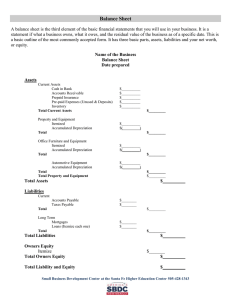

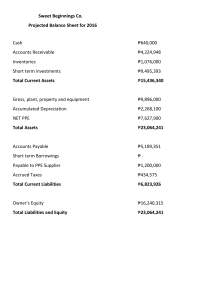

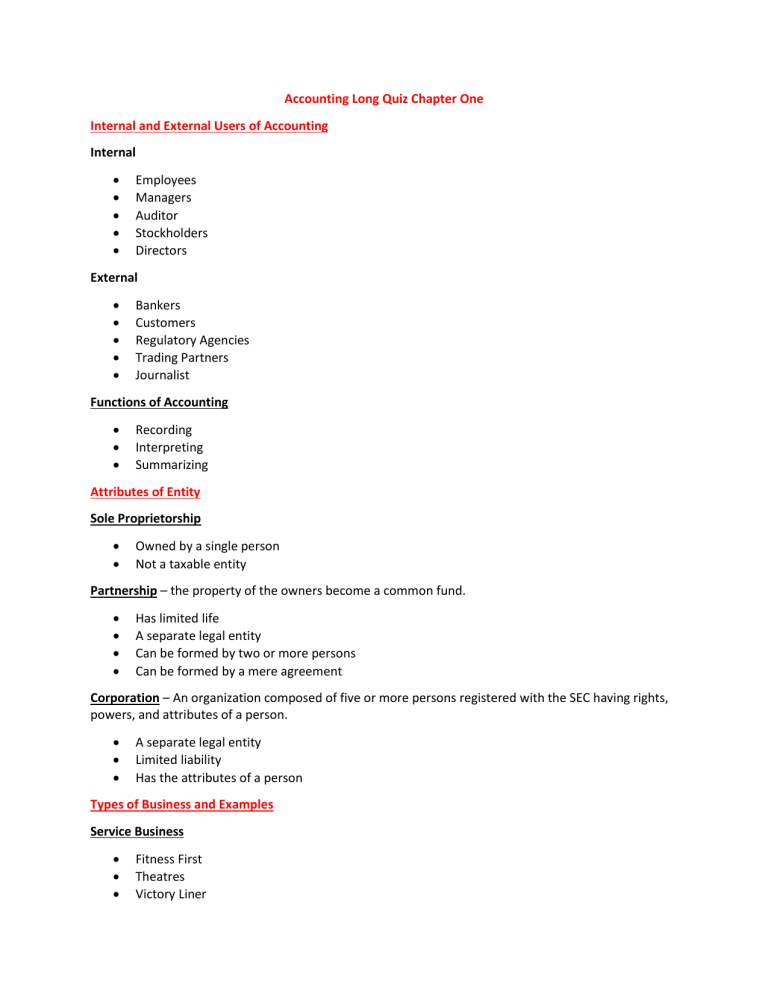

Accounting Long Quiz Chapter One Internal and External Users of Accounting Internal Employees Managers Auditor Stockholders Directors External Bankers Customers Regulatory Agencies Trading Partners Journalist Functions of Accounting Recording Interpreting Summarizing Attributes of Entity Sole Proprietorship Owned by a single person Not a taxable entity Partnership – the property of the owners become a common fund. Has limited life A separate legal entity Can be formed by two or more persons Can be formed by a mere agreement Corporation – An organization composed of five or more persons registered with the SEC having rights, powers, and attributes of a person. A separate legal entity Limited liability Has the attributes of a person Types of Business and Examples Service Business Fitness First Theatres Victory Liner Cut Salon Tony and Jacky Jollibee Resort Hotel Merchandising Business – engaged in buying and selling goods. SM Supermarket Market Vendors Sari-Sari Stores Villman Computes Ideal Vision Manufacturing Business Goldilocks Rebisco Company Sterling Paper Group of Companies In bookkeeping, transactions or events are recorded chronologically. The real objective of the financial statements is to help the users make decision. People engage in business for profit. Accountants employed in business organization as chief accountant, accounting clerk, or controller are to be engaged in financial accounting. Investors are interested in the financial statements to know the rate of return of their money. The usual accounting period is 12 months. A business can be classified as a field of endeavor. A calendar period is a period of 12 months. A fiscal period is a period of 12 months. Investors need financial information to enable them to evaluate the ability of the business to pay dividends. Financial statements are made within fiscal and/or calendar period. In the business entity concept, the money of the business is treated as the money of the business. A. Creditors are interested in the financial statements because they will earn dividends. B. Income of a service business is derived from getting commissions. Answer: Both statements are false. Accounting Short Quiz: Financial Statements Accounts in Income Statement Professional fees Service Income Bad Debts Depreciation Expense SSS Premium Expense Repairs and Maintenance Utilities Expense Accounts in Balance Sheet Interest Receivable Alvarez, Drawing Accrued Interest Income Unearned Interest Income Prepaid Interest Accumulated Depreciation Mortgage Payable Unused Supplies Supplies Inventories Supplies on Hand Withholding Tax Payable Petty Cash Fund Allowance for Bad Debts Cash in Bank Accounts Payable Prepaid Insurance Unexpired Insurance Salaries Payable Land Accrued Taxes Expense SSS Premium Payable Unearned Rent Income Seatwork Chapter One What do you want to show the internal users? Answer: accurate information What language do you use to the government? Answer: Revenue Code What do you want to show the external users? Answer: high profit What language do you use for external users? Answer: GAAP What language do you use with internal users? Answer: What do you want to show the government Answer: Accounting Long Quiz Chapter Two Account form is the form of balance sheet when assets are listed on the left side and the liabilities and equity are on the right side. A loss in incurred when expenses are more than income. The balance sheet should be dated As of MM/DD/YYYY. Multi-step is a form of Income Statement showing different sections used by a merchandising business. Single step is a form of Income Statement where all expenses are deducted from total income. Owner’s drawing is deduction from the capital of the business. Accounting date flow from: Income Statement to the Owner’s Equity. Statement of Owner’s Equity to the Balance Sheet. Working Capital is defined as total current assets less current liabilities. Net book value is the difference between building less accumulated depreciation. The date of the Balance Sheet shows the position of the business for the period covered. The profit figure appears in all the following statements except the statement of cash flows. Equity means total assets less total liabilities.