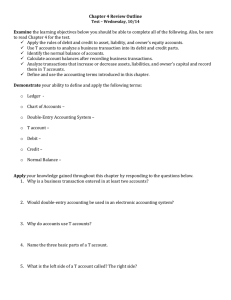

So yung five major accounts: - ASSET LIABILITY EQUITY EXPENSES INCOME So lahat ng transaction na nirerecord ang ginagamit eh yung DOUBLE ENTRY SYSTEM, ang ibig sabihin lang nito kung may debit dapat may equivalent amount sa credit and vise versa DEBIT – eto yung narereceive mo CREDIIT – eto naman yung binibigay mo So pagdating sa NORMAL BALANCE ng mga accounts: DEBIT CREDIT - ASSET EXPENSES LIABILITY EQUITY INCOME Rules of DEBITS and CREDITS - To debit an account with a normal debit balance means to increase that account. To credit it means to decrease it So for example, sa business may nagbayad sayo na customer so since nag increase yung asset mo IDEDEBIT mo siya ngayon pero kapag ikaw naman yung nagbayad since nabawasan/nag decrease yung asset mo ICCREDIT mo siya ngayon - To credit an account with a normal credit balance means to increase that account. To debit it means to decrease it Example naman dito, umutang ka sa banko ngayon so since nadagdagan utang mo tsaka yung LIABILITY eh may normal balance na CREDIT kapag nirecord mo siya ngayon mapupunta siya sa CREDIT SIDE, kapag naman nabayaran na yung utang (nabawasan na) mapupunta siya ngayon sa DEBIT SIDE JOURNALIZING Sa pag journalize naman, kailangan mo kasi munang i-analyze yung transaction kasi hindi lahat kailangang irecord example nun eh yung mga non-accountable events. Dec 1 Millan invested P200,000 in the firm. Date Description Post Ref. Debit Dec 1 Cash 200,000 Millan, Capital Yung mga accounts na affected: CASH (asset), MILLAN CAPITAL, (equity) Nag increase yung asset so debit side Nag increase din yung equity so credit side Credit 200,000 Dec 2 Paid rent covering 2 months (December to January) to Recoletos Realty, P8,000. Date Description Post Ref. Debit Credit Prepaid Rent Dec 2 8000 Cash 8000 Dito naman, since advance payment, irerecord mo siya as Prepaid Rent (sakan siya marerecord na RENT EXPENSE kapag na incurred na); asset is increased through debit Naglabas ka ng pera (nabawasan asset mo); asset is decreased through credit Dec 2 Purchased supplies on account, P7,200. Date Description Post Ref. Supplies Dec 2 Accounts Payable Accounts affected: supplies (asset), a/p (liability) Supplies is increased (DEBIT) and a/p is increased (CREDIT) Debit 7,200 Credit 7,200 Dec. 3 Surveyed xerox machine with price not exceeding P60,000 Non accountable events so no need irecord Dec 5 Acquired 3 desktop sets, P75,000 paying P37,000 down with the balance due in 30 days Date Description Post Ref. Debit Credit Equipment Dec 5 75,000 Cash 37,000 Accounts Payble 38,000 Accounts affected: equipment (asset), cash (asset), a/p (liability) Nag acquire ka ng equipment so nadagdagan asset mo; nag partial payment ka rin so nabawasan asset mo; may natira pa so nadagdagan yung a/p mo Asset in increased through debit and decreased through credit; liability is increased through credit Dec 8 Paid P7,200 on account for supplies purchased. Date Description Post Ref. Debit Credit Accounts Payable Dec 8 7,200 Cash 7,200 Accounts affected: a/p (liability), cash (asset) And since nagsettle ka ng payment; liability is decreased through debit and asset is decreased through credit Dec 10 Performed tax consultation services on account, P30,000. Date Description Post Ref. Debit Account Receivable Dec 10 30,000 Service Revenue Accounts affected: a/r (asset), service revenue (income) Asset is increased through debit and income is increased through credit Dec 14 Performed consulting services for cash, P20,000. Date Description Post Ref. Debit Cash Dec 14 20,000 Service Revenue Affected accounts: cash (asset), income (service revenue) Asset is increased through debit and income is increased through credit Dec. 15 Paid assistant's salaries for two weeks, P6,000. Date Description Post Ref. Debit Salaries Expense Dec 2 6,000 Cash Accounts affected: salaries expense (expense), cash (asset) Expense is increased through debit and asset is decreased through credit Dec 17 Hired a part-time assistant, with agreed salary of P3,500 per month. NON-ACCOUNTABLE EVENTS Dec 18 Collected P5,000 cash from services performed on December 10 Date Description Post Ref. Cash Dec 18 Account Receivable Accounts affected: cash (asset), a/r (asset) Asset is increased through debit and is decreased through credit Debit 5,000 Dec 25 Millan received electricity bill, P2,500 Date Description Post Ref. Debit Utilities Expense Dec 25 2,500 Utilities Payable Accounts affected: utilities expense (expense), utilities payable (liability) Expense is increased through debit and liability is increased through credit Credit 30,000 Credit 20,000 Credit 6,000 Credit 5,000 Credit 2,500 Dec 31 Millan withdrew P12,000 from the business. Date Description Post Ref. Debit Credit Dec 31 Millan, withdrawal 12,000 Cash 12,000 Accounts affected: millan withdrawal (equity), cash (asset) Millan drawing (equity) is increased through debit and asset is decreased through credit Sa drawing/withdrawal kaya ang normal balance niya ay debit kasi consider siya as contra account ng equity.