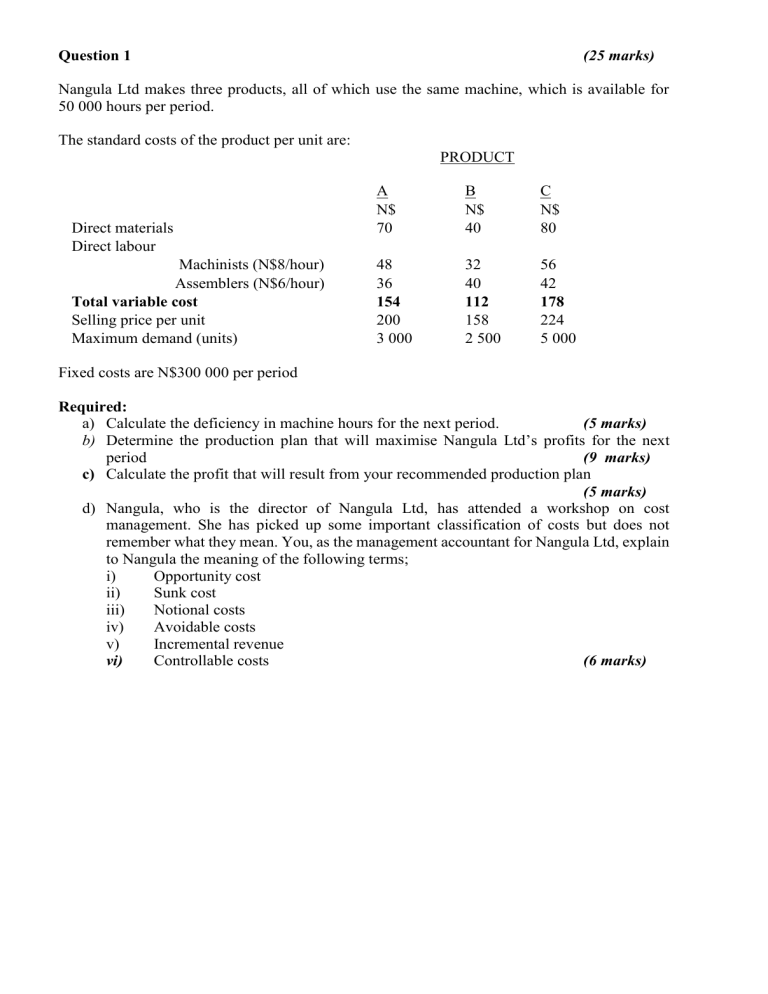

Question 1 (25 marks) Nangula Ltd makes three products, all of which use the same machine, which is available for 50 000 hours per period. The standard costs of the product per unit are: PRODUCT Direct materials Direct labour Machinists (N$8/hour) Assemblers (N$6/hour) Total variable cost Selling price per unit Maximum demand (units) A N$ 70 B N$ 40 C N$ 80 48 36 154 200 3 000 32 40 112 158 2 500 56 42 178 224 5 000 Fixed costs are N$300 000 per period Required: a) Calculate the deficiency in machine hours for the next period. (5 marks) b) Determine the production plan that will maximise Nangula Ltd’s profits for the next period (9 marks) c) Calculate the profit that will result from your recommended production plan (5 marks) d) Nangula, who is the director of Nangula Ltd, has attended a workshop on cost management. She has picked up some important classification of costs but does not remember what they mean. You, as the management accountant for Nangula Ltd, explain to Nangula the meaning of the following terms; i) Opportunity cost ii) Sunk cost iii) Notional costs iv) Avoidable costs v) Incremental revenue vi) Controllable costs (6 marks) Question 1 (Suggested solution) In part (b) remember to rank the products according to their contribution per machine hour. Then the available machine hours according to this ranking. Do not attempt to apportion the fixed costs to the individual products when you are calculating the profit in part (c). Simply deduct the total fixed costs from your calculated contribution. (a) Deficiency in machine hours fro next period: Product A Product B Product C Machine hours required per unit 48/8 = 6 32/8 = 4 56/8 = 7 Maximum demand (units) 3 000 2 500 5 000 Total machine hours to meet maximum demand 18 000 10 000 35 000 Machine hours available Deficiency in machine hours (1/2 mark for each correct entry on each product and 1/2 mark for the deficiency) Total 63 000 50 000 13 000 (b) Product A $ 200 (154) 46 Selling price per unit Variable costs per unit Contribution per unit Machine hours required per unit 6 Contribution per machine hour $7.67(1 mk) Order of production 2 (1 mk) Product B $ 158 (112) 46 Product C $ 224 (178) 46 4 $11.50(1 mk) 1 (1 mk) 7 $6.57(1 mk) 3(1 mk) Therefore, make M/C Hours 10 000(1 mk) 18 000(1 mk) 28 000 Machine hours left to make product C 22 000 50 000 Therefore the company should make 3 142 i.e (22 000/7) units of product C. (1 mk) 2 500 units of product B, using machine hours of (4 x 2 500) 3 000 units of product A, using machine hours of (6 x 3 000) (c) Profit for the next period: Total Contribution from recommended Production: $46 x 3000 $46 x 2 500 $46 X 3 142 Fixed Costs Profit for the period 397 532 (300 00)(1 mk) 97 532(1 mk) Product A $ Product B $ Product C $ $ 138 000 (1 mk) 115 000 (1 mk) ________ 138 000 ________ 115 000 144 532 (1) ________ 144 532 d) i) opportunity cost is the cost of the next best alternative forgone ii) Sunk costs are costs already incurred and cannot be reversed iii) Notional costs are hypothetical costs taken into account to represent a benefit enjoyed in respect for which no actual expense has been incurred iv) Avoidable costs are cost directly linked to an activity such that if that activity is cancelled then no costs will be incurred (v) Incremental revenue is additional revenue for selling the extra unit of a product (marginal revenue) vi) Controllable costs are costs that can be controlled by the division or department where they are being incurred (1 mark for each correct definition. Students may vary in their expression and any meaningful definition should be merited) QUESTION 2 (25 marks) Mr Sitapata is a chartered accountant who makes custom-built furniture as a hobby. Recently, a picture of one o f his hand-made lounge suites appeared in a popular fashion magazine, and ever since then, Mr Sitapata has been inundated with calls from prospective customers. One of the most interesting calls he has had, was from a well-known guest house in Windhoek, which has asked him to design and produce mini-lounge suites, consisting of a coffee table and two chairs, for each of their five guest rooms. The guest house is expecting a number of delegates from an upcoming NAMA wards to stay over, and therefore need the lounge suites in two months’ time. Mr Sitapata would like to take this opportunity to expand his customer base, as he wishes to retire soon, and would like to turn his hobby into a full-time business. He has consequently set out the following information which may be relevant to his decision: 1. Mr Sitapata will not be able to meet the two month deadline if he attempts to do all the work himself, and will therefore have to employ two craftsmen to assist him. The craftsmen will only be employed for the two months that it is expected to take in order to complete the five lounge suites. Each craftsman will earn a salary of N$1 500 per month, and will also be paid overtime at time-and-a-half, should it be required. Normal clock hours will consist of 8 hours per day, 5 days per week. There are nine full weeks in the next two months. 2. The craftsmen will also, on normal week days, be served breakfast and lunch at Mr Sitapata’s house, where the furniture will be produced. The cost of each meal has been set at N$12. 3. Mr Sitapata has asked his son, currently studying at the local university (IUM), to oversee the project. His son is willing to help, but he has indicated that he expects to be remunerated for his time. Mr Sitapata’s son will be able to spend two hours per day on the project, provided that Mr Sitapata pays the following: Petrol to and from his residence, estimated at N$150 for the first month with a 6% increase in the second month; Cost of reproducing notes for a class that Mr Sitapata’s son will be forced to miss as a result of his overseeing function, at N$15 per week; an overseer’s fee of N$500 per month, to replace the income Mr Sitapata’s son could potentially have earned as a waiter at a local restaurant during these two months. Mr Sitapata’s son is not prepared to work over weekends. 4. Mr Sitapata already has the upholstery required for the chairs in stock. Approximately 2 kg of upholstery will be required per chair. The upholstery was purchased at a discounted price of N$50 per kg for a previous project. The upholstery is used on all of the chairs Mr Sitapata produces, and Mr Sitapata fully intends to use the upholstery in future for his usual projects, should the guest house contract not be awarded to him. The current cost for the upholstery is N$60 per kg. Mr Sitapata could also sell the upholstery at N$25 per kg if it is not used again. 5. Mr Sitapata only uses rose wood for his tables and chairs. Due to the recent drought and rather extensive bush fires, the wood is hard to come by. Mr Sitapata will have to acquire the wood from a supplier in Katima Mulilo, who has the wood in stock and ready to send to Mr Sitapata by rail. Each chair makes use of 3 metres of wood and each table uses 5 metres. The wood is sold at N$24 per meter, and the total rail cost for all of the wood is N$1 500. It will take approximately two weeks for the wood to be transported from Katima Mulilo to Windhoek, during which time the craftsmen will work on the upholstery and trimming required for the chairs. 6. Mr Sitapata will need to rent a bakkie at a cost of N$400 for the day, in order to collect the wood from the railway station. He will, however, also use the bakkie on the same day to drive away refuse from his home to the municipal dump. This service is normally performed by a local old-age pensioner who charges N$80 per load of rubbish. Mr Sitapata expects to make two trips to the municipal dump. 7. Gold brocade material is used to cover the seats and back rest of the chairs. A total of 30 meters of material will be required for the guest house order, and the material may be purchased at a cost of N$120 per meter. Off-cuts are expected to amount to 15% of the material used. Mr Sitapata has decided to stuff five pillows with the cut-offs, at an additional cost of N$5 per pillow, after which he will donate the pillows to an old-age home in Katutura. 8. Variable costs of N$15 per chair and N$10 per table are also expected to be incurred. 9. Mr Sitapata will use tools that he already owns for this project. Mr Sitapata has established that a company in a similar line of business, using similar tools, would write off depreciation of N$1 000 per month for the use of the tools. 10. The furniture will be produced in Mr Sitapata’s third lock-up garage. The garage has until now been rented to his next-door neighbour for storing tools, at a cost of N$200 per month. 11. Mr Sitapata’s water and electricity bill is currently N$1 500 per month. The bill is set to increase by 10% per month, half of the increase is due to hikes in the electricity cost due to recent shortages experienced by NAMPOWER, and the remainder of the increase is due to additional water and electricity use as a result of the guest house order. 12. Towards the end of the life of the project, it will be necessary for Mr Sitapata to oversee the project himself. As he has already used all of his vacation leave for the year, he has decided to book two days of sick leave for this purpose and will also take two days of unpaid leave. He expects that the company where he is currently employed will subtract N$2 500 from his normal monthly pay for the two days of unpaid leave. 13. The rest of the functions he expects to perform, such as the design of the lounge suites and the moulding of the wood, Mr Sitapata will undertake in the evenings and over weekends. He will incur no additional costs for these functions. 14. It will be necessary for Mr Sitapata and the two craftsmen to each work a total of 20 hours of overtime at the end of the two months to complete the order on time. 15. It will cost N$250 to deliver the completed lounge suites to the guest house. 16. At the end of the project, Mr Sitapata will take photographs of the completed lounge suites in the guest rooms, for future use in advertisements and flyers. The cost of the development of these photographs is set at N$120. 17. Mr Sitapata will charge a small profit of 30% levied on the sum of all relevant cash flows. Required: Mr Sitapata needs a minimum profit of N$4 500 from the order and has approached you, as his friend to help him make a decision whether to accept the order or not for the guest house. Advise Mr Sitapata. Question 2 Suggested solution (25 marks) N$ Craftsmen salaries (2 employees x 2 months x N$1 500) 6 000 Craftsmen’s meals (2 employees x 2 meals x 9 weeks x 5 days x N$12) 2 160 Overseer (petrol: N$150 + (N$150 x1.06) 309 (notes: N$15 x 9 weeks) 135 (fee: N$500 x 2 months) 1 000 Upholstery (5 suites x 2 chairs x 2 kg p chair x N$60 replacement 1 200 Rose wood (5 x 2 chairs x 3m x N$24) + (5 x 1 table x 5m x N$24) 1 320 Rail cost Bakkie rental 1 500 (N$400 – (2 trips x N$80 to rubbish dump) Gold brocade (30 meters x N$120) 240 3 600 Variable costs (5 x 2 chairs x N$15) + (5 x 1 table x N$10) 200 Loss of rental (N$200 per month x 2 months) 400 Electricity 150 (N$1 500 x 5% x 2 months) Unpaid leave Overtime 2 500 (N$3000 per employee /(9 weeks x 5 days x 8 hours) 500 = N$8.33 per hour x 1.5 overtime rate x 20 hours = N$250 x 2 employees Delivery cost 250 Total cost 21 464 30% profit 6 439 Selling price 27 903 Recommendation: Mr Sitapata should accept this project because he will get a profit of N$6 439, more than the minimum profit that he wants. This excludes all other non-financial factors affecting this project. Costs omitted Upholstery purchase price - Sunk cost – already incurred. Upholstery selling price The upholstery is frequently used and will be used again. Mr Sitapata wouldn’t sell the upholstery at N$25 per kg, only to replace it again at N$60 per kg. Cost of pillows This is not a cost directly linked to the project and it is not required for the project – Mr Sitapata does not have to incur the cost of the pillows. Depreciation on tools Not a cash flow. No indication is given as to the change in market or replacement value for the tools, and therefore the depreciation is not relevant to this decision. 5% hike in electricity prices The mandatory hike brought by NAMPOWER’s shortage would have been incurred in any case and it is therefore not a result of the decision to undertake this project, and thus not relevant. Two days sick leave The two days of sick leave will not cost Mr Sitapata any money – only the unpaid leave will force a salary sacrifice. Overtime: Mr Sitapata As this is on his own time, and there is no indication of other, more lucrative projects he may have undertaken or any contribution sacrificed, the overtime for Mr Satapata has not cost. Photo development cost This is not a cost as a result of the project – Mr Sitapata does not have to incur this cash flow: it is avoidable and therefore irrelevant. Question 3 25 Marks Taku-Tau Ltd is a company in the civil engineering industry with the headquarters located 22 miles from Omuthiya undertaking contracts anywhere in Namibia. The company has had its tender for a job in the north-east Namibia accepted at N$288 000 and work is due to begin in March 2012. However, the company has also been asked to undertake a contract on the south coast of Namibia. The price offered for this contract is N$352 000. Both of the contracts cannot be taken at the same time because of constraints on staff site-management personnel and on plant available. An escape clause enables the company to withdraw from the contract in the north-east, provided notice is given before the end of November and an agreed penalty of N$28 000 is paid. The following estimates have been submitted by the company’s quantity surveyor: Cost estimates North-east N$ Materials: In stock at original cost, Material X In stock at original cost, Material Y Firm orders placed at original cost, Material X Not yet ordered – current cost, Material X Not yet ordered – current cost, Material Z Labour – Hire locally Site management Staff accommodation and, travel for site management Plant on site –depreciation Interest on capital, 8% Total local contract costs 21 600 24 800 30 400 60 000 86 000 34 000 71 200 110 000 34 000 6 800 9 600 5 120 5 600 12 800 6 400 253 520 264 800 North-east Headquarters costs Allocated at a rate of 5% ontotal contract costs Contract price Estimated profit Additional information: South coast N$ South coast 12 676 266 196 288 000 13 240 278 040 352 000 21 804 73 960 1. X, Y and Z are three building materials. Material X is not in common use and would not realize much money if resold; however, it could be used on other contracts but only as a substitute for another material currently quoted at 10% less than the original cost of X. The price of Y, a material in common use, has doubled since it was purchased; its net realisable value if re-sold would be its new price less 15% to cover disposal costs. Alternatively, it could be kept for use on other contracts in the following financial year. 2. With the construction industry not yet recovered from the recent recession, the company is confident that manual labour, both skilled and unskilled, could be hired locally on a subcontracting basis to meet the needs of each of the contracts. 3. The plant which would be needed for the south coast contract has been owned for some years and N$12 800 is this year’s depreciation on a straight-line basis. If the north-east contract is undertaken, less plant will be required and the surplus plant will be hired out for the period of the contract at a rental of N$6 000. 4. It is the company’s policy to charge all contracts with notional interest at 8% on estimated working capital involved in contracts. Progress payment would be receivable from the contractee. 5. Salaries and general costs of operating the small headquarters amount to about N$108 000 each year. There are usually ten contracts being supervised at the same time. 6. Each of the two contracts is expected to last from March 2012 to February 2013, which, coincidentally, is the company’s financial year end. 7. Site management is treated as a fixed cost. Required: a) Present comparative statements to show the net benefit to the company of undertaking the more advantageous of the two contracts and advise management on which contract to choose. (15 marks) b) List 2 items and explain the reasoning behind the inclusion if any in your comparative financial statement of each item given in the cost estimates and the notes relating thereto. (4 marks) c) List 3 items and explain the reasoning behind the omission if any from your comparative financial statement of each item given in the cost estimates and the notes relating thereto. (6 marks) Question 3 (Suggested solution) (a) North East Material X from stock (1) 19 440 Material Y from stock (2) 49 600 Firm orders of material X (3) 27 360 Material X not yet ordered (4) 60 000 Material Z not yet ordered (5) Labour (6) Site management South coast 71 200 86 000 - Staff accommodation & travel for site (7) 6 800 Plant rental received (8) (6 000) Penalty clause (9) 110 000 5 600 28 000 Total cost 193 600 264 400 Contract price 288 000 352 000 Net benefit 94 400 87 600 (b) Included costs 1. If material X is not used on the North East contract the most beneficial use is to use it as a substitute material thus avoiding future purchases of N$19 440 (0.9 x 21 600). Therefore by using the stock quantity of material X the company will have to spend N$19 440 on the other materials. 2. Material Y is in common use and the company should not dispose of it. Using the materials on the South coast contract will mean that they will have to be replaced a cost of N$49 600 (N$24 800 x 2). Therefore the future cash flow impact of taking on the contract is N$49 600. 3. It is assumed that with firm orders of materials it is not possible to cancel the purchase. Therefore the cost will occur whatever future alternative is selected. The materials will be used as substitute material if they are not used on the contract and therefore, based on the same reasoning as point 1 above, the relevant cost is the purchase price of the substitute material (0.9 x N$30 400). 4. The material has not been ordered and the cost will only be incurred if the contract is undertaken. Therefore additional cash flows of N$60 000 will be incurred if the company on the North East contract. 5. The same principles apply here as were explained in point 4 and additional cash flows of N$71 200 will be incurred only if the company takes on the South coast contract. 6. It is assumed that labour is an incremental cost and therefore relevant. 7. The costs would be undertaken only if the contracts are undertaken. Therefore they are relevant costs. 8. If the North East contract is undertaken the company will be able to hire out surplus plant and obtain a N$6 000 cash inflow. 9. If the South coast contract is undertaken the company will have to with draw from the North East contract and incur a penalty cost of N$28 000. (C) Excluded costs 1. The headquarter costs will continue whichever alternative is selected and they are not relevant costs. 2. It is assumed that there will be no differential cash flows relating to notional interest. However, if the interest costs associated with the contracts differ then they would be relevant and should be included in the analysis. 3. Depreciation is a sunk cost and irrelevant for decision –making. 4. The site management function is performed by staff at central headquarters. It is assumed that the total company costs in respect of site management will remain unchanged in the short term whatever contracts are taken on. Site management costs are therefore irrelevant. Question 4 30 Marks PMS plc is a large diversified organisation with several departments. It is concerned over the performance of one of its departments – department P. PMS plc is concerned that department P has not been able to meet its sales target in recent years and is considering either to reduce the level of production or to shut down the department. The following information has been made available: Budgeted sales and production in units Sales Less: production costs Material A – 1 kg per unit Material B – 1 litre per unit Labour – 1 hour per unit Variable overhead Fixed overhead Non-production costs Total cost Budgeted profit 50 000 N$ (000) 500 50 25 125 100 50 50 400 100 The following additional information has also been made available: (i) There are 50 000 kg of material A in inventory. This originally cost N$1 per kg. Material A has no other use and unless it is used by the division it will have to be disposed of at a cost of N$500 for every 5 000 kg. (ii) There are 30 000 litres of material B in inventory. Any unused material can be used by another department to substitute for an equivalent amount of a material, which currently costs N$1.25 per litre. The original cost of material B was N$0.50 per litre and it can be replaced at a cost of N$1.50 per litre. (iii) All production labour hours are paid on an hourly basis. Rumours of the closure of the department have led to a large proportion of the department’s employees leaving the organisation. Uncertainty over its closure has also resulted in management not replacing these employees. The department is therefore short of labour hours and has sufficient to produce 25 000 units. Output in excess of 25 000 units would require the department to hire contract labour at a cost of N$3.75 per hour. If the department is shut down the present labour force will be deployed within the organisation. (iv) Included in the variable overhead is the depreciation of the only machine used in the department. The original cost of the machine was N$200 000 and it is estimated to have a life of 10 years. Depreciation is calculated on a straight-line basis. The machine has a current resale value of N$25 000. If the machinery is used for production it is estimated that the resale value of the machinery will fall at the rate of N$100 per 1,000 units produced. All other costs included in variable overhead vary with the number of units produced. (v)Included in the fixed production overhead is the salary of the manager of department P which amounts to N$20 000. If the department were to shut down the manager would be made redundant with a redundancy pay of N$25 000. All other costs included in the fixed production overhead are general factory overheads and will not be affected by any decision concerning department P. (vi) The non-production cost charged to department P is an apportionment of the total non-production costs incurred by the department. (vii) The marketing manager suggests that either: ● a sales volume of 25 000 units can be achieved with a selling price of N$9.00 per unit and an advertising campaign of N$25 000; or ● a sales volume of 35 000 units can be achieved at a selling price of N$7.50 with an advertising campaign costing N$35 000. Requirements (a) As the management accountant of PMS plc you have been asked to investigate the following options available to the organisation: Reduce production to 25 000 units Reduce production to 35 000 units Shutdown department P. (b) Discuss the relevance of opportunity costs in decision-making Question 4 a) (Suggested solution) (25 marks) Relevant savings & revenues Sales revenue Material B Sale of machinery Total revenue/savings 25 000 units N$ 225 000√ 6 250√ 22 500√ 253 750 35 000 units N$ 262 500√ 21 500√ 284 000 Shut down N$ 37 500√ 25 000√ 62 500 Relevant costs Material A disposal Purchase material B Labour Variable overhead (depreciation-excl.) Advertising campaign Manager’s salary Redundancy pay Total relevant costs Net savings N$ 2 500√ 62 500√ 40 000√ 25 000√ 20 000√ 150 000 103 750√√ N$ 1 500√ 7 500√ 100 000√ 56 000√ 35 000√ 20 000√ 220 000 64 000√√ N$ 5 000√ 25 000√ 30 000 32 500√√ 25 000 units 35 000 units shut down 25 000 N$9 N$225 000 35 000 N$7.50 N$262 500 (√= Half mark) Workings: Sales revenue: No. of units Selling price Sales revenue Saving made on material B: Surplus available Saving per litre Total saving Sale of machinery: Current market price Reduction in value Sales proceeds Disposal of material A: Quantity to be disposed of Cost of disposal Purchase cost of material B: Production requirement No. of litre to be purchased Purchase cost Labour costs: Normal labour costs Contract labour Variable overheads @ N$1.60 per unit (variable overhead per unit) Total variable overhead Less: Depreciation Variable overhead (Total) Units 5 000√√ N$1.25√ N$6 250 - 30 000√√ N$1.25√ N$37 500 N$25 000 N$2 500√ N$22 500 N$25 000 N$3 500√ N$21 500 N$25 000√ N$25 000 25 000 N$2 500 15 000 N$1 500 50 000 N$5 000 25 000 - 35 000 5 000√ N$7 500 N$62 500 N$62 500 N$62 500√ N$37 500√ N$100 00 N$40 000 N$100 000 N$20 000√√ N$80 000√ 50 000 N$56 000 Variable cost per unit N$1 .60√√ (√=Half mark) b) An opportunity cost is the value which represents the cost of the next best alternative or the benefit forgone by accepting one course of action in preference to others when allocating scare resources √. If there is only one scare resource, decisions can be made by ranking alternatives according to their contributions per unit of scare resource√. However, in reality, there will be many scare resources, and different alternatives will use alternative combinations of those scare resources. In these situations opportunity costs are used to identify the optimum use of those resources√. (3 Marks) Question 5 Chineke Ltd produces two products, join product 1 and joint product 2, using common manufacturing process. The joint cost that arise out of the common process are N$3 750. Joint product 1 Joint product 2 N$ N$ Sales value at split off point 1 875 2 250 Sales value after further processing 2 625 5 250 Allocated joint costs 1 704.55 2 045.45 Cost of further processing 800 2 500 . Required: Determine whether joint products 1 and 2 should be sold at split or be further processed. The net realisable method must be used to allocate joint cost and all units produced where sold. Question 6 Philander Ltd manufactures and sells fancy pencils. Plant capacity is 100 000 units per year and there are no inventories at the end of the year. The following budgeted income statement has been prepared: Details Sales (80 000 units) - Manufacturing costs: Direct material Direct labour Overheads (50% variable) Gross income - Marketing and administrative costs (50% variable) Net income Per unit (N$) 16 5 2 6 Total (N$) 1 280 000 400 000 160 000 480 000 240 000 80 000 160 000 The company has received a special order to sell 30 000 units of its fancy pencils at N$11 each. Required: Make a recommendation as to whether the company should accept this special order. Your answer should be substantiated by relevant calculations. Note: The variable portion of marketing and administrative costs is for commission. Commission will not have to be paid on the special order. Question 7 25 Marks KO-KA-KU (Pty) manufactures large structural fabricated metal items. The county government has invited companies to tender for the construction of a display board, which will provide tourist and traffic information using a computerized electronic faceboard. The display board will take 60 days to manufacture and erect on site and start date is exactly one month from today. KO-KA-KU (Pty) Ltd is currently preparing the tender documents for submission. Competition for the project is expected to be aggressive and management is therefore keen to submit its best possible price. The following information is relevant to the tender bid: 1. Direct materials In inventory Required Purchase Current price inventory purchase price items Current resale price Rods - coated 1 000m 2 000m N$40/m N$35/m N$30/m Sheet metal 600m² 270m² N$30/m² N$32/m² N$30/m Brace bars 1 500 units 4 000 units N$10/unit N$10.5/unit N$8.50/ unit The coated rods and sheet metal are in continuous and regular use by KO-KA-KU (Pty) Ltd, but the brace bars are not. The latter are surplus from a project that was completed a year ago and the company has just received an offer from a scrap metal dealer to purchase them at the resale price. The company also has 2 000 metres of uncoated rods in inventory which could be used if they were coated, although it is not common practice to do this in the industry. The cost of coating is N$10 per metre. If they are not used for the provincial government job, they will be disposed of for N$15 per metre. The company will only acquire coated rods in future. Other materials, of which none are currently in inventory (concrete, blocks, bolts etc) will need to be purchased at a total cost of N$100 000. 2. Project Management and labour A site engineer will be on site for the entire duration of the project. His normal monthly salary is N$12 000. It is estimated that he will work 100 hours of overtime on the project at a rate of N$100 per hour. The project requires ten workers for sixty days, their normal daily wage being N$120 per day. In the event that KO-KA-KU (Pty) Ltd is unsuccessful in the provincial government tender, they intend retrenching the ten workers at a total cost of N$20 000 to the company. However, should they be successful in the tender then management believe that no retrenchment will be necessary. 3. Equipment Special hoisting equipment would have to be hired at a cost of N$2 000 per day for ten days. The company would use its argon welder (acquired six months ago), which has never been used and is not likely to be used on any other project in the foreseeable future. It cost N$60 000, and is being depreciated over five years on a straight-line basis. “We must include the cost of this in the bid, so we can recover the costs incurred,” says the company’s production engineer. 4. Out of town expenses Accommodation and related expenses for the site will amount to N$1 000 per day for the duration of the project. 5. Electronic Face-board This will be acquired at a cost of N$100 000. 6. Other expenses The company has already paid N$5 000 non-refundable tender levy to obtain the tender documents. Variable overheads have been estimated to be N$500 per day for the duration of the project. Head office fixed overheads are charged at the rate of N$2 000 per day. 7. Normal price The company’s policy is to apply a mark-up of 25% on full costs of the project. Full-cost comprises all direct and indirect costs. For normal pricing purpose, direct materials are costed on a first-in-first-out (FIFO) basis. 8. Other projects The company has successfully bid for a project in Mozambique, which is due to start at the same time as the provincial government tender and will result in a contribution towards general fixed costs of N$200 000. However, KO-KA-KU (Pty) Ltd cannot undertake both projects, as each requires the company’s best- qualified site engineer to oversee them. If KO-KA-KU (Pty) Ltd were to withdraw from the Mozambique project, they would incur a penalty of N$25 000. Required: a) Advice the management of KO-KA-KU (Pty) Ltd whether to reject or accept the tender if the government is willing to pay them a tender price of N$ 800 000. (18 marks) b) List 2 items and explain the reasoning behind the omission if any from your calculation. (4 marks) c) Identify three qualitative factors that management of KO-KA-KU (Pty) Ltd may want to consider before submitting their tender price. (3 marks)