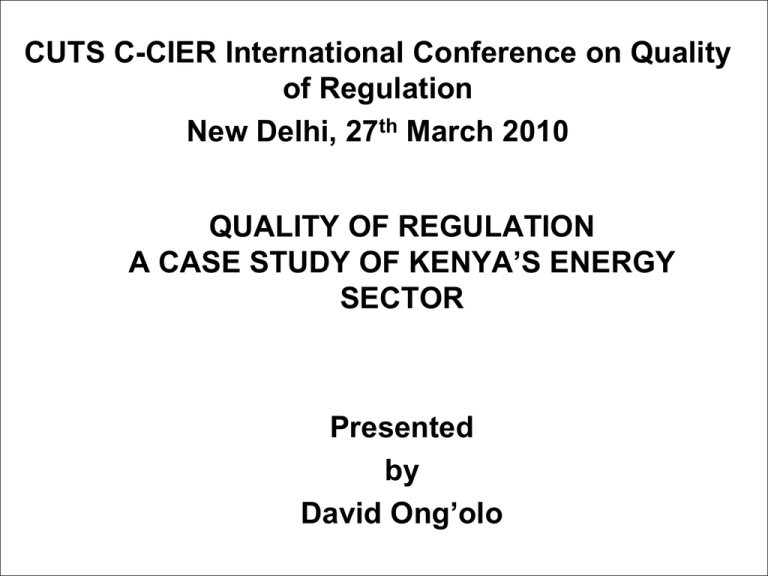

CUTS C-CIER International Conference on Quality of Regulation New Delhi, 27 March 2010

advertisement

CUTS C-CIER International Conference on Quality of Regulation New Delhi, 27th March 2010 QUALITY OF REGULATION A CASE STUDY OF KENYA’S ENERGY SECTOR Presented by David Ong’olo Outline of the Presentation • The Energy Sector in Kenya •Reforms in the Energy Sector •Imperfect Market Conditions in the Energy Sector •Findings of the Study • Quantitative Analysis • Regulatory Impact Assessment •Recommendations The Energy Sector in Kenya Energy Sources Electric Power Sources Wood fuel (68%) Petroleum (22%) Electricity (9%) Coal/Solar (1%) Wind (0.003%) Hydro (50.6%) Thermal oil (33.2%) Geothermal (16.1%) Cogeneration (0.061%) •Effective power capacity - 1,480MW •Electricity demand - 1,135 MW to >10,000MW in 20 years. •About 4,000MW - geothermal sources • “Talk” of nuclear energy •Solar power has potential but not developed •Advent of wind power Reforms in the Energy Sector •ERC – Is the Sectoral Regulator •Early 1990s fundamental structural, institutional and regulatory reforms in the energy sector •ERB replaced by ERC through Electric Power Act, 1997 •Energy sector has central place in Kenya Vision 2030 Functions of the Energy Regulatory Commission •The objects and functions of the ERC are set out in section 5 of the Energy Act 2006. These are to inter alia: – regulate the sector – protect the interests of consumer, investor and other stakeholder interests – formulate, enforce and review environmental, health, safety and quality standards – enforce and review regulations Imperfect Market Conditions Asymmetric Information ERC has fairly reliable information – revenues and cost structures Data on sale of electricity and distribution losses are less reliable Petroleum companies provide manipulated information Commission and energy sector players – asymmetry Externalities External costs - Diesel generators There is need to improve the short-term security of energy supply Natural Monopoly Benefits of natural monopoly do not exist – excessive prices at the consumer level – high production inefficiencies – 20% distribution losses – poor service quality Generation of electricity has been opened up to competition Anticompetitive Practices Pricing of petroleum products, 2004 and 2009 ERC published proposals for price controls in the industry Study Findings -Qualitative Analysis - 1 Regulatory Independence and Enforcement Capacity Procedures for selection of the Members of the ERC and the Chairman •Energy Act, 2006 and State Corporations Act •Section 3 of the State Corporations Act - control and regulation of state corporations •Chairman and Commissioner's appointments Professional backgrounds of the Commissioners •Current crop of Commissioners adequately meet the requirements of the law The Use of Media •Budget is about 10% of the total ERC annual recurrent expenditure •ERC could be more visible Study Findings -Qualitative Analysis - 2 Capacity for Service Delivery and Dispute Settlements Petroleum • Frequent shortages/inadequate supply (34%) • High prices or fluctuations in prices (30%) • Poor quality of products (including adulterations) (20%) Electricity • Most common complaints were black-outs, outages, accidents, low voltage supply. Dispute settlement • 45 consumer complaints received in 2006/7 • 51% were resolved, 38% awaiting utility response and 11% complainant’s responses. • A key monitorable Project Development Objective (PDO) is to “….increase the percentage of disputes and complaints resolved annually by ERC from 85% in 2009 to 95% Study Findings -Qualitative Analysis - 3 Setting of Performance Standards •Adopted from those set up by ERB •ERB has already set out a clear allocation of responsibilities for monitoring compliance with EHS standards. Co-ordination and Information Exchange •The Energy Act of 2006 imposes an obligation on ERC to coordinate with other statutory authorities •Setting enforcing and reviewing Environment Health and Safety standards – needs to improve •Granting licenses for sustainable charcoal development - acceptable •Competition regulation – needs to improve •ERC and the REA – needs to improve •Proposals for concurrent powers for competition regulation with the competition regulators – new Competition Bill will facilitate this. Study Findings -Qualitative Analysis - 4 Transparency, Advocacy and Awareness Creation •Documentation for consultation is freely available. •17.3% were of the opinion that the regulator was transparent •46.2% of the respondents were not aware of the rules, principles and guidelines •38.5% were aware of the rules and principles pursued by ERC •15.3% either didn’t know or were not sure of existing rules and regulations. Accountability •28.8% of the respondents indicated that the regulator is accountable •55.8% indicated that the regulator is not accountable to the public Financial Performance of the Sector •ERC collects 96% of the levy and is well funded. •KPLC and Kengen make high profits RIA – Prepaid Electricity Meters •First phase - commenced in mid May 2009 •Existing 1,708 electricity postpaid electricity customers in the Kasarani •Actaris Measurements & Systems from South Africa - 25,000 - 250,000 – 400,000 Key objective •Consumers to manage their expenditure and spare them disconnection or reconnection costs •ERC had approved the system •Sec. 44 of the Energy Act has specific provisions in relation to the forms of contract for supply of electrical energy to consumers •But no Energy Prepayment Meter System Code or Guideline exist Findings of the Study - RIA - 1 Item Average Annual cost/benefit per Consumer (Ksh) Net Present Value (over 20 years) (Ksh. Million) -1509 -323 330 72 -1179 -251 Costs -2183 -456 Benefits 3015 635 Sub-Total 832 179 -30 -0.065 Benefits 1,324 281 Sub Total 1,294 281 947 208 ELECTRICITY CONSUMERS Costs Benefits Sub-Total KPLC ERC and GoK Costs TOTAL Findings of the Study - RIA - 2 Use of prepayment meters in Kenya is, in aggregate, in the public interest. •Discounted net cost for consumers is Ksh. 251 million •Cost of prepaying electricity is the main element. •For KPLC there is a net benefit of Ksh. 179 million •Cost element is commission to card retailers •Main benefit is reduction in reconnection costs. There is, however, potential for some electricity customers being significantly worse off Avoiding this would require developing mechanisms to ensure that customers on prepayment meters •Are protected by ERC •Have appropriate access credit terms - negotiated with KPLC. Recommendations Challenges for better Energy Sector Regulation Some of the most important regulatory issues in Kenya today: •Introduction of prepayment meters for electricity •Introduction of gasohol mix with petrol •Proposed nuclear energy production •Regulation of petroleum prices Policy Recommendations •Increase efforts to integrate a “whole-of-government” approach for regulatory quality sector Improve co-ordination mechanisms with e.g. NEMA and clarify responsibilities •Internalise RIA in Kenya as an effective tool for regulatory quality •Improve transparency and increase social participation in regulatory processes. •Increase cooperation between sectoral and competition authorities Thank You For Your Attention