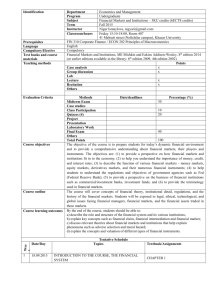

8. Non-bank financial institutions This sector includes the following categories of non-bank financial institutions as mentioned in (Appendix IV). i) Development financial institutions ii) Investment banks iii) Leasing companies iv) Modaraba companies v) Discount & guarantee houses vi) Housing finance corporations/ companies vii) Venture capital companies 2. Except National investment trust, House building finance corporation, Investment Corporation of Pakistan. and Equity participation fund whose accounts are on a financial year basis, all other development institutions keep their accounts on a calendar year basis. Accounts kept on a calendar year basis were, therefore, assumed to represent transactions during the corresponding financial year. For example, accounts ending as on 31 December 2000 were assumed to be as of 30 June 2001. 3. Information was derived from the published annual reports and accounts, which were consolidated to arrive at the aggregate balance sheet for the sector as per Table 8.1. 4. Movements in liabilities and assets were calculated to compile the financial flows accounts as per Table 8.2. Where deficient information prevented adequate transaction/ sectoral classification, the same was done on fragmentary evidence and, at times, reference to unpublished records. Where sector classification of investment in bonds and debentures was not possible the same has been allocated to private corporate business sector. The capital account of NIT comprises principal and increase/ decrease in value of investments. Changes in principal only have been included under stocks and shares (item D-6c) while the valuation change has been lumped with miscellaneous sources (item D-11). 5. On the uses side investments in shares have been adjusted by taking out the aforementioned valuation change and including the same with miscellaneous uses (item D-11). Unspecified investments have been assumed to be in the shares of private corporate business (item D6e). Loans and advances other than those extended to public enterprises (non-financial ) and Non-Corporate and Households sectors have been attributed to private corporate business sector (item D-7c) while various items of the aggregate balance sheet (Table 8.1) include inter-institution transactions, the same have been segregated and lumped with miscellaneous financial sources or uses, as the case may be, (item D-11). 43 8.1 AGREGATE BALANCE SHEET NON-BANK FINANCIAL INSTITUTIONS (Million Rupees) 1999-2000 2000-01 2001-02 2002-03 Fixed assets 14,451 8,783 8,002 8,993 Cash & deposits 37,755 30,753 16,337 15,168 Federal Government securities 12,606 13,857 16,634 22,287 Other bonds & debentures/PTC's 12,822 18,192 8,001 11,783 584 3,197 4,486 3,554 43,280 38,064 43,200 66,705 120,479 101,909 75,571 70,186 19,869 24,823 13,110 16,804 261,846 239,578 185,341 215,480 (3,895) 14,979 33,277 58,676 5,988 2,297 2,192 2,752 95,387 93,855 50,711 41,415 2,611 3,091 3,494 7,166 Stocks & shares 50,445 25,107 25,866 26,733 Provident Fund 38 38 - - Loans & advances 89,923 80,004 52,999 57,956 Other liabilities 21,349 20,207 16,802 20,782 Assets Treasury bills Stocks & shares Loans & advances Other assets Liabilities Reserves Depreciation Deposits Bonds & debentures 44 8.2 FLOW OF FUNDS ACCOUNTS NON-BANK FINANCIAL INSTITUTIONS ITEMS 2000-01 U (5,768) (5,668) (5,668) (100) R A. GROSS SAVINGS 15,183 1. Capital Consumption (3,691) 2. Net Savings 18,874 B. GROSS CAPITAL FORMATION 1. Gross Fixed Capital Formation a) Land & Building b) Plant &Machinery c) Others 2. Change in Inventories C. NET LENDING(-)/BORROWING(-)(A-B) 20,951 D. FINANCIAL RESOURCES /USES 1. Currency State Bank of Pakistan (13) 2. Deposits a) State Bank of Pakistan 670 b) Sch. & Coop. Banks (5,348) c) Non-Bank Financial Institutions (2,748) d) Rest of The World (1) 3. Bonds and Debentures a) Federal Government 1,251 b) Public Enterprises (Non-Finanical) (73) c) Sch. & Coop. Banks 327 d) Non-Bank Financial Institutions (239) e) Private Corporate Business 5,287 4. Treasury Bills Federal Government 2,613 5. Small Savings Federal Government 6. Stocks and Shares a) Public Enterprises (Non-Finanical) 4,237 b) Sch. & Coop. Banks 1,620 c) Non-Bank Financial Institutions (25,363) d) Insurance (79) e) Private Corporate Business (7,311) f) Rest of The World 7. Loans & Advances a) Public Enterprises (Non-Finanical) 568 b) Non-Bank Financial Institutions (5,826) c) Private Corporate Business (24,330) d) Non-Corporate & Households 4,109 8. Life Fund 9. Provident Fund Non-Bank Financial Institutions 10. Other Foreign Claims (3,275) (27) 11. Miscellaneous E. TOTAL FINANCIAL RESOURCES/USES (37,451) (16,500) F. FINANCIAL SURPLUS(+)/DEFICIT(-)(U-R) 20,951 G. STATISTICAL DISCREPANCY ( C - F ) 0 Note: 1.'R' stands for Resources and 'U' for Uses 2. The figures in brackets indicate negative amounts 3. Items with nil or negligible figures have been suppressed R 18,193 (105) 18,298 18,973 2001-02 U (780) (781) (781) 1 (Million Rupees) 2002-03 R U 25,959 560 25,399 1,019 991 991 28 24,940 - 17 - (25) (42,861) - (2,487) (11,442) - (9,689) - (1,453) 460 - 121 - 2,777 (600) (240) 5,653 67 324 (9,394) 3,365 - - 1,289 - (932) - - - - 770 - 1,622 1,326 12 3,131 - 1,131 - 490 3,164 187 18,659 - (11,226) - 440 (6,045) (24,459) - 4,366 - 148 (8,622) (2,336) - 5,007 4,180 10,129 29,120 (38) (19,196) (72,430) (9,404) (53,457) 18,973 0 3,207 24,940 0 45

![THE COMPANIES ORDINANCE, 1984 [Section 82]](http://s2.studylib.net/store/data/015174202_1-c77c36ae791dae9b4c11c6213c9c75e5-300x300.png)