it faces contractual cash flows that are fixed in foreign currencies • The home-currency cash flow is uncertain as it depends on changes in exchange rates • Hedging transaction exposure with financial contracts: ▫ Forward market hedge ▫ Money market hedge ▫ Option market hedge 8-3 Importer (payable) vs. Exporter (receivable) IMPORTER (payable) EXPORTER (receivable) Cash flow owes foreign currency receives foreign currency Risk if the foreign currency appreciates against the domestic currency, the domestic currency outflow will be higher if the foreign currency depreciates against the domestic currency, the domestic currency receipt will be lower Exposure payable is like a short position in the foreign currency as the company gains when the foreign currency depreciates and loses when appreciates receivable is like a long position in the foreign currency as the company gains when the foreign currency appreciates and loses when depreciates 8-4 Forward Market Hedge: Importer • If you expect to owe foreign currency in the future, you can hedge by agreeing today to buy the foreign currency in the future at a set price by entering into a long position in a forward contract. Importer Forward Contract Counterparty Foreign Supplier 8-5 Forward Market Hedge: Exporter • If you are going to receive foreign currency in the future, agree to sell the foreign currency in the future at a set price by entering into short position in a forward contract. Exporter Forward Contract Counterparty Foreign Customer 8-6 Importer’s Forward Market Hedge A U.S.-based importer of Italian shoes has just ordered next year’s inventory. Payment of €100,000 is due in one year. If the importer buys €100,000 at the forward exchange rate of $1.50/€, the cash flows at maturity look like this: U.S. Importer Forward Contract Counterparty Italian Supplier 8-7 Importer’s Forward Market Hedge Suppose the forward exchange rate is $1.50/€. $30k If he does not hedge the €100,000 payable, in one year $0 his gain (loss) on the unhedged position is shown in –$30k green. The importer will be better off if the euro depreciates: he still buys €100,000 but at an exchange rate of only $1.20/€ he saves $30k relative to $1.50/€ Value of €1 in $ $1.20/€ $1.50/€ $1.80/€ in one year But he will be worse off if the euro appreciates. Unhedged payable 8-8 Importer’s Forward Market Hedge If he agrees to buy €100,000 in one year at $1.50/€ his gain (loss) on the forward are shown in blue. $30k $0 If you agree to buy €100,000 at a price of $1.50/€, you will make $30,000 if the price of the euro reaches $1.80. Long forward Value of €1 in $ $1.20/€ $1.50/€ $1.80/€ in one year –$30k If you agree to buy €100,000 at a price of $1.50 per euro, you will lose $30,000 if the price of the euro falls to $1.20/€. 8-9 Importer’s Forward Market Hedge The red line shows the gains/losses of the hedged $30 k payable. Note that gains on one $0 position are offset by losses on the other –$30 k position. Long forward Hedged payable Value of €1 in $ $1.20/€ $1.50/€ $1.80/€ in one year Unhedged payable 8-10 Importer’s Forward Market Hedge The red line shows the payoff of the hedged payable. $150 k $0 Unhedged payable Hedged payable Value of €1 in $ $1.20/€ $1.50/€ $1.80/€ in one year 8-11 Exporter’s Forward Market Hedge A U.K.-based exporter sold a €100,000 order to an Italian retailer. Payment is due in 1 year and the exporter used a forward hedge. S0(£/€) = £0.80/€, i£ = 15½% i€ = 5% F1(£/€) = £0.88/€ Forward €100,000 Exporter Goods Contract Customer Counterparty £88,000 €100,000 8-12 Currency Futures versus Forwards • A firm could use a currency futures contract, rather than a forward contract, for hedging purposes • A futures contract is not as suitable as a forward contract for hedging purposes for two reasons: 1. Unlike forward contracts that are tailor-made to the firm’s specific needs, futures contracts are standardized instruments in terms of contract size, delivery date, etc. Thus, in most cases, the firm can only hedge approximately 2. Due to the marking-to-market property, there are interim cash flows prior to the maturity date of the futures contract that may have to be invested at uncertain interest rates Again, this makes exact hedging difficult 8-13 Exporter’s Futures Market Cross-Currency Hedge Your firm is a U.K.-based exporter of bicycles. You have sold €750,000 worth of bicycles to an Italian retailer. Payment (in euros) is due in six months. Your firm wants to hedge the receivable into pounds. Country U.S. $ equiv. Currency per U.S. $ Britain (£62,500) $2.0000 £0.5000 1 Month Forward $1.9900 £0.5025 3 Months Forward $1.9800 £0.5051 6 Months Forward $2.0000 £0.5000 12 Months Forward $2.1000 £0.4762 Euro (€125,000) $1.4700 €0.6803 1 Month Forward $1.4800 €0.6757 3 Months Forward $1.4900 €0.6711 6 Months Forward $1.5000 €0.6667 12 Months Forward $1.5100 €0.6623 Sizes of forwards on this exchange are £62,500 and €125,000. 8-14 Exporter’s Futures Market Cross-Currency Hedge • The exporter has to convert the €750,000 receivable first into dollars and then into pounds. • If we sell the €750,000 receivable forward at the six-month forward rate of $1.50/€, we can do this with a SHORT position in 6 six-month euro futures contracts. €750,000 6 contracts = €125,000/contract Selling the €750,000 forward at the six-month forward rate of $1.50/€ generates $1,125,000: $1.50 $1,125,000 = €750,000 × €1 At the six-month forward exchange rate of $2/£, $1,125,000 will buy £562,500. We can secure this trade with a LONG position in 9 six-month pound futures contracts: £562,500 9 contracts = £62,500/contract 8-15 Exporter’s Futures Market Cross-Currency Hedge: Cash Flows at Maturity Short position in 6 six-month euro futures on €125,000 at $1.50/€1 €750,000 $1,125,000 Long position $1,125,000 in 9 six-month pound futures £562,500 on £62,500 at $2.00/£1 Exporter Bicycles Customer €750,000 8-16 Money Market Hedge • This is the same idea as covered interest arbitrage. • A firm may borrow (lend) in foreign currency to hedge its foreign currency receivables (payables), thereby matching its assets and liabilities in the same currency 8-17 Importer’s Money Market Hedge • To hedge a foreign currency payable, buy the present value of that foreign currency payable today and put it in the bank at interest. ▫ Buy the present value of the foreign currency payable today at the spot exchange rate. ▫ Invest that amount at the foreign rate. ▫ At maturity your investment will have grown enough to cover your foreign currency payable. 8-18 Importer’s Money Market Hedge A U.S.–based importer of Italian shoes owes €100,000 to an Italian supplier in one year. ▫ The spot exchange rate is $1.514 = €1.00. ▫ The one-year interest rate in Italy is i€ = 4%. ▫ The importer can hedge this payable by buying €100,000 €96,153.85 = 1.04 and investing €96,153.85 at 4% in Italy for one year. At maturity, he will have €100,000 = €96,153.85 × (1.04). Dollar cost today = $145,631.1 = €96,153.85 × $1.514 €1.00 8-19 Importer’s Money Market Hedge • With this money market hedge, we have redenominated a one-year €100,000 payable into a $ 145,631.1 payable due today. • If the U.S. interest rate is i$ = 3%, we could borrow the $145,631.1 today and owe $150,000 in one year. $148,557.69 = $ 145,631.1 × (1.03) €100,000 T $150,000 = S($/€)× × (1+ i ) $ (1+ i€)T 8-20 Importer’s Money Market Hedge: Cash Flows Now and at Maturity €96,153.85 Importer $145,631.1 €96,153.85 Italian Bank €100,000 $145,631.1 $150,000 Spot Foreign Exchange Market deposit i€ = 4% T= 1 cash flows Supplier U.S Bank 8-21 Importer’s Money Market Hedge: Step One Suppose you want to hedge a payable in the amount of €y with a maturity of T: i. Borrow $x at t = 0 on a loan at a rate of i$ per year. €y $x = S($/€)× (1+ i )T € $x 0 Repay the loan in T years –$x(1 + i$)T T 8-22 Importer’s Money Market Hedge: Step Two ii. Exchange the borrowed $x for at the prevailing spot rate. €y Invest (1+ i€)T €y (1+ i€)T at i€ for the maturity of the payable. At maturity, you will owe a $x(1 + i$)T. Your Euro investments will have grown to €y. This amount will service your payable and you will have no exposure to the euro. 8-23 Importer’s Money Market CrossCurrency Hedge Your firm is a U.K.-based importer of bicycles. You have bought €750,000 worth of bicycles from an Italian firm. Payment (in euros) is due in one year. Your firm wants to hedge the payable into pounds. ▫ ▫ Spot exchange rates are $2/£ and $1.55/€ The interest rates are 3% in €, 6% in $ and 4% in £, all quoted as an APR. What should you do to redenominate this 1-year €denominated payable into a £-denominated payable with a 1-year maturity? 8-24 Importer’s Money Market CrossCurrency Hedge • Sell pounds for dollars at spot exchange rate, buy euro at spot exchange rate with the dollars, invest in the euro zone for one year at i€ = 3%, all such that the future value of the investment equals €750,000. Using the numbers, we have: ▫ Step 1: Borrow £564,320.39 at i£ = 4%. ▫ Step 2: Sell pounds for dollars, receive $1,128,640.78. ▫ Step 3: Buy euro with the dollars, receive €728,155.34. ▫ Step 4: Invest in the euro zone for 12 months at 3% APR (the future value of the investment equals €750,000). ▫ Step 5: Repay your borrowing with £586,893.20. (see next slide for where the numbers come from) 8-25 Where Do the Numbers Come From? €750,000 The present value of the euro payable =€728,155.34 = (1.03) The dollar cost of buying the present value of the = $1,128,640.78 = €728,155.34 × $1.55 €1 euro payable today Cost today in pounds of the £1 present dollar value of the £564,320.39 = $1,128,640.78 × $2 euro payable FV in pounds of the cost in pounds of being able to pay £586,893.20 = £564,320.39 × (1.04) the supplier €750,000 8-26 Importer’s Money Market Cross-Currency Hedge: Cash Flows Now and at Maturity Spot Foreign $1,128,640.77 €728,155.34 Exchange Market €728,155.34 Importer deposit i€ = 3% Italian Bank £564,320.39 $1,128,640.77 £586,893.20 €750,000 £564,320.39 Spot Foreign Exchange Market U.K Bank T= 1 cash flows Supplier 8-27 Exporter’s Money Market Hedge Borrow PV of €100,000 at i€ = 5% Exporter €95,238.10 £76,190.48 €100,000 A British exporter has just sold €100,000 worth of bicycles to an Italian customer. Payment is due in one year. Interest rates are 15.5% in the U.K. and 5% in the euro zone. The spot exchange rate is £0.80/€1.00. £88,000 €95,238.10 £76,190.48 Spot Foreign Exchange Market U.K Bank Italian Bank T= 1 cash flows Customer 8-28 Exporter’s Money Market Hedge 1. Borrow the present value of €y at i€ €y (1+ i€)T €y 2. Exchange £x = S(£/€)× (1+ i€)T €y (1+ i€)T for 3. Invest £x at i£ for T years. 4. Collect €y from your customer and use it to repay the € loan. 5. Receive the maturity value £x (1+i£)T which is the guaranteed £ proceeds from your sale 8-29 Money Market Hedge: a recap • Generally speaking, the firm: • may borrow in foreign currency to hedge its foreign currency receivables • may lend (i.e. invest) in foreign currency to hedge its foreign currency payables • Apart from transaction costs, the money market hedge is fully self-financing 8-30 Options Market Hedge • One possible shortcoming of both forward and money market hedges is that these methods completely eliminate exchange risk exposure ▫ Ideally, an exporter would like to protect itself only if the foreign currency weakens, while retaining the opportunity to benefit if the foreign currency strengthens • Currency options provide a flexible “optional” hedge against exchange exposure ▫ Firm may buy a foreign currency call (put) option to hedge its foreign currency payables (receivables) 8-31 Using Options to Hedge: Exports • A British exporter who is owed €100,000 in one period has many choices: ▫ Buy call options on the pound with a strike in dollars while also buying put options on the euro with a strike in dollars. ▫ Buy call options on the pound with a strike in euros. ▫ Buy put options on the euro with a strike in pounds. ▫ Spot rates are S0(£/€) = £0.80/€, i£ = 15½% and i€ = 5%. ▫ In the next year, suppose that there are two possibilities: S1(£/€) = £1.00/€ or S1(£/€) = £0.75/€ 8-32 Exporter’s Options Market Hedge • An option is written on €10,000. • Strike price £0.80/€ A British exporter with a €100,000 receivable should buy 10 put options on €10,000. 10 × p0 = £2,077.92 S1(£/€) = £1.00/€ or S1(£/€) = £0.75/€ €10,000 = £8,000 p0 = £207.79 £10,000 up p1 = £0 S1(£/€) = £1.00/€ £7,500 down p1 = £500 S1(£/€) = £0.75/€ 8-33 10 Puts on €10,000 (Strike £8,000) Option Dealer Out-of-the-Money: S1(£/€) = £1.00/€ K0(£/€) = £0.80/€ Put Buying Exporter £100,000 T = 1 Spot Market Sell €100,000 €100,000 S1(£/€) = £1.00/€. customer 10×p0 = £2,077.92 £80,000 Put S1(£/€) = £0.75/€ Buying K0(£/€) = £0.80/€ Exporter €100,000 Option Dealer The future value of the receivable net of the cost of 10 options is either £97,600 = £100,000 − £2,077.92 × 1.155 or £77,600 = £80,000 − £2,077.92 × 1.155 8-34 Options Market “Perfect” Hedge • Suppose the exporter (importer) wants to completely eliminate exchange risk exposure using options • How can this be achieved? • Compute the hedge ratio and choose the number of options to buy accordingly • The hedge ratio tells how fast the option value changes with changes in the value of the underlying currency 8-35 Options Market “Perfect” Hedge Consider a British exporter with a €100,000 receivable. The hedge ratio of this option is − 1/5 £10,000 up H= p up 1 – down 1 p S1up – S1down €10,000 = £8,000 p0 = £207.79 –£500 £0 – £500 1 = = − /5 = £10,000 – £7,500 £2,500 p1 = £0 S1(£/€) = £1.00/€ £7,500 down p1 = £500 S1(£/€) = £0.75/€ With a hedge ratio of –0.20 our exporter would actually achieve a perfect hedge with a long position in 50 puts (written on €10,000). 8-36 Long 50 Puts = Perfect Hedge 50 × p0 = £10,389.61 Out-of-the-Money: Put S1(£/€) = £1.00/€ K0(£/€) = £0.80/€ Buying £100,000 T = 1 Spot Market Sell €100,000 €100,000 S1(£/€) = £1.00/€. Option Dealer Exporter T = 1 Spot Market Buy €400,000 S1(£/€) = £0.75/€. customer Put Buying Exporter In-the-Money Puts S1(£/€) = £0.75/€ K0(£/€) = £0.80/€ £400,000 €500,000 The future value of the receivable net of the cost of 50 puts is £88,000 = £100,000 − £10,389.61 × 1.155 or £88,000 = £400,000 − £10,389.61 × 1.155 − £300,000 Option Dealer 8-37 Importer’s Options Market Hedge Consider a British importer who owes €100,000 in one year. The importer can use call options on the euro with a pound strike to hedge his € liability. Buy 10 call, each written on €10,000 £10,000 up c1 = £2,000 £8,000 c0 = £900.43 £7,500 down c1 = £0 8-38 Importer’s Option Market Hedge Option Dealer Out-of-the-Money: Call S1(£/€) = £0.75/€ K0(£/€) = £0.80/€ Buying Importer £75,000 T = 1 Spot Market Buy €100,000 €100,000 S1(£/€) = £0.75/€. T = 1 Spot Market Supplier Call premium: 900.43*10*1.155=£10,400 S1(£/€) = £1.00/€. Call Buying Importer The future value of the payable plus the cost of the call is £85,400 = £75,000 + £10,400 or £90,400 = £80,000 + £10,400 £80,000 €100,000 Option Dealer In-the-Money Calls: S1(£/€) = £1.00/€ K0(£/€) = £0.80/€ 8-39 Options Markets Hedge With an exercise price denominated in domestic currency IMPORTERS who OWE foreign currency in the future should BUY CALL OPTIONS. EXPORTERS with accounts receivable denominated in foreign currency should BUY PUT OPTIONS. ▫ If the price of the currency goes up, his call will lock in an upper limit on the domestic cost of his imports. ▫ If the price of the currency goes down, he will have the option to buy the foreign currency at a lower price. ▫ If the price of the currency goes down, puts will lock in a lower limit on the domestic value of his exports. ▫ If the price of the currency goes up, he will have the option to sell the foreign currency at a higher price. 8-40 Summary of Hedging Strategies for Transaction Exposure Forward Hedge Foreign Currency Receivable Foreign Currency Payable Sell the foreign currency receivable amount forward by entering into a short position on a forward contract. Buy the foreign currency payable amount forward by entering into a long position on a forward contract. Borrow in foreign currency against the foreign currency Money Market receivable, buy domestic Hedge currency with the loan, and invest in the domestic market. Borrow in domestic currency, buy foreign currency today with the loan, and invest abroad against the foreign currency payable. Options Hedge Buy call options on the foreign currency payable. Buy put options on the foreign currency receivable. 8-4141 Cross-Hedging Minor Currency Exposure • If a firm has positions in major currencies (e.g., British pound, euro, and Japanese yen), it can easily use forward, money market, or options contracts to manage its exchange risk exposure • However, if the firm has positions in less liquid currencies (e.g., Indonesian rupiah, Thai bhat, and Czech koruna), it may be either very costly or impossible to use financial contracts in these currencies ▫ In this situation, firms may use cross-hedging, which involves hedging a position in one asset by taking position in another asset 8-42 Hedging Contingent Exposure • Options contract can also provide an effective hedge against what might be called contingent exposure ▫ Contingent exposure is the risk due to uncertain situations in which a firm does not know if it will face exchange risk exposure in the future ▫ Example: Suppose GE is bidding on a hydroelectric project in Canada. If the bid is accepted, which will be known in three months, GE is going to receive C$100m to initiate the project. Since GE may or may not face exchange exposure, it faces a typical contingent exposure situation ▫ Difficult to manage contingent exposure using traditional hedging tools like forward contracts, but an alternative is for GE to buy a put option on C$100m 8-43 Hedging Recurrent Exposure with Swap Contracts • Firms often must deal with a “sequence” of accounts payable or receivable in terms of a foreign currency, and these recurrent cash flows can be best hedged using a currency swap contract ▫ Currency swap contracts are agreements to exchange one currency for another at a predetermined exchange rate, that is, the swap rate, on a sequence of future dates ▫ Similar to a portfolio of forward contracts with different maturities ▫ Very flexible in terms of amount and maturity, with maturity ranging from a few months to 20 years 8-44 Hedging through Invoice Currency • Hedging through invoice currency is an operational technique that allows the firm to shift, share, or diversify exchange risk by appropriately choosing the currency of invoice ▫ Example: If the U.K. exporter invoices £88k rather than €100k for the sale of bicycles to the Italian customer, it does not face exchange exposure anymore. Though the exchange exposure has not disappeared, it has been shifted to the importer. ▫ Another option would be for the U.K. exporter to invoice half of the bill in pounds and the remaining half in foreign currency, thereby sharing the exchange exposure 8-45 Hedging via Lead and Lag • The lead/lag strategy reduces transaction exposure by paying or collecting foreign financial obligations early (lead) or late (lag) depending on whether the currency is hard or soft ▫ To “lead” means to pay or collect early; to “lag” means to pay or collect late ▫ If a currency is appreciating, pay those bills denominated in that currency early; let customers in that country pay late as long as they are paying in that currency. ▫ If a currency is depreciating, give incentives to customers who owe you in that currency to pay early; pay your obligations denominated in that currency as late as your contracts will allow. ▫ Strategy can be employed more effectively to deal with intrafirm payables and receivables among subsidiaries 8-46 Exposure Netting: Lufthansa • “In 1984, Lufthansa, a German airline, signed a contract to buy $3 billion worth of aircraft from Boeing and entered into a forward contract to purchase $1.5 billion forward for the purpose of hedging against the expected appreciation of the dollar against the German mark. This decision, however, suffered from a major flaw: A significant portion of Lufthansa’s cash flows was also dollar-denominated.” ▫ Lufthansa had a so-called “natural hedge” ▫ The following year, the dollar depreciated substantially against the mark and Lufthansa experienced a major foreign exchange loss from settling the forward contract ▫ The lesson here is that, when a firm has both receivables and payables in a given foreign currency, it should consider hedging only its net exposure 8-47 Exposure Netting • Realistically, typical multinational corporations are likely to have a portfolio of currency positions ▫ In this case, firms should hedge residual exposure rather than hedge each currency position separately • Exposure netting is hedging only the net exposure by firms that have both payable and receivables in foreign currencies ▫ For firms that would like to apply this approach aggressively, it helps to centralize the firm’s exchange exposure management function in one location ▫ Many MNCs are using a reinvoice center, a financial subsidiary, as a mechanism for centralizing exposure management functions 8-48 Should the Firm Hedge? • Not everyone agrees that a firm should hedge. ▫ Hedging by the firm may not add to shareholder wealth if the shareholders can manage exposure themselves. ▫ Hedging may not reduce the non-diversifiable risk of the firm. Therefore, shareholders who hold a diversified portfolio are not benefitted when management hedges. 8-49 LA METTE COME DOMANDA Market imperfections and hedging • In the presence of market imperfections, the firm should hedge. • Information Asymmetry: ▫ The managers may have better information than the shareholders. • Differential Transactions Costs: ▫ The firm may be able to hedge at better prices than the shareholders. • Default Costs Hedging: ▫ May reduce the firms cost of capital if it reduces the probability of default. • Taxes can be a large market imperfection: ▫ Corporations that face progressive tax rates may find that they pay less in taxes if they can manage earnings by hedging than if they have “boom and bust” cycles in their earnings stream. 8-50 What Risk Management Products Do Firms Use? • Among U.S. corporations, based on a survey of Fortune 500 firms, the most popular product was the traditional forward contract ▫ Jesswein, Kwok, and Folks (1995) found 93% of respondents reported using forward contracts • Kim and Chance (2018) study: ▫ Examined actual currency risk management practices of 101 largest nonfinancial corporations in South Korea ▫ Authors document a great discrepancy between what firms say they do versus what they actually do, attributing the discord to attempts by companies to time their hedges 8-51 Required reading • Eun C.S. and Resnik B.G. (2021) “International Financial Management”, Mc Graw Hill, ch. 8 8-52