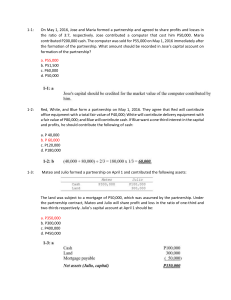

1-1: On May 1, 2016, Jose and Maria formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Jose contributed a computer that cost him P50,000. Maria contributed P200,000 cash. The computer was sold for P55,000 on May 1, 2016 immediately after the formation of the partnership. What amount should be recorded in Jose’s capital account on formation of the partnership? a. P55,000 b. P51,500 c. P60,000 d. P50,000 1-2: Red, White, and Blue form a partnership on May 1, 2016. They agree that Red will contribute office equipment with a total fair value of P40,000; White will contribute delivery equipment with a fair value of P80,000; and Blue will contribute cash. If Blue want a one third interest in the capital and profits, he should contribute the following of cash: a. P 40,000 b. P 60,000 c. P120,000 d. P180,000 1-3: Mateo and Julio formed a partnership on April 1 and contributed the following assets: The land was subject to a mortgage of P50,000, which was assumed by the partnership. Under the partnership contract, Mateo and Julio will share profit and loss in the ratio of one-third and two-thirds respectively. Julio’s capital account at April 1 should be: a. P350,000 b. P300,000 c. P400,000 d. P450,000 1-4: Elsa and Perla form a new partnership. Elsa invests P300,000 in cash for her 60 percent interest in the capital and profits of the business. Perla contributes land that has an original cost of P40,000 and a fair market value of P70,000, and a building that has a tax basis of P50,000 and a fair market value of P90,000. The building is subject to a P40,000 mortgage that the partnership will assume. What amount of cash should Perla contribute? a. P 40,000 b. P 80,000 c. P110,000 d. P150,000 1-5: Anton and Bauzon formed a partnership and agreed to divide initial capital equally, even though Anton contributed P100,000 and Bauzon contributed P84,000 in identifiable assets. Under the bonus method, to adjust the capital accounts, Bauzon’s intangible assets should be debited for: a. P46,000 b. P16,000 c. P 8,000 d. Zero 1-6: Reyes and Santos drafted a partnership agreement that lists the following assets contributed at the partnership formation: The building is subject to a mortgage of P100,000, which the partnership has assumed. The partnership agreement also specifies the profits and losses are to be distributed evenly. What amounts should be recorded as capital for Reyes and Santos at the formation of the partnership? Reyes a. P350,000 b. P350,000 Santos P850,000 P750,000 c. P550,000 d. P600,000 2-9: P550,000 P600,000 LT and AM have capital account balances at the beginning of the year of P40,000 and P45.000, respectively. They share net income and losses as follows: 1. 8 percent interest on beginning capital balances 2. salary allowance of P15,000 to LT and P7,500 to AM 3. remainder in 3:2 ratio The partnership reported net income of P10,000 for the year, before interest and salary allowances to partners. What are the profit share of LT and AM, respectively? a. P6,620 and P3,380 b. P6,630, and P3,380 c. P6,500, and P3,500 d. P6,000, and P4,000 2-10: Peter and Paul formed a partnership on January 2, 2016; and agreed to share net income and losses 90 percent and 10 percent, respectively. Peter invested cash of P250,000. Paul invested no assets but had a specialized expertise and managed the firm full time. The Partnership contract provided for the following: 1. Partners’ capital accounts are to be credited annually with interest at 5 percent of beginning capital account balances. 2. Paul is to be paid a salary of P10,000 a month. 3. Paul is to receive a bonus of 20 percent of income before deduction of salary, bonus and interest on partners’ capital account balances. 4. Bonus, interest, and Paul salary are considered expenses. The statement of comprehensive income for the year ended 2016 for the partnership includes the following: What is Paul’s bonus for 2016? a. P120,000 b. P150,000 c. P130,000 d. P93,750 2-11: CC, DD, and EE, doctors, agree to form a partnership and to share profits in the ratio 5:3:2. They also agreed that EE is to be allowed a salary of Pl4,000, and that DD is to be guaranteed P 10,500 as his share of the profits. During the first year of operation, income from fees are P90,000, while expenses total P48,000. What amount of net income should be credited to each partners’ capital account? CC a. P14,000 b. P12,500 c. P12,000 d. P12,500 2-12: DD P8,400 P10,500 P11,000 P10,500 EE P5,600 P19,000 P19,000 P19,500 LL, MM, PP are partners with capitals of P40,000, P25,000, and P15,000 respectively. The partnership agreement provides that each partner shall be allowed 5 percent interest on their capital, that LL shall be allowed an annual salary of P8,500, and that MM shall be entitled to a minimum of P14,000 per annum including amounts allowed as interest on capital and as share of profit. Profit after interest and salary allowances is to be divided between LL, MM, and PP 5:3:2 respectively. What amount must be earned by the partnership during 2016 before charges for interest or salary if LL is to receive an aggregate of P20,000 to include interest, salary, and share of profit? a. b. c. d. P38,000 P50,000 P38,550 P35,880 PP