Risk-Management-Involvement- Provide a methodology to identify and analyze the financial impact of loss to the organization, employees, the public, and the environment.

advertisement

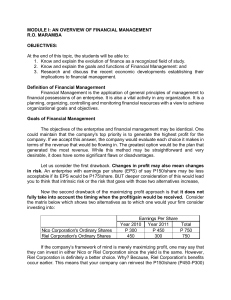

Chief Financial Officer (CFO), supervises all financial functions and sets overall financial strategy. Basically, CFO is a senior executive, one of the highest financial position, who is responsible for managing the financial actions of the company and it includes financial planning, management of financial risk and analyzing the company's financial strengths and weaknesses and proposing corrective actions. The CFO plays a vital role in the company as he is the one who directs the company’s financial goals, objectives and budget. The chief financial officer is a member of the C-suite, a term used to describe the most important executives in a company together with CEO, COO, and CIO. Shareholders desire wealth maximization. Shareholders are individuals who own shares of stock of the company and basically they are the owners of the corporation. Thus, they are the one who have potential to gain profit if the company is doing well or they can also be at risk if the company is having a loss. In nature, the shareholders prioritize maximizing the wealth of the company because they will be the one who can benefits of it. Wealth maximization of the company which is gaining more profit, in such case it will also increase the dividends paid out to each common stock of the shareholders