TARIPE, Jennifer A.

TABO, Janelle

IV- BS Accountancy

X- Audit of Equity

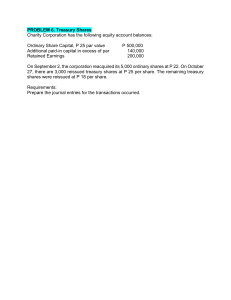

PROBLEM NO. 1 – Components of equity

Alcoy Corporation’s post-closing trial balance at December 31, 2010 was as follows:

Alcoy Corporation

Post-Closing Trial Balance

December 31, 2010

Debit

Accounts payable

Accounts Receivable

Reserve for depreciation

Reserve for doubtful accounts

Premium on ordinary shares

Gain on sale treasury shares

Bonds Payable

Building and equipment

Cash

Dividends payable on preference shares

Ordinary share capital (P1 par value)

Inventories

Land

Available-for-sale securities at fair value

Trading securities at fair value

Net unrealized loss on available-for-sale

Securities

Preference share capital (P50 par value)

Prepaid expenses

Donated Capital

Share warrants outstanding

Retained earnings

Treasury shares – ordinary, at cost

Totals

Credit

P 495,000

P 963,000

360,000

54,000

1,800,000

450,000

720,000

1,980,000

396,000

7,200

270,000

1,116,000

684,000

513,000

387,000

45,000

900,000

72,000

800,000

208,000

415,800

324,000

P 6,480,000

P 6,480,000

At December 31, 2010, Alcoy had the following number of ordinary and preference shares:

Ordinary

900,000

270,000

252,000

Authorized

Issued

Outstanding

Preference

90,000

18,000

18,000

The dividends on preference shares are P 0.40 cumulative. In addition, the preference share has a

preference in liquidation of P50 per share.

QUESTIONS:

Based on the above and the result of your audit, determine the following as of December 31,

2010:

1. Share premium/ Additional paid-in capital

a. P3,213,000

c. P3,050,000

b. P3,258,000

d. P2,600,000

2. Total contributed capital

a. P4,428,000

b. P4,220,000

c. P3,770,000

d. P1,170,000

3. Unappropriated retained earnings

a. P415,800

c. P91,800

b. 739,800

d. P37,800

4. Total equity

a. P4,266,800

b. P4,519,800

c. P4,888,800

d. P4,474,800

Answers: 1) B; 2) A; 3) C; 4) D

Suggested Solution:

Question No. 1

Premium on ordinary shares

Gain on sale of treasury shares

Donated capital

Share warrants outstanding

P1,800,000

450,000

800,000

208,000

Total share premium/additional paid-in-capital

P3,258,000

Question No. 2

Preference share capital (P50 par value)

Ordinary share capital (P1 par value)

Share Premium (see no. 1)

Total contributed capital

P900,000

270,000

3,258,000

P 4, 428, 000

Question No. 3

Total retained earnings

Less appropriate for treasury shares

Unappropriated retained earnings

P415,800

324,000

P 91,800

Question No. 4

Total contributed capital (see no.2)

Retained earnings:

Unappropriated (see no. 3)

Appropriated for treasury shares

Total

Less : Treasury shares

Net unrealized loss on AFS

P4,428,000

P 91,800

324,000

415,800

4,843,800

324,000

45,000

369,000

Total equity

P 4,474,800

PROBLEM NO.2 – Adjusted components of equity

The “shareholders equity” account of Alegria Corporation, after its initial year of operation in

2010 shows the following:

Date

Jan. 01

Jan. 15

Mar. 10

May 15

June 10

Dec. 31

Dec. 31

Particulars

Issued 6,000 shares at par of P100 in

exchange for real property with a

market value of P800,000;

authorized 20,000 shares

Sold 8,000 shares at P120

Purchased 800 shares at P150

Loss on sale of machinery

Sold 400 treasury shares

Cash dividends declared payable

January 15, 2011

Profit for the year

Debit

Credit

P600,000

960,000

P120,000

40,000

68,000

80,000

316,000

Questions:

Based on the information presented above and the result of your audit, answer the following:

1. The adjusted share capital as of December 31, 2010 is

a. P1,360,000

c. P1,400,000

b. P1,560,000

d. P1,340,000

2. The total share premium as of December 31, 2010 is

a. P360,000

c. P368,000

b. P160,000

d. P168,000

3. The unappropriate retained earnings as of December 31, 2010 is

a. P196,000

c. P136,000

b. P156,000

d. P144,000

4. The adjusted total equity on December 31, 2010 is

a. P1,944,000

c. P1,744,000

b. P1,704,000

d. P1,904,000

5. The book value per share of Alegria Corporation on December 31, 2010 was

a. P140.00

c. P128.20

b. P132.22

d. P125.29

Answers: 1) C; 2) C; 3) C; 4) D; 5) A

Suggested Solution:

Share

Date

Capital

Jan. 1

P600,000

Jan. 15

800,000

Mar. 10

May 15

June 10

Dec. 31

Profit(P316,000P40,000)

Bal.,

(12/31/10)

P1,400,000

Share

premium

P200,000

160,000

Retained

Earnings

Treasury

shares

P120,000

(60,000)

8,000

(P80,000)

276,000

P368,000

P196,000

P60,000

PROBLEM NO. 3 – Various equity transactions

Your audit client, Argao, Inc., is a public entity whose shares are traded in the over- the- counter

market. At December 31, 2009, Argao had 3,000,000 authorized, P10 par value, ordinary shares,

of which 1,000,000 shares were issued and outstanding. The equity accounts at December 31,

2009 had a following balances.

Ordinary share capital

Share Premium

Retained earnings

P10,000,000

3,750,000

3,250,000

Transactions during 2010 and other information relating to the equity accounts were as follows:

• On January 2. 2010. Argao issued at P54 per share, 50,000 shares of P50 par value, 9%

cumulative convertible preference shares. Each preference share is convertible into two ordinary

shares. Argao had 300,000 authorized shares of preference shares. The preference share has a

liquidation value equal to its par value.

• On February 1, 2010, Argao reacquired 10,000 ordinary shares for P16 per share.

• On April 30, 2010, Argao sold 250,000, P10 par value, ordinary shares (previously unissued)

to the public at P17 per share.

• On June 15, 2010, Argao declared a cash dividend of P1 per share on ordinary shares, payable

on July 15, 2010, to shareholders of record on July 1, 2010.

• On November 10, 2010, Argao sold 5,000 treasury shares for P21 per share.

• On December 15, 2010, Argao declared the yearly cash dividend on preference share, payable

on January 15, 2011, to shareholders of record on December 31, 2010.

• On January 20, 2011, before the books were closed for 2010, Argao became aware that the

ending inventories at December 31, 2009 were understated by P150,000 (after tax effect on 2009

profit was P90,000). The appropriate correction entry was recorded the same day.

• After correcting the beginning inventory, profit for 2010 was P2, 250,000.

Questions:

Based on the above and the result of your audit, determine the following as of December 31,

2010.

1. Share premium

a. P5700,000

b. P5,525,000

c. P5,500,000

d. P5,725,000

2. Unappropriated retained earnings

a. P4,125,000

c. P4,045,000

b. P4,035,000

d. P3,955,000

3. Treasury shares

a. P160,000

b. P80,000

c. P55,000

d. 50,000

4. Total equity

a. P22,190,000

b. P24,770,000

c. P24,690,000

d. P24,840,000

5. Book value per share of ordinary

a. P17.89

c. P17.71

b. P17.82

d. P15.41

Answers: 1) D; 2) C; 3) B; 4) B; 5) A

Suggested Solution:

Questions No. 1 to 4

Preference share capital

Ordinary share capital

Share premium

Retained earnings:

Appropriated

Unappropriated

Treasury shares

Total equity, 12/31/10

P 2,500,000

12,500,000

5,725 (1)

P 80,000

4,045,000

4,125,000 (2)

(80,000) (3)

P 24,770,000 (4)

Question No. 5

Total equity (see no. 4)

Less liquidation value of preference shares

Ordinary shareholders’ equity

Divide by ordinary shares outstanding

Book value per share of ordinary

P24,770,000

2,500,000

22,270,000

1,245,000

P

17.89

Prepare T accounts for each component of equity. Place the balances as of January I, 2010,

journalize the transactions affecting the equity accounts post the entries to the accounts, then

extract the balances.

Journal entries affecting the equity accounts during 2010:

1/2

Cash (50,000 shares x P54)

P2,700,000

Preference share capital (50,000 shares x P50)

Share Premium excess over par PS

2/1

Treasury shares (10,000 x P16)

Cash

P2,500,000

200,000

P 160,000

P 160,000

4/30 Cash (250,000shares x P17)

Ordinary share capital (250,000 shares x P10)

Share premium -excess over par OS

P4,250,000

6/ 15 Retained earnings

Dividends payable - ordinary

* ((1,000, 000 + 250,000 10, 000) xP1]

P1,240,000*

P1,240,000

11/ 10 Cash (5,000 shares x P21)

Treasury shares (5,000 shares x P16)

Share premium - treasury shares transactions

P 105,000

P2,500,000

1,750,000

P 80,000

25,000

12/ 15 Retained earnings (2,500,000 x 9%)

Dividends payable – preference

P 225,000

P225,000

12/31

P 150,000

Inventory, 1/1/ 10

Retained earnings

Income tax payable

12/31

Profit or loss summary

Retained earnings

12/31

Retained earnings

Retained earnings - appropriated (cost of TS)

P 90,000

60,000

P2,250,000

P2,250,000

P 80,000

P 80,000

PROBLEM NO. 4 – Various equity transactions

The equity section of the Asturias Inc. showed the following data on December 31, 2009: Share

capital, P3 par, 300,000 shares authorized, 250,000 shares issued and outstanding, P750,000;

Share premium – excess over par, P7,050,000. The share options were granted to key executives

and provided them the right to acquire 30,000 ordinary shares at P35 per share. Each option has a

fair value of P5 at the time the options were granted.

The following transactions occurred during 2010:

Feb. 1 Key executives exercised 4,500 options outstanding at December 31, 2009. The market

price per share was P44 at this time.

Apr. 1 The company issued bonds of P2,000,000 at par, giving each P1,000 bond a detachable

warrant enabling the holder to purchase two ordinary shares at P40 each for a 1- year

period. The bonds would sell at P996 per 1000 bond without the warrant.

July 1 The company issued rights to shareholders (one right on each share, exercisable within a

30- day period) permitting holders to acquire one share at P40 with every 10 rights

submitted. All but 6,000 rights were exercised on July 31, and the additional shares were

issued.

Oct. 1 All warrants issued in connection with the bonds on April were exercised.

Dec. 1 The market price per share dropped to P33 and options came due. Because the market

price was below the option price, no remaining options were exercised.

Dec.31 Profit for 2010 was P250,500.

Questions:

Based on the above and the result of your audit, determine the following as of Dec. 31, 2010:

1. Share capital

a. P777,300

b. P848,700

c. P833,850

d. P850,050

2. Total share premium

a. P7,522,200

b. P8, 402,800

c. P8,219,650

d. P8,419,450

3. Total contributed capital

a. P8,299,500

b. P9,053,500

c. P9,269,500

d. P9,251,500

4. Retained Earnings

a. P580,000

b. P858,000

c. P730,500

d. P654,150

5. Total equity

a. P10,000,000

b. P9,784,000

c. P9,030,000

d. P9,982,000

Answers: 1) D; 2) D; 3) C; 4) C; 5) A

Suggested Solution:

Questions No. 1 to 5

Share capital

Share premium

Contributed capital

Retained earnings

Total equity, 12/31/10

P 850,050

8,419,450

9,269,500

730,500

P10,000,000 (5)

(1)

(2)

(3)

Note: Follow the same approach in Problem no. 3.

Journal entries affecting the equity accounts during 2010:

2/1

4/1

Cash (4,500 options x P35)

P157,500

Share premium-share options (4,500 x P5)

22,500

Share capital (4,500 shares x P3)

Share premium excess over par

P 13,500

166,500

Cash

P2,000,000

Bond discount [P2,000,000-(2,000xP996)]

8,000

Bonds payable

2,000,000

Share premium-share warrants

8,000

7/1

Memorandum: Issued rights to shareholders permitting holder to acquire for a 30-day

period one share at P40 With every 10 rights submitted- a maximum of 25,450 shares

(254,500 shares + 10).

7/ 31 Cash {(25,450 - (6,000/ 10)] x P40}

P 994,000

Share capital (24,850 shares x P3) P

Share premium excess over par

10/1

12/ 1

12/31

Cash (2,000 x 2 x P40)

Share premium-share warrants

Share capital (2,000 shares x 2 x P3)

Share premium excess over par

P 160,000

8,000

Share premium-share options

[P150,000-(4,500xP5)]

Share premium - expired share options

Profit or loss summary

74,550

919,450

P 12,000

156,000

P127,500

P127,500

P250,500

Retained earnings

P250,500

PROBLEM NO. 5 – Various equity transactions

Balamban Corporation was authorized at the beginning of 2008 with 540,000, P100 par

value, ordinary shares. At December 31, 2008, the equity section of Balamban was as follows:

Share capital, par value P100 per share; authorized

540,000 shares; issued 54,000 shares

Share premium

Retained earnings

Total equity

P 5,400,000

540,000

810 000

P6,750,000

On May 10,2009, Balamban issued 90,000 ordinary shares for P10,800,000. A 5% share

dividend was declared on September 30, 2009 and issued on November 10, 2009 to shareholders

of record on October 31, 2009. Market value of ordinary share was P110 per share on declaration

date. The profit of Balamban for the year ended December 31, 2009 was P855,000.

During 2010, Balamban had the following transactions;

Feb. 15

Balamban reacquired 5,400 ordinary shares for P95 per share.

May 15

Balamban sold 2,700 treasury shares for P120 per share.

Jun. 30 Issued to shareholders one right for each share held to purchase two additional

ordinary shares for P125 per share. The rights expire on December 31, 2010.

Aug. 15

share.

45,000 rights were exercised when the market value of ordinary share was P130 per

Sep. 30 72,000 rights were exercised when the market value of the ordinary share was

P140 per share.

Dec. 01 Balamban declared a cash dividend of P2 per share payable on January 15, 2011 to

shareholders of record on December 31, 2010. .

Dec. 15 Balamban retired 1,800 treasury shares. On this date, the market value of the ordinary

share was P150 per share.

Dec. 31 Profit for 2010 was P900,000.

QUESTIONS:

Based on the above and the result of our audit, determme the following as of December

31, 2010:

1. Share capital

a. P38.520,000

b. P26,640,000

c. P38.340,000

d.P38,250,000

2. Share premium

a. P8,329,500

b. P8,338,500

c. P5,413,500

d. P8,266,500

3.Retained earnings

a. P1,080,000

b. P1,002,600

c. P1,017,000

d. P1,008,000

4.Treasury shares

a. P18,000

b. P90,000

c. P85,500

d. P 0

Answers: 1) C; 2) B; 3) D; 4) C

Suggested Solution:

Questions No. 1 to 4

Balances, 1/1/09

May 10, 2009

Sept. 30, 2009

Profit- 2009

Balances, 12/31/09

Feb. 15, 2010

May 15, 2010

Aug. 15, 2010

Sept. 30, 2010

Dec. 01, 2010

Share

Capital

P5,400,000

9,000,000

720,000

Share

premium

P540,000

1,800,000

72,000

15,120,000

2,412,000

9,000,000

14,400,000

Retained

Earnings

P810,000

(792,000)

855,000

873,000

67,500

2,250,000

3,600,000

(765,000)

Treasury

shares

P0

0

513,000

(256,500)

Dec. 15, 2010

Profit 2010

Balances, 12/31/10

(180,000)

P38,340,000

9,000

P8,338,500

(171,000)

900,000

P1,008,000

P85,000

PROBLEM NO. 6 – Various equity transactions

Bogo Corporation began operations on January 1, 2010. The company was authorized to issue

60,000, P10 par value, ordinary shares and 120,000 shares of 10%, P100 par value convertible

preference shares.

In connection with your audit of the company’s financial statements, you noted the following

transactions involving shareholders’ equity during 2010:

Jan. 1 Issued 1,500 ordinary shares to the corporation promoters in exchange for equipment

valued at P510,000 and services valued at P210,000. The property costs P270,000 3 years ago

and was carried on the promoters’ books at P150,000.

Jan. 31 Issued 30,000 convertible preference shares at P150 per share. Each share can be

converted to five ordinary shares. The corporation paid P225,000 to an agent for selling the

shares.

Feb. 15 Sold 9,000 ordinary shares at P390 per share. The corporation paid issue costs of

P75,000.

May 30

Received subscriptions for 12,000 ordinary shares at P450 per share.

Aug. 30 Issued 2,100 ordinary shares and. 4,200 preference shares in exchanged for a building

with a fair value of P1,530,000. The building was originally purchased for P1,140,000 by the

investors and has a carrying amount of P660,000. In addition, 1,800 ordinary shares were sold

for P720,000 cash.

Nov. 15 Payments in full for half of the subscriptions and partial payments for the rest of the

subscriptions were received. Total cash received was P4,200,000. Shares stock were issued for

the fully paid subscriptions. The balance is collectible next year.

Dec. 1

Declared a cash dividend of P10 per share on preference shares, payable on December

31 to shareholders of record on December 15, and P20 per share cash dividend on ordinary

shares, payable on January 15, 2011 to shareholders of record on December 15.

Dec. 31

Paid the preference share dividend.

Profit for the year of operations was P1,800,000.

QUESTIONS:

Based on the above and the result of your audit, determine the following as of December 31,

2010:

1. Ordinary share capital

a. P204,000

b. P144,000

c. P264,000

d. P186,000

2. Share premium- preference

a. P1,500,000

b. P1, 545,000

c. P1,275,000

d. P1,860,000

3. Share premium – ordinary

a. P8,211,000

b. P10,851,000

c. P11,121,000

d. P10,032,000

4. Retained earnings

a. P1,050,000

b. P1,170,000

c. P930,000

d. P1,458,000

5. Total equity

a. P17,295,000

b. P16,950,000

c. P15,810,000

d. P17,010,000

Answers: 1) A; 2) B; 3) B; 4) C; 5) D

Suggested Solution:

Questions No. 1 to 5

Preference share capital

Ordinary share capital

Subscribed ordinary share capital

Share premium – preference

Share premium – ordinary

Retained earnings

Total equity, 12/31/10

P3,420,000

204,000

60,000

1,545,000

10,851,000

930,000

P17,010,000 (5)

Journal entries affecting equity during 2010:

(1)

(2)

(3)

(4)

1/ 1 Equipment

P510,000

Organization expenses

210,000

Ordinary share capital (1,500 shares 1: P10)

Share premium - ordinary

P 15,000

705,000

1/31 Cash (30,000 shares x P150)

P4,500,000

Preference share capital (30,000 shares x P100) P3,000,000

Share premium preference

1 ,500,000

Share premium -preference

Cash

P225,000

P225,000 '

2/20 Cash (9,000 shares x P390)

P3,510,000

Ordinary share capital (9,000 shares x P10)

Share premium - ordinary

Share premium – ordinary

Cash

5/30 Subscriptions rec. (12,000 sh. X P450)

Subscribed ordinary share capital

(12,000 shares x P10)

Share premium - ordinary

8/30

P 90,000

3,420,000

P75 000

P75,000

P5,400,000

P120,000

5,280,000

Cash

P720,000

Ordinary share capital (1,800 shares x P10)

P18,000

Share Premium – ordinary

702,000

Building

P1,530,000

Ordinary share capital (2100 shares x P10)

Share premium- ordinary

[(2,100 sh x P400*)-21,000]

Preference share capital (4,200 shares x P100)

Share premium -preference (balance)

P21,000

819,000

420,000

270,000

* (P720, 000/ 1,800 shares)

Note: The fair value of the building should be allocated to the preference and ordinary shares

based on fair values. The problem did not specifically mention the fair value of the ordinary

shares. However, on the same date the company issued 1,800 ordinary shares for

P720, 000 cash. Therefore, ordinary shares were selling at P400/ share (P720,000/ 1,800).

Since the fair value of the preference share is not determinable, it will be assigned the

residual amount after deducting the fair value of ordinary shares from the fair value of the

building.

1 1/07

Cash

Subscriptions receivable

P4,200,000

P4,200,000

Subscribed ordinary share capital

(120,000 x 1/2)

Ordinary share capital

P60,000

P60,000

Note: Since the subscriptions receivable is collectible next year, it will be presented

under current assets. Incidentally, if the subscriptions receivable is not collectible currently, it

will be presented as a deduction within the equity section.

12/01

Retained earnings

Dividends payable - Preference

Dividends payable - Ordinary

P870,000

P342,900

528,000

Preference - (P3,420,000/P100 x P10)

Ordinary - {[P204,000+P60,000)/P10] x P20}

Note: Shares issued plus subscribed less treasury shares are entitled to dividends.

12/ 31

Profit or loss summary

Retained earnings

P1,800,000

P 1,800,000

PROBLEM NO. 7 - Various equity transactions

The Borbon Corporation has requested you to audit its financial statements for the year 2010.

During your audit, Borbon presented to you its statement of financial position as of December

31, 2009 containing the following equity section:

Preference share capital P10 par; 60,000 shares

authorized and issued, of which 6,000 are treasury

shares costing P90,000 and shown as an asset

Ordinary share capital, par value P4; 600,000 shares

authorized, of which 450,000 are issued and

outstanding

Share premium (P5 per share on preference shares

issued in 2001)

Allowance for doubtful accounts receivable

Reserve for depreciation

Reserve for fire insurance

Retained earnings

Total equity

P 600,000

1,800,000

300,000

12,000

840,000

198,000

2,250,000

P 6,000,000

Additional information:

1) Of the preference share capital, 3,000 shares were sold for P18 per share on August

30, 2010. Borbon credited the proceeds to the Preference share capital account. The

treasury shares as of December 31, 2009 were acquired in one purchase in 2009.

2) The preference share carries an annual dividend of P1 per share. The dividend is

cumulative. As of December 31, 2009, unpaid cumulative dividends amounted to P5 per

share. The entire accumulation was liquidated in June, 2010, by issuing to the preference

shareholders 54,000 ordinary shares.

3) A cash dividend of P1 per share was declared on December 1, 2010 to preference

shareholders of record December 15, 2010. The dividend is payable on January 15, 2011.

4) At December 31, 2010, the Allowance for Doubtful Accounts Receivable and Reserve

for Depreciation had balances of P25,000 and P1,050,respectively.

5) On March 1 2010, the Reserve for Fire Insurance was increased by P60,000; Retained

Earnings was debited.

6) On December 31, 2010, the Reserve for Fire Insurance was decreased by P30,000, which

represents the carrying amount of a machine destroyed by fire on that date. Estimated the

fire cleanup costs of P6,000 does not appear on the records.

7) The December 31, 2009 Retained Earnings consists of the following;

Donated land from a shareholder

(Fair value on date of donation)

P450,000

Gains from treasury share transactions

51,000

Earnings retained in business

1,749,000

P2,250,000

8) Profit for the year ended December 31, 2010 was P1,297,500 per company’s records.

QUESTIONS:

Based on the above and the result of your audit, determine the adjusted balances of the following

as of December 31, 2010. (Disregard tax implications)

1. Total share premium

a. P414,000

b. P804,000

c. P810,000

d. 864,000

2. Retained earnings- Appropriated

a. P258,000

b. P303,000

c. P228,000

d. P 0

3. Retained earnings- Unappropriated

a. P2,677,500

b. P2,626,500

c. P2,578,500

d. P2,623,500

4. Treasury shares

a. P45,000

b. P90,000

5.Total equity

a. P3,700,500

b. P5,812,500

c. P36,000

d. P 0

c. P6,316,500

d. P6,319,500

Answers: 1) D; 2) B; 3) C; 4) A; 5) C

Suggested Solution:

Questions No. 1 to 5

Preference share capital

Ordinary share capital

Share Premium

Retained eanrings – Appropriated

Retained earnings – Unappropriated

Treasury shares

Total equity, 12/31/10

P600,000

2,106,000

864,000 (1)

303,000 (2)

2,578,000 (3)

(45,000) (4)

P6,316,600 (5)

Journal entries affecting the equity accounts during 2010:

1. Cash (3,000 shares x P18)

P54,000

Treasury shares [(90,000/6,000 shares) x 3,000 shares]

P45,000

Share Premium

9,000

2. Retained earnings

P270,000 *

Ordinary share capital (54,000 shares xP4)

P216,000

Share premium

54,000

*[(60,000 – 6,000) x P5]

3. Retained earnings

Dividends payable

**[(60,000 – 3,000) x P1]

4. Ignore

5. Retained earnings

Retained earnings – appropriated

P57,000**

P57,000

P60,000

P60,000

6. See no. 8

7. Retained earnings

Share premium

P501,000

8. Profit or loss summary

Retained earnings

P1,261,500

Profit per company’s records

Fire loss erroneously charged to reserve

For fire insurance

Estimated fire clean up cost

Adjusted profit

P501,000

P1,261,500

P1,297,000

(30,000)

(6,000)

P 1,261,500

9. Retained earnings

P45,000

Retained earnings – appropriated (cost of TS)

P45,000

PROBLEM NO. 8 - Various Equity Transaction

The shareholders equity of Cordova Corporation shared the following data on December

31, 2009:

12% Preference Share capital, P30 par, 135,000

share issued and outstanding

Ordinary share capital, P50 par, 180,000 shares

issued and outstanding

Share premium – preference

Share premium – ordinary

Retained earnings

P4,050,000

P9,000,000

P1,080,000

P3,240,000

1,395,000

The 2010 transactions of the company affecting its equity summarized chronologically as

follows:

1.

2.

3.

4.

5.

6.

7.

Issued 27,000 preference shares at P40.

Issued 94,500 ordinary shares at P70.

Retired 5,400 preference shares at P45.

Purchased 13,500 ordinary shares at P80.

Split ordinary shares two for one (par value reduce toP25)

Reissued 13,500 treasury shares at P50.

Shareholders donated to the company 9,000 ordinary shares when shares had a market

price of P52. One half of these shares were subsequently issued for P54.

8. Dividends were paid at the end of the calendar year on the ordinary shares at P2 per share

and on the preference shares at the preference rate.

9. Profit for the year was 2,520,000.

QUESTIONS:

Based on the above and the result of your audit, determine the following as of December 31,

2010:

1. Preference share capital

a. P4,617,000

b. P4,698,000

c. P4,968,000

d. P4,860,000

2. Ordinary share capital

a. P15,615,000

c. P13,968,000

b. P13,500,000

d. P13,725,000

3.

Share premium

a. P6,777,000

b. P6,858,000

c. P6,679,800

d. P 6,814,800

4. Unappropriated retained earnings

a. P1,749,240

c. P1,711,440

b. 2,251,240

d. P1,684,440

5. Total equity

a. P26,949,240

b. P26,922,240

c. P26,958,960

d. P26,940,240

Answers: 1) B; 2) D; 3) D; 4) C; 5) A

Suggested Solution:

Questions No. 1 to 5

Preference share capital

Ordinary share capital

Share premium

Retained earnings – Appropriate

Retained earnings – Unappropriate

Treasury shares

Total equity, 12/31/10

P 4,698,000 (1)

13,725,000 (2)

6,814,800 (3)

540,000

1,711,440 (4)

( 540,000)

P 26,949,240 (5)

Journal entries affecting the equity accounts during 2010:

1. Cash (27,000 shares x P40)

P1,080,000

Preference share capital (27,000 shares x P30)

Share premium - preference

2.

3.

P 810,000

270,000

Cash (94,500 shares x P70)

P 6,615,000

Ordinary share capital ( 94,500 shares x P50)

Share premium – ordinary

P 4,725,000

1,890,000

Preference share capital (5,400 shares x P30)

P 162,000

Share premium - preference (1,080,000 x 5.4 /135)

43,200

Retained earnings

37,800

Cash (5,400 shares x P45)

P243,000

4. Treasury shares (13,500 shares x P80)

P 1,080,000

Cash P

P1,080,000

5.

Memo entry.

6.

Cash (13,500 shares x P50).

P 675,000

Treasury shares (1,080,000 x 1/2)

P 540,000

Share premium - treasury shares transaction

135,000

7.

Memo entry

Cash (9,000 shares x 1/2 x P54)

Share premium - donated capital

8.

Retained earnings

Cash

P 243,000

P 243,000 �

P 1,625,760

P 1,625,760

Ordinary shares issued and outstanding, 1/1/10

2) Shares issued

4) Purchase of treasury shares

5) Share split

6) Re-issuance of treasury shares

7) Donated shares

Re-issuance of donated shares

Ordinary shares issued and outstanding, 12/31/10

x Dividend per share.

Dividends to ordinary

Dividends to preference (P4,698,000 x 12%)

Total

9) Profit or loss summary

Retained earnings

180,000

94,500

(13,500)

261,000

261,000

13,500

(9,000)

4,500

531,000

P

2

P1,062,000

563,760

1,625,760

P 2,520,000

10) Retained earnings

P 540,000

Retained earnings - appropriated (cost of TS) P

P 2,520,000

540,000

PROBLEM NO. 9 - Various equity transactions

In connection with your audit of the Colon Corporation, you were able to obtain the following

information pertaining to the corporation's equity accounts.

Colon Corporation has 32,000, P2 par value, ordinary shares authorized. Only 75% of these

shares have been issued, and of the shared issued, only 22,000 are outstanding. On December 31,

2009, the equity section revealed that the balance in Share premium - ordinary was P832,000,

and the Retained Earnings balance was P220,000. The Treasury shares were purchased at an

average price of P37.50 per share.

During 2010, Colon had the following transactions:

Jan. 15 Colon issued, at P55 per share, 1,600 shares of P50 par, 5% cumulative preference

shares, 4,000 shares are authorized.

Feb. 01

Colon sold 3,000 newly issued ordinary shares at P42 per share.

Mar. 15 Colon declared a cash dividend on ordinary shares of P0.15 per share, payable on

April 30 to all shareholders of record on April 1.

Apr. 15

Colon reacquired 400 ordinary shares for P43 per share.

Employees exercised 2,000 share options granted in 2004. When the options were

granted, each option entitled the employees to purchase 1 ordinary share for P50 per share.

The share price on the date of grant was also P50 per share. Colon issued new shares to the

employees.

May 01 Colon declared a 10% share dividend to be distributed on June 1 to shareholders of

record on May 7. The market price of the ordinary share was P50 per share on May 1.

31

Colon sold 300 treasury shares reacquired on April 15 and an additional 400 shares

costing P15,000 taht had been on hand since the beginning of the year. The selling price was

P57 per share.

Sept. 15 The semiannual cash dividend on ordinary shares was declared, amounting to P0.15

per share. Colon also declared the the yearly dividend on preference shares. Both are payable on

October 15 to shareholders of record on October 1.

Profit for 2010 was P100,000.

QUESTIONS: Based on the above and the result of your audit, determine the balances of the

following as of December 31, 2010:

1.

Preference share capital

a. P86,000

b. P90,000

c. P80,000

d. P84,000

2.

Ordinary share capital

a. P63,320

b. P23,320

c. P183,320

3.

Share premium

a. P1,175,680

b. P1,068,000

d. P58,000

c. P1,195,680

4. Treasury shares

a. P64,300

b. P77,200

c. P92,200

5. Total retained earnings

a. P74,756

b. P99,756

c. P183,250

d. P1,099,680

d. P75,000

d. P174,756

Suggested Solution:

Questions No. 1 to 5

Preference share capital

Ordinary share capital

Share premium

Retained earnings

Treasury shares

Total Equity, 12/31/10

P 80,000 (1)

63,320 (2)

1,195,680 (3)

174,756 (5)

(64,300) (4)

P1,449,456

Journal entries affecting the equity accounts during 2010:

1/15 Cash (1,600 shares x P55)

P 88,000

Preference share capital (1,600 shares x P50) P 80,000

Share premium - preference

8,000

2/1

Cash (3,000 shares x P42)

P 126,000

Ordinary share capital (3,000 shares x P2)

P 6,000

Share premium - ordinary

120,000

3/15 Retained earnings [(22,000+3000)xP0.15)]

Dividends payable - ordinary

P 3,750

4/15

P 17,200

4/15

Treasury shares

Cash (400 shares x P43)

P 3,750

P 17,200

Cash (2,000 shares x P50)

P 100,000

Ordinary share capital (2,000 shares x P2)

P 4,000

Share premium - ordinary

5/1

96,000

Retained earnings (26,600 x 10% x P50)

Share dividends payable - ordinary

(26,600 x 10% x P2)

Share premium - ordinary

P 133,000

P 5,320

127,680

5/31

Cash (700 shares x P57)

P 39,900

Treasury shares [(300 shares x P43) + P15,000)]

P 27,900

Share premium - treasury shares transactions

12,000

6/1

Share dividends payable -ordinary

Ordinary share capital

9/15

P 5,320

P 5,320

Retained earnings

Dividends payable - preference (80,000 x 5%)

Dividends payable - ordinary (29,960 x P15)

12/31 Profit or loss summary

Retained earnings

P 8,494

P 4,000

4,494

P 100,000

P 100,000

PROBLEM NO. 10 – Various equity transactions

Following is the equity section of Carcar Corporation’s statement of financial position at

December 31, 2009:

Share capital, P10 par value; authorized

1,500,000 shares; issued and outstanding

900,000 shares

Share premium

Retained earnings

Total equity

P9,000,000

750,000

2,700,000

P12,450,000

Transactions during 2010 and other information relating to the equity accounts were as follows:

On January 26, Carcar reacquired 75,000 ordinary shares for P11 per share.

On April 4, Carcar sold 45,000 treasury shares for P14 per share.

On June 1, Carcar declared a cash dividend of P1 per share, payable on July 15, 2010 to

shareholders of record on July 1, 2010.

On August 15, each shareholder was issued one right for each share held to purchase two

additional shares for P12 per share. The rights expire on October 31, 2010

On September 30, 150,000 rights were exercised when the market value of the share was

P12.50 per share.

On November 2, Carcar declared a two for one share split up and changed the par value

of the share from P10 to P15 per share. On November 20, shares were issued for the

share split

On December 5, 60,000 shares were issued in exchanged for a secondhand equipment. It

originally cost P600,000 was carried by the previous owner at a carrying amount of

P300,000, and was recently appraised at P390,000.

Profit for 2010 was P720,000.

Questions:

Based on the above and the result of your audit, determine the following as of December

31, 2010:

1. Share Capital

a. P12,600,000

b. P10,050,000

2. Share Premium

a. P1,485,000

b. P3,825,000

3. Unappropriated Retained Earnings

a. P2,550,000

b. P2,220,000

4. Total Equity

a. P16,425,000

b. P16,095,000

c. P10,800,000

d. P12,300,000

c. P1,575.000

d. P1,275,000

c. P2,422,500

d. P2,190,000

c. P14,295,000

d. P16,065,000

Answers: 1) D; 2) C; 3) B; 4) B

Suggested Solution:

Questions No. 1-4

Share Capital

Share Premium

Appropriated Retained Earnings

Retained Earnings

Treasure shares

Total Equity 12/31/10

Journal entries affecting the equity accounts during 2010:

P112,300,000 (1)

1,575,000 (2)

330,000

2,220,000 (3)

(330,000)

P16,095,000 (4)

1/26

4/4

6/1

Treasury shares (75,000 x P11)

Cash

P 825,000

Cash (45,000 x P14)

Treasury shares (45,000 x P11)

Share Premium

P 630,000

Retained Earnings [(900,000-30,000) x P1]

Dividends Payable

P 870,000

P 825,000

P 495,000

P 135,000

P870,000

8/15

Memo entry

9/30

Cash (150,000 x 2x P12)

Share Capital (150,000 x 2 x P10)

Share Premium

P 3, 600,000

Equipment

Share Capital

P 390,000

P 3,000 000

600,000

P

300,000

Share Premium

P90,000

12/31 Profit or loss summary

Retained Earnings

P 720,000

12/31 Retained Earnings

Appropriated Retained Earnings

P 330,000

P 720,000

P 330,000

PROBLEM NO.11 –Various equity Transactions

You were able to gather the following information in connection with your audit of the equity

section of the statement of financial position of Liloan, Inc. The company is a manufacturer of

school and office equipment. As of December 31, 2009, the equity of the company is presented

below:

Cumulative preference share capital

(P15 par value; 100,000 shares authorized,

12,000 shares issued and outstanding)

Ordinary share capital

(P10 par value: 1,000,000 shares authorized, 330,000 shares issued

and outstanding)

Retained Earnings

Liloan’s equity transaction during 2010 were as follows:

P 180,000

3,300,000

1,866,000

P 5,346,000

a. On January 31, 24 000 Preference shares were issued in exchange for land with a fair

value of P300,000, Six months ago, 2,000 shares of Liloan’s preference shares were

exchanged “over the counter “ for P14 per share.

b. On February 14, 13,500 ordinary shares were sold to Ms. P. Saway at P25 per share.

c. On Decemer 14, Liloan purchased dissident shareholder Saway’s 13,500 shares at P27

per share. The shares are to be held as treasury shares. (Saway violently opposed Liloan’

business strategy and Liloan’s management decided to eliminate her interest.)

d. On December 20, Liloan contracted with Ms. Buti for the sale of 30,000 previously

unissued ordinary shares at P25 per share to be issued when the purchase price is fully

paid. At December 31, only P585,000 had been paid. Buti agreed to pay the balance on or

before January 31, 2011.

e. On December 31, Liloan retired 12,000 preference shares at P18 per share.

f. A cash dividend of P2 per share was declared on the preference shares on October 15,

and paid on November 15.

g. A cash dividend of P1.50 per ordinary shares was declared on December 15 and payable

on January 15, 2011.

h. Liloan’s profit for the year 2010 was P750,000.

Questions:

Based on the above and the result of your audit, determine the following as of December 31,

2010:

1. Preference share capital

a. P360,000

b. P300,000

c. P264,000

d.P324,000

2. Ordinary share capital

a. P3,435,000

b. P4,020,000

c.P3,735,000

d.P3,637,500

3. Share Premium

a. P592,500

b. P202,500

c.P652,500

d. P142,500

4. Total Retained Earnings

a. P1,977,000

b. P1,648,500

c. P2,013,000

d. P2,037,000

5. Total equity

a. P6,171,000

b. P6,036,000

c. P6,396,000

d. P6,336,000

Answers: 1) A; 2) A; 3) C; 4) C; 5) D

Suggested solutions:

Questions No. 1 to 5

Preference share capital

Ordinary share capital

Subscribed ordinary share capital

Share premium

Total retained earnings

Treasury shares

Discount on preference share capital

Total Equity, 12/31/10

P6,336,000

Journal entries affecting the equity accounts during 2010:

P 360,000 (1)

3,435,000 (2)

300,000

652,500 (3)

2,013,000 (4)

(364,500)

(60,000)

(5)

a. Land (at fair value)

P300,000

Discount on Preference share capital

60,000

Preference share capital (24,000 shares x P15)

P360,000

b. Cash (13,500 shares x P25)

P337,500

Ordinary share capital (13,500 shares x P10)

Share Premium

202,500

c. Treasury shares

Cash(13,500 shares x P27)

P135,000

P364,500

P364,500

d. Cash

P585,000

Subscriptions Receivables

165,000*

Subscribed ordinary share capital (30,000 shares x P10)

Share Premium

P300,000

450,000

*[(30,000 shares x P25) – P585,000]

e. Preference share capital (12,000 shares x P15)

Retained earnings

Cash (12,000 shares x P18)

P180,000

36,000

f. Retained earnings

Cash [(12,000+24,000 x P2)]

P72,,000

P216,000

P 72,000

g. Retained earnings

P495,000

Dividends payable [(12,000 + 24,000 x P2)

**[(330,000 + 13,500) x P1.5]

h. Profit or loss summary

P750,000

P495,000

Retained Earnings

P750,000

PROBLEM NO. 12-Various equity transactions

You gather the following information pertaining to the equity section of the Oslob Corporation in

connection with your audit of the company’s financial statements for 2010:

Ordinary share capital, P1 par value; authorized

1,500,000 shares; issued 750,000 shares; outstanding 700, 000 shares

Share Premium:

Excess over par

From Treasury shares

Total paid-in capital

Unappropriated retained earnings

Total equity

P700,000

P7,000,000

100,000

P7,800,000

4,050,000

P11,850,000

All of the outstanding ordinary and treasury shares were originally issued in 2007 for P11 per

share. The treasury shares were acquired on March 31, 2009. Oslob uses the par value method of

accounting for treasury shares.

During 2010, the following events or transactions occurred relating to Oslob’s equity:

Feb. 10

March 15

Aug. 30

Dec. 15

Issued 200,000 of unissued ordinary shares for P12.50 per share.

Declared cash dividend of P0.20 per share to shareholders of record. April 1, 2010

and payable April 15, 2010. This was the first dividend ever declared by Oslob.

Oslob’s president retired, Oslob purchased from the retiring president 50,000

ordinary shares of Oslob for P13 per share, which was equal to market value on

this date

Declared a cash dividend of P0.20 per share to shareholders of record on January

2, 2011 and payable on January 15, 2011.

Oslob is being used by two separate parties for patent infringements. Oslob management and

outside legal counsel share the following opinions regarding to these suits:

Suit

#1

#2

Likelihood of losing the suit

Reasonably possible

Probable

Estimated loss

P300,000

200,000

Questions:

Based on the above and the result of your audit answer the following:

1. The issuance of 200,000 ordinary shares on February 10, 2010 caused Oslob’s share

premium to increase by

a. P 200,000

c. P 2,300,000

b. P2,500,000

d. P

0

2. The retirement of 50,000 ordinary shares on August 30, 2010 caused Oslob’s share

premium to decrease by

a. P 50,000

c. P 500,000

b. P 600,000

d. P

0

3. Oslob wants to appropriate retained earnings for all loss contingencies that are not

properly accruable by a charged to expense. How much of Oslob loss contingencies

should be appropriated by charged to unappropriated retained earnings?

a. P 230,000

c. P 500,000

b. P 200,000

d. P

0

4. How much cash dividends should Oslob charge against unappropriated retained earnings

in 2010?

a. P 350,000

c. P 370,000

b. P 180,000

d. P 170,000

5. How much should Oslob show in note to financial statements as a restrictions on retained

earnings because of the acquisitions of treasury shares?

a. P 100,000

c. P 600,000

b. P 450,000

d. P 650,000

Answers: 1) C; 2) C; 3) A; 4) A; 5) B

Suggested solutions:

Question No. 1

Proceeds from issuance (200,000 x P12.50)

Less par value of shares issued (200,000 shares x P1)

Increase in share premium

Question No. 2

Journal entry to record the retirement:

Ordinary share capital (50,000 shares x P1)

Share Premium (50,000 shares x (P11-1)

Unappropriated retained earnings

Cash

P 2,500,000

200,000

P 2,300,000

P 50,000

500,000

100,000

P 550,000

Question No. 3

Loss contingency that is not properly accruable by a charged to expense:

Suit # 1 – Reasonably possible

P 300,000

Question No. 4

Dividends declared, 3/15/10 [(700,000+200,000) x P0.20]

Dividends declared, 12/15/10 [(700,000+200,000-50,000)x P0.20]

Total cash dividends

P180,000

170,000

P350,000

Question No. 5

Reconstruction of the entry made to record the acquisition of treasury shares:

Treasury shares (50,000 shares x P1)

P 50,000

Share Premium – excess over par (50,000 shares x (P11-1) 500,000

Share premium – TS transactions

Cash (balancing figure)

P100,000

450,000

PROBLEM NO. 13 – Analysis of share and dividend transactions

In connection with your audit of the Poro Company, you were asked to prepare comparative data

from the Company’s inception to the present. The following gathered during your audit:

a. Poro Company’s charter became effective on January 2, 2006, when 80,000, P10 par

value, ordinary shares and 400,000, 5% cumulative, nonparticipating, preference shares

were issued. The ordinary shares was sold at P12 per share and preference shares was

sold at its par value of P100 per share.

b. Poro was unable to pay preference dividends at the end of its first year, The owners of the

preference shares agreed to accept 2 ordinary shares for every 50 shares of preference

shares owned in discharge of the preference share dividends due on December 31, 2006.

The shares were issued on January 2 , 2007. The fair value was P30 per share for ordinary

on the date of issue.

c. Poro Company acquired all outstanding shares of Pos Corporation on May 1, 2008, in

exchange for 40,000 ordinary shares of Poro.

d. Poro split its ordinary shares 3 for 2 on January 1, 2009, and 2 for 1 on January 1, 2010.

e. Poro offered to convert 20% of the preference shares to ordinary on the basis of 2

ordinary shares for 1 preference share. The offer was accepted, and the conversion was

made on July 1, 2010.

f. No cash dividends were declared on ordinary shares until December 31, 2008. Cash

dividends per ordinary share were declared and paid as follows:

December 31

June 30

2008

P 4.00

2009

P 5.00

P 3.00

2010

P 2.00

P 2.50

Questions:

Based on the above and the result of your audit, determine the following:

1. Outstanding number of ordinary shares as of December 31, 2010

a. 364,800

c. 372,800

b. 684,800

d. 380,800

2. Outstanding number of preference shares as of December 31, 2010

a. 40,000

c. 32,000

b. 24,000

d. 96,000

3. Amount of cash dividends declared and paid to ordinary shareholders for the year 2009

a. P 972,800

c. P 1,459,200

b. P 608,000

d. P 1,981,440

4. Amount of cash dividends declared and paid to ordinary shareholders for the year 2010

a. P 3,911,040

c. P 1,713,600

b. P 3,041,600

d. P 1,673,600

Answers: 1) D; 2) C; 3) C; 4) D

Suggested solutions:

Questions 1 and 2

Jan. 02, 2006

Jan. 02, 2007

Ordinary issued to preference

Shareholders (40,000/50 x 2)

Dec. 31, 2007

May 01, 2008Acquisition of Pos Corp.

Dec. 31, 2008

Jan. 01, 2009 3:2 Ordinary share split

[(121,600 x 3/2) – 121,600]

Dec. 31, 2009

Jan. 01, 2010 2:1 Ordinary share split

Jan. 01, 2010 Conversion of preference

(40,000 x 20% x 2)

Dec, 31, 2010

Ordinary

80,000

Preference

40,000

1,600

81,600

40,000

121,600

40,000

40,000

60,800

182,400

182,400

40,000

16,000

380,000

(8,000)

32,000

Questions No. 3

Dividends declared, 7/1/09 (182,400 x P3.00)

Dividends declared, 12/31/09 (182,400 x P5.00)

Cash dividends to ordinary shareholders in 2009

P 547,200

912,000

P 1,459,200

Question No. 4

Dividends declared, 7/1/10 (364,800 x P2.50)

Dividends declared, 12/31/10 (380,800 x P2.00)

Cash dividends to ordinary shareholders in 2010

P 912,000

761,600

P 1,673,600

PROBLEM NO. 14 – Analysis of equity transactions

The equity section of Ronda Corporation’s statement of financial position as of December 31,

2009 is as follows:

Shareholders’ Equity

Share Capital, P5 par value; authorized,

2,000,000 shares; issued, 400,000 shares

Share Premium

Retained earnings

P 2,000,000

850,000

3,000,000

5,850,000

The following events occurred during 2010:

Jan. 5

Jan 16

Feb 10

Mar. 1

Apr. 1

July 1

Aug 1

Dec. 31

10,000 shares were sold for P9 per share.

Declareda cash dividend of P0.40 per share, payable February 15 to shareholders

of record on February 5.

40,000 shares were sold for P11 per share.

A 40% share dividend was declared and issued. Market value is currently P15.

A two-for-one split was carried out. The par value of the share was to be reduced

to 2.50 per share. Market value on March 31 was P18 per share.

A 10% share dividend was declared and issued. Market value is currently P10 per

share.

A cash dividend of P0.40 per share was declared, payable September 1 to

shareholders of record on August 21.

Profit for 2010 was P 1,880,0000.

Questions:

Based on the above and the result of your audit, answer the following:

1. The number of shares issued and outstanding as of December 31, 2010 is

a. 2,079,000

c. 1,188,000

b. 1,386,000

d.

346,500

2. The balance of share capital as of December 31, 2010 is

a. P 3,465,000

b. P 3,780,000

c.

d.

P 3,228,750

P 3,622,500

3. The balance of share premium as of December 31,2010 is

a. P 2,075,000

c.

b. P 2,547,500

d.

P 1,760,000

P 3,695,000

4. The balance of retained earnings as of December 31, 2010 is

a. P 381,600

c.

b. P 3,362,400

d.

P 1,094,400

P 2,001,600

Answers: 1) B; 2) A; 3) A; 4) D

Suggested solution:

Date

Shares issued

and outstanding

Bal. 12/31/09

400,000

January 5

10,000

410,000

January 16

February 10

40,000

450,000

March 1

180,000

630,000

April 1

630,000

1,260,000

July 1

126,000

1,386,000

August 1

December 31

Bal. 12/31/10 1,386,000

Share Capital

Share Premium

Retained earnings

P 2,000,000

50,000

2,050,000

P 850,000

40,000

890,000

200,000

2,250,000

900,000

3,150,000

3,150,000

315,000

3,465,000

P3,465,000

240,000

1,130,000

P 3,000,000

3,000,000

(164,000)

2,836,000

(900,000)

1,936,000

1,936,000

(1.260,000)

676,000

(554,400)

1,880,000

P2,001,600

1,130,000

1,130,000

945,000

2,075,000

P2,075,000

PROBLEM NO.15-Share Options

You were able to gather the following information in connection with your audit of Sagod

Corporation:

On January 1, 2008, Sogod Corporation granted share options to officers and key

employees for the purchase of 30,000, P10 par value, ordinary shares of the company at

P25 per share. The options are exercisable within a 5-year period beginning January 1,

2010 by grantees still in the employ of the company, and expiring December 31, 2014.

The service period for this award is 2 years. The fair value option pricing model

determined total compensation expense to be P525,000 . The share was selling at P35 at

the time the options were granted.

On April 1, 2009, 3,000 option were terminated when the employees resigned from the

company. The market value of ordinary share was P35 per share on this date.

On March 31,2010, 18,000 option shares were exercised when the market value of

ordinary shares was P40 per share.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Compensation expenses in 2008

a. P 525,000

c. P 236,250

b. P 262,500

d. P 150,000

2. Net compensation expense in 2009

a. P262,500

b. P210,000

c. P120,000

d. P150,000

3. The exercise of the 18,000 options will result in a credit to Share premium-excess over

par of

a. P585,000

c. P270,000

b. P620,000

d. P450,000

4. Share Premium-share options as of December 31,2010

a. P

0

b. P 90,000

c. P472,500

d. P157,500

Answers: 1) B; 2) B; 3) A; 4) D

Suggested solutions:

Question No. 1

Compensation expense in 2008 (P525,000 x 1/2)

P262,500

PFRS 2 par. 10 states that for equity-settled share-based payment transactions, the entity shall

measure the goods or services received, and corresponding increase in equity, directly, at the

fair value of the goods or services rendered, unless the fair value cannot be estimated reliably.

If the entity cannot estimate reliably the fair value of the goods of services received, the entity

shall measure their fair value, and the corresponding increase in equity, indirectly, by

reference to the fair value of the equity instruments granted.

In cases, that the entity is unable to estimate reliably the fair value of the equity instruments

granted at measurement date, the entity may measure the equity instruments at their intrinsic

value.

If the equity instruments granted do not vest until the counterparty completes a specified

period of service, the entity shall presume that the services to be rendered by the counterparty

as consideration for those equity instruments will be received in the future, during –the

vesting period. On the other hand, if the equity instruments granted vest immediately, the

entity shall recognize the services received in full, with a corresponding increase in equity.

Question No. 2

Compensation expense in 2009 (P525,000 x 1/2 )

Less: Share options of terminated employees (P525,000 x 3/30)

Net compensation expense in 2009

P262,500

52,500

P210,000

Question No. 3

Journal entry to record the exercise of the options:

Cash (18,000 x P26)

Share Premium-options (P472,500 x 18/27)

Share Capital ( P18,000 x P10 )

P450,000

315,000

P180,000

Share premium-excess over par

Question No. 4

Compensation expense, 2008

Compensation expense, 2009

Share options exercised (see no. 3)

585,000

P262,500

210,000

(315,000)

Share premium- share options, 12/31/10

P157,500

PROBLEM NO. 16 Share options

At the beginning of 2010, Sibonga Company grants 100 share options to each of its 200

employees. Each grant is conditional upon the employee working for the entity over the next

three years. The entity estimates that the fair value of each share option is P45.

On the basis of a weighted average probability, the entity estimates that 25 per cent of employees

will leave during the three-year period and therefore forfeit their rights to the share options.

During 2010, 10 employees leave. The entity revises it estimates of total employee departures

over the three-year period from 25 per cent to 20 per cen. During 2011, a further 8 employees

leave. The entity revises its estimate of total employee departures over the three-year period from

20 per cent to 15 per cent. During 2012, a further 6 employees leave.

Questions:

Based on the above and the result of the audit, determine the following:

1. Compensation expense in 2010

a. P240,000

b. P225,000

c. P720,000

d. P

0

2. Compensation expense in 2011

a. P240,000

b. P270,000

c. P510,000

d. P

0

3. Compensation expense in 2012

a. P240,000

b. P720,000

c. P282,000

d. P792,000

Answers: 1) A; 2) B; 3) C

Suggested solutions:

Question No. 1

Compensation expense in 2010

(200 employees x 100 options x 80% x P45 x 1/3)

Question No. 2

P240,000

Cumulative compensation expense, 12/31/11

(200 employees x 100 options x 85% x P45 x 2/3)

Less: compensation expense for 2010

Compensation expense in 2011

P510,000

240,000

P270,000

Question No. 3

Cumulative compensation expense, 12/31/12

(176 employees x 100 options x P45)

Less: Cumulative compensation expense, 12/31/11

Compensation expense in 2012

P792,000

510,000

P282,000

PROBLEM NO. 17- Share options

At the beginning of 2010, Santander grants share options to each of its 100 employees working

in the sales department. The share options will vest at the end of 2012, provided that the

employees remain in the entity’s employ, and provided that the volume of sales of a particular

product increases by at least an average of 5 percent per year. If the volume of sales of the

product increases by an average of between 5 per cent and 10 per cent of the year, each employee

will receive 100 share options. If the volume of sales increases by an average of between 10 per

cent and 15 per cent each year, each employee will receive 200 share options. If the volume of

sales increases by an average of 15 per cent or more, each employee will receive 300 share

options.

On grant date, Santander estimates that the share options have a fair value of P20 per option.

Santander also estimates that the volume of sales of the product will increase by an average of

between 10 per cent and 15 per cent per year. The entity also estimates, on the basis of a

weighted average probability, that 19 per cent of employees will leave before the end of 2012.

By the end of 2010, seven employees have left and the entity still expects that aa total of 19

employees will leave by the end of 2012. Product sales have increased by 12 per cent and the

entity expects this rate of increase to continue over the next 2 years.

By the end of 2011, further six employees have left. The entity now expects only three more

employees will leave during 2012. Product sales have increased by 18 percent. The entity now

expects that sales will average 15 percent or more over three-year period.

By the end of 2012, a further two employees have left. The entity’s sales have increased by an

average of 16 percent over the three years

Questions:

Based on the above and the result, determine the following:

1.Compensation expense in 2010

a. P162,000

c.

P108,000

b.

P124,000

d.

P

0

2. Share premium-share options at the end of 2011

a. P348,000

b. P336,000

c. P340,000

d. P

0

3.Compensation expense in 2011

a. P228,000

b. P224,000

c. P232,000

d. P

0

4.Compensation expense in 2012

a. P510,000

b. P162,000

c. P174,000

d. P

0

Answers: 1) C; 2) B; 3) A; 4) C

Suggested solutions:

Question No. 1

Compensation expense in 2010

(8 employees x 200 options x P20 x 1/3)

P108,000

Question No. 2

Share premium-share options,12/31/11

(84 employees x 300 options x P20 x 2/3)

P336,000

Question No. 3

Cumulative compensation expense, 12/31/11

Less: compensation expense in 2010

Compensation expense in 2011

P336,000

108,000

P228,000

Question No. 4

Cumulative compensation expense, 12/31/12

(85 employees x 300 options x P20)

Less: cumulative compensation expense, 12/31/12

Compensation expense in 2012

P510,000

336,000

P174,000

PROBLEM NO. 18 –Share appreciation rights

On January 1, 2010, Tabogan Corp. grants 100 cash share appreciation rights (SARs) to each of

to 200 employees, on condition that the employees remain in its employ for the next three years.

During 2010, 14 employees leave. The entity estimates that a further 24 will leave during 2011

and 2012. During 2011, 10 employees leave and the entity estimates that a further 8 will leave

during 2012. During 2012, 6 employees leave. At the end of 2012, 60 employees exercise their

SARs, another 40 employees exercise their SARs at the end of 2013 and the remaining

employees exercise their SARs at the end of 2014.

The entity estimates the fair value of the SARs at the end of each year in which a liability exist as

shown below. At the end of 2012, all SARs held by the remaining employees vest. The intrinsic

values of the SARs at the date of exercise (which equal the cash paid out) at the end of 2012,

2013 and 2014 are also shown below.

YEAR

Fair value

Intrinsic value

2010

P30

2011

32

2012

36

P35

2013

42

40

2014

46

Questions:

Based on the above and the result of the audit, determine the following:

1. Compensation expense in 2011

a. P189,467

c. P196,400

b. P117,840

d. P

0

2. Compensation expense in 2012

a. P247,600

b. P232,560

c. P230,533

d. P

0

3. Compensation expense in 2013

a. P 58,000

b. P160,000

c. P157,600

d. P

0

4. Compensation expense in 2014

a. P322,000

b. P 86,800

c. P 28,000

d. P

0

Answers: 1) B; 2) C; 3) A; 4) A; 5) C

Suggested solutions:

Question No. 1

Compensation expense in 2010

(162 employees x 100 SARs x P30 x 1/3)

P162,000

For cash settled share based-payment transactions, the entity shall measure the goods or services

acquired and the liability incurred at the fair value of the liability. Until the liability is settled, the

entity shall remeasure the fair value of the liability at each reporting date and at the date of

settlement, with any changes in fair value recognized in profit or loss for the period. (PFRS 2 par.

30)

Question No. 2

Liability on SARs, 12/31/11

(168 employees x 100 SARs x 32x 2/3)

Less: compensation expense in 2010

Compensation expense in 2011

Question No. 3

Liability on SARs, 12/31/12

(110 employees x 100 SARs x 36)

Less liability on SARs, 12/31/11

Increase in liability

SARs exercised (60 employees x 100 SARs X P35)

Compensation expense in 2012

Question No. 4

Liability on SARs, 12/31/13

(7 employees x 100 SARs x 42)

Less liability on SARs, 12/31/12

Decrease in liability

SARs exercised (100 employees x 100 SARs X P40)

Compensation expense in 2013

Question No. 5

Liability on SARs, 12/31/14

Less liability on SARs, 12/31/13

Decrease in liability

SARs exercised (70 employees x 100 SARs X P46)

Compensation expense in 2014

P358,400

162,000

P196,400

P396,000

358,400

37,600

210,000

247,600

P294,000

396,000

(102,000)

160,000

58,000

P

0

294,000

(294,000)

322,000

28,000

PROBLEM NO. 19-Share options with cash alternatives

An entity grants to an employee the right to choose either 5,000 phantom shares, ie a right to a

cash payment equal to the value of 5,000 shares or 6,000 shares. The grant is conditional upon

the completion of three years’ service. If the employee chooses the share alternative, the shares

must be held for three years after vesting date.

A grant date, the entity’s share price is P81 per share. At the end of years 1, 2 and 3, the share

price is P82, P85 and P90 respectively. The entity does not expect to pay dividends in the next

three years. After taking into account the effects of the post-vesting transfer restrictions, the

entity estimates that the grant date fair value of the share alternative is P78 per share.

Questions:

Based on the above and the result of the audit, determine the following:

1. Compensation expense in year 1

a. P156,000

c. P157,667

b. P136,667

d. P

0

2. Compensation expense in year 2

a. P156,000

b. P167,666

c. P146,666

d. P

0

2. Compensation expense in year 3

a. P156,000

b. P167,666

c. P187,667

d. P

0

Answers: 1) C; 2) B; 3) C;

Suggested solutions:

Question No. 1

Liability component (P5,000 x P82 x 1/3)

Equity component (63,000/3)

Compensation expense in year 1

P136,667

21,000

P157,667

Computation of equity component:

Fair value of equity alternative (6,000 shares x P78)

Fair value of cashalternative (5,000 shares x P81)

Fair value of equity component

P468,000

405,000

P 63,000

For share-based payment transactions in which the terms of arrangement provide either the entity

or the counterparty with the choice of whether the entity settles the transactions in cash (or other

assets) by issuing equity instruments, the entity shall account for the share-based payment

transaction of, and to the extent that, the entity has incurred a liability to settle in cash or other

assets, or as an equity settle share-based payment transaction if, and to the extent that, such a

liability has been incurred.

If an entity has granted the counterparty the right to choose whether a share-based payment

transaction is settled in cash or by issuing equity instruments, the entity has granted a compound

financial instrument, which includes a debt component (ie the counterparty’s right to demand

payment in cash) and an equity component (ie the counterparty’s right to demand settlement in

equity instruments rather than in cash).( PFRS 2 par. 35)

The entity shall account separately for the goods or services received or acquired in respect of

each component of the compound financial instrument. For the debt component, the entity shall

recognize the goods or services acquired, and a liability to pay for those goods or services, as the

counterparty supplies goods or renders service, in accordance with the requirements applying to

cash-settled share-based payment transactions. For the equity component, the entity shall

recognize the goods or services received, and an increase in equity, as the counterparty supplies

goods or render service, in accordance with the requirements applying to equity-settled sharebased payment transactions. (PFRS 2 par. 38)

Question No. 2

Cumulative liability component end of year 2

(P5,000 x P85 x 2/3)

Less: Cumulative liability component end of year 1

Expense liability

Equity component (63,000/3)

Compensation expense in year 2

Question No. 3

Cumulative liability component end of year 3

(P5,000 x P90)

Less cumulative liability component end of year 2

Expense-liability

Equity component (P63,000/3)

Compensation expense in year 3

P283,333

136,667

146,666

21,000

P167,666

P450,000

283,333

P166,667

21,000

P187,667

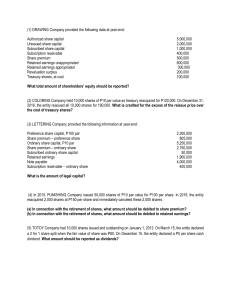

PROBLEM NO. 20 –Substantive audit procedures for equity

Select the best answer for each of the following:

1. All share capital transaction should ultimately be traced to the

a. Numbered stock certificates

b. Minutes of the Board of Directors.

c. Cash receipts journal

d. Cash disbursement journal

2. Which of the following information is most important when auditing shareholders’

equity?

a. Entries in the share capital account can be traced to a resolution in the minutes of the

board of directors’ meetings.

b. Share dividends and/or share splits during the year were approved by the

shareholders.

c. Share dividends are capitalized at par or stated value on the dividend declaration date.

d. Changes in the share capital account are verified by an independent stock transfer

agent.

3. When a corporate client maintains its own stock records, the auditor primarily will rely

upon

a. Confirmation with the company secretary of shares outstanding at year end.

b. Review of the corporate minutes for data as to shares outstanding,

c. Confirmation of the number of shares outstanding at year end with the appropriate state

official.

d. Inspection of the stock book at year end and accounting for all certificate numbers.

4. When a client company does not maintain its own stock records, the auditor most likely

will

a. Obtain written confirmation from the transfer agent and registrar concerning the number

of shares issued and outstanding.

b. Inspect the stock book at year end and accounting for all certificate numbers.

c. Review of the corporate minutes for information as to shares outstanding.

d. Confirmation the number of shares outstanding at year end with the appropriate state

official.

5. The primary responsibility of a bank acting as registrar of capital stock is to

a. Verify that stock issued in accordance with the authorization of the board of directors and

the articles of incorporation.

b. Act as an independent third party between the board of directors and outside investors

concerning mergers, acquisitions and the sale of treasury stock.

c. Ascertain that dividends declared do not exceed the statutory amount allowable in the

state of incorporation.

d. Account for stock certificates by comparing the total shares outstanding to the total in

shareholders’ subsidiary ledger.

6.

a.

b.

c.

The CPA’s examination normally need not include

Determining that dividend declaration is in compliance with debt agreements

Tracing the authorization for the dividends from the directors’ meetings

Testing the propriety of the payment list to the capital stock records.

7. The board of directors of Mega Supermarkets declared a 20% cash dividend at its

meeting on March 12, 2010 payable on May 15, 2010 to shareholders on record as of

April 15, 2010. The dividend declaration should be taken up in the company’s financial

statements on

a. March 12, 2010

c. December 31, 2010

b. May 15, 2010

d. April 15, 2010

8. An auditor usually obtains evidence of shareholders equity transactions by reviewing the

entity’s

a. Cancelled stock certificates

b. Transfers agent’s records

c. Treasury stock certificate book

d. Minutes of board of directors meetings

9. In audit of a medium sized manufacturing concern, which one of the following areas can

be expected to require the least amount of audit time?

a. Revenue

c. Liabilities

b. Owner’s equity

d. Assets

10. During an audit of an entity’s shareholder’s equity accounts, the auditor determines

whether there are restrictions on retained earnings resulting from loans, agreements, or

law. This audit procedure most likely is intended to verify management’s assertion of,

a. Completeness

c. Presentation and disclosure

b. Existence

d. Valuation

Answers:

1. A

2. A

3. D

4. A

5. A

6. D

7. A

8. D

9. B

10. C