52 Beaconsfield Road Blackheath London SE3 7LG

advertisement

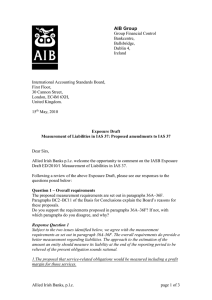

52 Beaconsfield Road Blackheath London SE3 7LG 12th March 2010 Dear Sirs Exposure Draft – Measurement of Liabilities in IAS37 I am writing to comment on the exposure draft Measurement of Liabilities in IAS37. Although the Board is not requesting comments on matters not addressed in the exposure draft, it will be aware (as illustrated by the alternative views on due process) that respondents will see this is a final opportunity to comment on the overall proposed standard. My responses to the specific Board questions are set out in the attached appendix but I wish to address in this covering letter concerns specific to the exposure draft and the standard in general. The Proposals in the Exposure Draft The basic principle that a liability should be measured at the amount an entity would rationally pay to be relieved of the obligation would appear to be based on a hypothetical decision by management calculated (in some cases of fulfilling an obligation by marketing a service) in a hypothetical market. This does not seem a sound basis for providing decision useful information. In addition, the requirement to add a profit margin when the obligation is settled based on internal resources seems perverse. It would mean that, in the case of an entity with the sole purpose of extracting oil through constructing, operating and dismantling an oil rig, profits would be earned in the dismantling phase, a representation of performance which would not seem to meet the requirement of IAS1 of fair presentation. Lastly, it is not clear what the risk adjustment proposed is intended to achieve. If it is to allow for the variation in expected outflow, this would seem to be incorporated in the probability weighting of expected cashflows. If it is to compensate a third party for assuming the obligation, this would seem to be incorporated in the use of observable market prices. Comments on the whole package The proposals in the June 2005 exposure draft met with considerable criticism and disagreement, and the subsequent roundtables held in December 2006 simply reinforced these positions. The list of proposed revisions published at the same time as the current exposure draft, and the working draft of the Proposed Standard, together with the Project Snapshot document, demonstrate that the Board have either not responded to the criticisms or, to the extent they have, responded inappropriately. What is the need for a revision to/replacement of IAS37? Respondents to the exposure draft and attendees at the roundtable show no pressing need to changes. The current IAS37 was well understood in application (as demonstrated by the lack of interpretations requested of the IFRIC) and the inconsistency with IFRS3 in accounting for contingencies was not a differently compelling reason to amend. Indeed, the apparent inconsistency with IFRS3 may actually be regarded as a reflection of reality. The removal of the probability recognition criteria Paragraph 36 of the summary of the comment letters on the original exposure draft states, “the majority of respondents oppose this proposal”. And despite this overwhelming verdict, the Board has maintained this proposal. This seems to be evidence of the hitherto unrecognised phenomenon of the Brian Clough school of standard setting - “If I had an argument with a player we would sit down for twenty minutes, talk about it and then decide I was right”. I do note that the Board has responded to the concerns about single obligation issues, particularly legal cases. However, the decision to simply reverse the conclusion of example one is unsatisfactory and appears to conflict with the conclusion in paragraph 22 in that it invests a degree of certainty in the term “unlikely” that is stated not to exist in the term “expected”. Paragraph 22 itself is thoroughly unsatisfactory and appears to be an attempt by the Board to retro-fit a preference (for probability weighted single point estimates over a probability recognition criterion) by overriding the commonly accepted and dictionary definition and understanding of the term “expected”. The practicality of applying the proposals and the resulting information At the roundtable, even those participants who agreed with an expected cash flow approach recognised that there would be difficulties in applying it. There were questions as to the relevance of the expected value. These concerns are echoed in the alternate views which draw attention to the hypothetical nature of the resulting information. Conclusion The assessment I draw from this is that the Board risks devoting both its own and (more importantly) its constituents’ time and resources to an area where there is little or no demand for change, resulting in a standard which will not enjoy credibility amongst stakeholders and information that risks being, at best, meaningless and, at worst, misleading. I am also concerned that, despite requests, no cost/benefit analysis of the proposals appears to have been undertaken. I set out any responses to the specific Board questions in the attached appendix. In conclusion, I recommend that the Board does not proceed with the proposed new IFRS and leaves the existing IAS37 in place, unamended. Yours faithfully Bill Hicks Question 1 – Overall requirements The proposed measurement requirements are set out in paragraphs 36A–36F. Paragraphs BC2–BC11 of the Basis for Conclusions explain the Board’s reasons for these proposals. Do you support the requirements proposed in paragraphs 36A–36F? If not, with which paragraphs do you disagree, and why? In responding to this question, I have not addressed those issues considered in question 2. Whilst the intent of providing measurement guidance is to address divergent approaches under the existing requirements, it is not clear that current practice has resulted in less decision useful information. I disagree with the principle in the proposed requirements of the lowest amount that management would rationally pay since the result may well be a hypothetical value based on a hypothetical decision (that management may or may not make) and, potentially, established in a hypothetical market. I believe expected outflows (based on either the most likely outcome or probability weighted outcomes, as appropriate in individual cases) is a more appropriate approach. I am not clear what the risk adjustment requirements are intended to achieve. Question 2 – Obligations fulfilled by undertaking a service Some obligations within the scope of IAS 37 will be fulfilled by undertaking a service at a future date. Paragraph B8 of Appendix B specifies how entities should measure the future outflows required to fulfil such obligations. It proposes that the relevant outflows are the amounts that the entity would rationally pay a contractor at the future date to undertake the service on its behalf. Paragraphs BC19–BC22 of the Basis for Conclusions explain the Board’s rationale for this proposal. Do you support the proposal in paragraph B8? If not, why not? No. The proposal to include a hypothetical profit margin which will be recognised as the liability is discharged does not result in an appropriate reflection of an entity’s performance. Question 3 – Exception for onerous sales and insurance contracts Paragraph B9 of Appendix B proposes a limited exception for onerous contracts arising from transactions within the scope of IAS 18 Revenue or IFRS 4 Insurance Contracts. The relevant future outflows would be the costs the entity expects to incur to fulfil its contractual obligations, rather than the amounts the entity would pay a contractor to fulfil them on its behalf. Paragraphs BC23–BC27 of the Basis for Conclusions explain the reason for this exception. Do you support the exception? If not, what would you propose instead and why? Yes. This is a sensible exemption although I must note that a remediation obligation met by undertaking a service (on which a profit margin would be recognised) seems conceptually little different from an onerous contract.