专业:会计

advertisement

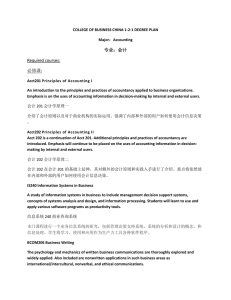

COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 Business Core Required Courses Electives (Choose 3) Proficiency Requirements Service Learning Required courses: ACCT201 ACCT202 BCOM206 BCOM207 BSAD300 BSAD305 FIN320 MKTG330 MGMT340 MKTG341 MGMT449 IS240 ACCT301 ACCT302 ACCT313 ACCT314 ACCT321 ACCT401 ACCT404 ACCT460 ACCT305 ACCT405 ACCT415 ACCT417 Principles of Accounting I 会计学原理一 Principles of Accounting I 会计学原理二 Business Writing 商务写作 Business Presentation 商务演示 Diversity in the Workplace 工作场所中的多样性 Legal and Regulatory Environment 法律和监管环境 Principles of Finance 金融学概论 Principles of Marketing 市场营销学原理 Organizational Behavior 组织行为学 Operations Management 运营管理 Strategic Management in a Global Business Environment 全球企业环境战略管理 Information Systems in Business 商业咨询系统 Intermediate Accounting I 中级会计一 Intermediate Accounting II 中级会计二 Auditing 审计 Cost Accounting 成本会计 Introduction to Income Tax 个人所得税 Advanced Financial Accounting 高级财会 Income Tax Assistance 报税协助 Accounting Technology and Applications 会计技术与运用 International Accounting 国际会计 Advanced Auditing and Consulting 高级审计及咨询 Governmental and Nonprofit Organization Accounting 政府和非盈利组织会计 ACCT420 Fraud Investigation and Prevention 欺诈调查与预防 ACCT425 Ethics in Accounting 会计道德规范 ACCT430 Accounting Systems 会计系统 ACCT444 Profit Management and Budgetary Control 收益管理与预算控制 ACCT450 Financial Statement Analysis 财务报表分析 ECON103* Principles of Microeconomics 微观经济学 ECON104* Principles of Macroeconomics 宏观经济学 (*One Economics course must be taken at UWEC) 30 Hours COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 必修课: Acct201 Principles of Accounting I An introduction to the principles and practices of accountancy applied to business organizations. Emphasis is on the uses of accounting information in decision-making by internal and external users. 会计 201 会计学原理一 介绍了会计原则以及对于商业机构的实际运用。强调了内部和外部的用户如何使用会计信息决策。 Acct202 Principles of Accounting II Acct 202 is a continuation of Acct 201. Additional principles and practices of accountancy are introduced. Emphasis will continue to be placed on the uses of accounting information in decisionmaking by internal and external users. 会计 202 会计学原理二 会计 202 在会计 201 的基础上延伸。其对额外的会计原则和实践入手进行了介绍。重点将依然放 在内部和外部的用户如何使用会计信息决策。 IS240 Information Systems in Business A study of information systems in business to include management decision support systems, concepts of systems analysis and design, and information processing. Students will learn to use and apply various software programs as productivity tools. 信息系统 240 商业咨询系统 本门课程进行一个业务信息系统的研究,包括管理决策支持系统,系统的分析和设计的概念,和 信息处理。学生将学习,使用和应用作为生产力工具各种软件程序。 BCOM206 Business Writing The psychology and mechanics of written business communications are thoroughly explored and widely applied. Also included are nonwritten applications in such business areas as international/intercultural, nonverbal, and ethical communications. 商务通信 206 商务写作 本门课程介绍了书面商业通信的心理和力学,深入探讨和广泛的应用。此外,还包括国际/跨文化 的,非语言,和道德通信等业务领域的应用。 COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 BCOM207 Business Presentations Students will learn to communicate professionally in meetings, roundtables, project teams, and individual presentations using appropriate psychology, sensitivity, and technology. 商务通信 207 商务演示 学生将学习进行专业商务会议,圆桌会议,项目团队并且恰当使用适当的心理,灵敏度和技术演 示。 BSAD300 Diversity in the Workplace Develops the awareness and sensitivity of students to issues of race, religion, culture, age, gender, sexual orientation, and disabilities in the workplace. 公管 300 工作场所中的多样性 发展和提高学生对于在工作环境中的种族、宗教、文化、年龄、性别、性取向、残疾等问题的意 识和敏感性。 BSAD305 Legal and Regulatory Environment Legal environment affecting business decision making, including sources of law, court systems, civil procedure, negligence, intellectual property, criminal law standards, agency, partnerships, corporations and securities regulation, trade regulation, administrative law, and insurance law. 公管 305 法律和监管环境 本门课程介绍了影响企业决策的法律环境,包括法的渊源、法院系统、民事诉讼法、疏忽、知识产 权、刑事法律标准,代理出口,合作伙伴,公司和证券监管、贸易规定,行政法律、保险法律。 Fin 320 Principles of Finance Study of the techniques used to make investment, financing, and dividend decisions in order to maximize the value of the firm to its owners. Topics include financial planning and control, working capital management, capital budgeting, capital structure, cost of capital, dividend policy, and international finance. 金融 320 金融学概论 研究投资、融资、收益以及红利等技术为最大限度地提高企业的价值。课程内容包括财务计划和 控制、资本管理、资本预算、资本结构、资本成本、股利政策、国际金融。 MKTG330 Principles of Marketing COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 The marketing function is critical to the success of every organization around the world. This course examines how profit and nonprofit organizations identify and evaluate customer needs; select target markets; and create, price, promote, and distribute need-satisfying products/services to individuals, organizations, and society. This course contains an integrated communication component. 市场 330 市场营销学原理 营销功能是世界各地每个组织成功的要诀。本课程探讨营利性和非营利组织如何识别和评估客户 需求,选择目标市场;创建,价格,推广,并分发需要满意的产品/服务的个人,组织,和社会。 这当然包含一个集成的通讯组件。 MGMT340 Organizational Behavior Review of the theories and applications of behavioral science research in human organizations. Topics include: motivation, group dynamics, communication, leadership, conflict, and change. 管理 340 组织行为学 回顾了在研究人类行为科学的组织的理论和应用。本门课程主题包括:动机、团体动力学、商务交 流、领导、冲突、改变。 MGMT341 Operations Management Processing of inputs into outputs consisting of goods and services; includes plant and machine location and layout, materials handling, work methods and simplification, manpower planning, inventory control, quality control, maintenance, and operational control. 管理 341 运营管理 本门课程介绍了输入输出处理成组成的货物和服务,包括厂房和机器位置和布局、材料处理、工作 方法、简化、人力规划、库存控制、质量控制、维护和运行控制。 MGMT449 Strategic Management in a Global Business Environment Covers the formulation and implementation of business strategy in a global environment. Case studies and simulations provide an integrative view of international business operations from a total enterprise perspective. This course contains an integrated communication component. 管理 449 全球企业环境战略管理 涵盖在全球的环境制定,实施经营战略。案例研究和模拟提供了一种综合国际业务总企业的观察 角度。本课程包含综合通信组件。 IS240 Information Systems in Business COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 A study of information systems in business to include management decision support systems, concepts of systems analysis and design, and information processing. Students will learn to use and apply various software programs as productivity tools. 信息系统 240 商业咨询系统 本门课程进行一个业务信息系统的研究,包括管理决策支持系统,系统的分析和设计的概念,和 信息处理。学生将学习,使用和应用作为生产力工具各种软件程序。 Acct 301 Intermediate Accounting I Development and implementation of the conceptual and practical aspects of valuation and income determination, time value of money, accounting changes, inventory valuation, and current and noncurrent assets. Special emphasis on GAAP as it relates to topics being covered. 会计 301 中级会计一 发展和实施的概念和实践的评估和收入的决心,货币时间价值会计的变化,存货估值,流动资产和固 定资产。特别强调与 GAAP 相关的主题。 Acct302 Intermediate Accounting II Development and implementation of the conceptual and practical aspects of valuation and income determination, with emphasis on intangible assets, retained earnings and contributed capital, earnings per share, pensions, leases, tax allocation, current and long-term liabilities, statement of cash flows, statement analysis, interim and segment reporting. Special emphasis on GAAP as it relates to topics being covered. 会计 302 中级会计二 发展和实施的概念和实践的评估和收入的决心,并重点对无形资产、留存收益,为资本,每股收益、 养老金、租赁、税收分配、当前和长期负债、报表现金流量表、报表分析、临时和环节的报告。 特别强调与 GAAP 相关的主题。 Acct313 Auditing Basic coverage of all steps in creating audit programs according to the audit risk model, and current issues in auditing. Specific coverage includes company risk evaluation, internal control, company analysis, and audit reporting. 会计 313 审计 COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 基本的覆盖了根据审计风险模型创建的审计程序中所有步骤,以及当下关于审计的一些问题。具体 内容包括公司风险评估、内部控制、公司分析以及审计报告。 Acct314 Cost Accounting Principles of cost accounting, emphasizing analysis of materials, labor, and factory overhead; application of standard costing to job order and process cost systems; analysis of cost behavior in the manufacturing firm with exposure to cost-profit-volume relationships, break-even analysis, and direct costing. 会计 314 成本会计 成本的核算,强调分析材料,人工,和工厂的开销;成本核算工作秩序和过程中的成本系统的标准 应用;曝光成本利润量的关系,根据成本性态分析的原则对制造企业盈亏平衡进行分析,以及直接 成本。 Acct321 Introduction to Income Tax Introduction and application of accounting and legal concepts underlying federal and Wisconsin income tax laws applicable to gross income, exclusions, business and non-business deductions, gains and losses, credits, and tax computations. 会计 321 所得税 联邦和威斯康星州的所得税法适用于总收入,排除,商业和非商业扣除,收益和损失,信贷,税 计算为基础的会计和法律概念的介绍和应用。 Acct401 advanced Financial Accounting Accounting for multiunit business enterprises; consolidated balance sheets, income statements, and statement of cash flows; Security and Exchange Commission reporting; foreign currency transactions and translation; international operations; and liquidation of partnerships. 会计 401 高级财会 制作多家单位工商企业的合并资产负债表,损益表和现金流量表;证券交易委员会的报告;外币交 易和翻译,国际化经营;以及清算伙伴关系。 Acct404 Income Tax Assistance COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 Course provides students with instruction in state and federal personal income taxes in conjunction with the IRS/Volunteer Income Tax Assistance program. Students will prepare income tax returns at various sites on and off campus. 会计 404 报税协助 本课程将结合同美国国税局/志愿者所得税救助计划为学生对州级和联邦政府级个人所得税提供指 导。学生将在校内和校外的多个地点准备所得税申报表。 Acct460 Accounting Technology and Applications An overview of technology as it relates to the practice of accounting. Possible topics include enterprise accounting systems, small business accounting packages, tax preparation packages, cost analysis packages, and spreadsheet and database applications in accounting. 会计 460 会计技术与运用 概述涉及到技术实践的会计。主题包括企业会计制度,中小企业会计包,税务包裹,成本分析软件包, 用于会计的试算表和数据库应。 Electives: (Choose from 3) 选修:(多选 3) Acct305 会计 305 Acct405 International Accounting A study of the international dimensions of accounting, including the patterns of accounting development found in other nations, the promulgation of worldwide accounting standards, and the accounting problems associated with multinational corporate operations. 会计 405 国际会计 一项研究的国际维度的会计,包括出现在其它国家的会计发展模式,全球会计准则的颁布,跨国公司 业务相关的问题。 Acct410 Investment and Retirement Plan Accounting COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 Coverage of investment planning and advising for clients, retirement plan accounting, and tax considerations in retirement planning. 会计 410 投资和退休计划会计 为客户投资进行规划和指导、退休计划会计,以及退休计划中牵扯到税务的因素,。 Acct415 Advanced Auditing and Consulting In-depth analysis of current audit topics and research, including legal liability, operational audits, audit effectiveness, environmental costs, and statistical sampling. Concentration includes EDP auditing. 会计 415 高级审计及咨询 对我国现行审计话题进行深入的分析和研究,主要包括法律责任、经营审计,审计效率、环境成本, 并统计抽样。包括电子浓度审计。 Acct417 Governmental and Nonprofit Organization Accounting An introduction to accounting principles for governmental units; educational institutions; hospitals; voluntary health and welfare organizations; and other nonprofit organizations. Includes budgetary and financial reporting requirements of these organizations. 会计 417 政府和非盈利组织会计 介绍政府机关,教育机构;医院,自发的健康和福利组织;以及其他非盈利组织中的会计原则。包括这 些组织的预算和队财务报告的要求。 Acct420 Fraud Investigation and Prevention Coverage of fraud methods, fraud investigation, and fraud prevention through internal controls. Emphasis on financial and asset misappropriation frauds. 会计 420 欺诈调查和预防 报扩报道欺诈、欺诈调查、通过内部控制预防欺诈。强调在金融和资产上得侵占。 Acct423 Advanced Tax Accounting Federal income taxation of entities including C corporations, S corporations, partnerships, trusts, and estates. Federal, estate, and gift taxation. Business and family tax planning. 会计 423 高级税务会计 COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 联邦所得税的实体,包括 C 类公司,S 类公司、合伙业务、信托、房地产、联邦政府、房地产、礼品 税收。事业与家庭的纳税筹划。 Acct425 Ethics in Accounting An introduction to ethics and professional responsibility in accounting. Coverage includes models of ethical reasoning, ethical dilemmas in accounting, and creating solutions to those ethical dilemmas. 会计 425 会计道德规范 介绍专业会计人员在道德准则和职业责任。内容包括道德推理模型,会计的道德困境,以及如何解决 这些伦理困境。 Acct430 Accounting Systems Analysis, design, and documentation of accounting systems; includes transaction processing, internal accounting controls, data management, flowcharting, financial reporting, various types of technology, and ethical issues. 会计 430 会计系统 分析、设计、和文档的会计系统,包括交易处理,内部会计控制、数据管理、流程图、财务报告、各 种类型的技术,和伦理问题。 Acct444 Profit Management and Budgetary Control Theory and procedures for profit planning; financial and operating budgets as managerial devices in coordination and control; program and operational budgeting and cost analysis. 会计 444 收益管理与预算控制 利润计划的理论和程序;财务和经营预算管理设备的协调和控制;程序和操作预算和成本分析。 Acct450 Financial Statement Analysis An in-depth study of the techniques of financial statement analysis. Topics will include ratio analysis, liquidity analysis, capital structure analysis, and profitability analysis. Both oral and written communications will be stressed. This course contains an integrated communication component. 会计 450 财务报表分析 对财务报表分析技术深入研究。内容包括比率分析、流动性分析、资本结构分析、盈利能力分析。 强调包括口语交流以及书面交流。本课程包含综合通信组件。 COLLEGE OF BUSINESS CHINA 2-2 DEGREE PLAN Major:Accounting 专业:会计 Proficiency Requirements:(One must be taken in UWEC) 水平要求:(其中一门必须在威斯康辛欧克莱尔分校修) Econ103 Principles of Microeconomics In the context of contemporary economic issues, product and resource markets are analyzed with respect to pricing decisions, efficiency, and equity. 经济 103 微观经济学原理 本门课程介绍了在当代经济问题的情况下,产品和资源市场的分析与定价决策,效率和公平。 Econ104 Principles of Macroeconomics Theory of aggregate income determination in the American economy with consideration of the international economy and other related problems, policies, and institutions. 经济 104 宏观经济学原理 在美国经济中的总收入决定理论与国际经济和其他有关问题,政策和机构的审议