IMBA-2018-IS-Research-on-Business-Strategy-of-7-Eleven-in-Thailand compressed

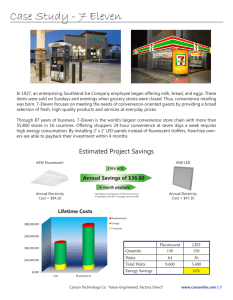

advertisement