Term Structure of Interest Rates

Term Structure of Interest Rates

Outline

Meaning of Term Structure of Interest

Rates

Significance of Term Structure of Interest

Rates

What is Yield Curve?

A spot rate and a forward Rate

Theories of Term Structure of Interest

Rates

Why practically homogeneous bonds of different maturities have different interest rates?

This question issue is of great significance to both borrowers and lenders.

Should a lender invest in short-term bonds and have to worry about the rates at which to reinvest when short-term bond matures? Or should the lender buy long-term bonds and run the risk of an uncertain liquidating value if selling is necessary before maturity?

Borrowers are faced with the choice of whether to borrow short-term or long-term. Short-term borrowing runs the risk that refinancing may be at higher rates. Long-term financing runs the risk that a high rate may be locked in.

A study of the yield-curve and term-structure of interest rates can help borrowers and lenders in making the right decision.

What is a Yield Curve?

A graphical depiction of the relationship between the yield on bonds of the same credit quality, but different maturities is known as the yield curve.

Term structure of interest rates may be defined as the relation between yield to maturity of zero coupon securities of the same credit quality and maturities of those zero-coupon securities.

Yield-to-maturity on zero-coupon securities for different maturities is also the spot rate for that maturity. Therefore, term structure of interest rate may also be defined as the pattern of spot rates for different maturities.

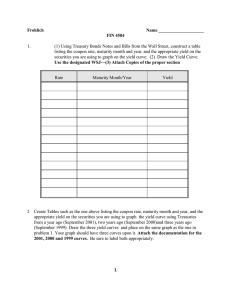

How to Construct the Term Structure of Interest

Rates?

The yield on Treasury securities is a benchmark for determining the yield curve on non-Treasury securities.

Consequently, all market participants are interested in the relationship between yield and maturity for Treasury securities.

The graphical depiction of the relationship between the yield on Treasury securities for different maturities is known as the yield curve.

While a yield curve is typically constructed on the basis of observed yields and maturities, the term structure of interest rates is the relationship between the yield on zero-coupon Treasury securities and their maturities.

Therefore, to construct term structure of interest rates, we need the yield on zero-coupon Treasury securities for different maturities.

Zero-coupon Treasuries are issued with maturities of six-months and one-year, but there are no zero-coupon Treasury securities with maturity more than oneyear.

Thus, we cannot construct such term structure solely from market observed yields.

Rather, it is essential to construct term structure from theoretical consideration applied to yields of actually traded Treasury debt securities.

Such a curve is called “Theoretical Spot Rate

Curve”

Any noncallable security can be considered as a package of zero-coupon securities

Each zero coupon security in the package has a maturity equal to its coupon payment date and, in the case of principal, equal to maturity date

The value of the Treasury coupon security should be equal to the value of the package of zerocoupon securities

If this equality does not hold, it will be possible to create arbitrage profits.

To determine the value of each zero coupon security, it is necessary to know the yield on the zero-coupon Treasury corresponding to that maturity. This yield is called the Spot Rate

The graphical depiction of the relationship between the spot rate and maturity is called the spot rate curve.

Such a curve is also known as “Theoretical Spot

Rate Curve”

Remember spot rate is a zero-coupon rate. The theoretical spot rates for Treasury securities represent the appropriate set of interest rates that should be used to value default-free cash flows