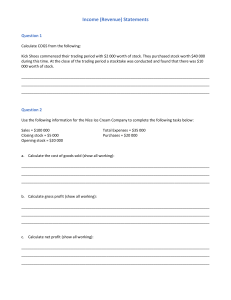

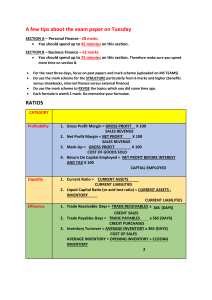

1 Incomplete Records Everything that you need to know name…………………………………… 2023-2024 KUNBURUDHOO SCHOOL A. DH Kunburudhoo 2 Incomplete records formula’s Calculating profit by means of capital: First you may need to find the capital balances (opening and closing) using statement of affairs that is by finding total assets and liabilities for beginning of the year and the total assets – total liabilities will give you capital balance. example: see walkthrough 17.1 from page 243-245 formula of finding profit using the capital: Closing capital – Opening capital + Drawings – Capital introduced = Profit format of finding profit using the capital account: Date Details $ Drawings (if took cash or bank write that, if taken to buy an equipment write purchases) Balance c/d Date Details $ xxxx Opening balance xxxx xxxx Capital introduced (write equipment name if it was introduced by purchasing equipment on owners own money) otherwise cash or bank xxxx format of finding profit using the capital by statement: Details $ $ Opening capital xxxx Less: closing capital (xxxx) xxx Add: drawings: cash : purchases xxxx xxxx xxxx xxxxx Less: capital introduced xxxx Profit for the year xxxxx Check guys: 1 Manan is a trader. The following information is provided: Capital 1 January 20–5 $40 000, capital 31 December 20–6 $50 000, profit for the year $8 500, capital introduced during the year $5 000. Calculate, by means of a capital account, Manan’s drawings for the year. 3 Calculating profit by means of calculating capital, revenue and purchases, closing bank balance: Even when a business has not maintained the double entry records it is sometimes able to provide information in addition to details of the assets and liabilities. If details of money received and paid are available, it is possible to calculate the sales, purchases and expenses. This means that, after various calculations, a set of financial statements can be prepared. example: see walkthrough 17.1 from page 247-252 Revenue calculation: Credit sales + cash sales = total revenue (if there are no cash sales the total sales are equal to the credit sales calculated) Finding credit sales: receipts from credit customers – opening trade receivables + closing trade receivables. Alternatively, the credit sales can be calculated by inserting a ‘missing figure’ in a total trade receivables account: Purchases calculation: Credit purchases + cash purchases = total purchases (if there are no cash purchases the total purchases are equal to the credit purchases calculated) Finding credit purchases: Payments to credit suppliers – opening trade payables + closing trade payables. Alternatively, the credit purchases can be calculated by inserting a ‘missing figure’ in a total trade payables account: Closing bank balance: Using the information from receipts and payments. Finding closing bank balance: Bank account Date Details $ Opening balance xxxx Date Details $ Total payment xxxx Total receipts Then find the balance c/d which will be closing bank balance AFTER FINDING SALES AND PURCHASES AND CLOSING BANK BALANCE THEN YOU CAN DO A NORMAL FINANCIAL STATEMENTS FROM THE INFORMATION YOU MAY NEED TO ADJUST ADDITIONAL INFORMATION. 4 Calculating profit by means of calculating Mark-up, margin and inventory turnover: When dealing with incomplete records, it is sometimes necessary to use percentages to calculate missing information. These both measure the gross profit as a percentage. The mark-up is the gross profit measured as a percentage of the cost price. The margin is the gross profit measured as a percentage of selling price. example: see walkthrough 17.1 from page 254-256 MARK-UP AND MARGING PERCENTAGE: Mark - up: The mark-up = Gross profit divided by Cost of sales ×100 divided by 1 Margin: The margin= Gross profit divided by Sales ×100 divided by 1 FINDING PROFIT USING MARK-UP AND MARGING PERCENT Mark - up: REVENUE × MARK UP % = GROSSPROFIT To find gross profit from markup add 100% to given markup% and divide original markup with added markup then multiply with revenue. To find cost of sales add 100% to given markup% and divide 100 with added markup then multiply with revenue. You can find cost of sales by finding the difference. The missing figure can be calculated by working ‘backwards’ from the cost of sales. The cost of sales plus the opening inventory the answer less the opening inventory equals the missing figure. Margin: REVENUE × MARGIN % = GROSSPROFIT To find cost of sales minus 100 with given margin then use the answer % multiply with revenue. Or You can find cost of sales by finding the difference The missing figure can be calculated by working ‘backwards’ from the cost of sales. The cost of sales plus the opening inventory the answer less the opening inventory equals the missing figure. To find gross profit from margin deduct 100% to given margin% and divide original markup with added markup then multiply with revenue. 5 RATE OF INVENTORY TURNOVER: It is sometimes necessary to use calculations relating to the rate of inventory turnover in order to calculate an unknown figure in the trading account section of an income statement. The rate of inventory turnover is the number of times a business replaces its inventory in a given period of time. The formula for calculating the rate of inventory turnover is: Cost of sales DIVIDED BY Average inventory Average inventory = Opening inventory + Closing inventory DIVIDED BY 2