ACCA-F5-Performance-Management-Progress-Test-1-Section-A

advertisement

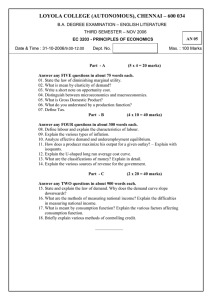

F5: PROGRESS TEST 1 1 Using activity based costing, what is the overhead cost per unit of product Y? Product X 500 Production (units) Machine hours per unit Production runs Inspections during production Production set-up costs Quality control costs A B C D Product Y 2,000 10 5 6 $168,000 $96,000 10 2 6 $48.00 $37.71 $66.00 $105.60 (2 marks) The following data relate to costs, output volume and cost drivers of Heighway Rubbery Ltd for June 20X1. Product P Product Q Product R Total 1 Production and sales 3,000 units 2,000 units 1,500 units 2 3 4 5 6 7 8 9 Direct production costs Direct materials Direct labour Labour hours per unit Machine hours per unit Number of production runs Number of deliveries to customers Number of production orders Number of deliveries of materials into store Production overhead costs Machining Set-up costs Materials handling (receiving) Packing costs (despatch) Engineering $ per unit 12 3 15 ½ 2 8 3 30 17 $ per unit 11 6 17 1 1 2 2 5 3 $ per unit 8 2 10 1/ 3 2 10 10 15 20 $70,000 $24,000 $94,000 20 15 50 40 $ 71,500 10,500 35,000 22,500 25,500 165,000 F5: PROGRESS TEST 1 Indirect production overheads that are not driven by production volume are: Item Set-up costs Materials handling Packing Engineering 2 What would be the full production cost per unit of product R if overheads are absorbed on the basis of direct labour hours? A B C D 3 $13.75 $23.75 $30.00 $51.25 (2 marks) What would be the full production cost per unit of product R using activity based costing? A B C D 4 Cost driver Production runs Deliveries of materials Deliveries to customers Production orders $43.27 $45.28 $62.27 $53.27 (2 marks) Orchard manufactures three products and operates a system of throughput accounting. $ per hour Sales price Material Labour Overhead Profit A 40 10 5 15 10 B 50 15 15 10 10 If there is unlimited demand for the product which should be produced? 5 C 60 30 10 5 15 (2 marks) A company makes product X which passes through three production operations A, B and C. Product X sells for $8 per unit and has a direct materials cost of $3 per unit. Total labour cost for the period is $10,000 and overheads for the same period amount to $14,000. Processing times per unit and maximum processing times available for the three operations are given below. Operations A B C Time per unit 3 mins 11 mins 6 mins Total capacity (mins) 30,000 50,000 80,000 Calculate the throughput ratio for product X. A B C D 0.32 0.45 0.48 0.94 (2 marks) F5: PROGRESS TEST 1 6 In activity based costing what is a cost driver? A B C D 7 (2 marks) Indicate which of the following methods can be used to move a currently-attainable cost closer to target cost. A B C D 8 An overhead cost that is incurred as a direct consequence of an activity Any factor which causes a change in the cost of an activity An activity or product item for which costs are incurred A basis for apportioning overheads to cost centres Using standard components wherever possible Acquiring new, more efficient technology Making staff redundant Reducing the quality of the product in question (2 marks) A mobile phone manufacturer, C Ltd, is planning to produce a new model. The potential market over the next year is 1,000,000 units. C Ltd has the capacity to produce 400,000 units and could sell 100,000 units at a price of $50. Demand would double for each $5 fall in the selling price. The company has an 80% cost experience curve for similar products. The cost of the first batch of 1,000 phones was $103,000. A minimum margin of 25% is required. Calculate C Ltd's target cost per unit, to the nearest $. A B C D 9 (2 marks) When are the bulk of a product's life cycle costs normally determined? A B C D 10 $40 $30 $50 $45 At the design/development stage When the product is introduced to the market When the product is in its growth stage On disposal (2 marks) J Co produces and sells two products. The O sells for $12 per unit and has a total variable cost of $7.90, while H sells for $17 per unit and has a total variable cost of $11.20. For every four units of O sold, three of H are sold. J Ltd's fixed costs are $131,820 per period. Budgeted sales revenue for the next period is $398,500. What is the margin of safety (in $)? A B C D $131,820 $12,511 $385,989 $27,292 (2 marks)