Forecasting

advertisement

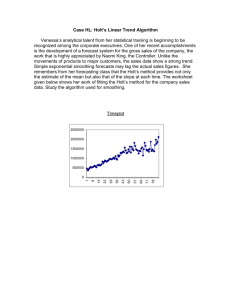

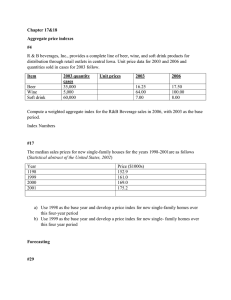

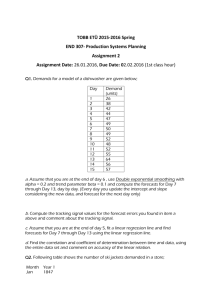

Forecasting • Purpose is to forecast, not to explain the historical pattern • Models for forecasting may not make sense as a description for ”physical” behaviour of the time series • Common sense and mathematics in a good combination produces ”optimal” forecasts • With time series regression models, forecasting (prediction) is a natural step and forecasting limits (intervals) can be constructed • With Classical decomposition, forecasting may be done, but estimation of accuracy lacks and no forecasting limits are produced • Classical decomposition is usually combined with Exponential smoothing methods Exponential smoothing • Use the historical data to forecast the future • Let different parts of the history have different impact on the forecasts • Forecast model is not developed from any statistical theory Single exponential smoothing • Given are historical values y1,y2,…yT • Assume data contains no trend Algorithm for forecasting: t yt (1 ) t 1 ; t t1 , t1 1,, T yˆT T ; 1,2, ( constant forecasts! ) where is a smoothing parameter with value between 0 and 1 • The forecast procedure is a recursion formula • How shall we choose α? • Where should we start, i.e. which is the initial value t0 ? For long length time series: Use a part (usually first half) of the historical data y1 ,, yt0 and calculate their average: Set yhist 1 t0 t0 y t 1 t0 yhist Update with the rest of the historical data yt0 1 , , yT using the recursion formula t Example: Sales of everyday commodities Year Sales values 1985 151 1986 151 1987 147 1988 149 1989 146 1990 142 1991 143 1992 145 1993 141 1994 143 1995 145 1996 138 1997 147 1998 151 1999 148 2000 148 Note! This time series is short but we use it for illustration purposes! Calculate the average of the first 8 observations of the series: yhist (151 151 ...145)/8 146.75 Set 8 yhist 146.75 Assume first that the sales are very stable, i.e. during the period the background mean value is assumed not to change Set α to be relatively small. This means that the latest observation plays a less role than the history in the forecasts. Thumb rule: 0.05 < α < 0.3 E.g. Set α=0.1 Update using the next 8 values of the historical data 9 0.1 y9 0.9 8 0.1 141 0.9 146.75 146.175 10 0.1 y10 0.9 9 0.1 143 0.9 146.175 145.8575 11 0.1 y11 0.9 10 0.1 145 0.9 145.8575 145.772 12 0.1 y12 0.9 11 0.1 138 0.9 145.772 144.995 13 0.1 y13 0.9 12 0.1 147 0.9 144.995 145.1955 14 0.1 y14 0.9 13 0.1 151 0.9 145.1955 145.776 15 0.1 y15 0.9 14 0.1 148 0.9 145.776 145.998 Forecasts: 16 0.1 y16 0.9 15 0.1 148 0.9 145.998 146.2 yˆ17 146.2 yˆ18 146.2 yˆ19 146.2 etc. For short length time series: Calculate the average of all historical data i.e. 1 T yhist yt T t 1 Update from the beginning of the time series: t yt (1 ) t 1 ; t 1,2,, T 1 T t 0 0 yt T t 1 There are a lot of alternatives: • Average of all data, update from the middle of the series • Average of the first half, update from beginning • etc. Analysis of example data with MINITAB MTB > Name c3 "FORE1" c4 "UPPE1" c5 "LOWE1" MTB > SES 'Sales values'; SUBC> Weight 0.1; SUBC> Initial 8; SUBC> Forecasts 3; SUBC> Fstore 'FORE1'; SUBC> Upper 'UPPE1'; SUBC> Lower 'LOWE1'; SUBC> Title "SES alpha=0.1". Single Exponential Smoothing for Sales values Data Sales values Length 16 Smoothing Constant Alpha 0.1 Accuracy Measures MAPE 2.2378 MAD 3.2447 MSD 14.4781 Forecasts Period Forecast Lower Upper 17 146.043 138.094 153.992 18 146.043 138.094 153.992 19 146.043 138.094 153.992 MINITAB uses smoothing from 1st value! Assume now that the sales are less stable, i.e. during the period the background mean value is possibly changing. (Note that a change means an occasional “level shift” , not a systematic trend) Set α to be relatively large. This means that the latest observation becomes more important in the forecasts. E.g. Set α=0.5 (A bit exaggerated) Single Exponential Smoothing for Sales values Data Sales values Length 16 Smoothing Constant Alpha 0.5 Accuracy Measures MAPE 1.9924 MAD 2.8992 MSD 13.0928 Forecasts Period Forecast Lower Upper 17 147.873 140.770 154.976 18 147.873 140.770 154.976 19 147.873 140.770 154.976 Slightly narrower prediction intervals We can also use some adaptive procedure to continuosly evaluate the forecast ability and maybe change the smoothing parameter over time Alt. We can run the process with different alphas and choose the one that performs best. This can be done with the MINITAB procedure. Single Exponential Smoothing for Sales values --Smoothing Constant SES optimal alpha 156 Alpha Variable Actual Fits Forecasts 95.0% PI 0.567101 Accuracy Measures MAPE 1.7914 MAD 2.5940 MSD 12.1632 Sales values 152 Smoothing Constant 0.567101 Alpha 148 144 140 2 Forecasts Period Accuracy Measures 1.7914 MAPE 2.5940 MAD 12.1632 MSD 4 Forecast Lower Upper 17 148.013 141.658 154.369 18 148.013 141.658 154.369 19 148.013 141.658 154.369 6 8 10 Index 12 14 16 18 Yet, narrower prediction intervals Exponential smoothing for times series with trend and/or seasonal variation • Double exponential smoothing (one smoothing parameter) for trend • Holt’s method (two smoothing parameters) for trend • Multiplicative Winter’s method (three smoothing parameters) for seasonal (and trend) • Additive Winter’s method (three smoothing parameters) for seasonal (and trend) Example: Real Estate Price Index for Weekend Cottages in Sweden REPI_C 1993 226 1994 241 1995 239 1996 240 1997 268 1998 303 1999 336 2000 414 2001 472 2002 496 2003 505 2004 546 2005 591 Time Series Plot of REPI_C 600 500 REPI_C Year 400 300 200 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Year Trend but no seasonal variation Applying Holt’s method with MINITAB (denoted Double exponential smoothing in Minitab) 2 smoothing parameters, one for level and one for trend. Option to let Minitab calculate optimal parameters. Smoothing parameters should still be kept low (0.05,0.3) Double Exponential Smoothing for REPI_C Data REPI_C Length 13 Double Exponential Smoothing Plot for REPI_C Variable A ctual Fits Forecasts 95.0% PI 700 Smoothing Constants 600 0.2 Gamma (trend) 0.2 Smoothing C onstants A lpha (lev el) 0.2 Gamma (trend) 0.2 500 REPI_C Alpha (level) Accuracy Measures MAPE 9.78 MAD 30.15 MSD 1160.79 400 Accuracy Measures 300 MAPE 9.78 MAD 30.15 MSD 1160.79 200 100 1 2 Forecasts Period Forecast Lower Upper 14 611.411 537.537 685.286 15 646.167 570.753 721.581 3 4 5 6 7 8 9 Index 10 11 12 13 14 15 Example: Quarterly sales data year quarter sales 1991 1 124 1991 2 157 1991 3 163 1991 4 126 200 1992 1 119 190 1992 2 163 180 1992 3 176 170 1992 4 127 160 1993 1 126 1993 2 160 1993 3 181 1993 4 121 1994 1 131 1994 2 168 1994 3 189 1994 4 134 1995 1 133 1995 2 167 1995 3 195 1995 4 131 sales Time Series Plot of sales 150 140 130 120 110 Quarter Q1 Year 1991 Q3 Q1 1992 Q3 Q1 1993 Q3 Q1 1994 Q3 Q1 1995 Q3 Applying Winter’s multiplicative method with MINITAB 3 smoothing parameters, one for level, one for trend an one for seasonal variation. No option to calculate optimal parameters. Choices have do be based on visual inspection of the times series Winters' Method for sales Multiplicative Method Data sales Length 20 Winters' Method Plot for sales Multiplicative Method 210 Variable Actual Fits Forecasts 95.0% PI 200 Smoothing Constants 190 0.2 Gamma (trend) 0.2 Delta (seasonal) 0.2 180 sales Alpha (level) Smoothing C onstants A lpha (lev el) 0.2 Gamma (trend) 0.2 Delta (seasonal) 0.2 170 160 Accuracy Measures MA PE 2.6446 MA D 3.8808 MSD 23.7076 150 Accuracy Measures 140 MAPE 2.6446 130 MAD 3.8808 120 MSD 23.7076 Quarter Year Q3 2008 Forecasts Period Forecast Lower Upper Q3-2013 135.625 126.117 145.133 Q4-2013 174.430 164.773 184.087 Q1-2014 194.667 184.844 204.490 Q2-2014 136.933 126.928 146.939 Q3 2009 Q3 2010 Q3 2011 Q3 2012 Q3 2013