Unit 4 Money Management

advertisement

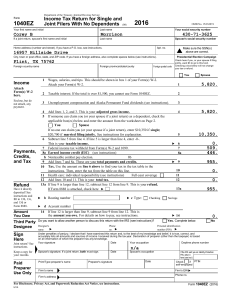

Unit 4 Money Management Taxes and Your Paycheck ► Terms • • • • • to Examine Income Tax FICA Gross income Net income IRS Sample Paycheck Stub W-4 Form Proper Withholding • Paying Too Much • Withholding Too Little 1. Common with students who work only in summer Forced Savings Program 1. Sending extra payments to the IRS 2. Claiming fewer allowances 2. 3. Specifying extra money to be withheld on W-4 Filing a Tax Return ► Income – wages, tips, interest from savings ► Employers will send a Form W-2 by January 31. The form summarizes earnings and withholdings for the year for a specific job. ►A copy of your W-2 Form is sent to the IRS by your employer. Form W-2 Form 1099-INT Taxes the EZ Way People who can use a Tax Form 1040EZ: Single or married and filing jointly with your spouse Person who has no dependents You and spouse are under age 65 Neither you or your spouse is blind Have a taxable income of less than $50,000 Earned no more than $400 in interest No income other than wages, interest, tips, scholarships, or unemployment compensation Form 1040EZ Form 1040 (“complicated”) Completing the 1040 and 1040EZ Forms ► Information to Understand/Remember: Social security number Total wages, salaries, and tips Taxable Interest Income Unemployment Compensation Adjusted Gross Income Deductions Taxable Income Taxes and Government Sources of Federal Government Income Compare The Following Internet Information to Textbook (pg. 171) Principles of Taxation ► Benefit Principle those who use a good or service provided by the government should pay for it ► Ability-to-pay-principle those who have larger incomes should pay a larger share of what they receive (Federal Income Taxes=15%-39.6%) How Taxes are Collected ► Direct Taxes Ex. Income taxes and property taxes ► Indirect Taxes Ex. Renting and paying property taxes ► Pay-as-you-earn Taxes Ex. Federal Withholding Types of Taxes ► Income Tax ► Sales Tax ► Property Tax ► Excise Tax ► Estate Tax ► Gift Tax ► Business or License Tax U.S. Government Spending 1. 2. 3. 4. 5. 6. Social Security, Medicare, and Other Retirement (37%) National Defense, Veterans and Foreign Affairs (20%) Social Programs (18%) Net Interest on the Debt (15%) Physical, Human and Community Development Law Enforcement and General Government Pg. 176 in textbook State and Local Governments Provide the Following: Building and maintaining local roads Operating police and fire protection services Maintaining a criminal justice system Building and staffing public schools Building and operating state colleges and universities Supporting hospitals and other medical facilities Constructing and operating sewage treatment plants Operating unemployment compensation programs