The rate of return obtained by dividing the average accounting net

advertisement

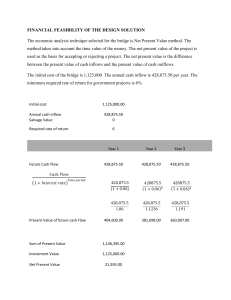

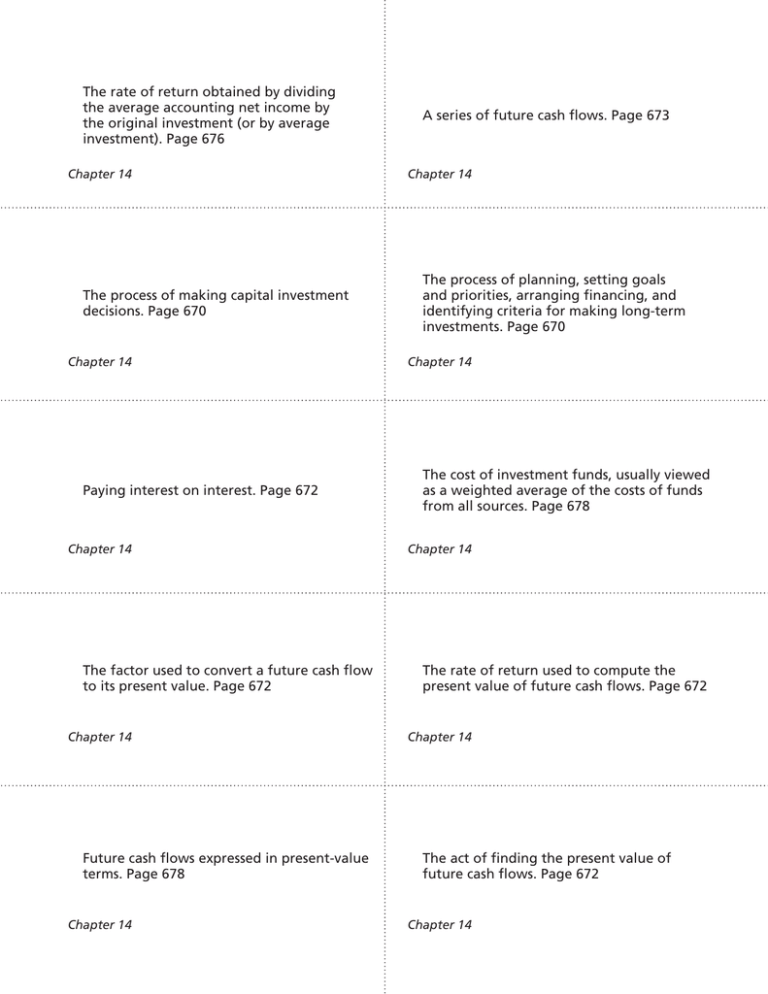

The rate of return obtained by dividing the average accounting net income by the original investment (or by average investment). Page 676 Chapter 14 The process of making capital investment decisions. Page 670 Chapter 14 Paying interest on interest. Page 672 Chapter 14 The factor used to convert a future cash flow to its present value. Page 672 Chapter 14 Future cash flows expressed in present-value terms. Page 678 Chapter 14 A series of future cash flows. Page 673 Chapter 14 The process of planning, setting goals and priorities, arranging financing, and identifying criteria for making long-term investments. Page 670 Chapter 14 The cost of investment funds, usually viewed as a weighted average of the costs of funds from all sources. Page 678 Chapter 14 The rate of return used to compute the present value of future cash flows. Page 672 Chapter 14 The act of finding the present value of future cash flows. Page 672 Chapter 14 Capital investment models that explicitly consider the time value of money in identifying criteria for accepting and rejecting proposed projects. Page 674 Chapter 14 Projects that, if accepted or rejected, will not affect the cash flows of another project. Page 670 Chapter 14 Projects that, if accepted, preclude the acceptance of competing projects. Page 670 Chapter 14 Capital investment models that identify criteria for accepting or rejecting projects without considering the time value of money. Page 674 Chapter 14 A follow-up analysis of an investment decision, comparing actual benefits and costs with expected benefits and costs. Page 684 Chapter 14 The value that will accumulate by the end of an investment’s life if the investment earns a specified compounded return. Page 672 Chapter 14 The rate of return that equates the present value of a project’s cash inflows with the present value of its cash outflows (i.e., it sets the NPV equal to zero). Also, the rate of return being earned on funds that remain internally invested in a project. Page 680 Chapter 14 The difference between the present value of a project’s cash inflows and the present value of its cash outflows. Page 678 Chapter 14 The time required for a project to return its investment. Page 674 Chapter 14 The current value of a future cash flow. It represents the amount that must be invested now if the future cash flow is to be received assuming compounding at a given rate of interest. Page 672 Chapter 14 A discounting method that divides the present value of future cash flows by the initial investment. Page 680 Chapter 14 A legal way to reduce net income for tax purposes, creating a reduction in income taxes payable. Page 694 Chapter 14 The minimum rate of return that a project must earn in order to be acceptable. Usually corresponds to the cost of capital. Page 678 Chapter 14