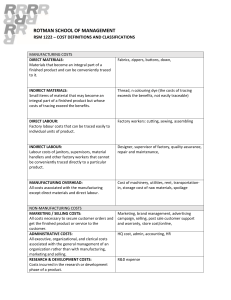

Lecture 6 Manufacturing Cost Statements Learning outcomes At the end of this learning unit, a student should: Be able to distinguish between the three cost components for the manufacturing of finished goods: • Materials • Labour • Manufacturing Be able to explain the physical flow of materials during the manufacturing process and the recognition thereof. Be able to do the accounting entries for a manufacturing entity. Be able to compile a manufacturing cost statement. Introduction • The unit on IAS 2, Inventories explained the definition, recognition and measurement and disclosure of inventory. • The latter referred to the purchase of finished goods with the purpose of selling them at a higher price. • In the case of a manufacturing entity the components of raw materials and consumable materials are purchased and processed to make a finished product. Introduction • In contradistinction to a trading entity (where the cost of purchase was available from the suppliers invoice), the objective of a manufacturing entity is to ensure accurate cost allocations to determine the cost to manufacture an item. • If the cost allocations are not done correctly, this will result in incorrect cost of sales and closing inventory amounts. Paragraph 10.11 of the prescribed textbook Materials • Materials (raw materials) is one of the primary components of manufacturing cost. • Please note that ‘raw materials’ are for the purpose of this lecture, materials or substances used in the primary production or manufacturing of goods. • Materials that are an essential part of the manufactured product are referred to as direct materials. Materials • Other materials, usually with a low value that cannot be identified in the final product are know as indirect materials and forms part of manufacturing overheads. • If the entity is registered for Value Added Tax (VAT), VAT must be excluded from the purchase price by multiplying the purchase price with 100/115. • The fraction of 100/115 is applied when the consideration includes VAT. Labour • Direct labour is the other component of primary manufacturing costs. • Direct labour is the labour performed by the workers in the factory who are actively involved in the manufacture of the product. • Indirect labour does relate to the actual manufacturing activities but forms part of the factory overheads.(for example wages of cleaners, security guards, supervisors et cetera.) Labour • Costs of direct labour that is directly involved in the manufacturing process, changes in relation to the quantities manufactured. • Indirect labour is not directly involved in the production process and therefore changes in quantities produced do not result in any change in indirect labour cost. Manufacturing overheads • Manufacturing overheads do not form part of primary costs. • Examples are rent of the factory, depreciation on machinery and tools in the factory, maintenance of factory machinery et cetera. Manufacturing overheads • A cost item must be associated with the manufacturing process before it can be included in overheads. Administration costs, the salary of the managing director, rent of offices, depreciation on office furniture, salaries of sales personnel et cetera do not form part of manufacturing overheads. • If the entity is registered for Value Added Tax (VAT), VAT can be claimed on certain overheads and VAT must be excluded from qualifying expenses. The physical flow of materials during the manufacturing process and the recognition thereof • When raw materials are received, they are packed in the material warehouse and debited to the raw materials account in the ledger. • Upon receipt of a requisition from the factory, materials are issued to the factory and the ‘work in progress account’ is debited, while the raw materials account is credited. • Finished goods are transferred to the storeroom. The physical flow of materials during the manufacturing process and the recognition thereof • The accounting entry for the latter is that the ‘work in progress account’ will be credited and the finished goods account will be debited with the cost of the finished goods manufactured. • Inventory accounts thus exists for the following and is disclosed (including the value of each item) as such in the notes to the financial statements; • Raw materials • Work in progress • Finished goods • For control purposes, inventory is recognised according to the perpetual inventory system. The following questions serves as exercises: Sparky Limited (Question 1 Page 115 of the Study Guide) HD Manufacturers Limited (Class Exercise 5 Page 106 of the Study Guide) Gasco Manufacturers Limited (Question 4 Page 122 of the Study Guide) Alpha Limited (Question 5 Page 134 of the Study Guide) Smoothies Limited (Question 7 Page 139 of the Study Guide)